FHA Mobile Home Financing for your New House

Explore FHA mobile home financing to achieve homeownership dreams with low down payments and flexible terms. Learn more now!

Why FHA Mobile Home Financing is Your Path to Affordable Homeownership

FHA mobile home financing helps you buy a manufactured home with affordable terms, even if your credit isn’t perfect. Here’s the quick breakdown if you’re in a rush:

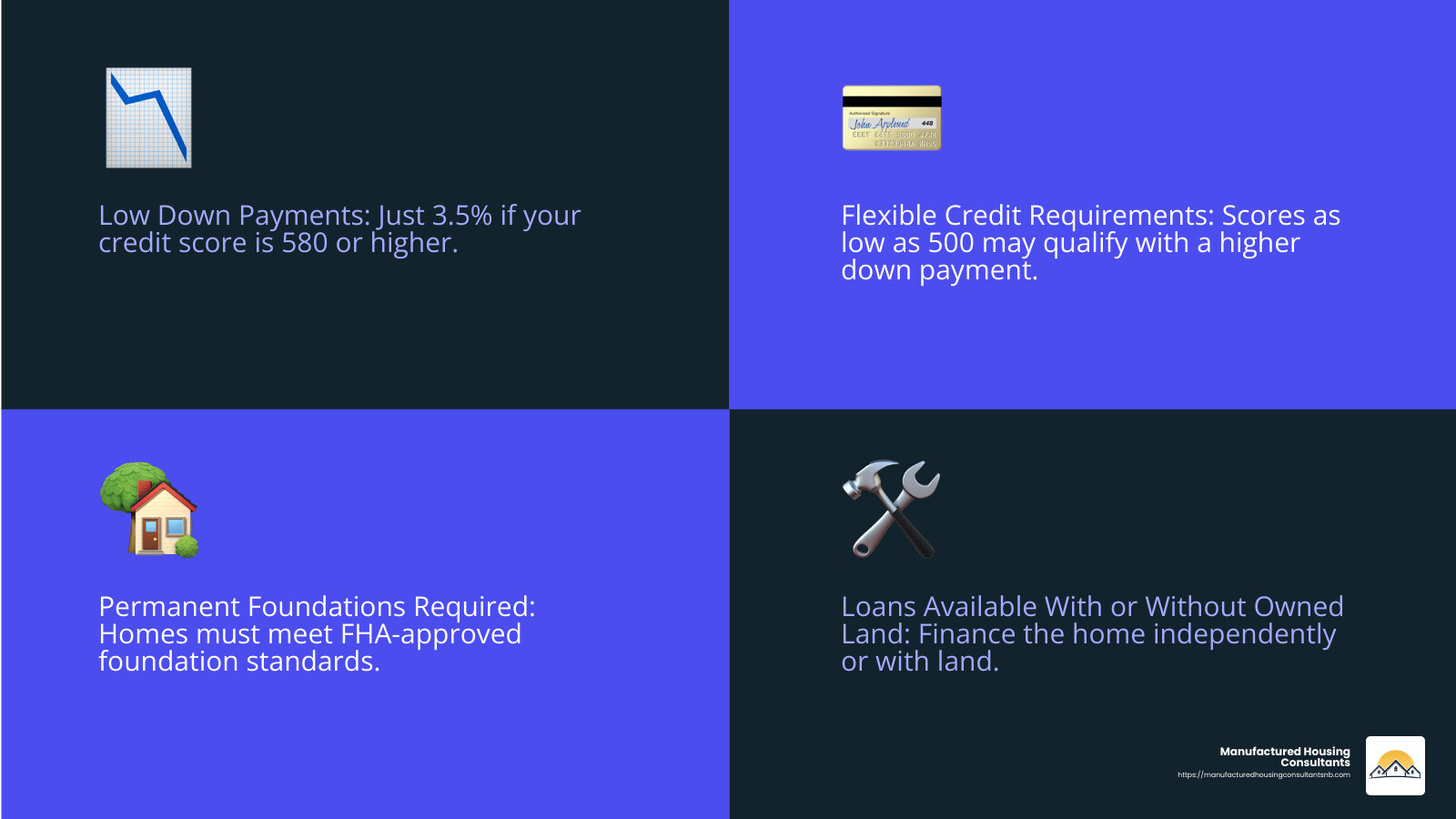

- Low Down Payments: As little as 3.5% down if your credit score is 580 or higher.

- Flexible Credit Requirements: Credit scores as low as 500 may qualify with a higher down payment (usually 10%).

- Permanent Foundations Required: The home must be on an FHA-approved foundation and meet HUD safety standards.

- Loans With or Without Owned Land: You can finance just the home or both the land and home together.

