From Credit Woes to Mobile Home: Your Guide to Buying with Bad Credit

Learn how to purchase a mobile home with bad credit. Get tips, loan options, and steps for affordable homeownership with poor credit.

Navigating the Path to Mobile Home Ownership with Credit Challenges

How to purchase a mobile home with bad credit is possible through specialized financing options including FHA loans (minimum score 500), chattel loans (575+), and personal loans (600+). Here’s a quick roadmap:

- Check your credit report and dispute errors

- Save for a down payment (10-20% typically required)

- Research specialized lenders (credit unions, online lenders)

- Consider a co-signer or using land as collateral

- Get pre-approved before shopping for homes

Your credit score does not define who you are, but it can feel like it defines your opportunities. With over half of all Americans currently having subprime credit scores, you’re not alone in facing this challenge. The good news? Mobile and manufactured homes offer a practical path to homeownership at a fraction of the cost of traditional site-built homes.

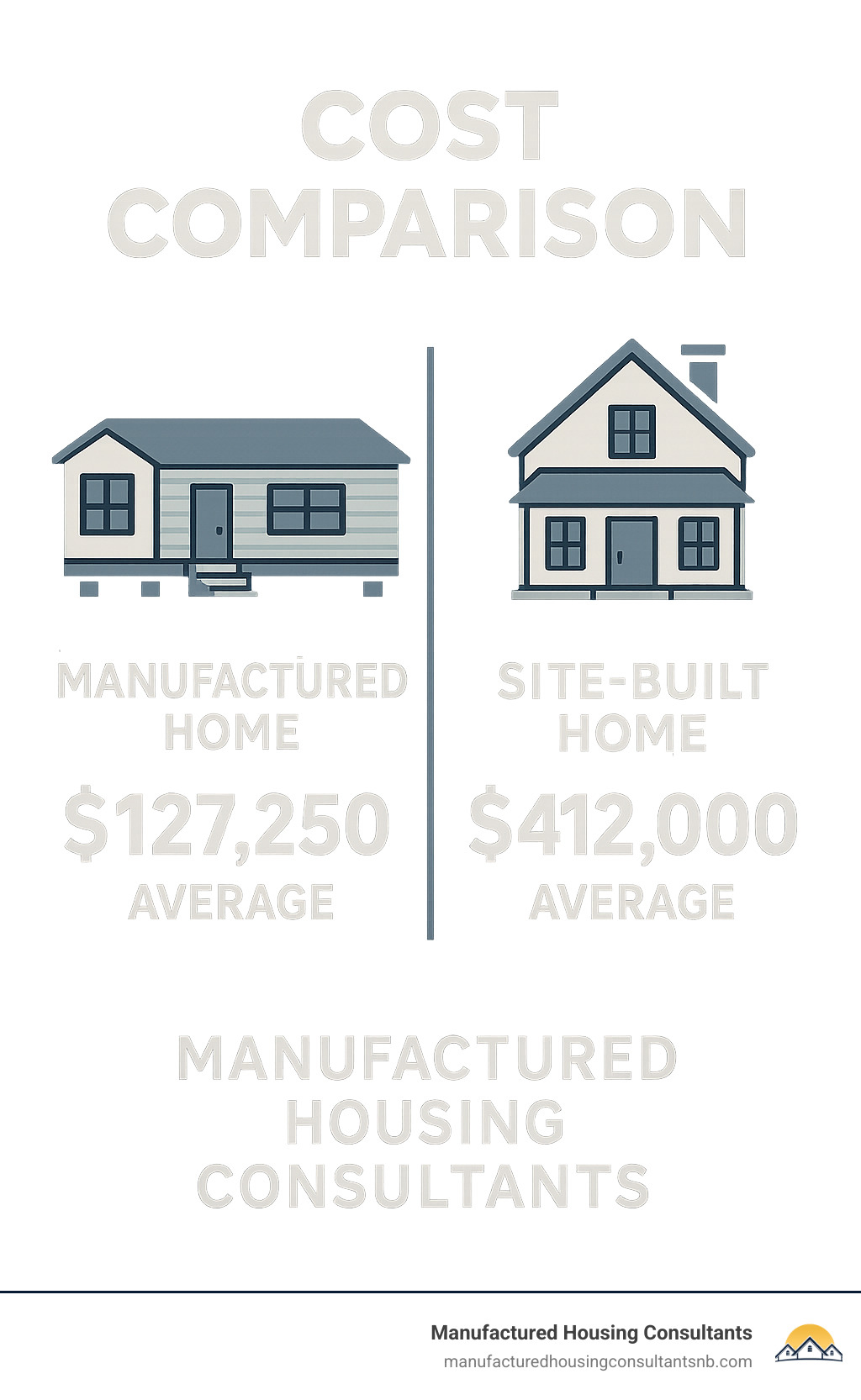

The median price of site-built homes exceeds $412,000, while manufactured homes average around $127,250. This significant difference makes manufactured housing an attractive option for budget-conscious buyers, even those with credit challenges.

Whether you’re looking for more space for a growing family, tired of paying high rent with nothing to show for it, or simply want the pride of homeownership, don’t let credit concerns stop you. There are multiple financing paths designed specifically for buyers in your situation.

This guide will walk you through the entire process of purchasing a mobile home with less-than-perfect credit—from understanding loan options to closing the deal and eventually refinancing when your credit improves.

Bad Credit & Mobile Home Financing 101

Let’s face it—navigating home financing can feel overwhelming, especially when your credit isn’t perfect. But don’t worry! Understanding how to purchase a mobile home with bad credit starts with knowing exactly where you stand and what options are available to you.

Credit scores typically range from 300 to 850, with higher scores opening more doors. Here’s what these numbers actually mean in the real world:

- Excellent: 720-850 (red carpet treatment)

- Good: 690-719 (still very solid)

- Fair: 630-689 (some limitations)

