Bank on Savings: Repo Manufactured Homes in Texas

Unlock savings with repo manufactured homes Texas! Find discounted homes, understand pros/cons, and navigate the buying process.

Opening Up Affordable Homeownership in the Lone Star State

If you’re looking for repo manufactured homes texas, here are the key facts you need to know:

Quick Facts About Texas Repo Manufactured Homes:

- Cost Savings: 20-40% below market value compared to new homes

- Condition: Sold “as-is” but many dealers offer habitability warranties

- Financing: Available through specialized lenders like 21st Mortgage, Vanderbilt, and Green Tree

- Popular Areas: San Antonio, Austin, Houston, and surrounding counties

- Timeline: 4-6 weeks for home-only purchases, 6-8 weeks with land

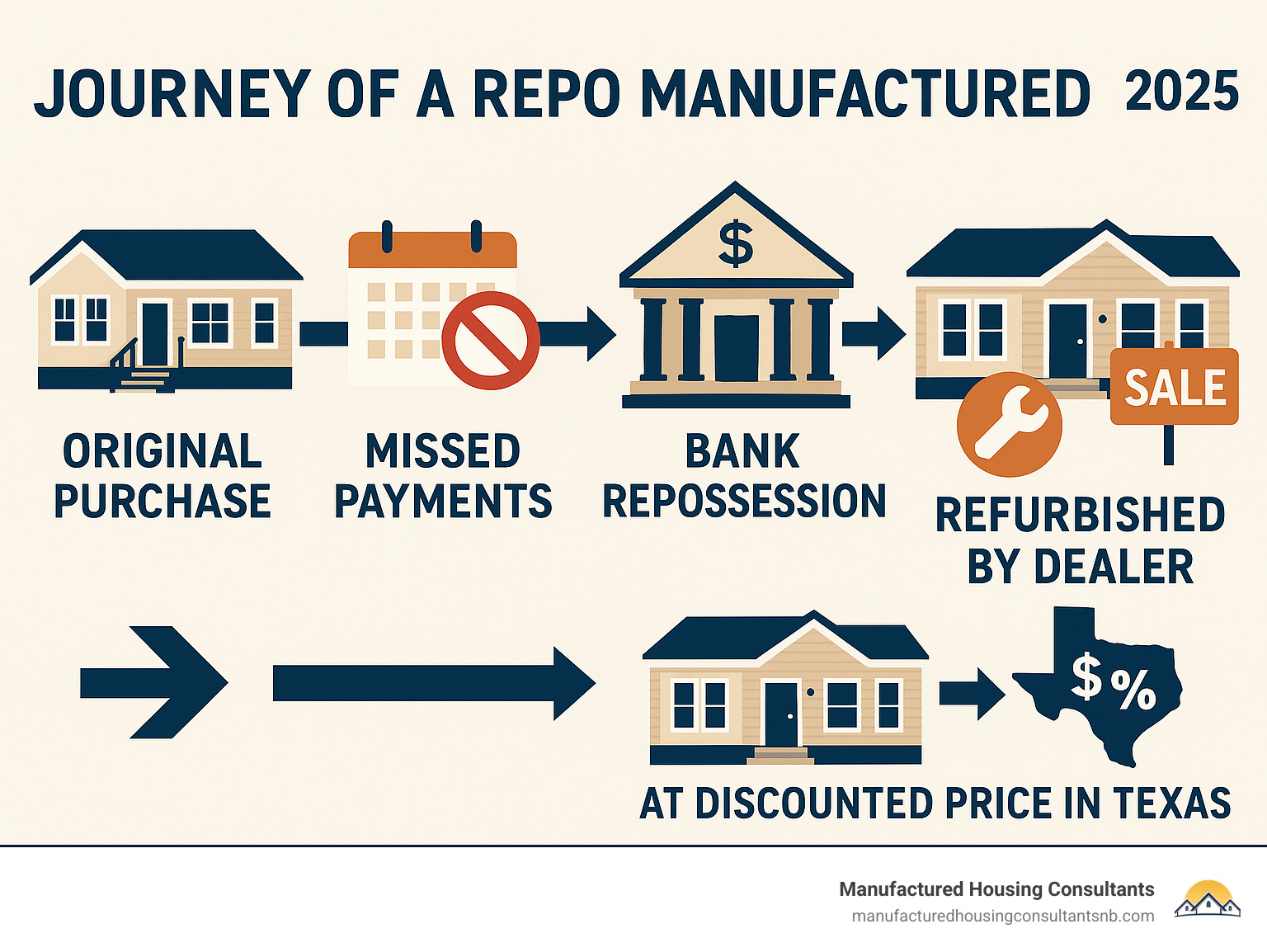

Texas homebuyers are finding a hidden gem: repo manufactured homes. These are homes repossessed by lenders due to missed payments, offering an affordable path to homeownership.

