Financing Freedom: Discover Your Mobile Home Options

Secure your dream home! Learn about all your financing options for mobile homes, including FHA, VA, and bad credit solutions. Start now!

Your Path to Affordable Homeownership

Financing options for mobile homes include several paths to homeownership that can fit different budgets and credit situations. Here are the main options available:

Primary Financing Types:

- Traditional Mortgages – Available when you own the land and the home qualifies as real property

- Chattel Loans – Personal property loans for the home itself, similar to auto loans

- FHA Title I Loans – Government-backed loans for manufactured homes, lots, or both

- VA Loans – Available to qualifying veterans with favorable terms

- Personal Loans – Unsecured financing option, though typically with higher rates

Key Factors That Affect Your Options:

- Whether you own or lease the land

- Your credit score and financial history

- The age and type of manufactured home

- Down payment amount available

If you’re feeling overwhelmed by rising housing costs in Texas, you’re not alone. Traditional home prices have increased sharply over recent years, making manufactured homes an attractive alternative for families seeking affordable homeownership.

The financing process for mobile and manufactured homes works differently than traditional home loans. Many people don’t realize that these homes can be classified as either personal property or real estate, which significantly impacts your financing options and loan terms.

Understanding your choices upfront helps you make informed decisions and potentially save thousands in interest over the life of your loan. Whether you’re a first-time buyer or looking to improve your credit situation, there are financing solutions designed to help you achieve homeownership.

Explore more about financing options for mobile homes:

Exploring Your Financing Options for Mobile Homes

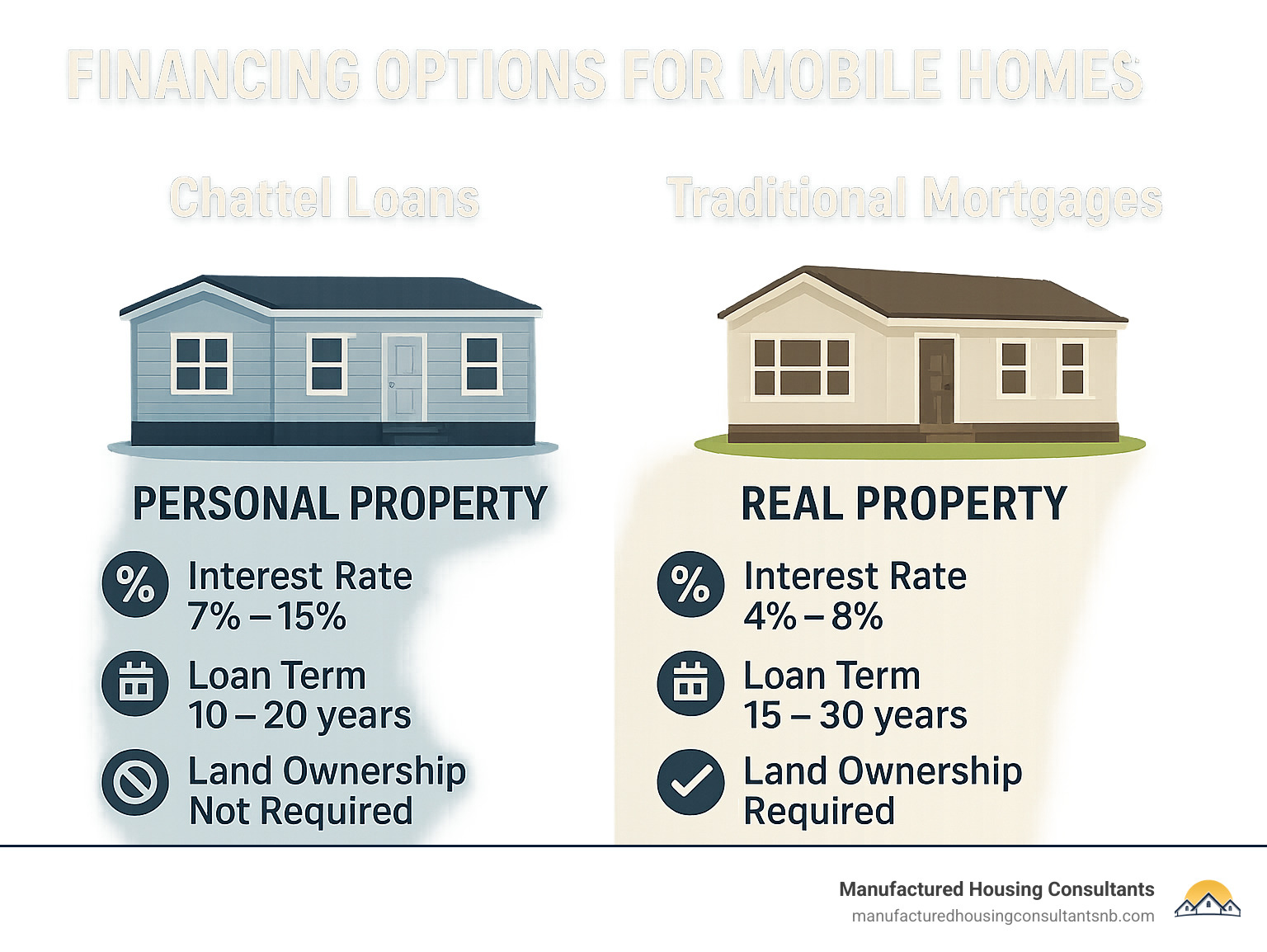

Mortgages vs. Chattel Loans: The Two Main Paths

The classification of your manufactured home—real property or personal property—dictates almost everything about the loan you can obtain.

- Real property = traditional mortgage. Own the land, place the home on a permanent foundation, convert the title, and you can access 30-year terms with interest rates that often start around 5.99% for well-qualified borrowers.

- Personal property = chattel loan. If the home sits on leased land or isn’t permanently affixed, lenders treat it like a large vehicle. Expect 8-14% interest, 10-20-year terms, and larger down-payments, but approvals are typically faster and you keep the flexibility to relocate the home.

For mortgage details, visit our Manufactured Home Mortgage page.

Government-Backed Loan Programs for Manufactured Homes

Government programs soften down-payment and credit problems:

- FHA Title I – Finance the home, the lot, or both—even on leased land—up to $105,532 (single-section) or $193,719 (multi-section) with terms up to 20 years.

- FHA Title II – Standard FHA mortgage for homes on permanent foundations with as little as 3.5% down.

More info: Financing Manufactured (Mobile) Homes (Title I) and Will FHA Finance a Manufactured Home?. - VA Loans – For eligible veterans: 0% down, no PMI, competitive rates. See VA Loan Rules for Manufactured Homes.

- USDA Loans – No down payment in qualifying rural areas, income limits apply.

Can You Finance a Home on Leased Land?

Absolutely. FHA Title I and most chattel lenders are built for this situation. A longer pad lease (three years or more) and non-disturbance agreements make lenders more comfortable. Remember to include lot rent when calculating your debt-to-income ratio. For details, visit Financing a Mobile Home.

Securing Financing Options for Mobile Homes with Bad Credit

Even scores in the 500–600 range can work:

- FHA flexibility – Scores 580+ need only 3.5% down; 500–579 require 10% down.

- Bigger down payments or a co-signer improve approval odds and rates.

- Credit unions & specialized lenders often judge applications on broader criteria than big banks.

While shopping, keep balances low, pay on time, and avoid new credit lines. Our Mobile Home Loan Bad Credit resource and FICO Score Improvement Program can help.

Your Next Steps to Securing a Loan

How to Prepare Your Loan Application

- Gather documents early. Two years of tax returns, 30 days of pay stubs, and 2–3 months of bank statements give lenders a clear picture.

- Pull your credit report. Dispute errors and be ready to explain any late payments.

- Show proof of funds. Lenders must see where your down payment and closing costs come from.

- Get pre-approved. It locks in your budget and strengthens offers.

- Follow the 31% rule. Keep your full housing payment—including lot rent—below 31% of gross income.

Avoid opening new credit or changing jobs until after closing. Read more about our streamlined Pre-Approval Process.

Let Us Help You Find the Best Financing Options for Mobile Homes

At Manufactured Housing Consultants, our lender network spans banks, credit unions, and manufactured-home specialists. We match you with the program that fits your budget, credit profile, and land situation, then handle the paperwork from application to closing.

Ready to start? Explore your mobile home financing options with us today!

New Braunfels Office | Manufactured Housing Consultants | (830) 888-9701