Maybe you’ve thought owning a home was too expensive or difficult because of traditional mortgages and high costs—especially here in Texas. You’re not alone.

As one homebuyer put it:

“Home sweet home comes in all sizes, locations, and budgets.”

FHA loans have been making homeownership possible since 1934, offering budget-conscious buyers like you accessible, clear-cut financing options designed specifically for manufactured homes.

In this guide, we’ll walk you through everything you need to know to simplify your path to homeownership with FHA mobile home financing.

Easy fha mobile home financing glossary:

Understanding FHA Mobile Home Financing

When you’re dreaming of buying a manufactured home, understanding your financing options can feel overwhelming. But don’t worry—FHA mobile home financing is designed specifically to help folks like you, even if you have less-than-perfect credit or limited savings for a down payment. FHA loans offer a clear pathway toward affordable homeownership, making your dream feel a lot closer to reality.

Let’s break things down step-by-step, in simple terms, so you know exactly what to expect.

What is an FHA Mobile Home Loan?

An FHA mobile home loan is a special type of mortgage that’s insured by the Federal Housing Administration (FHA), which is part of HUD—the U.S. Department of Housing and Urban Development. Now, the FHA doesn’t lend money directly. Instead, they insure loans from FHA-approved lenders, giving lenders confidence to offer you better terms—even if traditional banks might hesitate.

You might hear the terms “mobile home” and “manufactured home” used interchangeably, but there’s actually an important difference:

- A mobile home generally refers to homes built before June 15, 1976.

- A manufactured home refers to homes built after June 15, 1976. These newer homes must follow HUD’s strict safety, quality, and efficiency standards.

For FHA mobile home financing, only manufactured homes constructed after the 1976 cutoff date qualify. Each of these homes will have a HUD certification label, often called a “HUD tag,” attached to each transportable section of the home.

One customer at Manufactured Housing Consultants shared their surprise and excitement:

“I always thought manufactured homes were just trailers, but modern manufactured homes are built to strict HUD standards and offer the same quality as site-built homes—at a fraction of the cost. My FHA loan made it all possible.”

HUD standards ensure your new home meets stringent safety and quality benchmarks, giving you peace of mind that your investment is secure.

Eligibility and Loan Limits for FHA Mobile Home Financing

To qualify for an FHA mobile home loan, both you and your new home must meet certain criteria. Don’t stress though—we’ll walk you through it step-by-step.

First, let’s look at borrower eligibility. FHA loans are known for being flexible, especially compared to traditional financing.

You’ll typically need a credit score of at least 580 to take advantage of the lowest possible down payment—only 3.5%. If your score falls between 500 and 579, you’re still eligible, but you’d likely need a larger down payment of at least 10%.

Most lenders will look for a steady employment history, usually two years or more. Don’t worry if you’re newer to the job market, though—exceptions are sometimes made for recent college grads or veterans returning from military service.

Your debt-to-income ratio (or DTI), which measures your monthly debt payments against your monthly gross income, usually should be 43% or less. However, with strong credit or ample savings, you might qualify even if your DTI is higher—up to around 57%.

The home you’re buying must be your primary residence, not an investment or vacation property.

Now, let’s talk about the property itself:

Your manufactured home must have been built after June 15, 1976, with a HUD tag clearly displayed. It needs to have a minimum size of 400 square feet and must be placed on an FHA-approved permanent foundation—not just set on blocks or wheels. Lastly, your home should be officially classified as real estate, not personal property, to qualify for FHA financing.

When it comes to loan limits, FHA sets different caps depending on the type of loan and where you live. As of 2025, the general loan limit for single-family homes in most counties is around $498,257, though this can go up significantly in areas with higher home prices. You can easily check your county’s loan limits here on FHA’s mortgage limits page.

For FHA Title I loans—which we’ll explore next—the maximum limit is $92,904 for a home and lot, $69,678 for just the home, and $23,226 for just the lot.

Your loan-to-value (LTV) ratio, or the loan amount compared to the home’s appraised value, varies based on your credit score. With a credit score of 580 or better, you can borrow up to 96.5% of the property’s value—meaning your down payment is just 3.5%. If your credit score falls between 500 and 579, the maximum LTV ratio drops to 90%, requiring 10% down.

And don’t worry—we at Manufactured Housing Consultants have guided countless Texas families through these requirements, and we can help you too.

FHA Title I vs. Title II Loans for Manufactured Homes

When diving into FHA financing for your manufactured home, you’ll encounter two main types of loans: Title I and Title II. Let’s unpack them clearly so you know which one fits your situation best.

Title I loans are flexible, especially if you don’t own land. You can use them just to buy your manufactured home, just the lot, or both together. These loans are perfect if you’re planning to place your home in a land-lease community or mobile home park. The loan amounts are smaller—up to $92,904 for a home with land, $69,678 for just the home, and $23,226 for just a lot. Loan terms usually range from 20 to 25 years.

