The Lowdown on Bank Repos: Understanding Foreclosed Mobile and Modular Homes

Unlock savings on bank repossessed manufactured homes. Our guide covers finding, inspecting, financing, and buying in Texas.

Why Bank Repossessed Manufactured Homes Are Worth Your Attention

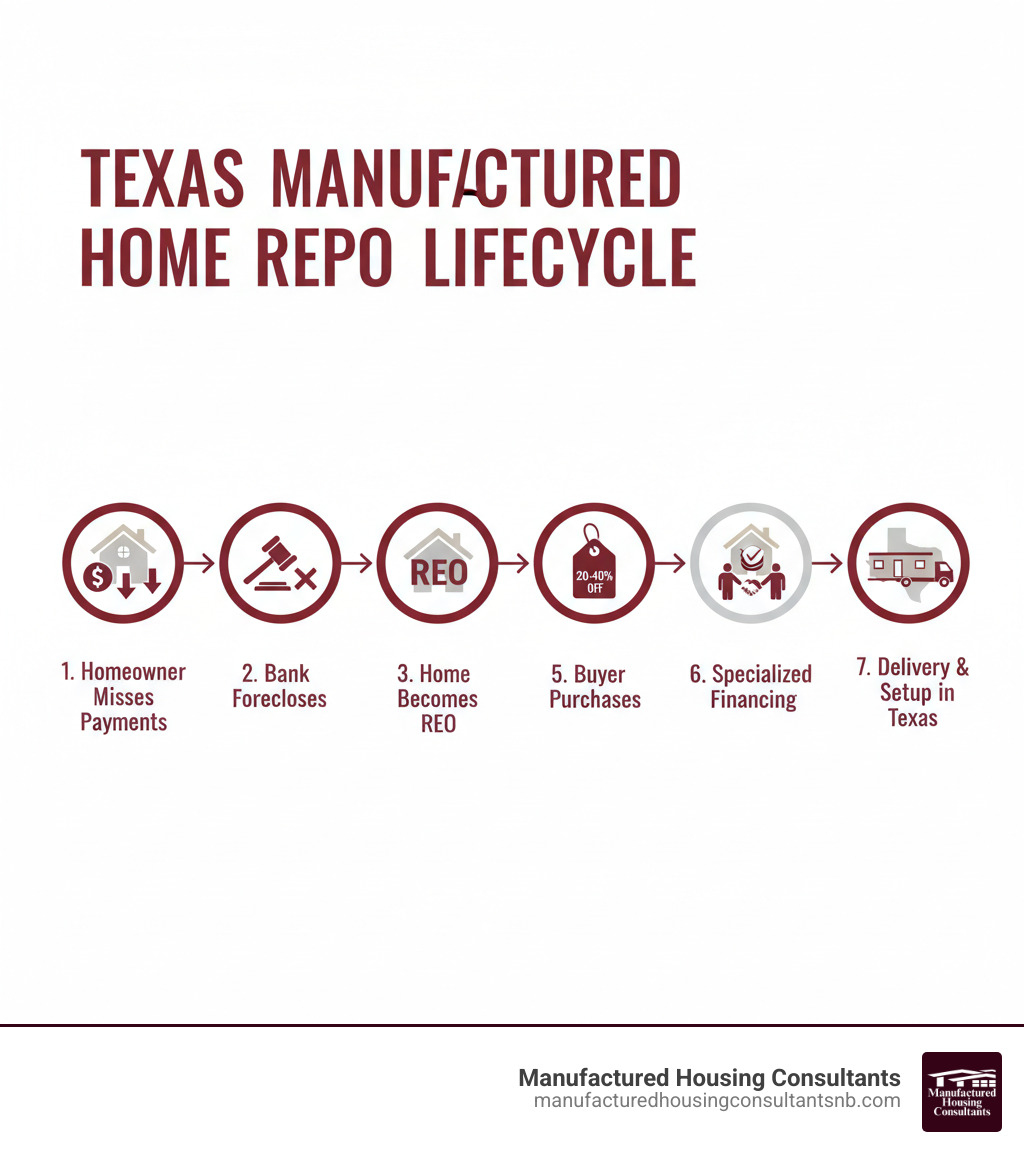

Bank repossessed manufactured homes are properties that lenders have taken back after a homeowner defaults on their mortgage. For budget-conscious buyers in Texas, these homes represent a significant opportunity. Banks want to sell these foreclosed properties quickly to recover their losses, not to manage real estate. This urgency translates into major savings for you.

