Buyer’s Guide: Best Foreclosed Trailers for Sale Near Me in 2025

Discover how to find and buy foreclosed trailers for sale near me in 2025. Save big with expert tips, guides, and helpful resources.

Why Foreclosed Trailers Offer the Best Housing Value in 2025

Foreclosed trailers for sale near me represent one of the last affordable paths to homeownership in today’s challenging market. These bank-repossessed mobile homes can offer savings of 20% or more compared to traditional used units.

Quick Answer – Where to Find Foreclosed Trailers:

- Government Auctions: GSA Auctions, GovDeals, FEMA surplus sales

- Bank Listings: Local credit unions, specialized lenders like VMF Homes

- Online Platforms: RepoFinder Pro, HUD foreclosure databases

- County Records: Public auction notices, sheriff sales

- Repo Dealers: Specialized dealers with bank relationships

The 2025 housing market presents unique challenges. Rising interest rates have pushed traditional home prices beyond reach for many families, while housing shortages continue across most states. Repossessed mobile homes can be discounted up to 20% or more compared to market value.

Foreclosed trailers offer a realistic alternative with up to 100% loan-to-value financing available on primary residences. However, most are sold “as-is” with no warranties, and buyers should expect to cover repairs after purchase.

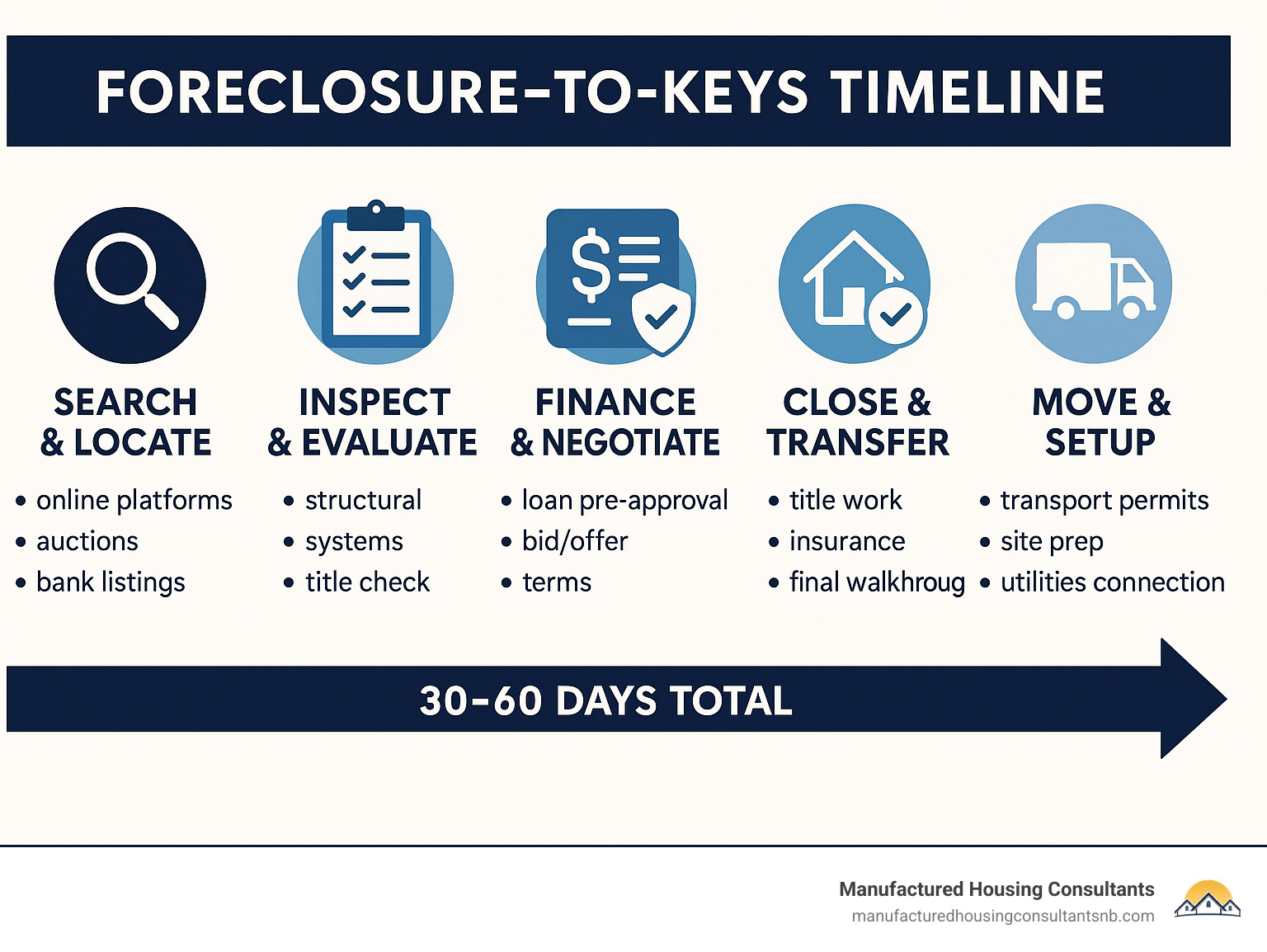

Understanding where to look, how to finance, and what to inspect can mean the difference between finding your dream home at a great price – or facing expensive surprises down the road.

Foreclosed Trailers for Sale Near Me: 2025 Buying Guide

Foreclosed trailers enter the market when families face job loss, medical bills, or divorce. After 90-120 days of missed payments, lenders begin the foreclosure process. What started as someone’s dream home becomes a bank’s problem to solve.

These repos come from bank repossessions, government surplus (especially FEMA trailers), HUD foreclosures from defaulted FHA loans, and credit union seizures.

Banks aren’t in the housing business – they want these homes gone, creating negotiation opportunities you’d never find with emotional private sellers. Foreclosed trailers flow through auction platforms like GovDeals, specialized repo dealers, online marketplaces such as RepoFinder Pro, and direct lender sales.

The trade-off is simple: foreclosed trailers are sold “as-is,” meaning no warranties or guarantees. This increases risk but creates potential for serious savings – sometimes 20% or more off market value.

For more detailed information about the repo process, check out our guide on repossessed mobile homes.

Understanding Foreclosed Trailers vs Other Used Mobile Homes

When you’re looking at a foreclosed trailer for sale near me, you’re dealing with institutional sellers who operate by different rules than individual homeowners.

