Buying a Home with Bad Credit: Tips and Tricks

Learn how to navigate a bad credit home purchase. Discover FHA, VA, and USDA loans, plus tips to improve your credit and qualify.

Why Bad Credit Doesn’t Have to Kill Your Dream of Homeownership

A bad credit home purchase is still possible with the right approach. While poor credit makes buying a home more challenging, it’s not impossible.

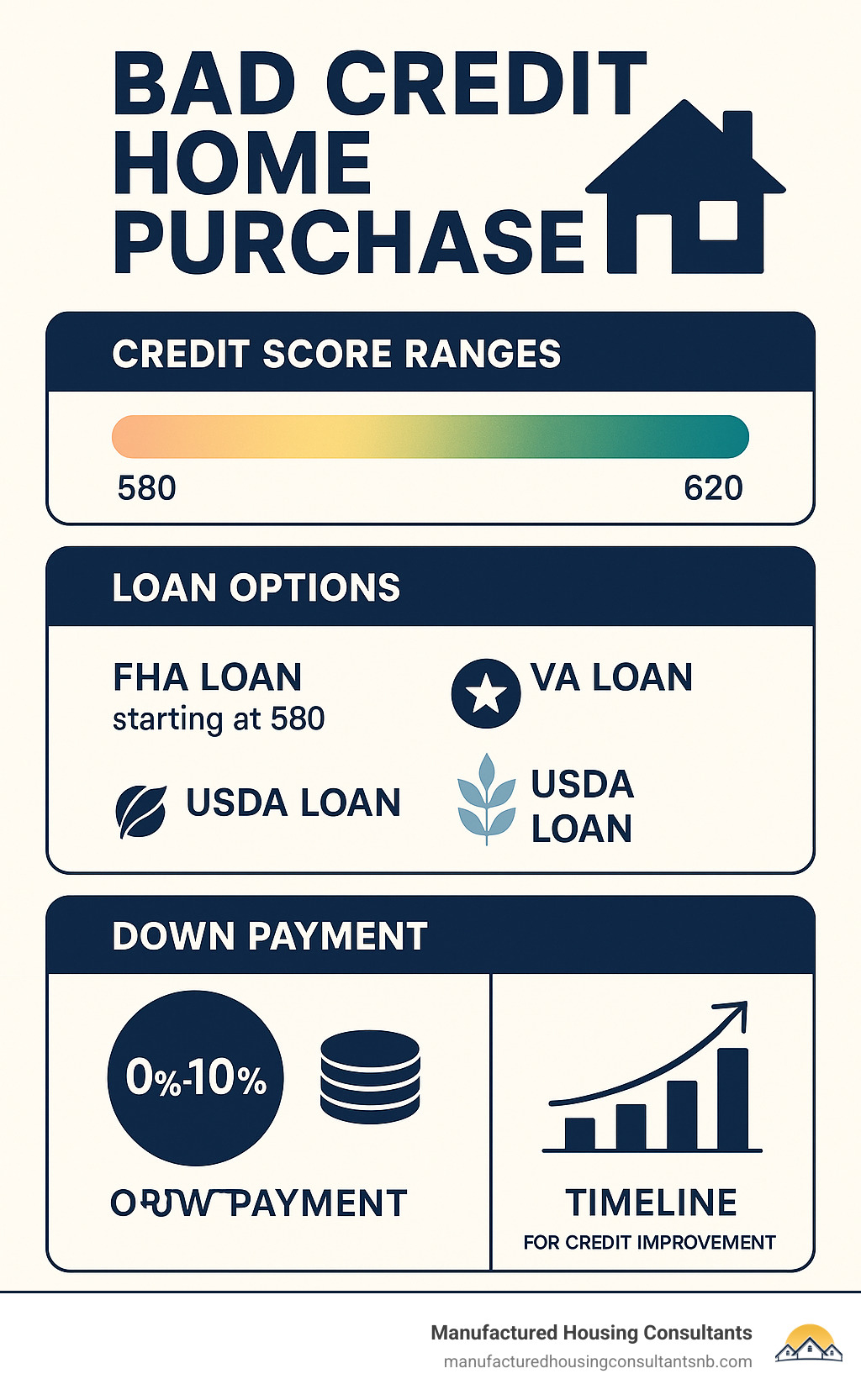

Quick answers for bad credit home buyers:

- Minimum credit scores: FHA loans accept scores as low as 580 (or 500 with 10% down).

- Best loan options: FHA, VA (for veterans), and USDA (for rural areas).

- Down payment: Can range from 0% to 10% depending on the loan type.

- Interest rates: Expect rates 1-2% higher than prime.

- Timeline: Focus on credit improvement 3-6 months before applying.

Having bad credit means you’ll face higher interest rates and stricter requirements, but government-backed loans and specialized lenders offer paths to homeownership even with scores below 600. The key is understanding which loan programs fit your situation, as different lenders have different requirements. Your credit score impacts your down payment, interest rate, and monthly payments, but affordable financing is still within reach.

Bad credit home purchase terms at a glance:

- financing options for mobile homes

- how to purchase a mobile home with bad credit

- mobile home loan bad credit

Understanding Bad Credit

What does “bad credit” mean for a home purchase? Your credit score is a financial report card for lenders. Most use the FICO score (300-850), and a bad credit home purchase usually involves scores in the “Fair” (580-669) or “Poor” (300-579) ranges. Even with these scores, homeownership is possible.

Your score is based on several factors:

- Payment history (35%): This is the most critical factor. Late or missed payments significantly lower your score.

- Credit utilization (30%): This is the percentage of available credit you’re using. Keeping balances low (ideally under 30%) is key.

- Length of credit history (15%): A longer history of responsible credit management is better.

- New credit & credit mix (20%): Opening too many new accounts can be a red flag, while having a mix of credit types (like a car loan and credit cards) can help.

Understanding these components is the first step to improving your score for your home buying journey.

Home Loan Options for Bad Credit

Several government-backed loan programs can make your bad credit home purchase a reality. These loans give lenders more security, allowing them to approve borrowers who might not qualify for a traditional mortgage.

Here are your best options:

- FHA Loans: Backed by the Federal Housing Administration, these are popular for buyers with lower credit. You can qualify with a FICO score as low as 580 with a 3.5% down payment. For scores between 500-579, a 10% down payment is required. The trade-off is mandatory mortgage insurance, which adds to your monthly cost.

- VA Loans: Available to eligible veterans, active-duty service members, and surviving spouses, these loans are backed by the U.S. Department of Veterans Affairs. While most lenders prefer scores in the mid-600s, the main benefits are no down payment and no private mortgage insurance, which saves you money monthly.

- USDA Loans: Backed by the U.S. Department of Agriculture, these are for homes in eligible rural and suburban areas. Lenders typically look for a FICO score of 640 or higher, but the loan often requires no down payment. Income and location restrictions apply.

At Manufactured Housing Consultants, we connect clients with these programs, which are often ideal for manufactured and mobile homes, providing a clear path to homeownership despite credit challenges.

Tips for Improving Your Chances

You can strengthen your loan application and improve your chances of a successful bad credit home purchase with a few smart moves.

- Check your credit report for accuracy. This is one of the fastest ways to boost your score. Get free reports from all three credit bureaus at AnnualCreditReport.com. Look for errors like incorrect late payments or accounts that aren’t yours. Disputing mistakes is free and can significantly raise your score.

- Make a larger down payment. If possible, putting down more than the minimum shows lenders you’re a lower-risk borrower. An extra down payment can sometimes offset a lower credit score.

- Lower your debt-to-income (DTI) ratio. Your DTI is the percentage of your monthly income that goes to debt. Lenders prefer a DTI below 43%. Paying down high-interest credit card debt is the quickest way to improve this ratio.

- Consider a cosigner. A family member with good credit who co-signs the loan can be a game-changer. They become equally responsible for the loan, so this is a big commitment, but it can turn a denial into an approval.

Bad Credit Home Purchase Strategies

Getting approved for a bad credit home purchase requires the right strategy.

First, focus on government-backed loans like FHA, VA, and USDA. Their flexible rules are designed to help buyers with credit challenges.

Next, look beyond traditional banks. Many alternative lenders specialize in working with buyers who have imperfect credit. They often consider your entire financial picture, including steady employment and rent payment history, not just your score.

Partnering with us at Manufactured Housing Consultants makes all the difference. We help people in New Braunfels and beyond achieve homeownership, even with credit issues. We specialize in affordable mobile and manufactured homes, which means smaller loan amounts and an easier path to approval.

Our network of lenders understands manufactured housing financing and knows how to work with FHA, VA, and USDA programs for these homes. They see beyond a past financial stumble. With our guaranteed lowest prices from 11 top manufacturers, we offer a significant advantage. We handle everything from home selection to financing and land improvement, helping you get the keys to a home you love. Your credit history is just one chapter—not the end of your story.

Frequently Asked Questions about Bad Credit Home Purchase

Here are answers to common questions about a bad credit home purchase.

Can I get a home loan with a 500 credit score?

Yes, you can get a home loan with a 500 credit score, though it’s challenging. Your best option is an FHA loan, which requires a 10% down payment for scores between 500 and 579. While VA and USDA loans have no official minimums, most lenders prefer scores in the mid-600s. With a 500-level score, expect higher interest rates. If possible, spending a few months improving your score to 580 will open up better terms and a lower 3.5% down payment option with FHA.

Will I pay more for mortgage insurance with bad credit?

Not necessarily. FHA loans require mortgage insurance for all borrowers, regardless of credit score. The cost is a standard part of the program. For conventional loans, bad credit does lead to higher private mortgage insurance (PMI) rates, but getting approved for a conventional loan with a low score is difficult. So, while your credit may lead you to a loan type with mandatory insurance, you aren’t being penalized with a higher rate within that specific program.

How can I improve my credit score before buying a home?

You can make a significant impact in just 3-6 months.

- Make every payment on time. This is the most important factor, making up 35% of your FICO score.

- Lower your credit utilization. Pay down credit card balances to below 30% of your available credit.

- Check your credit report for errors. Disputing inaccuracies can provide a quick score boost.

- Avoid opening new credit accounts. New applications create hard inquiries that temporarily lower your score. Don’t close old accounts either, as they help your credit history length.

Even a small jump from 520 to 580 can save you thousands and open up better loan options.

Conclusion

Your dream of homeownership is within reach, even with past financial hiccups. A bad credit home purchase has its challenges, but as we’ve shown, there are clear paths forward. From FHA and VA loans to lenders who look beyond the numbers, real options are available right now.

The key is having the right partner. At Manufactured Housing Consultants in New Braunfels, Texas, we make homeownership accessible to everyone. We work with 11 top manufacturers to offer a wide selection of quality mobile and manufactured homes, all backed by our guaranteed lowest prices.

We understand that financing can be overwhelming. That’s why we connect you with lenders who specialize in manufactured home financing and see your whole story, not just a credit score. We can help you steer loan requirements, find land, and choose the perfect home for your budget.

Don’t let past credit mistakes define your future. A bad credit home purchase can be your success story. Reach out to us today, and let’s turn your homeownership dream into a reality.