Here’s what you need to know:

- Deep Discounts: Repo homes are typically sold for 20-40% below market value. In Texas, prices can range from $44,900 to $131,900.

- Varied Conditions: Homes are sold “as-is,” ranging from move-in ready to needing significant repairs.

- Financing is Available: Specialized lenders like Vanderbilt Mortgage, 21st Mortgage, and Green Tree offer financing for these homes.

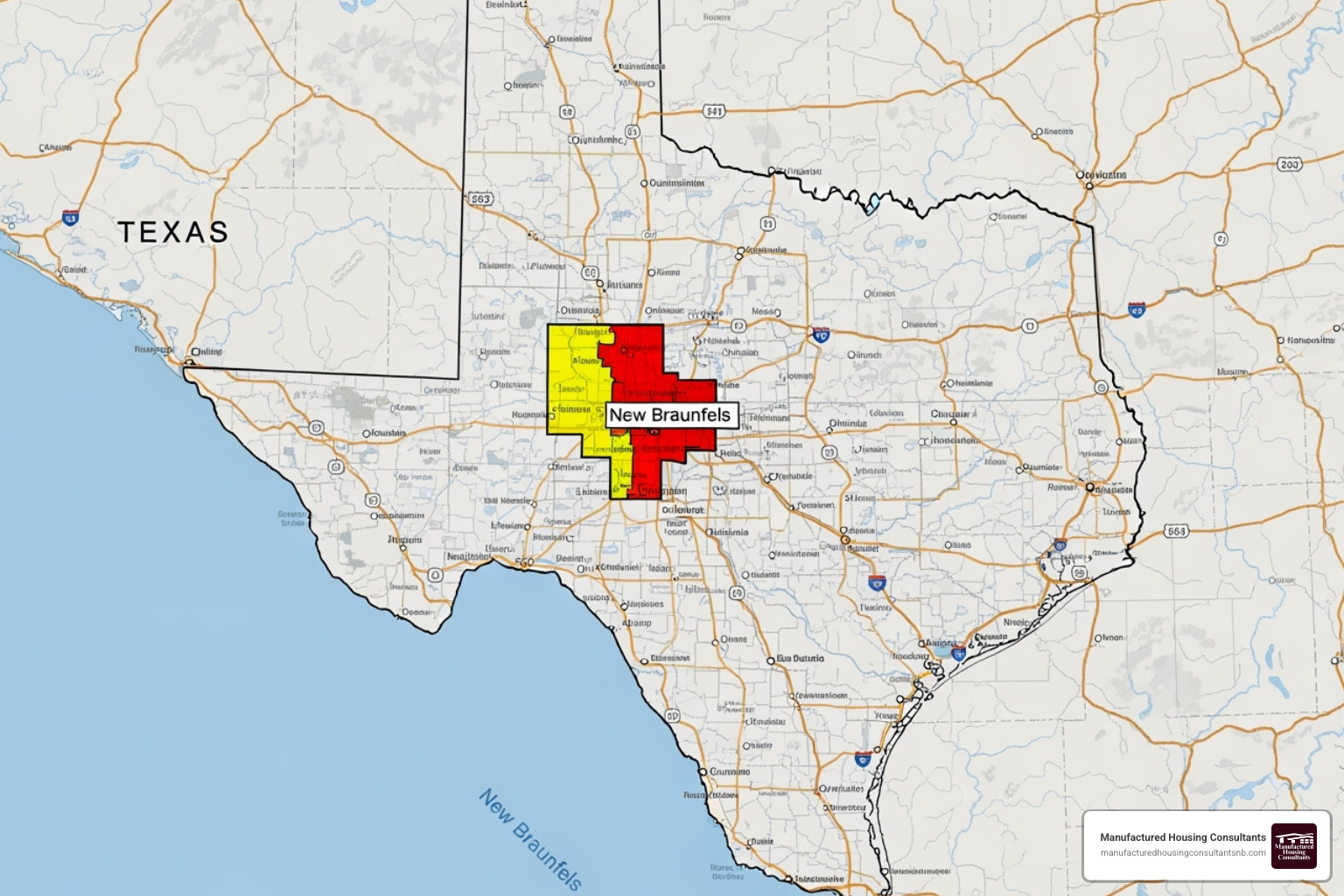

- Find Them Here: Manufactured Housing Consultants maintains a database of repo homes in New Braunfels and across Texas.