- Poor: 580-629 (fewer options, higher costs)

- Bad: Below 580 (challenging, but not impossible)

The good news? Manufactured home lenders often work with more flexible guidelines than traditional mortgage companies. They understand that manufactured homes represent an affordable pathway to homeownership for many Americans.

As Steve Sexton, a respected financial expert, puts it: “Manufactured homes provide a practical and affordable alternative to traditional housing in today’s market, and there are financing options designed specifically for buyers with credit challenges.”

You have several loan types to consider, each with different requirements and benefits:

Chattel loans secure the home itself as collateral, much like car financing. FHA Title I and II loans offer government backing that gives lenders confidence to work with lower credit scores. VA loans can be a lifeline for veterans, while USDA loans serve rural homebuyers. Freddie Mac and Fannie Mae programs provide conventional options, and personal loans might work in a pinch when other doors close.

More info about Introduction to Mobile Home Financing

What Credit Score Do You Need?

Your credit score sets the stage for which financing paths are open to you. Here’s the breakdown:

With a score of 500, you can potentially qualify for an FHA loan with a larger down payment. At 575+, chattel loans become accessible. Personal loans typically require 600+, while conventional financing generally starts at 620. For agency loans through Freddie Mac or Fannie Mae, you’ll usually need 640-680+.

“Your credit score is just one piece of the puzzle,” explains one of our financing specialists at Manufactured Housing Consultants. “Income, debt-to-income ratio, employment history, and down payment all play important roles in the approval process.”

These are typical minimums—approval isn’t guaranteed at these thresholds. Lenders look at your entire financial picture, not just one number.

Scientific research on subprime credit scores

Loan Types that Welcome Bad Credit Buyers

When your credit score sits below 620, certain loan types become your best friends:

FHA Title I Loans offer a government safety net that allows for credit scores as low as 500, with down payments ranging from 3.5% (if your score is 580+) to 10% (for scores between 500-579). These loans can provide up to $69,678 for a single-section home or $92,904 if you’re buying both a home and land, with terms extending up to 20 years.

