Find Your Next Haul: Top Bank Repo Trailers Available Now

Score huge savings on bank repo trailers! Our guide helps you find, inspect & buy affordable manufactured homes in Texas. Start saving now!

Open uping Value: An Introduction to Repo Trailer Homes

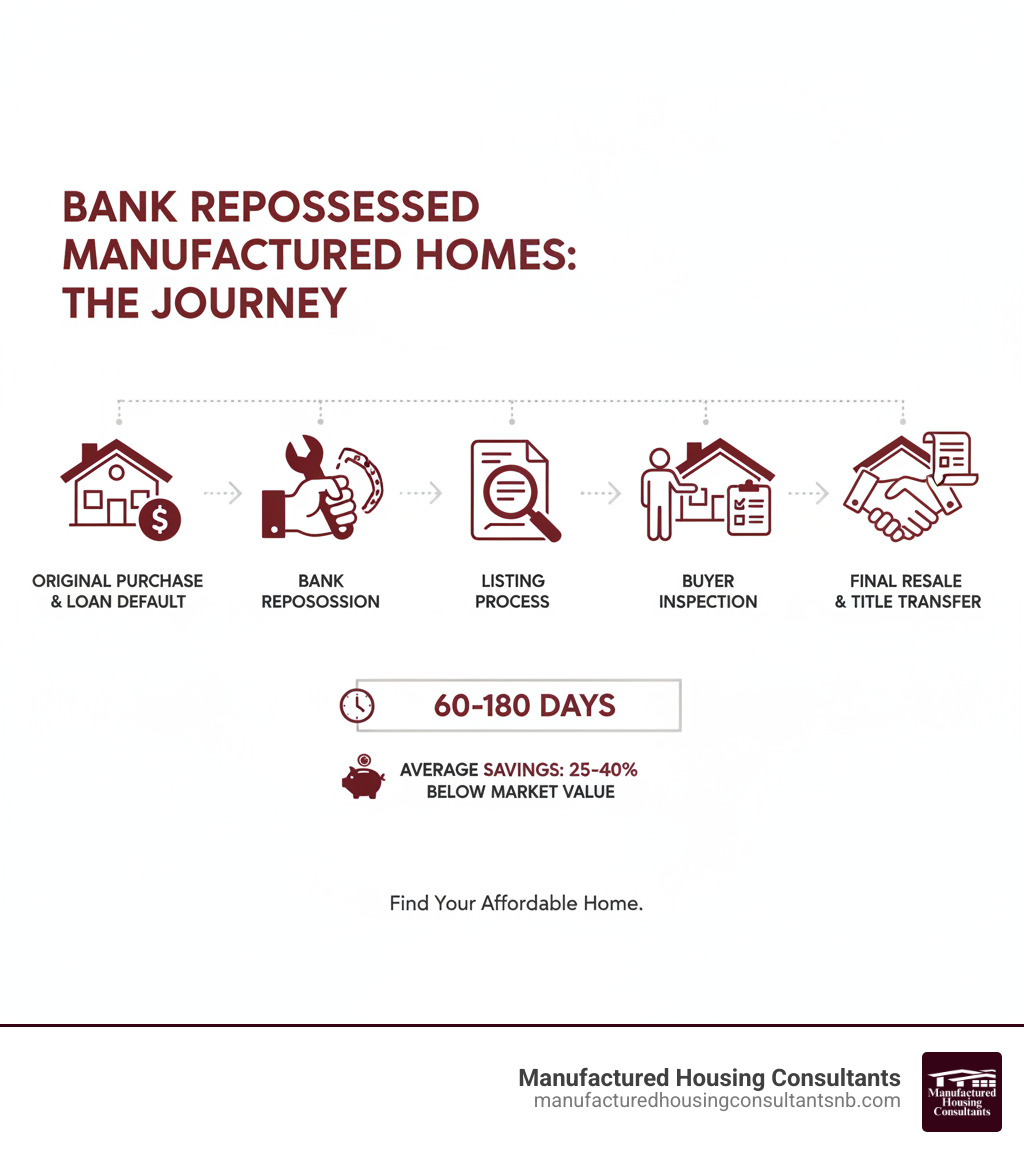

Bank repo trailers, specifically manufactured homes, offer a unique opportunity for affordable homeownership at significantly reduced prices. These are properties that banks or lenders have reclaimed after the previous owner defaulted on their loan payments. The lender then sells the home to recover their losses, creating a chance for savvy buyers to find a great deal.

