How to Finance a Mobile Home with Land Without Breaking the Bank

Discover expert tips for financing mobile home with land, compare loan options, and save on costs to achieve affordable homeownership.

Affordable Homeownership: Your Guide to Financing Mobile Home with Land

Dreaming of owning your own home without breaking the bank? You’re not alone. The good news is that financing a mobile home with land can make that dream a reality, offering a practical path to homeownership when traditional housing prices feel out of reach.

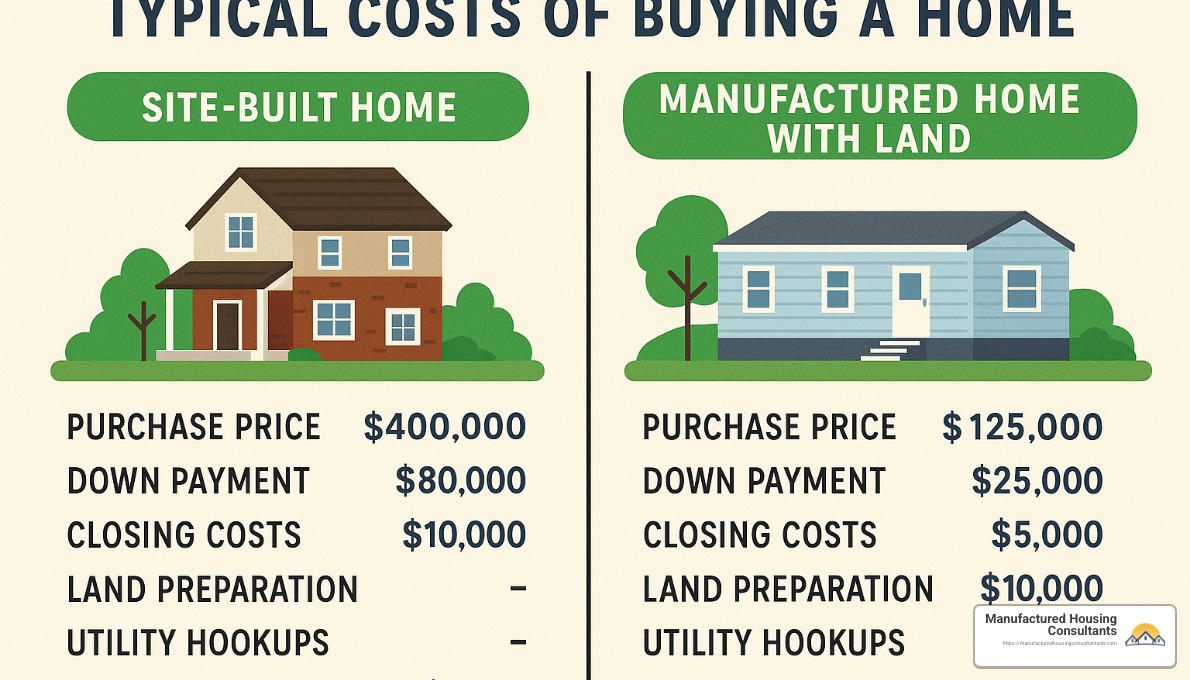

Think about it: manufactured homes average around $127,250, while conventional homes now exceed $412,000. That’s a difference that can transform homeownership from “someday” to “this year” for many families.

“Purchasing a mobile home and finding the right location is just like buying a home; a good neighborhood is important,” says Steve Sexton. While the financing process might look a little different than with traditional homes, the fundamentals of making a good investment remain the same.