Chattel Loans work well for scores around 575 and up. You’ll typically need 5-20% down, but can stretch payments over 15-23 years. Interest rates start around 7.75%, and these loans process faster than some alternatives. They’re especially useful when your home will sit on leased land.

VA Loans are a hidden gem for veterans and service members. While there’s no official minimum score, most lenders look for at least 580. The biggest perk? You might qualify with zero down payment.

Personal Loans can work with scores of 600+, with amounts up to $100,000 and terms extending to 12 years. Interest rates vary widely (6.99-26%), but you’ll avoid appraisal and collateral requirements.

Dealer Financing offers convenience and flexibility, often working with multiple lenders to find you a solution. Many manufactured home dealers like us have relationships with lenders who specialize in credit-challenged buyers.

| Loan Type | Min. Credit Score | Down Payment | Max Term | Best For |

|---|---|---|---|---|

| FHA Title I | 500-580 | 3.5-10% | 20 years | First-time buyers |

| Chattel | 575 | 5-20% | 23 years | Leased land |

| VA | N/A (580+ typical) | 0% | 25 years | Veterans |

| Personal | 600+ | Varies | 12 years | Quick funding |

| Dealer | Varies | Varies | Varies | Convenience |

How Bad Credit Changes Rates, Terms & Down Payments

When exploring how to purchase a mobile home with bad credit, you should prepare for several key differences in your loan terms.

Higher Interest Rates are perhaps the most obvious impact. While buyers with excellent credit might lock in rates between 5-7%, credit challenges could push your rate to 8-12% or even higher. This difference adds up significantly over time—potentially thousands of extra dollars over the life of your loan.

Larger Down Payments provide lenders with security when your credit history shows some bumps. Instead of the 3.5-5% down that strong-credit buyers might pay, you’ll likely need 10-20% of the purchase price. On a $100,000 manufactured home, that’s $10,000-$20,000 upfront instead of $3,500-$5,000.

“Lenders may ask for 5%, 10%, or even up to 35% down payment depending on your credit risk profile,” notes a financing specialist at Manufactured Housing Consultants. “The higher down payment shows personal investment and reduces the lender’s risk.”

Shorter Loan Terms often accompany credit challenges, with 15-20 year terms instead of the standard 30 years. This means higher monthly payments, though you’ll build equity faster and pay less interest over time.

Private Mortgage Insurance (PMI) becomes mandatory with FHA loans, adding both an upfront premium and annual costs throughout your loan term.

Stricter Debt-to-Income Requirements might limit you to a DTI of 36-41%, compared to the 43-45% that good-credit buyers might qualify for. This means you’ll need to show more income relative to your existing debts.

The good news? Several compensating factors can help overcome credit problems. A stable employment history of two years or more, higher income relative to your debts, significant savings, a larger down payment, and clear explanations for past credit issues all help lenders feel more comfortable working with you.

More info about Mobile Home Financing – What You Need to Know

Step-by-Step: How to Purchase a Mobile Home with Bad Credit

Now that you understand the landscape, let’s walk through the practical steps to secure financing and purchase your manufactured home despite credit challenges.

Step 1 — Prep Your Credit & Paperwork to Purchase a Mobile Home with Bad Credit

The journey to homeownership begins with understanding exactly where you stand financially. Start by pulling your free credit reports from all three major bureaus through AnnualCreditReport.com. When you review these reports, play detective – look for incorrect account information, outdated negative items, and any accounts you don’t recognize.

“I’ve seen clients boost their scores by 20-50 points just by fixing errors,” shares one of our credit specialists. “That small improvement can make a huge difference in your loan terms.”

If you’re not in a rush to buy, consider taking some time to boost your FICO score. Even small improvements can open doors to better financing options. Pay down those credit card balances to below 30% of your limits, and make absolutely every payment on time for at least six months. These two actions alone can significantly improve your credit profile.