The “as-is” nature of these sales means due diligence is key. Some homes are pristine, while others require work. Understanding the property’s condition is crucial. At Manufactured Housing Consultants, we guide you through this process, connecting you with trusted lenders and our extensive inventory. If you’re looking for an affordable path to homeownership, even with credit challenges, repo homes are an option you can’t afford to ignore.

What is a Bank Repossessed Manufactured Home?

A bank repossessed manufactured home is a home that a lender has taken back because the previous owner failed to make their loan payments, a process known as foreclosure. Once repossessed, the home becomes a Real Estate Owned (REO) property. The bank’s goal is not to be a landlord; it’s to recover the outstanding loan amount as quickly as possible.

To minimize maintenance costs and liquidate the asset, banks are highly motivated to sell these homes at a significant discount. This urgency creates a fantastic opportunity for buyers, making quality housing available for much less than its original market value.

The Key Advantages of Buying a Bank Repo Home

Buying a repo home in Texas can be a smart financial move. Here are the primary benefits:

- Significant Savings: This is the biggest draw. Repo homes are often discounted by 20-40% below market value. We’ve seen models like a 2011 CAVCO listed for $44,900, offering substantial savings.

- Potential for Instant Equity: Buying below market value means you could have equity in your home from day one, building your personal wealth.

- Move-in Ready Options: While some repo homes need work, many are in excellent condition, saving you time and renovation costs.

- Wide Variety: The repo market includes a diverse inventory of single-wide and double-wide homes from various manufacturers and model years.

- Flexibility for Customization: The money saved on the purchase can be used for renovations, allowing you to personalize your home to your exact tastes.

- Local Inventory: As experts in New Braunfels, we maintain an extensive database of bank repossessed manufactured homes across Texas, helping you find opportunities nearby.

Potential Risks and Disadvantages

While the advantages are compelling, it’s crucial to be aware of the potential downsides:

- “As-Is” Condition: Repo homes are almost always sold “as-is,” meaning the bank makes no repairs. The condition can vary from pristine to needing major work.

- Potential for Hidden Repair Costs: An “as-is” sale carries the risk of hidden issues like neglected maintenance or damage from vacancy. A thorough inspection is essential to avoid unexpected costs that can erode your savings.

- High Competition: Attractive pricing often leads to high competition from other buyers, which can make the process more stressful.

- Complex Financing: Securing a loan for a repo home can sometimes be more complex, with stricter requirements from lenders based on the home’s age and condition.

- Comparison to New Homes: A new manufactured home comes with a warranty and the latest features. A repo home offers cost savings but lacks a warranty and may need immediate investment. It’s also important to remember that manufactured homes typically depreciate over time.

Due diligence is paramount. Being prepared for the “as-is” nature of the sale will ensure a successful purchase.

The Buyer’s Guide to Bank Repossessed Manufactured Homes

Buying a bank repossessed manufactured home doesn’t have to be overwhelming, especially with an expert guide. Here in Texas, and particularly in the New Braunfels area, our team at Manufactured Housing Consultants specializes in this market. We know where to find these deals, what to look for, and how to connect you with the right financing. This guide walks you through the essential steps.

How to Find Bank Repossessed Manufactured Homes in Texas

The hunt for the perfect repo home starts with knowing where to look. Working with us at Manufactured Housing Consultants is your smartest first move. We are constantly buying pre-owned homes, taking trade-ins, and maintaining relationships with the banks and lenders who handle repossessions. This means we often know about available bank repossessed manufactured homes before they hit the wider market.

