The Ultimate Guide to Financing a Mobile Home

Discover top options for financing a mobile home. Learn about loans, requirements, and steps to secure affordable housing.

Financing a mobile home can be a practical solution for those seeking affordable homeownership, especially when the high costs of traditional houses become overwhelming. Unlike conventional homes, mobile and manufactured homes offer a flexible and often more budget-friendly option.

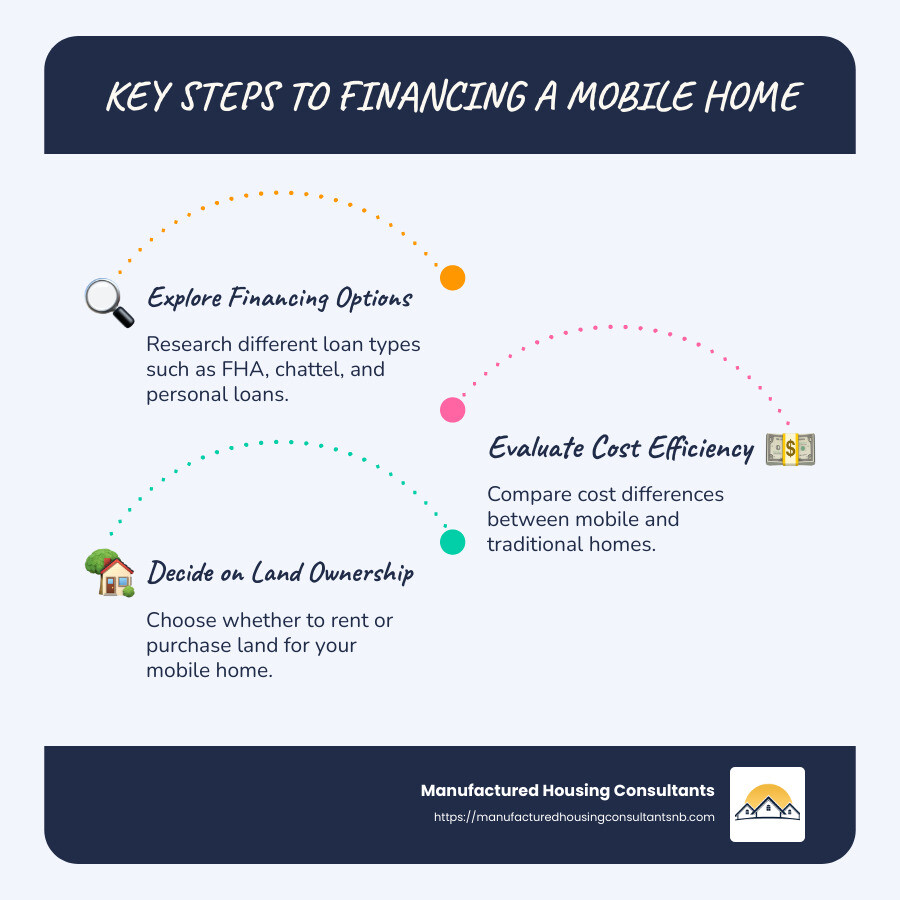

Here’s a quick overview of what you need to know about financing mobile homes:

- Financing Options: You can opt for traditional loans like FHA loans or more specialized ones like chattel loans for a mobile home.

- Cost Efficiency: Mobile home prices are significantly lower compared to standard houses, making them an attractive choice for budget-conscious buyers.

- Land Considerations: Decide whether to rent or buy land, as this can affect your financing choices and costs.

- Types of Homes: Mobile homes include both single-section and multi-section units, with the latter resembling traditional homes in size and layout.

Mobile homes refer to those built before 1976 using older standards, while manufactured homes follow updated safety codes. Both are prefabricated, offering various styles and price points to suit diverse needs.

For people like Sarah, a mobile home offers a chance to own property without the daunting price tag of traditional housing. With the right financing, owning one becomes a reality.

Understanding Mobile Home Financing

When it comes to financing a mobile home, it’s crucial to understand the key components that lenders consider. These include loan requirements, your credit score, and the down payment needed. Let’s break down each of these elements so you can approach the financing process with confidence.

Loan Requirements

Lenders have specific criteria for approving mobile home loans. Unlike traditional homes, mobile homes can be financed through various options, including FHA, Title I and II, and chattel loans. Each of these loans has unique requirements:

- FHA Loans: These require the home to meet certain safety standards and be placed on a permanent foundation. They are more accessible for those with lower credit scores.

- Chattel Loans: Designed for mobile homes not attached to land. These loans often have shorter terms and higher interest rates.

- Personal Loans: Typically used for smaller loan amounts, but they come with higher interest rates.