Your debt-to-income ratio matters tremendously when applying for manufactured home financing. Lenders want to see that your monthly debt payments don’t eat up too much of your income – ideally less than 43%. If you’re carrying high-interest debt, focusing on paying it down could improve both your credit score and DTI ratio simultaneously.

Stable income is your best friend when applying with credit challenges. Gather those pay stubs from the last month, your W-2 forms from the past two years, and recent tax returns. Self-employed? Be prepared to provide even more documentation. As our financing team often says, “Documentation is KING when applying for a loan with credit challenges.”

More info about FICO Score Improvement Program

Step 2 — Build a Bigger Down Payment & Pick the Right Lender

When figuring out how to purchase a mobile home with bad credit, your down payment becomes your secret weapon. While buyers with excellent credit might get away with minimal down payments, you’ll want to aim for 10-20% of the purchase price. On a $100,000 manufactured home, that means having $10,000-$20,000 ready.

“A larger down payment is like an instant risk-reducer in the eyes of lenders,” explains our financing specialist. “It shows commitment and literally reduces the amount they need to lend you.”

Don’t have that much saved? Get creative! Many of our clients use gift funds from family members – most loan programs allow this with proper documentation. If you already own land, its value can often count toward your down payment, instantly boosting your buying power. Already own a mobile home? Its trade-in value can significantly reduce the amount you need to finance.

Choosing the right lender makes all the difference when you have credit challenges. Traditional banks often have rigid requirements, but credit unions typically offer more flexibility for their members. They tend to look at your whole financial picture rather than just focusing on your credit score.

Online lenders like 21st Mortgage, Cascade Financial Services, and Triad Financial Services specialize in manufactured home loans and understand the unique aspects of this market. They often have programs specifically designed for buyers with credit issues.

When shopping for rates, submit all your applications within a 14-30 day window. This way, multiple credit inquiries will count as just one on your credit report. Compare the APR (Annual Percentage Rate), not just the interest rate, and ask about all fees involved, including origination fees and closing costs.

“We value you as a customer regardless of your credit score,” our financing team often reminds clients. “Our partnerships with multiple lenders allow us to find solutions for almost any credit situation.”

Scientific research on mobile home financing options

More info about Loan Options for Mobile Homes

Step 3 — Get Pre-Approved: How to Purchase a Mobile Home with Bad Credit Without Land

Getting pre-approved isn’t just a nice-to-have – it’s essential when you’re navigating how to purchase a mobile home with bad credit. This important step establishes your budget, shows sellers you’re serious, identifies potential issues early, and speeds up the final approval once you find your perfect home.

To get pre-approved, you’ll complete a loan application (either online or in person), provide your documentation (ID, income proof, bank statements), authorize a credit check, and explain any negative items in your credit history. Be upfront and honest about past credit issues – lenders appreciate transparency and many have heard every story imaginable.

When selecting a mobile home, lenders have specific requirements. The home must have been built after June 15, 1976, and display a HUD certification label (also called a “HUD tag”). Most lenders require a minimum size of 400 square feet, and for certain loan types (FHA, VA, and conventional), the home must sit on a permanent foundation.

Planning to place your home in a mobile home park or on leased land? Your financing options will be a bit different. You’ll likely need a chattel loan rather than a mortgage, and you should ensure your lease has a minimum term of three years with at least 180 days’ notice before termination. Always check park rules regarding home age, size, and appearance before falling in love with a particular community.

Before finalizing your plans, verify that zoning allows manufactured homes in your desired area, check for deed restrictions or HOA rules, confirm utility availability, and assess site preparation needs. These details matter tremendously and can save you headaches down the road.

“At Manufactured Housing Consultants, we help buyers steer these requirements to ensure a smooth purchasing process,” explains our sales team. “We can even help coordinate site preparation and utility connections in the New Braunfels, Texas area.”

