Financing Your Clayton Home with FHA: What You Need to Know

Unlock affordable homeownership in Texas! Learn about Clayton Homes FHA loans, requirements, and how to apply today.

Why Clayton Homes FHA Loans Are Perfect for Texas Homebuyers

Clayton homes FHA loans offer an affordable path to homeownership for Texas families, providing a great alternative to the high costs of traditional site-built homes. These government-backed loans make it possible to purchase a new Clayton home with as little as 3.5% down and flexible credit requirements.

Quick Answer: Can You Get FHA Loans for Clayton Homes?

- Yes – Clayton homes qualify for FHA financing when they meet specific requirements

- Down Payment – As low as 3.5% with a 580+ credit score (10% for 500-579 scores)

- Home Requirements – Must be built after June 15, 1976, with HUD certification

- Foundation – Permanent foundation required for most FHA programs

- Property Type – Can finance home-only or home-and-land combinations

- Primary Residence – Must be your main home, not investment property

For Texas homebuyers facing credit challenges, FHA loans provide a realistic alternative to conventional mortgages. The Federal Housing Administration insures these loans, which encourages lenders to work with borrowers who might not otherwise qualify.

At Manufactured Housing Consultants in New Braunfels, we’ve helped countless Texas families steer the FHA loan process for their Clayton homes. The combination of Clayton’s quality construction and FHA’s accessible financing creates homeownership opportunities that are hard to find in today’s housing market.

Whether you’re a first-time buyer or looking to upgrade, understanding how FHA loans work with Clayton homes can open doors to affordable homeownership across Texas.

Explore more about clayton homes fha loans:

Understanding Clayton Homes FHA Loans in Texas

If you’re considering homeownership in Texas but are worried about qualifying for a traditional mortgage, Clayton homes FHA loans are an excellent solution. The Federal Housing Administration (FHA) doesn’t lend money directly; instead, it insures your mortgage. This protection reduces the lender’s risk, making them more willing to work with borrowers who have lower credit scores or smaller down payments.

At Manufactured Housing Consultants in New Braunfels, we’ve seen this program help countless Texas families achieve their homeownership dreams. FHA loans recognize that a well-built Clayton home offers the same comfort and security as a traditional site-built property.

Key FHA Requirements for Manufactured Homes

Most new Clayton homes are designed to meet FHA requirements, but it’s important to know what the government looks for.

- Built After June 15, 1976: This is a strict rule, as this date marks when HUD’s modern safety and construction standards took effect. Every Clayton home we offer meets this requirement.

- HUD Certification Label: This small metal tag, usually on the home’s exterior, proves it meets federal construction and safety standards.

- Permanent Foundation: For most FHA loans, the home must be permanently attached to a foundation that meets FHA and local codes. This is key to classifying the home as real estate.

- Real Estate Classification: Once on a permanent foundation, the home is taxed like a traditional house and can appreciate in value over time.

- Minimum Floor Space: The home must have at least 400 square feet, which is rarely an issue with modern Clayton homes.

- Primary Residence: You must occupy the home as your main residence within 60 days of closing. FHA loans are not for investment properties.

- Site Requirements: The property must meet local standards for utilities like water and sewage. For more details, see the Official HUD foundation guidelines.

Borrower Eligibility: Credit, Down Payment, and More

FHA loans are known for their flexible borrower requirements.

- Credit Scores: You can qualify for a 3.5% down payment with a credit score of 580 or higher. Scores between 500 and 579 may still be approved with a 10% down payment.

- Down Payment: The low 3.5% minimum makes homeownership accessible sooner. This can often come from gift funds from family or approved non-profits.

- Debt-to-Income (DTI) Ratios: FHA programs are more lenient, sometimes accepting DTI ratios as high as 57%, whereas conventional loans often cap it around 43%.

- Mortgage Insurance Premiums (MIP): FHA loans require MIP. This includes an upfront premium (usually rolled into the loan) and a monthly premium. While it adds to your cost, it’s the trade-off for the loan’s flexibility.

If you have credit concerns, explore our guides on Mobile Home Loan Bad Credit and FHA Mobile Home Financing.

FHA Title I vs. Title II for Clayton Homes FHA Loans

Understanding the two types of FHA loans is key to choosing the right one.

- Title I Loans: These treat the manufactured home as personal property. They can finance the home only, the lot only, or both. This works well for homes on leased lots, but loan limits are lower (e.g., $69,678 for home-only).

- Title II Loans: These treat the manufactured home as real estate. The home and land are financed together with a traditional mortgage. Loan limits are much higher (based on county limits), and repayment terms can be up to 30 years. This is the most common and advantageous option for building equity.

At Manufactured Housing Consultants, we help clients determine which program best fits their needs. Learn more about the FHA’s mission at What is the FHA?

Pros and Cons of Using an FHA Loan

Choosing an FHA loan involves weighing its benefits and drawbacks.

Pros:

- Lower Down Payment: The 3.5% minimum makes homeownership achievable faster.

- Flexible Credit Requirements: Opens doors for borrowers with less-than-perfect credit.

- First-Time Homebuyer Friendly: Designed to be accessible, even allowing gift funds for the down payment.

Cons:

- Mortgage Insurance Premium (MIP): An ongoing cost that adds to your monthly payment.

- Strict Property Standards: The home must meet specific FHA quality and safety rules.

- Loan Limits: Can be restrictive, especially with Title I loans.

- Appraisal Requirements: The process is more detailed than for conventional loans.