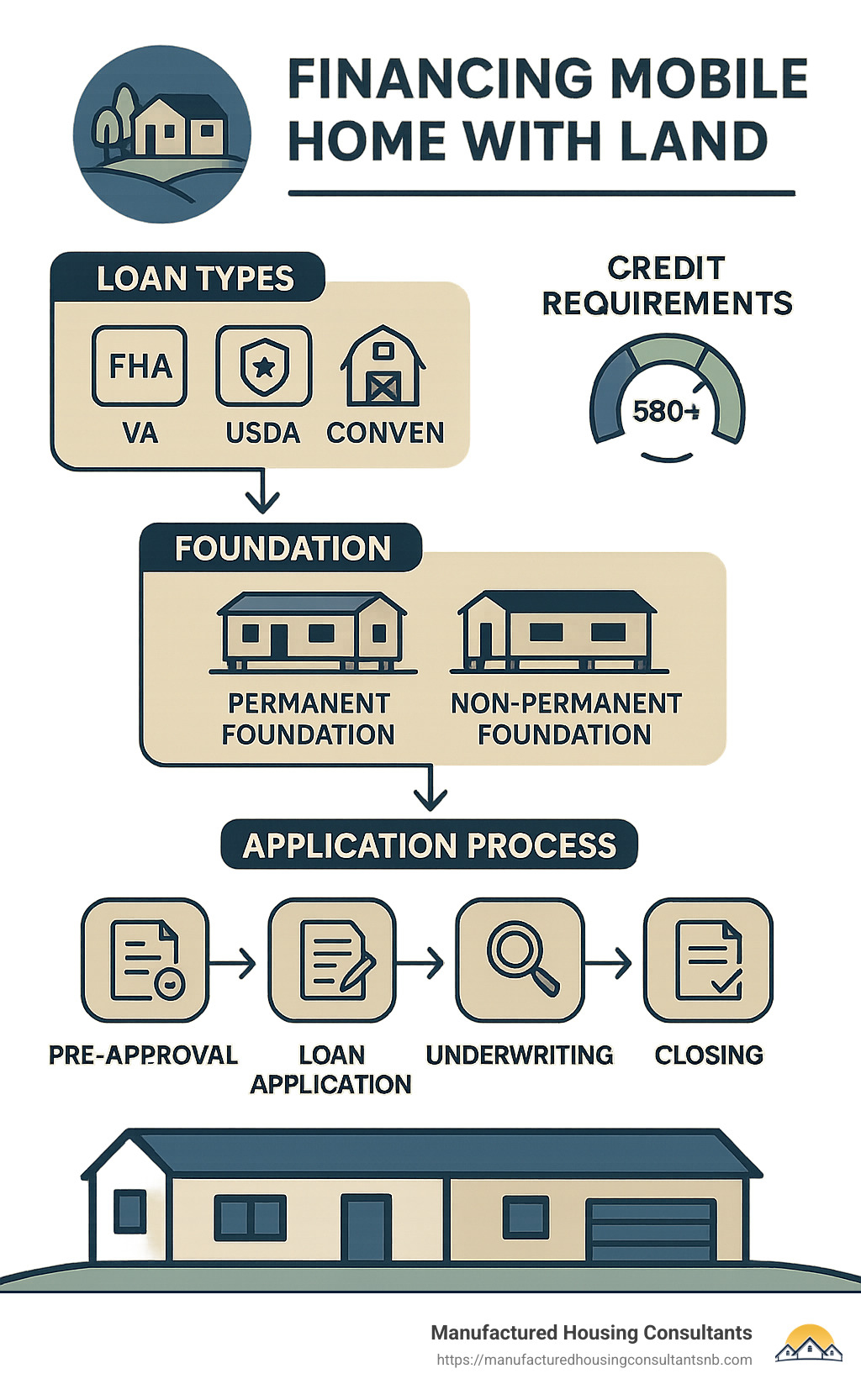

Let’s break down your options for financing a mobile home with land:

| Loan Type | Down Payment | Credit Score | Key Benefits |

|---|---|---|---|

| FHA Title I | 3.5% with 580+ credit | 500+ | Can finance home, lot, or both up to $93K-$194K |

| FHA Title II | 3.5% with 580+ credit | 500+ | For homes on permanent foundation with land |

| VA | 0% for veterans | No minimum | No PMI, competitive rates |

| USDA | 0% in rural areas | ~620 | No down payment in eligible rural areas |

| Conventional | 3-5% | 620+ | Standard mortgage if home is on permanent foundation |

| Chattel | 5-10% | 575+ | For mobile homes not permanently affixed |

Your home’s foundation plays a huge role in your financing options. Homes permanently attached to land you own can often qualify for traditional mortgages with better rates. On the flip side, homes without permanent foundations or on leased land typically need chattel loans, which come with higher interest rates but fewer restrictions.

Here in Texas, many of our customers ask if they can use their existing land as a down payment. The answer is often yes! This “land-in-lieu” approach can significantly reduce your upfront costs. Another popular option is bundling your land purchase with your home loan in what’s called a “land-home package.”

