The Ultimate Guide to Locating Bank Repos Mobile Homes

Unlock affordable homeownership! Find and buy bank repossessed mobile homes in Texas. Get expert tips on pros, cons, and financing.

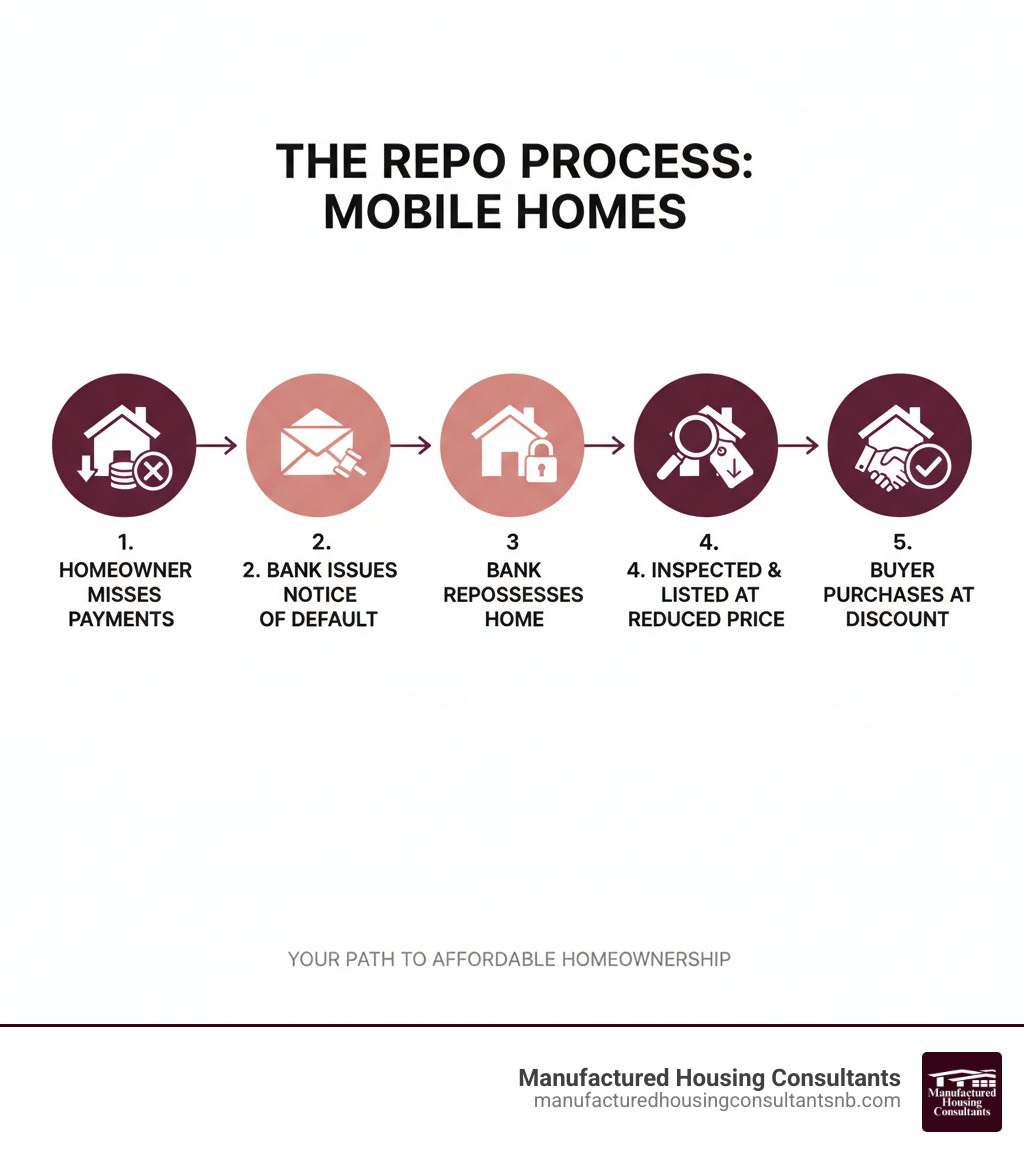

Your Path to Affordable Homeownership

Bank repossessed mobile homes offer a path to affordable homeownership, often at significantly reduced prices. When a homeowner defaults on their loan, the lender reclaims the property and sells it at a discount to recover their investment quickly.