Our inventory changes quickly, featuring everything from a 2015 Clayton Sierra Vista priced at $54,900 to a 2011 Cavco at $44,900. Our close partnerships with primary lenders like Vanderbilt Mortgage, Green Tree, and 21st Mortgage give us early access to listings, an advantage we pass on to you. Our team of professionals understands the repo market and can guide you through the entire process, from finding a home to making an offer.

Ready to see what’s available? See available repo homes in New Braunfels, TX on our website, or give us a call.

The Crucial Inspection Checklist

Before you sign anything for a repo home, a professional inspection is a critical, non-negotiable step. Since these homes are sold “as-is,” an inspection is your protection against costly surprises.

A qualified inspector should focus on these key areas:

- Structural Integrity: The frame, walls, roof, and subflooring must be sound.

- Foundation and Tie-Downs: Essential for stability, especially in Texas wind zones. The system must meet local codes.

- Roof and Siding: Check for leaks, missing shingles, or damage that could allow water intrusion.

- Plumbing and Electrical Systems: Verify that all systems are functional, safe, and free of leaks or hazards.

- HVAC System: In Texas, a working air conditioner is a must. Test both heating and cooling systems.

- Water Damage and Pests: Look for stains, musty odors, or signs of termite infestations.

At Manufactured Housing Consultants, we can connect you with reputable inspectors who specialize in manufactured homes. We’ll help you understand the inspection report so you can make a confident, informed decision.

