From Credit Woes to Mobile Home: Your Buying Guide

Learn how to buy a mobile home with bad credit in Texas. Our guide helps you secure financing & find your dream manufactured home.

Your Path to Homeownership Starts Here

How to buy a mobile home with bad credit is possible with the right approach. Here’s what you need to know:

Quick Steps to Buy a Mobile Home with Bad Credit:

- Check your credit score – Bad credit typically means a FICO score below 580

- Save for a larger down payment – Expect 10-20% down to offset credit concerns

- Explore specialized financing – Chattel loans, FHA loans, and owner financing options

- Gather documentation – Pay stubs, tax returns, and a letter explaining credit issues

- Work with experienced dealers – Find professionals who specialize in bad credit financing

If you have a less-than-perfect credit score, you’re not alone. Homeownership isn’t out of reach. Mobile homes offer an affordable path to building equity, even when traditional mortgages seem impossible.

The good news is that mobile homes are generally $200,000 – $300,000 cheaper than average single-family homes, making them more accessible. Specialized lenders often understand that past financial difficulties don’t define your ability to make future payments.

In Texas, manufactured homes are a practical solution to rising housing costs. At Manufactured Housing Consultants in New Braunfels, we help buyers steer financing regardless of their credit history.

Lenders consider more than just your credit score; they also look at your income, debt-to-income ratio, and down payment. With the right preparation, you can overcome credit obstacles and secure financing for your dream home.

Must-know how to buy a mobile home with bad credit terms:

Your Step-by-Step Plan: How to Buy a Mobile Home with Bad Credit in Texas

Buying a mobile home with bad credit can feel overwhelming, but thousands of Texans have done it. With a clear plan, you can too. This guide is your roadmap. At Manufactured Housing Consultants, we’ve guided countless families through this journey, and we know what works.

Understanding Your Starting Point: Credit Scores and Challenges

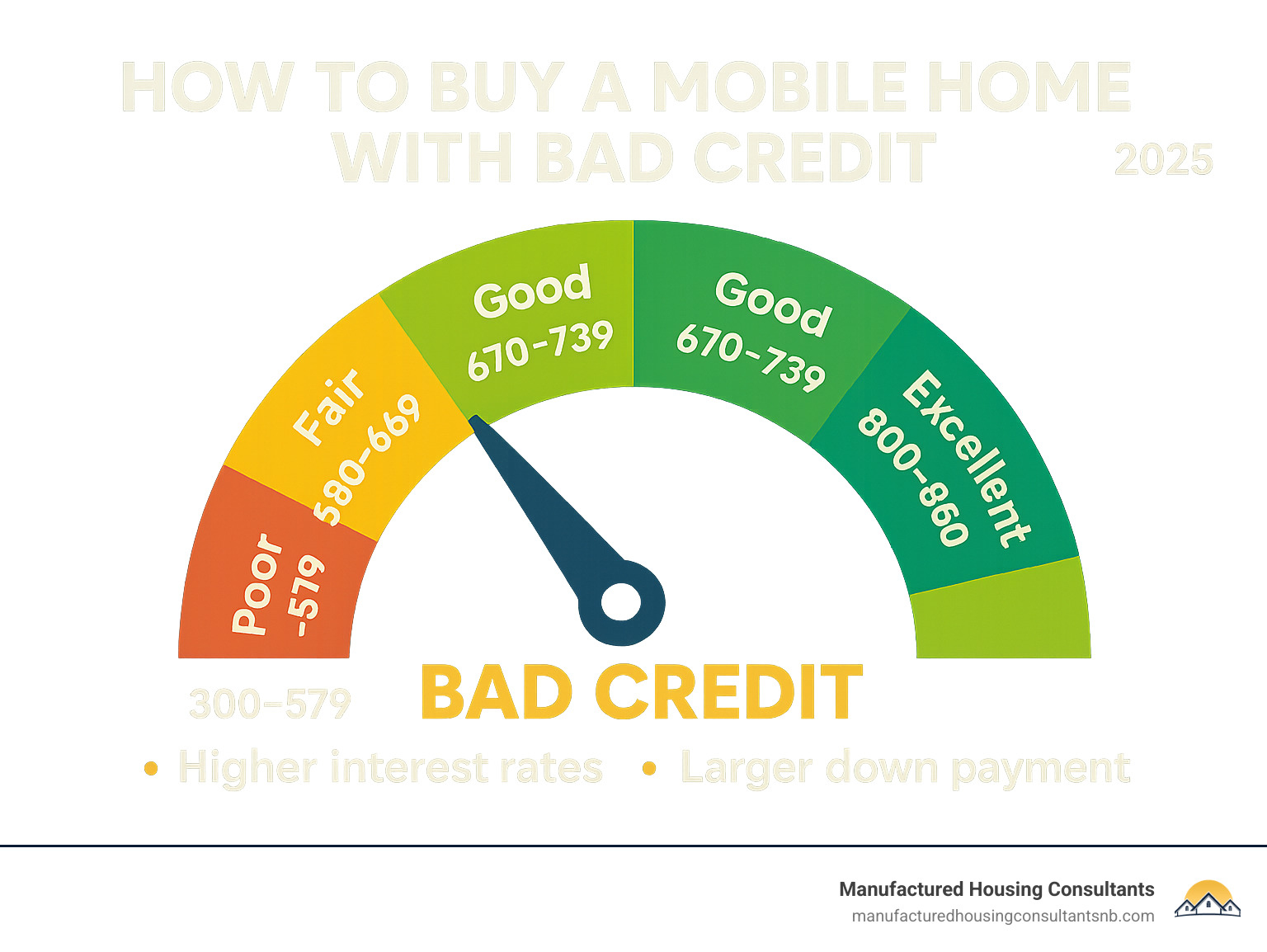

First, understand your credit score. Knowledge is power. Bad credit is usually a FICO score below 580. If that’s you, don’t worry. Your past doesn’t define your future.

With bad credit, you’ll likely face higher interest rates and need a larger down payment (10-20%). Lenders might also offer shorter loan terms. However, mobile home lenders are often more flexible than traditional mortgage companies because they specialize in affordable housing and work with buyers from various credit backgrounds.

Even bankruptcy isn’t a permanent roadblock. The key is showing lenders you’ve learned from the past and now have a stable income. Lenders also review your income stability, debt-to-income ratio, and employment history. A steady job can be more important than a slightly higher score.

Want to know exactly what credit score you need? Check out our guide on What Credit Score Do You Need to Buy a Mobile Home? And if you’re ready to start improving your score, our FICO Score Improvement Program can help.

Pre-Application Prep: Boosting Your Financial Profile

A little preparation now can save you thousands of dollars later.

Start by pulling your credit reports from all three bureaus—Equifax, Experian, and TransUnion—at a site like AnnualCreditReport.com. About 25% of reports have errors that could be lowering your score. Dispute any mistakes; it’s free and can provide a quick boost.

Pay every bill on time from now on. Payment history is 35% of your credit score, so this is critical. Also, reduce your credit card balances, aiming to get them below 30% of your credit limit. This shows lenders you can manage credit responsibly.

A larger down payment is your secret weapon. It reduces the lender’s risk, making them more likely to approve your loan. Aim to save 10% to 20% of the home’s purchase price. For an $80,000 home, that’s $8,000 to $16,000. This investment often leads to a lower interest rate, saving you money every month.

If saving that much is a challenge, our team at Manufactured Housing Consultants can help you find creative solutions. Check out our guide on How to Buy a Mobile Home with Little or No Money Down for strategies.

Keep your job steady, as lenders value consistent income. Start gathering your financial documents now: pay stubs, tax returns, and bank statements.

Want more specific tips for improving your credit? Visit our Tips to improve your credit score page for detailed strategies.

Exploring Financing for Mobile Homes with Bad Credit

Mobile home financing differs from traditional mortgages, often in ways that benefit buyers with bad credit.

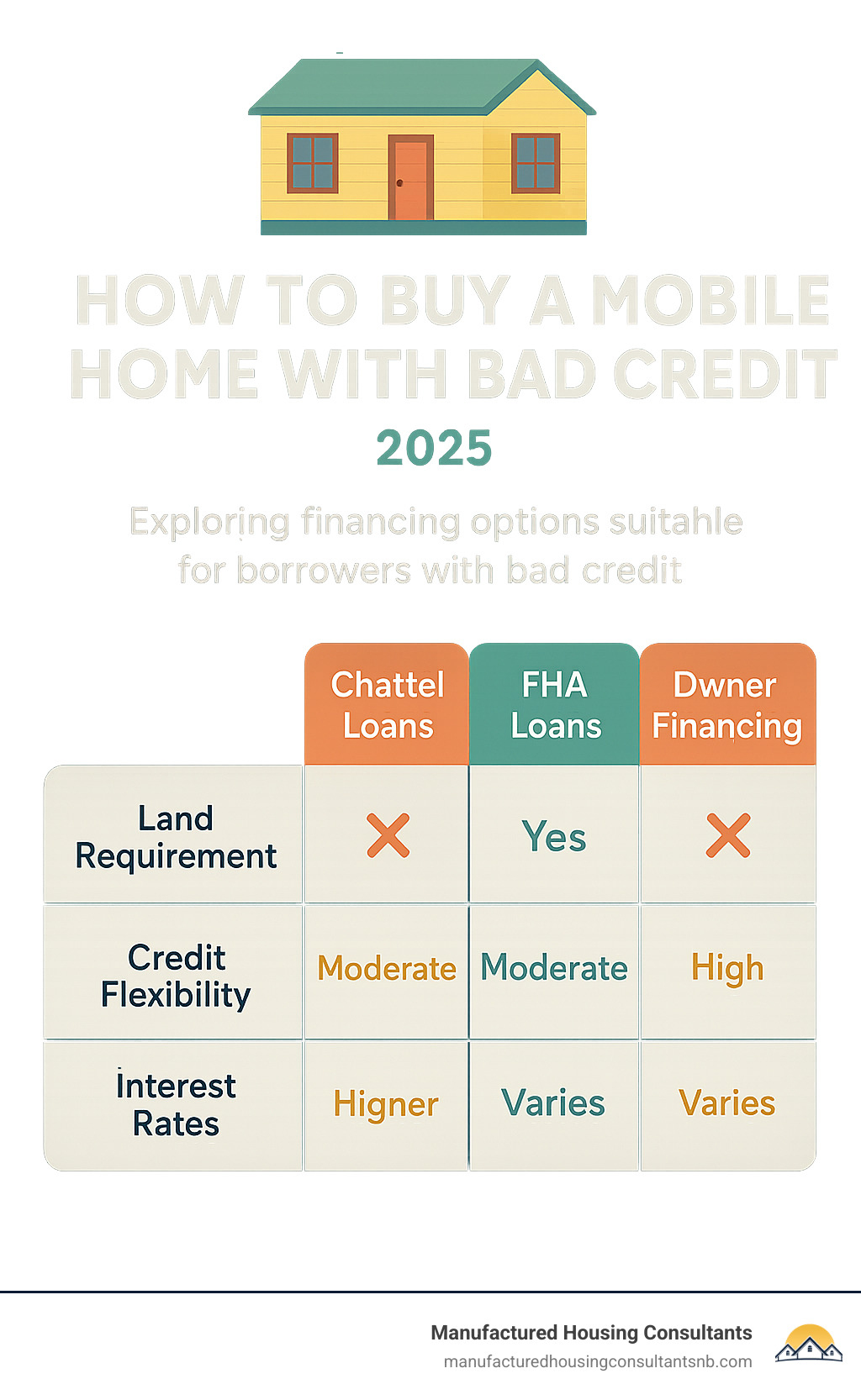

Many manufactured homes are considered personal property, so you’ll likely get a chattel loan. These loans are secured by the home itself, not the land. While interest rates can be higher and terms shorter (15-20 years), the credit requirements are often more flexible.

FHA loans are another excellent option. Backed by the Federal Housing Administration, these loans are available to buyers with credit scores as low as 500, though a score of 580+ gets better terms. The down payment can be as low as 3.5%. FHA offers Title I loans (home only) and Title II loans (home and land).

Owner financing, where the seller acts as the bank, can also be an option. It offers flexible credit requirements, but always have a lawyer review the agreement.

Your financing options are also affected by where you place the home. If you own the land, you’ll have more loan choices and better rates. If you lease land in a mobile home park, you’ll likely need a chattel loan.

At Manufactured Housing Consultants, we can help you explore FHA Mobile Home Financing and other Mobile Home Loan Options that fit your situation.

Navigating the Application and Approval Process

This is where your preparation pays off. You’ll need standard documents: recent pay stubs, the last two years of tax returns, bank statements, proof of identity, and employment verification.

With bad credit, a letter of explanation is crucial. This is your chance to explain what caused your credit issues and, more importantly, what you’ve done to fix the situation. Be honest, brief, and focus on the positive.

Your debt-to-income ratio is also critical. Lenders prefer your total monthly debt payments (including the new home) to be under 40% of your gross monthly income.

A co-signer with good credit can be a game-changer, helping you get approved with better terms. It’s a significant request, as this person agrees to be responsible for the loan if you can’t pay.

Ready to get started? Our Mobile Home Financing Application makes the process simple.

Common Mistakes to Avoid When Seeking Mobile Home Financing with Bad Credit

Avoid these common mistakes to save yourself headaches:

- Not checking your credit first. Know your score and what’s on your report before applying. Surprises during the application process are rarely good.

- Accepting the first offer. It’s tempting when you have bad credit, but rates and terms vary significantly. Shop around and compare offers.

- Falling for predatory lenders. If a deal seems too good to be true, it probably is. Be wary of guaranteed approvals, large upfront fees, or high-pressure tactics.

- Forgetting hidden costs. Your monthly payment is just the start. Budget for lot rent (if in a park), insurance, utilities, maintenance, closing costs, and property taxes.

Want to understand the full picture? Check out our article on Buying a Mobile Home Instead of a Regular Home.

Finding Your Perfect Texas Home

Now for the fun part: choosing your home! Texas offers many manufactured housing options.

- New Homes: Come with warranties, modern features, and better financing terms. At Manufactured Housing Consultants, we offer new homes from 11 top manufacturers.

- Used Homes: Are cheaper but may need repairs and can be harder to finance.

- Repossessed Homes: Often priced below market value and offer great value. Check our Repo Mobile Homes Texas selection.

Choose the size that fits your needs: single-wides are the most affordable, double-wides feel like a traditional house, and triple-wides offer luxury and space.

Location is key. Owning land in Texas can qualify you for better financing. Choosing a mobile home park means monthly lot rent but often includes amenities. Our team knows the New Braunfels area market and can help you find the perfect spot.

Ready to explore? Browse our manufactured home floor plans or check out our current Mobile Homes for Sale in New Braunfels inventory.

Let Us Help You Find Your Dream Home

Your credit score is a starting point, not a final verdict. At Manufactured Housing Consultants in New Braunfels, we believe that how to buy a mobile home with bad credit is a manageable process with the right team supporting you.

We’ve built relationships with specialized lenders who look beyond the numbers. Our team has helped Texas families with credit scores in the 400s secure financing for beautiful, modern manufactured homes.

Our guaranteed lowest prices and commitment to finding solutions set us apart. We work with 11 top manufacturers, offering an incredible selection of homes to fit your lifestyle and budget.

Our financing specialists will guide you through options like chattel loans and FHA financing. If you own land in the New Braunfels area, we can also assist with land improvement services.

We handle the complex paperwork so you can focus on choosing your perfect home. Our team will walk you through every step, from the initial application to the day you get your keys.

Don’t let credit concerns hold you back. Join the thousands of Texans enjoying the affordability and pride of manufactured homeownership. Ready to take the first step? Explore our mobile home financing options today.