Understanding what type of home you’re buying also matters tremendously:

- Mobile homes (built before 1976) have fewer financing options

- Manufactured homes (built after 1976 to HUD standards) qualify for most loan programs

- Modular homes (built to local building codes) are treated most like traditional homes for financing

The path to affordable homeownership doesn’t have to remain a distant dream. With the right information about financing a mobile home with land, you can make wise decisions that fit your budget today while building equity for tomorrow. Whether you’re a first-time homebuyer, looking to downsize, or simply seeking an affordable housing solution, manufactured housing with land ownership provides a practical route to having a place you can truly call your own.

Financing Mobile Home with Land: Loan Programs, Requirements & Rates

Dreaming of affordable homeownership that combines both a manufactured home and your own piece of land? You’re not alone! Financing a mobile home with land is more accessible than many think, though it does come with some unique considerations that set it apart from traditional home loans.

Unlike conventional homes, your financing options will largely depend on whether your manufactured home will be permanently attached to the land—a distinction that can save you thousands in interest over the life of your loan.

FHA Loans: Government-Backed Options

The Federal Housing Administration offers two excellent paths for financing a mobile home with land:

FHA Title I loans are versatile, covering just the home, just the lot, or both together. A single-section home has a maximum loan amount of $105,532, while multi-section homes can go up to $193,719. If you’re buying just land, you can borrow up to $43,377. Combining both? You’re looking at limits of $148,909 for single-section with land or $237,096 for multi-section with land.

FHA Title II loans work more like traditional mortgages but require your home to be permanently secured to a foundation on land you own or are buying. With credit scores of 580+, you can put down as little as 3.5%—a great option for buyers with limited savings!

As Erin Hybart, an experienced real estate agent, explains: “Most call it a land-home package; this option makes it simple for the buyer, but the opportunities may be more limited.” While these packages streamline the process, taking time to find the right match for your needs is worth the effort.

VA Loans: For Veterans and Service Members

If you’ve served our country, VA loans offer unbeatable benefits when financing a mobile home with land:

Your service could qualify you for zero down payment (though some manufactured home lenders might still request 5%), no private mortgage insurance, competitive interest rates, and more flexible credit requirements than many other loan types.

The key requirement? Your manufactured home must be permanently attached to a foundation on land you own or are purchasing. This permanent foundation requirement opens the door to the VA’s excellent terms.

USDA Loans: Rural Property Solutions

Looking at property outside city limits? USDA loans might be your perfect fit:

These loans require no down payment and charge lower mortgage insurance than FHA loans. You’ll need to be in an eligible rural area (which includes many suburban areas too), typically have a credit score around 620, and meet certain income limits. Your manufactured home must be permanently attached to a foundation, making it real property rather than personal property.

Conventional Loans: Traditional Mortgage Options

Conventional loans through Fannie Mae and Freddie Mac provide solid options with:

Down payments starting at just 3% (though 5% is more common for manufactured homes), minimum credit scores of 620, and maximum debt-to-income ratios around 45%. Loan limits reach $766,550 in most areas, with high-cost areas going up to $1,149,825. Like other mortgage options, your home needs that permanent foundation to qualify.

Chattel Loans: For Non-Permanent Foundations

If your manufactured home won’t be permanently attached to land you own, chattel loans become your primary option:

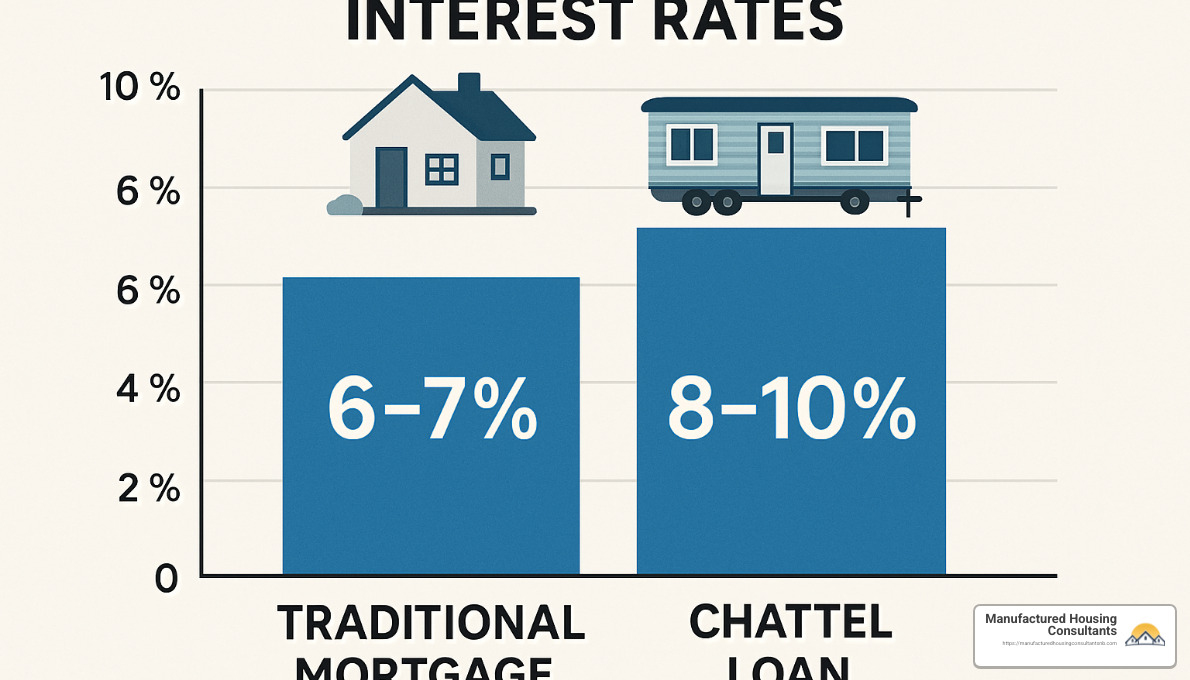

These loans treat your home more like a vehicle than real estate, resulting in higher interest rates (typically starting at 8%), shorter terms (usually 15-20 years instead of 30), down payments of 5-10%, and minimum credit scores around 575.

Mobile vs. Manufactured vs. Modular—Know Your Property

When financing a mobile home with land, terminology matters tremendously—using the wrong term could limit your options or cause confusion with lenders.

Mobile Homes technically only refers to factory-built homes constructed before June 15, 1976. These older homes often face significant financing problems due to their age and construction standards that preceded modern safety requirements.

Manufactured Homes are factory-built homes constructed after June 15, 1976, when the HUD Code established federal safety standards. These homes come with a metal HUD tag and data plate certifying their compliance. When lenders discuss financing mobile home with land options, they’re typically referring to these newer, HUD-compliant manufactured homes.

Modular Homes take a different approach—they’re factory-built in sections, transported to your property, and assembled according to local building codes rather than HUD standards. Since they follow the same codes as site-built homes, they typically qualify for traditional mortgage financing.

The cost differences can be substantial: Single-wide manufactured homes average about $86,500, double-wides typically run around $158,800, and modular homes generally cost 10–20% less than comparable site-built homes but more than manufactured options.

Here at Manufactured Housing Consultants in New Braunfels, we help Texas families understand these distinctions to ensure you select the right home type and financing package for your unique situation.

More info about Mobile Home Financing Options

Eligibility Checklist for Financing Mobile Home with Land

Before you start shopping for that perfect manufactured home and property, make sure you’re prepared with these essentials:

Your credit score will largely determine which loan programs you qualify for. FHA loans start at 500 (with 10% down) or 580+ (with 3.5% down), while VA loans have no specific minimum (though most lenders prefer 620+). USDA and conventional loans typically require 620+, while chattel loans usually want 575-660.

Your down payment options vary widely by loan type. FHA requires 3.5–10% depending on your credit score, while qualified veterans can access VA loans with 0% down. USDA loans also offer 0% down in eligible rural areas. Conventional loans typically need 3–5% (with 5% more common for manufactured homes), and chattel loans generally require 5–10%.

The property itself must meet certain standards. All manufactured homes built after 1976 must have a HUD certification label (metal plate) and data plate. If these are missing, you’ll need to obtain an IBTS verification letter. For traditional mortgages, your home must be on a permanent foundation. Land ownership is ideal for the best rates, though leased land can work if the lease term is at least 3 years with 180 days’ notice before termination. And don’t forget—the land must be properly zoned for manufactured housing.

Your financial situation needs to demonstrate readiness for homeownership. Most lenders cap your debt-to-income ratio at 43%, want to see consistent income history, and some require cash reserves after closing.

As Erin Hybart wisely advises, “When buying a manufactured home and land together, ensure the land is zoned for manufactured homes, has access to utilities, and meets foundation requirements.”

Scientific research on HUD standards: For a deeper dive into the regulations that govern today’s manufactured housing, explore the HUD Manufactured Home Construction and Safety Standards FAQs.