Step 4 — Close, Move In, and Plan for Future Refinancing

You’ve secured financing and selected your home – now it’s time to close the deal and plan for your future. When purchasing a manufactured home with credit challenges, be prepared for typical closing expenses beyond just your down payment. These include origination fees (1-5% of the loan amount), title search and insurance ($300-$1,500), home inspection ($300-$500), appraisal fee ($300-$700), and credit report fee ($25-$50).

Don’t forget about delivery and setup costs, which typically run $3,000-$10,000, foundation construction at $4,000-$12,000, and utility connections ranging from $1,000-$5,000. These amounts vary based on your location and specific home.

“Many buyers are surprised by these additional costs,” notes our team at Manufactured Housing Consultants. “We provide clear cost breakdowns so there are no surprises at closing.”

Unlike traditional homes, manufactured homes can be titled as either real property (when permanently affixed to owned land) or personal property (when on leased land or not permanently affixed). Your title type affects both your financing options and insurance requirements, so make sure you understand which applies to your situation.

At Manufactured Housing Consultants, we don’t just sell you a home and wish you luck. We coordinate the professional transportation of your home to the site, proper foundation installation, home placement and leveling, utility hookups, skirting, steps, and decks installation, and final inspections. Our goal is to make the process as smooth as possible for you.

One of the benefits of purchasing a manufactured home is the opportunity to rebuild your credit. Set up automatic payments to ensure you never miss a due date, consider making bi-weekly payments to reduce interest and build equity faster, and track your credit score improvement over time.

“Many of our customers see significant credit score improvements within 12-24 months of purchasing their home,” shares our financing specialist. “This opens the door to refinancing opportunities.”

As your credit improves and you build equity in your home, refinancing becomes a viable option to lower your interest rate, reduce monthly payments, shorten your loan term, convert a chattel loan to a mortgage (if on owned land), or access equity for home improvements.

“We’ve seen customers start with interest rates in the 10-12% range and refinance to 5-7% after just two years of on-time payments and credit improvement,” notes our refinancing expert. Your first loan doesn’t have to be your forever loan – think of it as your foot in the door to homeownership.

More info about Financing a Mobile Home

Conclusion & Next Steps

Purchasing a mobile home with bad credit isn’t just possible—it’s happening every day for families across Texas. With the strategies we’ve outlined, you can join the thousands who’ve found their path to affordable homeownership despite credit challenges.

Here at Manufactured Housing Consultants, we’ve seen the joy on countless faces when families receive their keys—many who never thought homeownership was within reach because of past credit mistakes. From our home base in New Braunfels, we’ve made it our mission to help Texas families find affordable manufactured housing solutions, regardless of their credit history.

What makes our approach different? We combine guaranteed lowest prices on homes from 11 top manufacturers with specialized financing programs designed specifically for buyers with credit challenges. We don’t just sell you a home and wish you luck—we offer land improvement services to prepare your site and provide comprehensive support from your first inquiry until long after you’ve moved in.

The journey we’ve walked through together in this guide highlights some crucial truths about how to purchase a mobile home with bad credit. First, you’re far from alone—over half of Americans are navigating subprime credit scores. Second, options exist specifically for situations like yours, from FHA loans to chattel financing. Third, saving that 10-20% down payment can make all the difference in getting approved.

Perhaps most importantly, homeownership itself becomes a powerful tool for rebuilding your financial future. Those monthly payments you make faithfully? They’re not just buying you a home—they’re rebuilding your credit profile month by month, opening doors to better refinancing options down the road.

“I’ve seen folks come to us with credit scores in the 500s who, two years later, qualify for conventional refinancing,” shares our financing director. “The pride they feel isn’t just in their home—it’s in taking control of their financial future.”

Ready to write your own success story? The team at Manufactured Housing Consultants is standing by to help you steer each step of the journey. We believe your past doesn’t define your future, and that everyone deserves a place to call home. Let’s start the conversation today about how we can help make your homeownership dreams a reality—regardless of what your credit report says.