Repo manufactured homes are repossessed by a lender and sold at a significantly lower price. Many are refurbished by factory-trained craftsmen to look like new.

While traditional home prices climb, repo manufactured homes sell for 20 to 40% below market value. A home that costs $100,000 new could be yours for $60,000-$80,000.

Texas is a hotspot for these deals, with dealers offering a wide selection of single-wide and double-wide homes for every budget and lifestyle.

Better yet, many Texas repo dealers guarantee habitability and offer warranties up to 60 days, giving you peace of mind with your purchase.

Explore more about repo manufactured homes texas:

The Ultimate Guide to Repo Manufactured Homes Texas

When you’re exploring repo manufactured homes Texas, you’re stepping into a unique corner of the housing market that can open up incredible opportunities. These aren’t just any used homes – they have their own special story that makes them worth understanding.

What to Expect: Repo vs. New and Used Homes

Let’s clarify the differences between repo, new, and used homes.

New manufactured homes are fresh from the factory with full warranties and customization options, but you’ll pay a premium price.

Used manufactured homes are sold by the previous owner. Their condition varies greatly depending on maintenance, and warranties are not guaranteed.

Repo manufactured homes are repossessed by lenders. Because banks want to recoup their money quickly, these homes are sold at a significant discount.

Think of them as diamonds in the rough. Our factory-trained craftsmen refurbish these homes, turning them into move-in ready gems.

The numbers are compelling: repo manufactured homes Texas sell for 20 to 40% below market value. This discount makes homeownership accessible.

While often sold “as-is,” working with experienced dealers who refurbish these homes ensures you get professional quality at a bargain price.

Want to dive deeper into your options? Check out:

The Pros and Cons of Buying Repo Manufactured Homes in Texas

We believe in straight talk, so let’s lay out exactly what you’re getting into with repo manufactured homes Texas – the good, the challenging, and everything in between.

| Advantages of Buying a Repo Manufactured Home | Disadvantages of Buying a Repo Manufactured Home |

|---|---|

| Lower Cost: Often 20-40% below market value, offering significant savings. | “As-Is” Condition: May require repairs or renovations, though many dealers refurbish them. |

| More Value for Money: Get a larger or better-equipped home for your budget. | Potential for Hidden Damage: Thorough inspection is critical to identify issues not immediately visible. |

| Faster Move-In: Repo homes are typically available immediately, unlike new builds. | Limited History: Less information about previous ownership and maintenance. |

| Affordable Homeownership: A great entry point into homeownership, especially for first-time buyers. | Relocation Costs: If the home isn’t already on your land, moving and setup costs apply. |

| Refurbishment by Dealers: Many dealers, like us, professionally refurbish repo homes, enhancing their value and condition. | Depreciation: Manufactured homes generally depreciate over time, unlike traditional stick-built homes that can appreciate. |

| Financing Options: Specialized lenders are available, even for those with challenging credit. | Legal Complexities: Potential for title issues or liens if not handled by a reputable dealer. |

The primary advantage is the incredible cost savings. This often means you can afford a larger home or one with better features than you thought possible. Many of our repo homes are refurbished by factory-trained craftsmen, so you’re getting a professionally restored home, not someone else’s problem.

On the downside, the “as-is” nature of many repo sales requires a thorough inspection. Even with our refurbishment work, it’s wise to know exactly what you’re buying. Manufactured homes typically depreciate, which is a key factor in long-term financial planning. There can also be legal complexities with titles, but an experienced dealer can steer these issues for you.

For most Texas families, the advantages of affordable homeownership far outweigh the challenges, especially when working with a dealer who ensures a smooth process.