Quick Answer: What You Need to Know

- What they are: Mobile homes taken back by banks or lenders after loan default

- Average savings: 20-30% below market value compared to similar used homes

- Where to find them: Specialized dealers, bank websites, foreclosure listings, and real estate agents

- Best for: Buyers with cash or flexible financing, investors, and those willing to handle repairs

- Key challenge: Often sold “as-is” with limited financing options

While repo homes can save you serious money, they require a careful approach. These homes are sold “as-is,” meaning inspections are critical and financing can be tricky.

At Manufactured Housing Consultants, we help Texas buyers steer the repo market successfully. We connect you with available bank repos and work with specialized lenders, making the process straightforward. This guide covers everything from finding listings to closing the deal on your affordable Texas home.

Your Guide to Buying Bank Repossessed Mobile Homes in Texas

When a manufactured home loan goes into default, the bank takes the property back. Their goal isn’t to be a landlord; it’s to recover their money quickly. This urgency creates a significant opportunity for buyers, with prices often well below market value.

The Pros and Cons: Is a Repo Home Right for You?

Bank repossessed mobile homes can be fantastic deals, but it’s crucial to understand the trade-offs.

Pros:

- Substantial Savings: Most repos sell for 20-30% below comparable homes on the market. This price difference can make homeownership a reality for those on a tight budget.

- Investment Potential: Buy a home at a discount, invest in smart repairs, and build instant equity. Some investors flip these homes for a profit.

- Motivated Sellers: Banks lack emotional attachment and are focused on selling quickly, which creates more room for negotiation than with a typical homeowner.

- Faster Closings: Without seller contingencies like finding a new home, the closing process can be remarkably fast, sometimes just a few weeks.

Cons:

- “As-Is” Condition: This means the bank makes no repairs. The home’s condition can vary from excellent to needing major work.

- Risk of Hidden Problems: Water damage, electrical faults, or foundation issues can turn a great deal into a costly project. A professional inspection is essential.

- Tricky Financing: Many traditional lenders avoid repos. At Manufactured Housing Consultants, we solve this by working with specialized lenders like Vanderbilt, 21st, and Legacy and offering custom financing solutions, including our FICO Score Improvement Program.

- Fierce Competition: The best deals attract other buyers and investors. Being prepared with pre-approved financing is key to acting quickly.

- Potential Legal Issues: A clear title search is necessary to ensure there are no outstanding liens or legal problems from the previous owner.

| Home Type | Average Cost in Texas (Estimated) | Notes |

|---|---|---|

| New Mobile Home | $70,000 – $150,000+ | Varies greatly by size, features, and manufacturer. |

| Used Mobile Home | $40,000 – $100,000+ | Depends on age, condition, and location. |

| Repo Mobile Home | $30,000 – $80,000+ | Often 20% or more below market value; condition varies greatly; prices from our inventory range from $44,900 to $131,900. |

How to Find and Purchase Bank Repossessed Mobile Homes

Knowing where to look is key to finding a great repo deal in Texas.

- Specialized Dealers: This is the most efficient route. At Manufactured Housing Consultants, we have direct relationships with lenders and an updated inventory of Texas repos. We simplify your search with curated lists to Find Repo Mobile Homes for Sale Near Me and focus on Repo Manufactured Homes Texas.

- Bank Websites: Many lenders list their repossessed properties (often called “REO” or Real Estate Owned) directly on their websites.

- Online Foreclosure Platforms: Sites like Foreclosure.com aggregate listings from banks, auctions, and dealers.

- Real Estate Agents: An agent specializing in manufactured homes can provide valuable market knowledge, especially for a bank repossessed mobile home with land.

- Auctions: Live and online auctions can offer incredible deals but require cash or pre-approved financing and quick decisions.

When making an offer, be prepared. Research comparable home values, factor in estimated repair costs, and act quickly. Don’t be afraid to submit a low offer, especially if a home has been on the market for a while. Banks are motivated by numbers, not emotions.

The Critical Inspection Checklist for Repo Homes

Never skip a professional inspection on a repo home. Here’s what to focus on:

- Foundation: Check piers, tie-downs, and skirting for cracks or shifting. Our Manufactured Homes Foundation Types Guide has more details.