Bank ownership changes everything. Instead of negotiating with someone emotionally attached to their home, you’re working with loan officers who view the property as a balance sheet line item. This can work in your favor during negotiations.

Every foreclosed trailer must meet HUD compliance standards and comes with the chassis included – that steel frame and axle system making them transportable.

The depreciation opportunity is where smart buyers make money. Banks price these homes to move, often below market value. We’ve seen motivated lenders accept offers 25-30% below comparable used homes.

From an investment potential standpoint, foreclosed trailers can be goldmines. Buy below market, invest in improvements, and flip for profit or rent for income.

However, foreclosed trailers typically come with zero maintenance history and condition issues are common. The timeline pressure is real – banks want quick closings with cash or pre-approved financing.

Where to Find Foreclosed Trailers for Sale Near Me

Finding foreclosed trailers for sale near me requires knowing where to look. Unlike regular homes on Zillow, repos hide in specialized market corners.

Start with local banks and credit unions. Call loan departments directly about REO inventory. County auctions handle sheriff sales and court-ordered foreclosures. Government auction sites like GSA Auctions and GovDeals offer federal and local surplus.

Specialized marketplaces like RepoFinder Pro aggregate listings from multiple sources. The HUD Home Store lists HUD-foreclosed manufactured homes with detailed photos.

Specialized dealers like us at Manufactured Housing Consultants maintain lender relationships and often know about upcoming repo sales before public advertising.

Repo inventory changes weekly, and the best deals disappear within days. Set up alerts on multiple platforms and be ready to act quickly.

For a comprehensive guide to finding repos in your area, visit our page on finding repo mobile homes for sale near me.

Verify lender credentials through the NMLS Consumer Access portal before working with any financial institution.

Can You Really Save 20%? Pricing Analysis

The 20% savings figure is conservative. We’ve seen buyers save 30% or more on foreclosed trailers for sale near me.

Lender motivation drives pricing more than condition. Banks bleeding money on storage and insurance would rather take a loss than continue carrying costs.

Here’s what we typically see in the Texas market:

| Home Type | New Price Range | Foreclosed Price Range | Potential Savings |

|---|---|---|---|

| Single-wide (2BR/1BA) | $45,000-$65,000 | $35,000-$50,000 | 15-25% |

| Double-wide (3BR/2BA) | $75,000-$110,000 | $55,000-$85,000 | 20-30% |

| Triple-wide (4BR/3BA) | $120,000-$180,000 | $90,000-$140,000 | 20-25% |

Note: Prices exclude land, transport, and setup costs

Last month, we helped a couple purchase a 2021 double-wide through a credit union repo sale. Originally financed for $95,000, they bought it for $71,000 – a 25% discount.