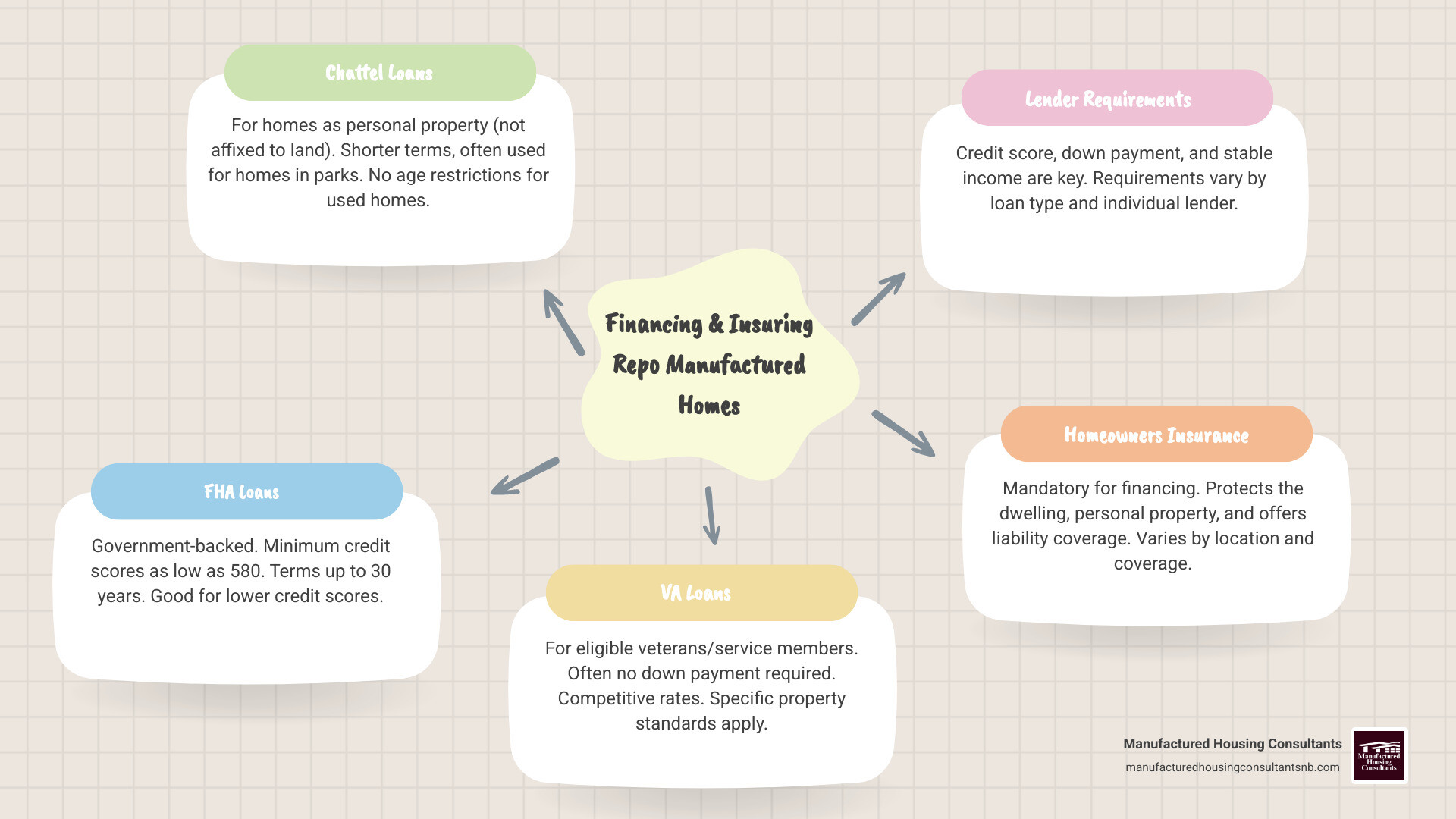

Financing and Insuring Bank Repossessed Manufactured Homes

Securing financing and insurance for a repo home is more straightforward than you might think, especially with our guidance. We work with trusted partners like Vanderbilt Mortgage, Green Tree, and 21st Mortgage who specialize in the manufactured housing market.

Common financing options include:

- Chattel Loans: “Home-only” loans that are accessible and widely used, even for homes on rented land. Lenders like 21st Mortgage have no age restrictions for used homes.

- FHA Loans: Government-backed loans with low credit score requirements (as low as 580) and terms up to 30 years.

- VA Loans: A fantastic benefit for veterans, often requiring no down payment.

- USDA Loans: Available in eligible rural areas, potentially offering 100% financing.

- Conventional Loans: Traditional mortgages that can work if the home is permanently affixed to land.

Lenders will review your credit, debt-to-income ratio, and the home’s condition. Even if you have credit challenges, we have programs designed to help. For a deeper dive, Learn about financing options.

Insurance is also required by your lender. A full homeowner’s insurance policy protects your investment. We recommend speaking with an agent who understands manufactured homes in Texas to ensure you have adequate coverage. With our expertise, we make financing and insuring your repo home a smooth process.

Finalizing Your Purchase and Next Steps

You’ve found your ideal bank repossessed manufactured home, had it inspected, and secured financing. Congratulations! The final steps involve navigating the paperwork and avoiding common pitfalls. At Manufactured Housing Consultants, we guide you through this home stretch to ensure a smooth and successful purchase.

Navigating the Legal and Documentation Process

The legal side is a series of straightforward steps. A title search is essential to verify the bank has clear ownership with no hidden liens or claims. Our team handles this diligently. You’ll also need to verify that property taxes are current.

The closing process varies. Home-only (chattel) loans may only require notarized documents, while loans including land typically close with a title company. Closing costs can often be rolled into your financing.

In Texas, a manufactured home can be classified as personal property (like a vehicle) or real property (permanently attached to land). This distinction affects financing and future resale. We have steerd Texas regulations hundreds of times and will ensure all your paperwork is handled correctly, from the title search to the final transfer of ownership. For official state guidance on manufactured home titling and Statements of Ownership, see the Texas Department of Housing and Community Affairs Manufactured Housing Division.

Avoiding Pitfalls and Finding Your Dream Home

Buying a repo home is rewarding, but a few traps can catch unprepared buyers. Working with an expert helps you get a fair deal.

- Don’t underestimate renovation costs. Always get a thorough inspection and budget for both expected repairs and a contingency fund for surprises.

- Don’t skip due diligence. Rushing the process without verifying documents or understanding the “as-is” sales conditions can lead to regret.

- Don’t go it alone. The repo market has unique quirks. Working with the Texas housing experts at Manufactured Housing Consultants gives you a significant advantage. We help you understand market value, negotiate effectively, and make informed decisions.

Our goal is simple: connect you with a quality home at a lower cost. With our guaranteed lowest prices and wide selection of bank repossessed manufactured homes, we’re ready to help you take this final step.

Are you ready to explore the possibilities? Our team is here to help you every step of the way.