Title II loans are more like traditional mortgages. The manufactured home must be permanently attached to land that you own, making it real estate. Title II loans offer higher loan amounts (up to the standard FHA limits, around $498,257 or more depending on your area). You can also enjoy longer repayment terms—up to 30 years. With Title II, the permanent foundation requirements are stricter and must follow HUD’s permanent foundation guidelines closely.

Here’s a quick side-by-side comparison to help clarify:

| Feature | Title I Loans | Title II Loans |

|---|---|---|

| Land Ownership | Not required | Required |

| Can Finance Just the Home | Yes | No |

| Can Finance Just the Lot | Yes | No |

| Maximum Loan Amount | $92,904 (home and lot) | Up to $498,257+ (varies by county) |

| Loan Term | 20-25 years | 30 years |

| Foundation Requirements | HUD standards (more flexible) | Strictly HUD’s Permanent Foundations Guide |

| Property Classification | Personal property allowed | Must be real estate |

| Down Payment | Typically about 5%+ | As low as 3.5% with 580+ credit |

At Manufactured Housing Consultants, we’ll help you decide which loan is right for you, whether you’re looking to buy land with your home or prefer the leased-land option.

Using FHA Mobile Home Financing Without Owning Land

One of the greatest benefits of FHA mobile home financing is that you don’t have to own the land underneath your home. Choosing leased land—like in a friendly manufactured home community—can reduce your upfront costs significantly.

If you select this route, FHA Title I loans are your best friend. The leased land needs a minimum initial lease term of three years, with at least 180 days’ notice before termination. The site itself must include proper utility hookups for water, electricity, and sewage as well as adequate drainage and all-weather road access.

Land-lease communities are popular here in Texas because they offer affordable monthly payments, community amenities (like pools or playgrounds), and a friendly neighborhood atmosphere.

One happy resident shared her thoughts with us:

“Thanks to my FHA Title I loan, I could afford a beautiful new home in a community that feels like family. I didn’t have to worry about buying expensive land, and I love the amenities and sense of belonging here.”

At Manufactured Housing Consultants, we’ll guide you every step of the way—helping you pick the perfect home, choose the right financing, and even find a community you’ll be proud to call home.

How to Qualify for an FHA Mobile Home Loan

Ready to take the next step toward owning your dream manufactured home? Great! Qualifying for FHA mobile home financing isn’t as daunting as you might think. Let’s walk through the process together, breaking down key requirements in a simple, friendly way.

Meeting the Credit Score and Down Payment Requirements for FHA Mobile Home Financing

One of the most attractive features of FHA loans is their accessibility—even if your credit isn’t perfect. However, there are still some important numbers to keep in mind.

First, let’s talk credit scores. FHA guidelines state that if your credit score is 580 or higher, you can enjoy a low down payment of just 3.5%. But even if your credit isn’t quite there yet—between 500 and 579—you can still qualify; you’ll just need a 10% down payment.

While technically FHA allows scores as low as 500, many lenders set their own minimum standards, often around 620 or higher. But don’t worry! At Manufactured Housing Consultants, we work closely with lenders who truly understand the manufactured home market and are flexible with various credit situations.

As an FHA expert once said:

“Borrowers with credit scores of 580 or higher can pay as little as 3.5% down.”

Speaking of down payments—where can that money come from? Thankfully, FHA is flexible here too. Your down payment can come from personal savings, gift funds from family, down payment assistance programs, or even approved grants from non-profits or government agencies. That means your path to homeownership might be easier than you realized.

That FHA loans include mortgage insurance to protect the lender. There’s an upfront mortgage insurance premium (UFMIP) of 1.75% of your loan amount, which can be rolled into your loan. Additionally, an annual mortgage insurance premium (MIP) between 0.15% to 0.75% of your loan amount is included in your monthly payments.

At Manufactured Housing Consultants, we help Texas families find the right homes at the best prices. We’ll walk you through all the numbers, step by step, so you can feel confident about your financing choice.

Understanding Property Standards and Foundation Requirements

Qualifying for an FHA mobile home loan isn’t just about you—it’s also about the home itself. FHA has specific property standards and foundation requirements to make sure your new home is safe, sturdy, and built to last.

First, your manufactured home must meet HUD’s Manufactured Home Construction and Safety Standards (HUD Code). These standards ensure structural safety, energy efficiency, electrical and plumbing quality, and much more. You’ll know your home complies if it has a red HUD certification label (“HUD tag”) attached outside and a data plate (compliance certificate) inside.

Next—and this one’s important—your manufactured home must sit on a permanent FHA-approved foundation. FHA requires a foundation that:

- Is built from durable, long-lasting materials (concrete, masonry, or treated wood).

- Extends footings below your local frost line.

- Properly transfers the home’s weight safely to the ground.

- Is constructed to resist weather events like winds or floods.

- Has adequate ventilation, access, and proper drainage to prevent moisture issues.

Before your loan closes, you’ll have an FHA-approved inspector check the foundation. This inspection typically costs around $500–650 and provides valuable peace of mind. As one of our happy homeowners shared:

“The foundation inspection seemed like an extra hassle at first, but now I understand why it’s so important. It gives me peace of mind knowing my home is properly secured and will last for decades.”

Other property-related requirements include having the wheels, axles, and towing hitch removed, proper utility hookups (water, sewer, and electricity), and placing the home on a properly prepared site with good drainage and road access. The home must also be at least 400 square feet and installed according to the manufacturer’s instructions and local building codes.

Wondering what your monthly payments might look like? Try our handy Manufactured Home Loan Calculator to see how affordable your new home could be.

Finding FHA-Approved Lenders for Manufactured Home Loans

Not all lenders are familiar with FHA manufactured home loans, so finding the right lender is key. Luckily, there are several ways to find FHA-approved lenders who specialize in manufactured homes.

First, you can check out the official HUD Lender List. It’s a searchable list of FHA-approved lenders near you.

But why not make it even easier? At Manufactured Housing Consultants, we’re already connected with lenders who specialize in FHA loans for manufactured homes. We know who offers the best rates, fastest approval times, and friendliest service.

When you’re comparing lenders, make sure to ask:

- How many manufactured home loans do you typically handle each year?

- Do you offer both Title I and Title II FHA loans?

- What specific credit scores do you require for manufactured home loans?

- What kind of paperwork will I need to provide (like income verification and employment history)?

- What’s your typical interest rate, and what fees do you charge?

- How long does the loan process usually take?

Here’s what you can expect from the FHA loan application process:

First, you’ll get pre-qualified or pre-approved based on your credit, income, and debts. This gives you an idea of how much home you can afford.

Next, you’ll select your new manufactured home. Your lender will order an appraisal to determine its value and confirm it meets FHA property standards.

Then, the foundation inspection takes place. You’ll need a certification that the foundation meets FHA standards before closing your loan.

The lender then reviews all documents in the underwriting stage. If everything checks out, you’ll be cleared for closing.

Finally, at closing, you’ll review and sign loan documents and officially become a homeowner!

At Manufactured Housing Consultants, we help Texas families smoothly steer every step of the FHA mobile home financing process. If you’re interested in learning more about financing options, check out our Mobile Home Financing page, or simply reach out—we’re here to make homeownership easy and affordable.

Conclusion

FHA mobile home financing has made the dream of owning a home possible for countless families across Texas and beyond. If you’ve ever felt like homeownership was out of reach—think again. FHA loans open up affordable options even if your credit isn’t perfect or your savings aren’t huge. They’re flexible, practical, and designed specifically with manufactured homes in mind.

One of the greatest benefits of FHA mobile home financing is affordability. If your credit score is 580 or higher, your down payment could be as low as 3.5%. And even if your score falls between 500-579, homeownership is still within reach, with just 10% down required.

Another appealing factor is accessibility. FHA understands life’s bumps and bruises—that’s why they offer financing that’s more forgiving of credit challenges than traditional mortgage loans. You don’t need flawless credit to secure a comfortable, high-quality home for you and your family.

Whether you already own land or you’re planning to lease a lot in a welcoming community, FHA has a solution for you. Title I loans let you finance just a manufactured home—even without owning land. On the other hand, Title II loans provide the option to bundle both home and land into one convenient mortgage, allowing loan terms up to 30 years and higher loan limits.

No matter which route you choose, FHA ensures your home meets strict quality and safety standards. Their property guidelines mean you can rest easy knowing your new home is sturdy, safe, and built to last.

At Manufactured Housing Consultants, we’ve helped Texas families find their dream homes from 11 top manufacturers, at guaranteed lowest prices. Our friendly, experienced team knows that buying a home—and navigating financing—can feel overwhelming. That’s why we’re here every step of the way, helping you find the right home, the right financing, and even land improvement services if needed.

If you’re ready to learn more about the financing programs we offer, head over to our Loan Options for Mobile Homes page. Or better yet, come visit our New Braunfels location—we’d love to meet you and show you around.

One of our happy homeowners summed it up best:

“I never imagined I’d own a home of my own, but with FHA financing and the great team at Manufactured Housing Consultants, my dream became a reality. Now I have a beautiful home, a spacious yard, and a payment I can afford. Life is good!”

Ready to create your own homeownership success story? Let’s make it happen together with FHA mobile home financing.