For more insights on manufactured home ownership in our area, visit:

Financing Your Repo Home Purchase

Financing repo manufactured homes Texas is very accessible, even if you’ve been turned down by traditional banks.

Manufactured home financing differs from traditional mortgages, often in your favor.

Chattel loans treat the home as personal property, like a car loan. Specialized lenders like 21st Mortgage, Vanderbilt Mortgage, and Green Tree offer these loans, which are ideal if the home is on rented land.

Real estate loans are available when the home is permanently attached to land you own. This allows access to FHA, VA, or conventional financing, often with better terms.

Our financing approach is special: we work with all credit situations. Whether you have low credit, no credit, or even no Social Security number, we have programs to help, including a FICO Score Improvement Program.

You may qualify for up to 100% financing for a primary residence, with closing costs often rolled into the loan. Our lending partners also have no restrictions on home age, expanding your options.

The timeline is typically 4 to 6 weeks for home-only purchases (6 to 8 with land). Our partners handle appraisals and title work to ensure a smooth process.

Ready to explore your financing options? Check out:

- Financing Options for Mobile Homes

- Mobile Home Loan Bad Credit

- Learn about financing from 21st Mortgage

How to Find and Purchase Your Texas Repo Home

With the right approach and trusted partners, finding the perfect repo manufactured home Texas can be a straightforward and exciting path to homeownership.

Where to Find Listings in Texas

When searching for repo manufactured homes Texas, knowing where to look is key.

Specialized dealers are your best resource. At Manufactured Housing Consultants, our relationships with lenders give us exclusive access to repo inventory that never reaches public listings. We acquire these homes quickly to refurbish for our customers.

Online resources can be a starting point, but the best deals move fast and often aren’t listed. A relationship with a dealer is valuable, as we can alert you to new inventory that fits your needs.

Banks rarely sell directly to consumers, preferring to work through dealer networks to move assets quickly and efficiently.

Our reach extends throughout the Lone Star State. We have repo manufactured homes Texas available in San Antonio, Austin, Houston, Tyler, Beaumont, Odessa, Abilene, and many other communities. We deliver to every county in Texas and to neighboring states like Arkansas, Oklahoma, New Mexico, and Louisiana.

Don’t limit your search; the perfect home might be a short drive away, especially with savings of 20-40%.

For specific metropolitan areas, explore:

The Buying Process for Repo Manufactured Homes in Texas

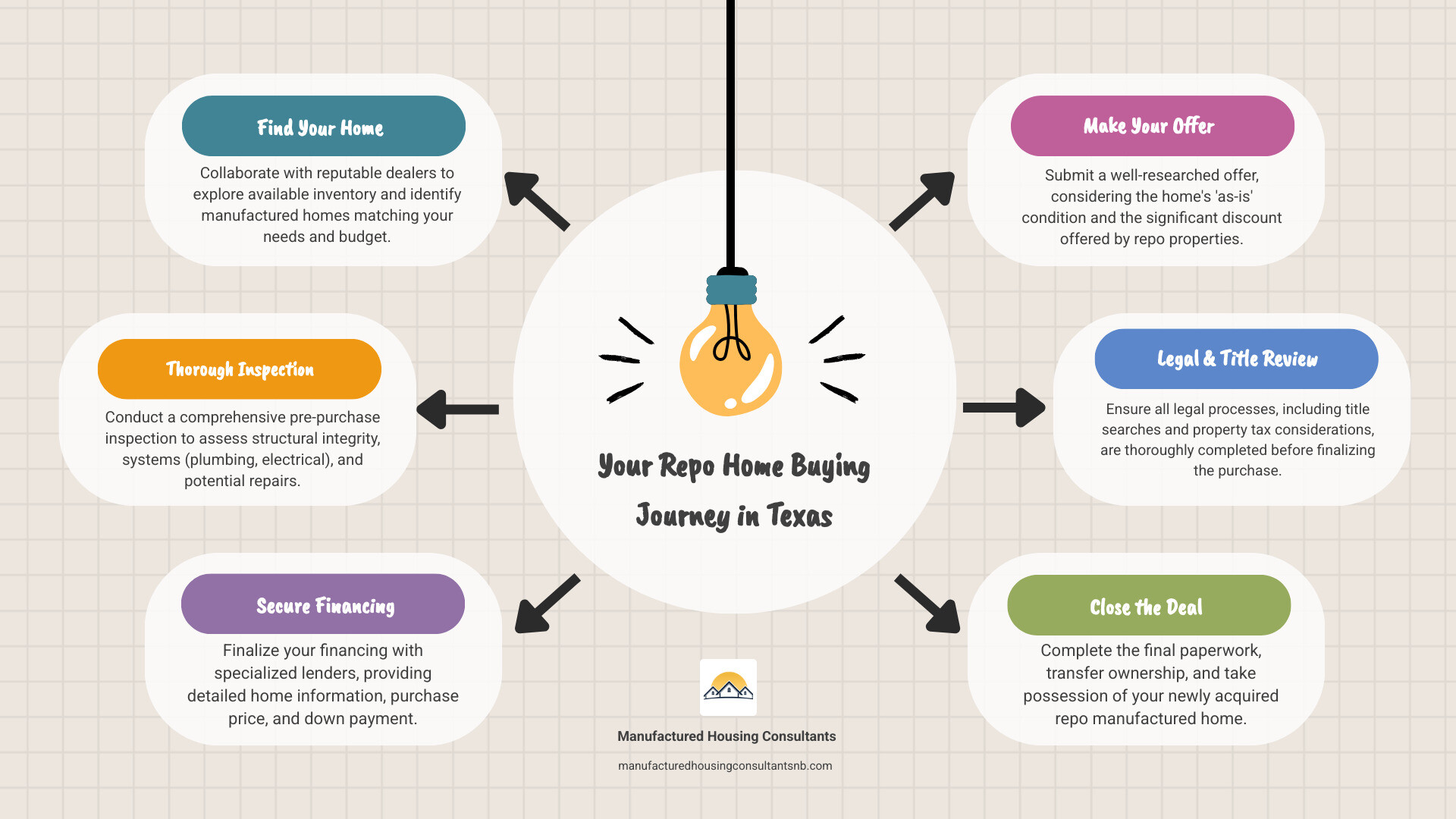

Once you find the right repo manufactured home Texas, the buying process is your roadmap to ownership. We’ll guide you through each step.

1. Find Your Home: After you identify a home, we provide its full history and our 1-10 condition rating.

2. Inspect Thoroughly: This phase is crucial. Even with our habitability guarantees and warranties, a detailed inspection ensures your confidence.

3. Secure Financing: We leverage our relationships with specialized lenders to help you complete your application. Our partners can often close home-only loans in 4-6 weeks.

4. Steer the Legal Details: The repossession process is legally complex. We handle the heavy lifting, ensuring clean titles and resolving any tax or lien issues. Title searches are non-negotiable.

5. Make an Offer: Our consultants provide market data to help you make a confident, informed offer.

6. Close the Deal: We coordinate all documents for a smooth closing. The typical timeline is 4-6 weeks for home-only purchases and 6-8 weeks with land. We advocate for you throughout the entire process.

For official regulations and consumer protections:

Your Pre-Purchase Inspection Checklist

Even with our quality guarantees, a thorough inspection of your repo manufactured home Texas is a smart investment. Use this checklist to get to know your future home.

- Structure: Check the foundation, blocking, and tie-downs for stability. Inspect the steel chassis underneath for rust or damage.

- Roof: Look for missing shingles, soft spots, or signs of leaks. Inside, check ceilings for water stains.

- Exterior: Ensure walls and siding are solid and weatherproof. Check that windows and doors operate smoothly and securely.

- Floors: Walk through every room, feeling for soft spots, squeaks, or uneven areas that could indicate subfloor damage.

- Plumbing and Electrical: Test all faucets, toilets, and showers for pressure and drainage. Check the water heater’s condition. Verify all electrical outlets and switches work, and inspect the main panel for issues.

- HVAC: Test both the heating and cooling systems. Ensure ductwork is clean, connected, and filters are accessible.

- Interior: Look past cosmetics for water stains, cracks, or odors. Check flooring, cabinets, and countertops for signs of neglect.

- Exterior Details: Check for proper skirting, good drainage around the foundation, and any signs of pest activity.

While our craftsmen ensure high standards for every repo manufactured home Texas, your personal inspection provides complete peace of mind.

Ready to see what’s available? Explore our current selection: