The Definitive Guide to Financing Options for Mobile Homes

Discover how to secure a loan for mobile home! Explore FHA, Chattel, and personal loan options for affordable homeownership.

Loan for mobile home is a common query among those looking to find an affordable path to homeownership through manufactured or mobile homes. These homes present a cost-effective alternative to traditional housing, particularly as their prices often fall significantly below the national median home prices. Yet, despite their affordability, securing a loan for one of these homes is often not straightforward. Here’s a quick glance at the main financing options available:

- FHA Loans: Federal-backed loans specifically designed for mobile homes.

- Fannie Mae and Freddie Mac Loans: Government-sponsored mortgage companies offering options custom for manufactured housing.

- Chattel Loans: Personal property loans custom specifically for mobile home financing.

- Personal Loans: Unsecured loans with higher interest rates.

Manufactured and mobile homes stand out as an appealing option for those like Sarah, who are seeking a more budget-friendly and flexible living opportunity. With prices averaging around $127,250, these homes allow ownership with lower upfront costs. However, their unique nature leads to specific financing challenges because most traditional mortgage lenders shy away from offering loans for properties perceived to depreciate over time.

Navigating through financing options can be daunting, but with the right information, loan seekers can better understand and pursue lending pathways that align with their circumstances. By exploring federal programs, personal loans, and alternative lending markets, potential mobile home buyers can find solutions that cater to their needs.

Important loan for mobile home terms:

Understanding Mobile Home Loans

When looking to finance a mobile or manufactured home, you’ll find several loan options catering to different needs and situations. Let’s break down the most common financing options available.

FHA Loans for Mobile Homes

FHA Loans are backed by the Federal Housing Administration (FHA) and are popular for financing mobile homes. They come in two main types:

-

Title I Loans: These loans can be used for purchasing a mobile home, with or without the land. They’re ideal for those placing their home in a mobile home park. Title I loans don’t require the borrower to own the land, making them flexible for many buyers.

-

Title II Loans: Suitable for those planning to buy both the mobile home and the land it will sit on. These loans require the home to be your primary residence. They offer longer terms and typically lower interest rates compared to Title I loans.

Chattel Loans Explained

Chattel Loans are designed specifically for movable personal property, like mobile homes. Unlike traditional mortgages, chattel loans focus on the home itself, not the land.

- Higher Interest Rates: These loans often come with higher interest rates than regular mortgages.

- Shorter Terms: They usually have shorter repayment periods, which might lead to higher monthly payments but can mean paying off the loan quicker.

Chattel loans are a common choice for those who plan to place their home on leased land or in a mobile home community.

Personal Loans for Mobile Homes

Personal Loans offer another route for financing mobile homes. These loans are unsecured, meaning they don’t require collateral, such as the home itself.

- Flexible Use: You can use the funds for various purposes, including buying a mobile home.

- Higher Interest Rates: Due to the lack of collateral, personal loans typically have higher interest rates.

While personal loans provide flexibility, they might not be suitable for everyone due to the potentially higher costs over time.

Each of these options has its own benefits and limitations, and understanding them can help you choose the best loan for your mobile home purchase. By evaluating your financial situation and goals, you can find the right financing to make your dream of owning a mobile home a reality.