Foundations & Titling: Why “Permanent” Opens up Better Rates

The foundation beneath your manufactured home might seem like a technical detail, but it dramatically affects your financing mobile home with land options.

Permanent foundations open up numerous benefits: qualification for traditional mortgage financing (FHA, VA, USDA, conventional), interest rates often 2–6% lower than chattel loans, longer loan terms (up to 30 years versus 15–20 for chattel), the ability to title your home as real property rather than personal property, and typically better appreciation over time.

You’ll encounter several foundation types when shopping for manufactured homes. Pier and beam foundations use concrete or steel piers to support the home above ground, slab foundations provide a solid concrete base that the home sits directly on, and basement/crawlspace foundations offer additional storage or living space.

For mortgage financing, your foundation must typically be engineered for your specific home and site conditions, meet HUD’s Permanent Foundation Guide standards, transfer all loads properly to the ground, use durable materials like concrete or masonry, and include proper drainage and ventilation.

More info about Mobile Home Foundation Types

The titling process is another key consideration. When your manufactured home is permanently affixed to land you own, you can often convert the title from personal property (like a vehicle) to real property (like a traditional house). This process—sometimes called “de-titling” or “surrender of title”—varies by state but typically involves attaching the home to a permanent foundation, surrendering the home’s title to the state, recording an affidavit of affixation, and getting the home assessed as real property for tax purposes.

Here in Texas, the Texas Department of Housing and Community Affairs handles this important process.

Interest Rates & Costs You’ll Face

When financing a mobile home with land, understanding the full cost picture helps you avoid surprises down the road.

Interest rates vary significantly based on your loan type. Traditional mortgages (FHA, VA, USDA, conventional) currently range from 6–10% depending on your credit score and down payment. Chattel loans typically run higher at 8–14%, often with adjustable rates after an initial fixed period.

Your down payment requirements range from 0–5% for traditional mortgages (depending on loan type) to 5–10% for chattel loans.

Closing costs add up quickly: loan origination fees (0.5–1% of your loan amount), appraisal ($300–600), title insurance (varies by location and loan amount), survey ($300–700), credit report ($25–50), and recording fees (varies by county).

Don’t forget these other essential costs: land preparation ($5,000–15,000 for clearing, grading, and foundation work), utility hookups ($6,500–34,600, averaging around $20,400), delivery and installation ($3,000–10,000), property taxes (varies by location), homeowners insurance (often higher for manufactured homes), and mortgage insurance (required for FHA loans and conventional loans with less than 20% down).

Step-by-Step Guide to Buying, Financing, and Protecting Your Investment

Starting on the journey of financing a mobile home with land doesn’t have to feel overwhelming. With a clear roadmap, you can steer each step with confidence and excitement about your future home.

1. Review Your Finances and Get Pre-Approved

Before falling in love with any particular home or piece of land, take a good look at your financial situation. This is like checking your gas tank before a road trip—you need to know how far you can go!

Start by checking your credit reports and scores—these numbers will significantly impact your loan options and interest rates. Next, calculate your debt-to-income ratio to understand how much home you can realistically afford. Lenders typically want to see a DTI of 43% or lower.

Gather your financial documents (tax returns, bank statements, pay stubs) and organize them neatly. Think of this as preparing your financial resume—you want to make a good impression!

Finally, get pre-approved with a lender experienced in manufactured housing. At Manufactured Housing Consultants, we can connect you with lenders who understand the unique aspects of financing a mobile home with land.

2. Find Your Location

Finding the right piece of land is like choosing the perfect frame for a beautiful picture—it sets the stage for your home.

First and foremost, check zoning regulations to ensure manufactured homes are permitted. Nothing derails a home purchase faster than finding you can’t legally place your home where you want it!

Verify utility availability for water, sewer/septic, electricity, and gas. Those beautiful rural parcels often come with the hidden cost of bringing utilities to the property, which can add thousands to your budget.

Consider accessibility for delivery of your home—a steep, narrow road might make transportation impossible or extremely costly. Research local building codes and permit requirements, and take time to evaluate the neighborhood and amenities that will surround your future home.

3. Choose Your Home

This is the fun part! At Manufactured Housing Consultants, we offer homes from 11 top manufacturers with options to suit every lifestyle and budget.

Consider whether a single-wide, double-wide, or triple-wide best meets your needs. Browse floor plans ranging from cozy 1-bedroom units to spacious 5-bedroom family homes. Think about which standard features matter most to you and which upgrades would truly improve your daily life.