Repo manufactured homes typically sell for 25-40% below market value, offering immediate affordability and the potential for instant equity. However, this advantage comes with a key consideration: these homes are almost always sold in “as-is” condition. This means they come with no warranty, making a thorough inspection absolutely essential before purchase.

In Texas, where affordable housing is a priority, bank repo manufactured homes are a practical path to owning a home. For budget-conscious buyers in New Braunfels and surrounding communities who are prepared to handle potential repairs, the repo market is a source of genuine value. The key is knowing where to find these homes, what to look for during an inspection, and how to steer the purchase process.

Your Complete Guide to Finding and Buying Bank Repo Trailers

Finding the right bank repo trailer takes patience and know-how, but the potential savings make it worth the effort. The Texas market for these homes moves quickly, so staying informed and ready to act is essential. Here at Manufactured Housing Consultants, we help our New Braunfels neighbors steer this process every day.

Where to Find Repo Mobile Homes in Texas

The hunt for bank repo trailers requires knowing where to look, as they don’t always appear in typical real estate listings. Here are the most common channels:

- Online Repossession Marketplaces: Websites like Repo Finder provide free access to bank and credit union repossession sales across the country, including manufactured homes.

- Auction Platforms: Banks often use online and live auctions to liquidate repossessed homes quickly. Checking these platforms regularly can reveal new inventory.

- Direct from Lenders: Some banks and credit unions sell repossessed homes directly. Contacting the asset recovery departments at local financial institutions can uncover unadvertised deals.

- Local Dealers: A local dealer like Manufactured Housing Consultants has the inside track on repo inventory in the New Braunfels area. We often secure the best deals before they hit public listings.

The Texas market for repo homes moves quickly, so persistence is key. For Texas-specific searches, explore our resources at Find Repo Mobile Homes For Sale Near Me and Repo Manufactured Homes Texas.

The Key Advantages and Potential Risks

Buying a bank repo trailer offers clear advantages, but it’s essential to understand the risks. We believe in straight talk to help you make the best decision.

| Feature | New Manufactured Home | Bank Repo Manufactured Home |

|---|---|---|

| Cost | Higher initial investment, reflects brand new condition and customization. | Significantly lower initial cost, often 25-40% below market value due to distressed sale. |

| Condition | Pristine, brand new, no wear and tear. | Varies widely from excellent to poor; often sold “as-is” with visible wear. |

| Warranty | Full manufacturer’s warranty, covering defects and major components. | Typically no warranty, sold “as-is”. |

| Customization | Full control over floor plans, finishes, and features. | Limited to existing features; customization requires post-purchase renovations. |

| History | Clear history, first owner. | Previous owner defaulted; history of maintenance/care is often unknown. |

| Financing | Wider range of traditional financing options, potentially better rates. | Can be more challenging to finance due to “as-is” condition; specialized options available. |

The biggest advantage is the lower price. Lenders want to recover their losses quickly, not maximize profit, creating opportunities for buyers. This can lead to instant equity potential, as the home’s value may exceed your purchase price, especially after a few smart improvements.

However, the biggest risk is the “as-is” condition. Most bank repo trailers come with no warranty. The bank will not fix any issues. This is compounded by an unknown history and potential neglect. You rarely know how the previous owner maintained the property, and deferred maintenance can lead to hidden damage. Condition varies wildly from one repo to another, so what you see is what you get. While financing can sometimes be more challenging, multiple options exist, which we can help you steer.

A Buyer’s Checklist for Inspecting Bank Repo Trailers

Given the “as-is” nature of repo sales, a thorough inspection is your most important tool. Never skip it, and consider hiring a professional inspector for peace of mind.

Focus on the home’s core systems and structure. Examine the steel frame for rust or damage and check the subfloor for soft spots indicating leaks. An improperly leveled home can cause widespread issues like sticking doors and windows. Inspect the roof for leaks or wear, as water damage can be destructive in Texas. Test all plumbing and electrical systems, including faucets, outlets, and the electrical panel. Don’t forget to run the HVAC to check both heating and cooling functions. Finally, look for any signs of pests like termites, which can compromise the home’s integrity.

Top inspection points for repo mobile homes:

- Roof Integrity: No leaks or significant damage.

- Subfloor Condition: No soft spots or water damage.

- Exterior: Siding and trim have no major gaps or damage.

- Windows and Doors: Seal properly and operate smoothly.

- Plumbing: No leaks and adequate water pressure.

- Electrical: Panel and wiring appear safe and functional.

- HVAC System: Both heating and cooling work correctly.

- Water Intrusion: No stains on ceilings or walls.

- Foundation: Home is level and stable.

- Pests: No evidence of termite, rodent, or insect infestation.

The cost of a professional inspection is minor compared to the cost of finding major problems after the sale. It’s the smartest investment you can make in the buying process.

Navigating the Purchase Process for a Bank Repo Trailer

Once you’ve found a promising bank repo trailer and completed your inspection, it’s time to steer the purchase.

Making Your Offer

Research comparable manufactured home sales in the New Braunfels area to understand the true market value. Factor your estimated repair costs into your offer price. Repo sales move fast, so be prepared to make a firm offer and act quickly if it’s accepted.

Securing Financing

More financing options exist for bank repo trailers than many buyers realize.

- Traditional Financing: Buyers with good credit (generally 620 or higher) can often secure favorable rates from banks, credit unions, or specialized lenders.

- Rent-to-Own Programs: These offer guaranteed approval for buyers with challenged credit, providing a path to homeownership with affordable monthly payments.

At Manufactured Housing Consultants, we work with lenders who understand the Texas repo market and can help you explore every option. For more details, visit our pages on Financing a Mobile Home and our Bad Credit Mobile Home Guide.

Title Transfer and Legal Steps

This stage requires careful attention to detail.

- Clear Title: The seller must provide a clear title, free from any liens. This is non-negotiable and ensures you are the sole legal owner.

- Bill of Sale: This document records the transaction details, including the home’s serial number, price, and the crucial “as-is” clause.

- Registration and Taxes: Manufactured homes in Texas are registered through the Texas Department of Housing and Community Affairs. Be prepared for additional costs like sales tax, dealer fees, and registration fees. Always clarify the total out-the-door price before closing.

Ensuring a Fair Deal

To ensure you’re getting a fair deal, compare prices extensively and consider a professional appraisal for an unbiased valuation. Don’t let the fast pace of the repo market pressure you into a rash decision. A good deal is one that you’ve thoroughly researched and feel confident about. Purchasing a bank repo trailer can be incredibly rewarding when done right. Learn more by reading Why Should You Get a Repo Mobile Home.

Partner with a Texas Expert for Your Repo Home Purchase

As you’ve seen, bank repo trailers—especially manufactured homes—offer a genuine path to affordable homeownership with substantial savings. While the process requires careful inspection and due diligence, you don’t have to steer it alone. For first-time buyers, having an expert partner can make all the difference.

That’s where we come in. At Manufactured Housing Consultants, we are your neighbors in New Braunfels, with deep roots in the Texas manufactured housing market. We understand the unique aspects of buying repo homes because we do it every day. Our local expertise means we know the regulations, financing options, and what to look for in a Texas home.

We work with 11 top manufacturers, guarantee the lowest prices, and specialize in finding financing for all credit situations. We also offer land improvement services, from site prep to utility connections, to make your move seamless. We believe repo manufactured homes are a smart solution for building equity and stability. Our team is here to guide you without pressure, helping you find a home that fits your needs and your budget.

Ready to start your journey?

Explore our available bank repo homes today!

Let’s open up that value together.