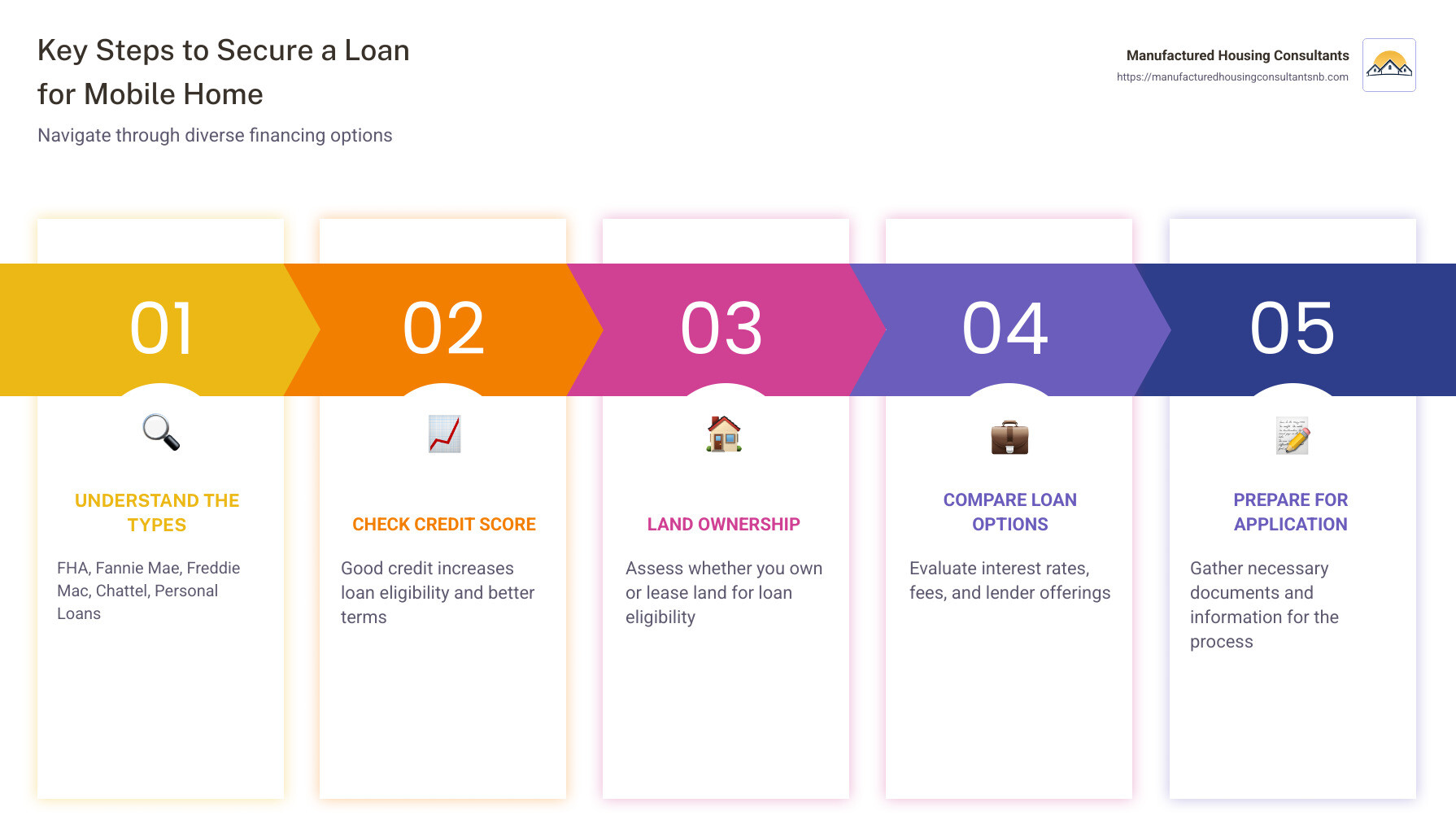

Steps to Secure a Loan for Mobile Home

Securing a loan for mobile home involves several key steps. From understanding the importance of your credit score to deciding on land ownership and comparing loan options, each step plays a crucial role in the process.

Importance of Credit Score

Your credit score is a vital factor when applying for any loan, including those for mobile homes.

-

Why It Matters: Lenders use your credit score to assess your creditworthiness. A higher score often means better interest rates and loan terms. This can save you thousands over the life of your loan.

-

Checking Your Score: Start by checking your credit reports from the three major credit bureaus: Experian, TransUnion, and Equifax. You can get a free annual report through Annualcreditreport.com.

-

Improving Your Score: If your score is lower than you’d like, work on improving it by paying off debts and correcting any errors on your credit report.

Land Ownership Considerations

Deciding whether to buy land along with your mobile home is a significant decision that affects your loan eligibility.

-

Owned Land: Owning the land can make you eligible for more loan options, such as FHA Title II loans, which often come with better terms.

-

Leased Land: If you plan to place your home on leased land, your options might be more limited, but loans like FHA Title I or Chattel loans could be viable choices.

-

Loan Eligibility: The stability of owning land can make lenders more open to offering favorable loans, as it reduces the risk of relocation.

Comparing Loan Options

Once you’ve checked your credit and decided on land ownership, it’s time to compare loan options.

-

Interest Rates and Fees: Different lenders offer varying interest rates and fees. Shopping around can help you find the best deal.

-

Lender Offerings: Consider speaking with multiple lenders to understand their offerings. Look for loans with the lowest fees and interest rates to minimize costs over time.

-

Application Process: When you’re ready, submit a complete and accurate loan application. Being prepared with all necessary documents can make the process smoother.

By following these steps and considering each element carefully, you can secure the right loan for your mobile home, making your homeownership journey a reality.

Conclusion

At Manufactured Housing Consultants, we understand that buying a mobile home is a significant step in your homeownership journey. With the rising costs of traditional homes, mobile homes offer a cost-effective and flexible alternative. Our mission is to provide you with affordable housing options and the best financing solutions available.

Financing Options: We offer a range of financing options to suit different needs and budgets. Whether you’re considering FHA loans, Chattel loans, or personal loans, we help guide you through the process. Our goal is to make financing straightforward, so you can focus on finding the perfect home.

Affordable Housing: Our homes are sourced from 11 top manufacturers, guaranteeing the lowest prices and a wide selection. We believe everyone deserves a quality home without breaking the bank. With our competitive pricing and expert guidance, owning a home is more accessible than ever.

Your Homeownership Journey: From the initial consultation to moving into your dream home, we’re here to support you every step of the way. Our team is dedicated to making the process as smooth and stress-free as possible. We offer personalized advice and services, including land improvement, to ensure your new home meets all your needs.

Ready to explore your options? Visit our mobile home financing page to learn more about how we can help you achieve your homeownership dreams.

At Manufactured Housing Consultants, we’re committed to making your dream of owning a home in Texas a reality. Let us guide you through the process and find the perfect financing option for your mobile home today.