Many of our customers are pleasantly surprised by the energy-efficient options available in today’s manufactured homes—features that not only help the environment but also reduce monthly utility bills.

4. Decide on Your Loan Type

Choosing the right financing is like picking the right shoes for a journey—comfort and fit matter tremendously.

If you qualify and plan to place your home on a permanent foundation, FHA, VA, or USDA loans offer attractive terms. For those with good credit and a permanent foundation, conventional loans provide competitive rates and terms.

If your home won’t be on a permanent foundation or you’re leasing the land, a chattel loan might be your best option, though interest rates are typically higher.

5. Apply for Financing

Once you’ve chosen a loan type, complete the formal application process. Submit all required documentation promptly and pay for the appraisal when requested.

Stay responsive to any additional information requests—delays in providing documents can extend your closing timeline. Review the loan estimate carefully, asking questions about anything you don’t understand.

Think of this step as a partnership between you and your lender—both working toward the same goal of getting you into your new home.

6. Prepare Your Land

While waiting for loan approval, start preparing your land. Obtain necessary permits, clear and grade the site, install the foundation, and arrange for utility connections.

This preparation stage is crucial—proper land preparation ensures your home will be stable, level, and correctly connected to all necessary services. At Manufactured Housing Consultants, we can recommend experienced contractors who specialize in manufactured home site preparation.

7. Close on Your Loan

Closing day is the finish line of your financing journey! Review all documents carefully before signing, pay your closing costs, and sign the loan agreement.

Upon closing, you’ll either receive keys (if the home is already installed) or schedule delivery and installation. Either way, you’re now officially a homeowner!

8. Have Your Home Delivered and Installed

The delivery and installation process requires precision and expertise. Professional delivery of your home, proper installation on the foundation, connection to utilities, and final inspections are all critical steps.

This process typically takes several days to complete, depending on the complexity of your home and site. Patience during this stage pays off with a properly installed home that will serve you well for decades.

9. Protect Your Investment

After move-in, focus on protecting your investment. Obtain comprehensive homeowners insurance specifically designed for manufactured homes. Keep up with regular maintenance—manufactured homes, like all homes, require ongoing care.

Pay property taxes on time to avoid penalties, and consider refinancing when rates improve or your equity increases. Your home is both a place to live and a financial asset—treating it as both will serve you well.

More info about Manufactured Home Mortgage

Buying Land and Home Together or Separately?

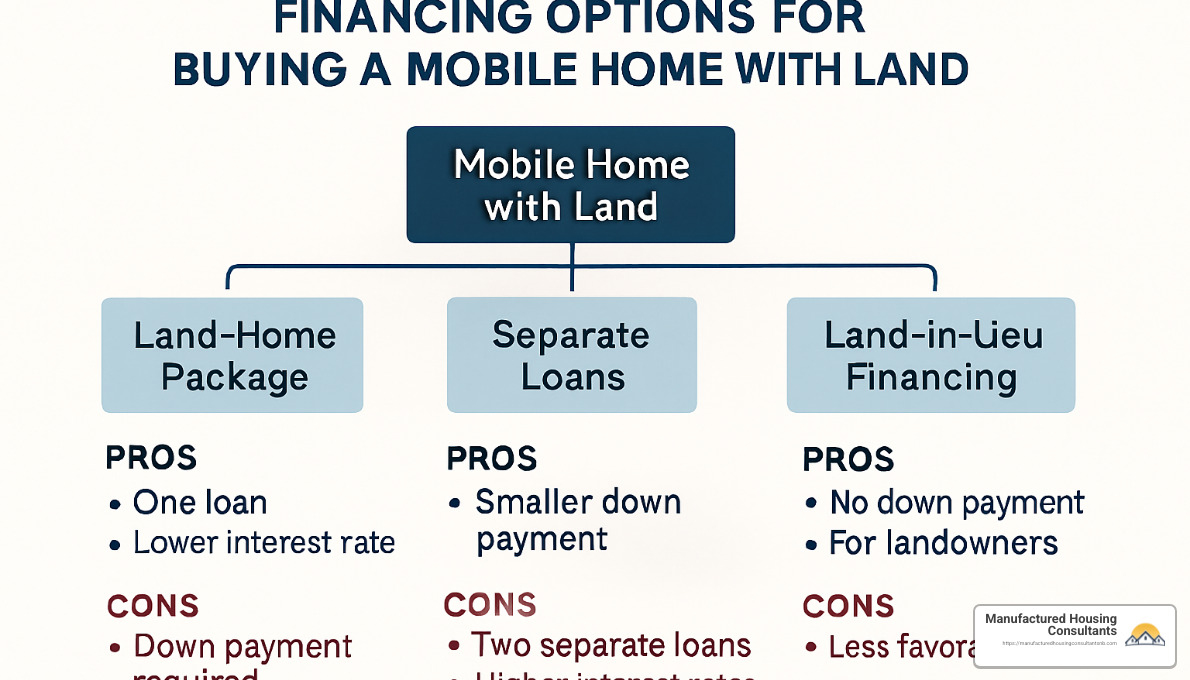

When financing a mobile home with land, you have several approaches, each with unique advantages:

Option 1: Land-Home Package (One Loan)

The simplicity of a single closing and potentially lower overall interest rate makes this an attractive option for many buyers. While it requires a permanent foundation and offers fewer lender choices, it’s ideal for those planning to stay long-term. Think of this as the “all-inclusive vacation package” of home buying—everything bundled together for convenience.

Option 2: Separate Loans (Chattel + Land Loan)

This approach offers more flexibility and allows you to finance your home even if the land doesn’t qualify for traditional mortgage financing. While it involves two closings and typically higher overall interest rates, it can be the right solution in certain circumstances. Consider this the “à la carte” approach—potentially more expensive but offering greater customization.

Option 3: Land-in-Lieu Financing

If you already own land free and clear or have substantial equity, this option allows you to use that equity instead of cash for your down payment. While convenient, remember you’re putting both your home and land at risk if you default on the loan.

“Using land as collateral can appeal to people who own their land as it eliminates the need for a significant cash down payment,” notes a housing expert at Manufactured Housing Consultants.

For example, with land-in-lieu financing, if your land appraises for $50,000 and you’re buying a $100,000 manufactured home, you might be able to use up to 65% of your land value ($32,500) toward your down payment requirement.

Financing Mobile Home with Land for First-Time & Low-Income Buyers

If you’re a first-time homebuyer or working with income constraints, don’t lose heart! Several programs can help make financing a mobile home with land more accessible.

Down payment assistance programs through state housing finance agencies can provide critical help with initial costs. For example, SONYMA (State of New York Mortgage Agency) offers loans with down payments as low as 3% plus additional 3% down payment assistance. Many counties and cities also offer local assistance programs worth exploring.

For those who qualify, zero down payment options include USDA loans in rural areas and VA loans for veterans. Land-in-lieu options can also eliminate the need for cash down payments if you already own suitable land.

The manufactured housing industry has developed special programs like Fannie Mae’s MH Advantage and Freddie Mac’s CHOICEHome, offering conventional financing with down payments as low as 3% for certain high-quality manufactured homes. These programs, along with Duty to Serve initiatives, are making manufactured housing more affordable and accessible.

Duty to Serve details

For buyers with income considerations, FHA loans offer more flexible income requirements, while Community Development Financial Institutions (CDFIs)—nonprofit lenders—may provide more accommodating terms.

At Manufactured Housing Consultants, we take pride in helping first-time buyers steer these programs to find the most affordable path to homeownership.

Refinancing Options for Financing Mobile Home with Land

Once you’ve settled into your manufactured home, refinancing might become an attractive option to lower your interest rate, reduce monthly payments, shorten your loan term, convert from a chattel loan to a traditional mortgage, or access equity for improvements.

FHA Streamline Refinance offers a simplified process for existing FHA loans with minimal documentation and often no appraisal requirement. The key qualification is that refinancing must result in a tangible benefit like a lower rate or payment.

For veterans with existing VA loans, the VA Interest Rate Reduction Refinance Loan (IRRRL) provides a streamlined path to better terms, typically without requiring an appraisal or income verification.

Conventional rate-and-term refinance replaces your existing loan with new terms and can be used to convert a chattel loan to a conventional mortgage if your home sits on a permanent foundation. This option requires appraisal and credit qualification but can result in significant savings.

If you’ve built substantial equity, a cash-out refinance lets you access that equity for home improvements, debt consolidation, or other needs. While interest rates are typically higher than with rate-and-term refinancing, this option provides flexibility for homeowners with significant equity.

For those who initially financed with a chattel loan but have a home on a permanent foundation on owned land, converting to a real property mortgage can offer substantial savings. This process involves converting the title to real property, meeting foundation requirements, and obtaining an appraisal that treats the home as real estate.

“When refinancing a manufactured home with land, ensure the home is permanently affixed to a foundation and titled as real property to qualify for the best rates,” advises a finance specialist at Manufactured Housing Consultants.

More info about Manufactured Home Loan Calculator

Common Pitfalls and How to Avoid Them

Even the smoothest journey can have a few bumps in the road. When financing a mobile home with land, being aware of potential challenges helps you steer around them:

Pre-1976 mobile homes present significant financing challenges through traditional means. If you’re considering an older unit, prepare to either save for a cash purchase or explore specialized programs through local credit unions.

Missing HUD tags or data plates can halt financing in its tracks. If your tags are missing, contact the Institute for Building Technology and Safety (IBTS) to obtain a verification letter before applying for loans.

Non-permanent foundations limit your financing options to higher-interest chattel loans. While the upfront cost of installing a permanent foundation is significant, the long-term interest savings often make this investment worthwhile.

Short-term land leases can complicate financing, as many lenders require at least a 3-year initial lease term. Whenever possible, negotiate longer lease terms or consider purchasing land outright.

Insufficient comparable sales can challenge appraisers trying to value your property. Working with lenders and appraisers experienced in manufactured housing helps overcome this hurdle.

Zoning restrictions in some areas prohibit or severely restrict manufactured homes. Always thoroughly research zoning before purchasing land to avoid finding costly limitations after you’ve already invested.

High interest rates on chattel loans can significantly increase your overall cost of homeownership. Prioritizing a permanent foundation and real property classification whenever possible helps secure more favorable financing terms.

Title conversion complications vary by state and can be complex. Working with a title company experienced in manufactured housing smooths this process considerably.

At Manufactured Housing Consultants, we help customers steer these challenges to ensure a smooth financing experience and long-term satisfaction with their manufactured home purchase.

Conclusion & Next Steps

Financing a mobile home with land isn’t as daunting as it might first appear. With the right knowledge and support, you can steer the options and find an affordable path to homeownership that works for your unique situation.

At Manufactured Housing Consultants, we’ve helped countless Texas families turn their homeownership dreams into reality. Our team in New Braunfels understands that buying a home is both exciting and nerve-wracking—especially when you’re exploring manufactured housing for the first time.

“The most rewarding part of our work is seeing families move into homes they never thought they could afford,” says our lead housing consultant. “When they realize they can own both a quality home AND the land beneath it, everything changes.”

We’re proud to offer:

- Access to beautiful, modern homes from 11 top manufacturers (at the guaranteed lowest prices)

- Personalized guidance through all financing options, whether FHA, VA, USDA, conventional, or chattel

- Complete land preparation services to ensure your site is ready for your new home

- Start-to-finish support that makes the entire process smoother and less stressful

Ready to take your next steps? Here’s a simple plan to get started:

First, take a good look at your finances. Check your credit score, determine what monthly payment fits comfortably in your budget, and honestly assess how much you can put toward a down payment. Some loan programs require as little as 0-3.5% down!

Next, reach out to our friendly financing team. We’ll help you understand which loan programs you qualify for and provide a clear picture of what you can afford. This pre-qualification step saves you time and prevents disappointment later.

Once you know your budget, visit our New Braunfels location where you can tour available homes and discuss land options. Seeing and touching different models helps you envision your future in ways online browsing simply can’t match.

Finally, we’ll help you choose the financing approach that makes the most sense for your situation—whether that’s a convenient land-home package, separate loans, or leveraging equity in land you already own.

As you move forward, keep these success tips in mind:

Investing in a permanent foundation might cost more initially, but it opens doors to better financing options with lower interest rates. Your credit score directly impacts your interest rate, so taking steps to improve it can save thousands over the life of your loan. And remember that owning your land provides both stability and potential for building equity over time.

Manufactured homes today offer impressive quality, energy efficiency, and modern designs at a fraction of traditional housing costs. With proper installation and maintenance, they provide comfortable, durable housing for decades.

Contact Manufactured Housing Consultants today, and let’s start your journey toward affordable homeownership. Whether you’re a first-time buyer, downsizing, or looking for a vacation property, we’ll help you find the perfect manufactured home and land package custom to your needs and budget.

More info about Mobile Home Financing