- Roof: Look for missing shingles, damage, or sagging.

- Walls and Ceilings: Check for stains, soft spots, or cracks that could indicate water intrusion or structural issues.

- Water Damage: This is a mobile home’s worst enemy. Check for signs of water damage under sinks, around windows, and on floors. A musty smell is a red flag for mold.

- Plumbing and Electrical: Test all fixtures, outlets, and switches. Look for leaks and check the electrical panel for outdated or unsafe wiring.

- HVAC System: Test both the heat and air conditioning. A replacement can cost thousands.

- Undercarriage: Inspect the frame, insulation, and for signs of pests.

Get professional quotes for all necessary repairs. Your true cost is the purchase price plus repairs. If the numbers don’t work, use your inspection report to negotiate a lower price or walk away.

Navigating Financing and Legal Paperwork

Securing a loan for an “as-is” repo home can be a major hurdle with traditional banks. This is where our expertise at Manufactured Housing Consultants is invaluable for Texas buyers.

We specialize in financing solutions for buyers with all types of credit. We work with lenders like Vanderbilt, 21st, and Legacy who understand manufactured homes. Explore our Mobile Home Financing options and our Bad Credit Mobile Home Guide.

- Loan Types: A chattel loan is common for mobile homes treated as personal property and has higher rates and shorter terms. A real estate mortgage is possible if the home is permanently affixed to land you own, offering better terms.

- Cash Purchase: Paying cash gives you maximum negotiating power and speeds up the closing.

- Legal Due Diligence: Always perform a title search to check for liens, verify the bill of sale is accurate, and confirm all property taxes are paid. Ensure the home meets local zoning and permit regulations, especially if you plan to move it.

Understanding the Repo Process and Long-Term Ownership

A repo begins with missed payments, leading to a notice of default and eventual repossession. The bank’s goal is to sell quickly, which creates the price advantage for buyers.

- Repo vs. Foreclosure: Repossession typically applies to personal property (chattel loan), while foreclosure applies to real estate (mortgage). The outcome for the buyer is similar.

- Value Over Time: Mobile homes generally depreciate, but this is slowed if the home is on land you own, is well-maintained, and is in a strong market. Smart upgrades can add value.

- Maintenance is Key: To protect your investment, regularly inspect the roof, foundation, plumbing, and HVAC system. Keep the exterior siding clean and sealed, and ensure the underbelly is secure from pests and moisture.

The Texas Market for Repossessed Homes

Texas is a prime market for bank repossessed mobile homes, with opportunities varying by region.

- I-35 Corridor (New Braunfels, San Antonio, Austin): This high-growth region has a dynamic market with consistent repo inventory. Our New Braunfels location is at the center of this activity, serving communities from San Antonio to Austin.

- Rural and Suburban Areas: These regions are excellent for finding a repo home with land, as manufactured housing is common and land is more affordable.

- Economic Factors: Repo availability often correlates with regional economic shifts and population growth, creating a steady supply in many parts of Texas.

At Manufactured Housing Consultants, our expertise covers the greater New Braunfels area and beyond, including San Antonio, Austin, Seguin, San Marcos, and Kyle. We track market trends to connect our clients with the best available repo homes.

Begin Your Search for a Repo Home Today

Buying a bank repossessed mobile home in Texas is a smart path to affordable homeownership. While it requires due diligence, the reward is significant savings—often 20-30% below market value.

The key is to be prepared. With a thorough inspection, solid financing, and an expert guide, you can find incredible value. This market isn’t for everyone, but for buyers willing to invest some effort, it’s the ticket to owning a home.

At Manufactured Housing Consultants, our New Braunfels team specializes in this market. We simplify the process, from finding the right home to securing financing, even for those with credit challenges. We partner with trusted lenders like Vanderbilt, 21st, and Legacy and offer a FICO Score Improvement Program to turn denials into approvals.

The Texas market moves fast, especially in growing areas like San Antonio and Austin. A great deal on a quality home won’t last long.

Your search for an affordable Texas home starts now. Let our team help you steer the opportunities and find a home that fits your budget and your dreams.

Explore our available Bank Repos and let’s find your home together.