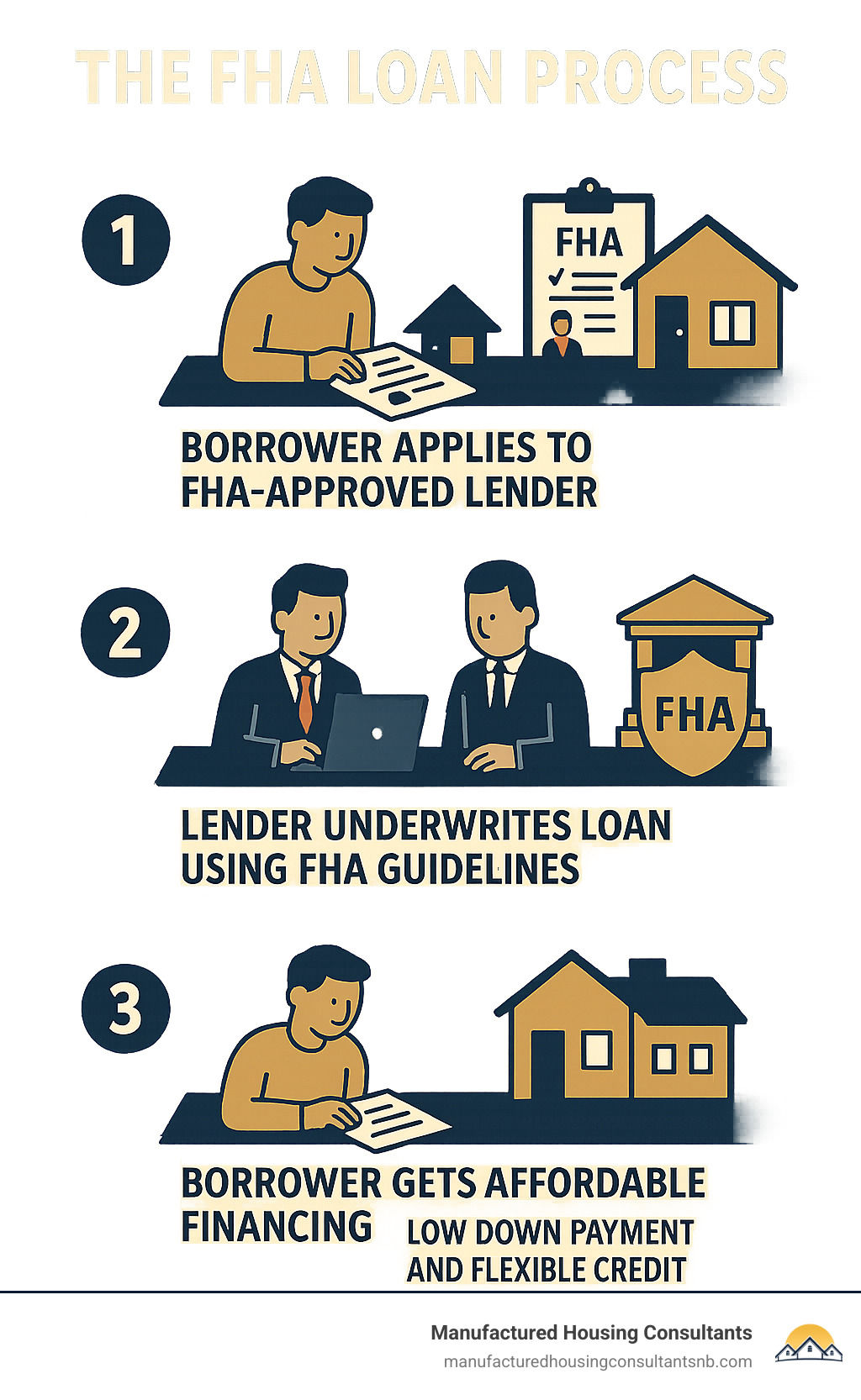

Navigating the FHA Loan Process for Your Texas Home

Getting your clayton homes fha loans approved is a straightforward process with the right team on your side. At Manufactured Housing Consultants, we’ve built relationships with lenders who understand the specifics of manufactured housing, ensuring a smooth journey for our clients.

Finding an FHA-Approved Lender and Necessary Documents

Not all FHA-approved lenders are experienced with manufactured homes. Starting with our network of trusted lenders can save you time and frustration.

When you apply, it’s best to have your documents ready. Lenders will typically ask for:

- Proof of Income: Recent pay stubs and W-2s for the last two years.

- Financial Statements: Bank statements for the last 60-90 days.

- Employment Verification: Proof of steady employment.

- Residential History: Your addresses for the past two years.

- Gift Letter: If you’re receiving help with the down payment, this letter confirms it’s a gift, not a loan.

The manufactured home loan process has unique steps. The appraiser will verify the home’s HUD certification label and ensure it meets all FHA standards, including the permanent foundation requirement. This detailed process protects your investment.

While your lender handles the financing, our team manages the property side with our Texas land improvement services. We ensure your land is ready for the foundation, creating a seamless process. Learn more about Will FHA Finance a Manufactured Home?

Start Your Texas Journey with Clayton Homes FHA Loans

Clayton homes fha loans have made homeownership a reality for many Texas families. First-time homebuyers especially benefit from this path.

- Lower Down Payment: Avoid renting for years while trying to save a large down payment.

- Flexible Credit: Past financial rough patches don’t have to stop you from owning a home.

- Brand-New Home: Get a quality, modern home built to strict standards, often for less than an older site-built house.

Here in New Braunfels, we see the positive impact of homeownership every day. We’re not just selling houses; we’re helping Texas families build their futures.

Our local expertise makes the difference. We know the right Clayton models for the Texas climate, understand local building codes, and have relationships with the best lenders and contractors. Plus, we guarantee the lowest prices.

We simplify the entire process by handling both home selection and land preparation. Our team coordinates the foundation, permits, and delivery, so you can focus on the excitement of becoming a homeowner.

Ready to start your journey? We’d love to show you our selection of Clayton homes and discuss your financing options.