Budget for transport and setup costs of $3,000-$8,000, immediate repairs (5-15% of purchase price), permits and inspections ($500-$2,000), and utility connections ($1,000-$3,000).

Financing, Titles & Negotiation Strategies

Financing foreclosed trailers for sale near me offers excellent opportunities for qualified buyers. 100% loan-to-value financing is available on primary residences.

Chattel loans work for home-only purchases. FHA loans can finance HUD-code homes on permanent foundations. VA loans serve eligible veterans with competitive rates.

Credit requirements aren’t scary – we’ve helped clients with scores as low as 580 get approved through government-backed programs.

Title situations can get complicated. Watch for UCC filings, ensure the certificate of title is clear, verify all previous liens are satisfied, and confirm proper repossession documentation.

Negotiation with banks requires preparation. Come with financing pre-approval, document needed repairs with contractor estimates, and offer quick closing timelines.

Research comparable sales and present written offers with supporting data. Banks appreciate logical arguments for pricing.

For first-time buyers, check our guide at repo mobile homes for sale first-time buyer.

Inspection, Moving & Setup Checklist

Inspecting a foreclosed trailer for sale near me requires detective work since homes are sold “as-is” without warranties.

Structural inspection starts with roof condition – look for missing shingles, soft spots, or leaks. Check floor joists by walking through and noting sagging areas. Test all windows and doors.

Mechanical systems need thorough testing. Run water at fixtures and check for plumbing freeze damage. Inspect electrical panels and test HVAC systems. Check water heater condition.

Transportation readiness is crucial. Inspect axles and suspension, check tire condition (replace if over seven years old), verify hitch and safety chains, and test electric brake systems.

The moving process involves transport permits ($200-$500), professional movers ($3,000-$6,000), site preparation ($2,000-$5,000), setup and leveling ($1,500-$3,000), and utility connections ($1,000-$3,000).

Insurance requirements include comprehensive coverage and liability protection with the lender listed as loss payee.

At Manufactured Housing Consultants, we work with specialized insurance agents to ensure clients get appropriate coverage at competitive rates.

Final Checklist & Next Steps

You’ve made it through the complete guide to foreclosed trailers for sale near me – now it’s time to put this knowledge into action. At Manufactured Housing Consultants in New Braunfels, Texas, we’ve walked hundreds of families through this process.

The repo market continues growing with economic uncertainty, creating more quality inventory monthly. But the best deals don’t last long – while you’re reading this, someone else might be touring that perfect double-wide.

Your roadmap starts with getting finances in order. Know exactly what you can afford – not just purchase price, but total costs including repairs, transport, and setup.

Pre-approval isn’t optional – it’s your ticket to being taken seriously. When competing against other buyers, having financing locked in makes the difference.

Research becomes your daily habit. Check bank websites, set up auction alerts, and call credit unions regularly. The repo market moves fast with weekly inventory changes.

Professional inspections save marriages – seriously. We’ve mediated heated discussions about “little water stains” that became $8,000 roof replacements. Every repo needs thorough inspection.

The due diligence checklist protects against expensive surprises. Verify clean title, confirm HUD standards compliance, and document repair needs with actual cost estimates. Get insurance lined up before closing.

The emotional side matters too. Buying a foreclosed trailer can feel overwhelming. Take your time, ask questions, and don’t let anyone pressure you into uncomfortable decisions.

At Manufactured Housing Consultants, we maintain relationships with lenders across Texas and often hear about repo inventory before it goes public. Our clients get first looks at quality homes with guaranteed lowest prices.

The foreclosed trailer market offers real opportunities for affordable homeownership, but success requires the right approach and professional support.

For specialized information about bank-owned properties, check our detailed guide on bank repos.

Ready to stop paying someone else’s mortgage? The housing market isn’t getting easier in 2025, but with the right guidance and strategic approach to foreclosed trailers, homeownership is still within reach.

We’ll guide you through every step – from that first phone call to getting your keys. With our comprehensive support services and decades of manufactured housing experience, you’re gaining a team invested in your success.

Don’t let another month pass wondering “what if.” The perfect foreclosed trailer for sale near me might be just one phone call away.