Understanding which loan fits your situation is essential in navigating the financing landscape.

Credit Score

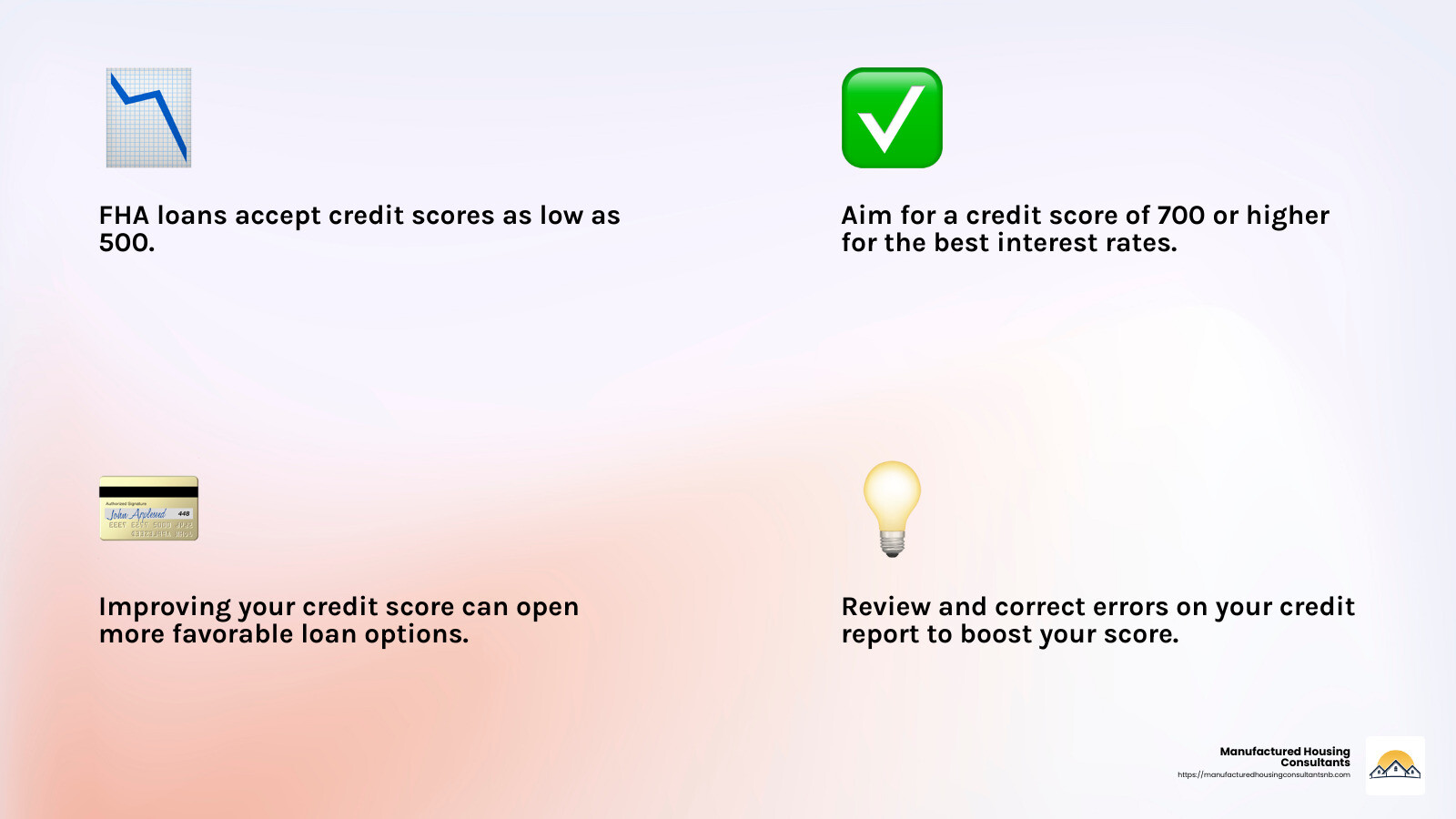

Your credit score plays a significant role in determining your eligibility for a loan and the interest rate you’ll receive. Here’s what you need to know:

- Minimum Scores: FHA loans may accept scores as low as 500, but better rates are available for scores above 580.

- Best Rates: Aim for a score of 700 or higher to secure lower interest rates, potentially saving you thousands over the loan’s lifetime.

If your credit score is less than ideal, consider improving it by paying down debts and correcting any errors on your credit report. This can open more favorable financing options for you.

Down Payment

The amount you need for a down payment can vary based on the loan type:

- FHA Loans: Require a minimum down payment of 3.5% if your credit score is 580 or higher.

- Chattel Loans: Typically demand a larger down payment, often around 5% to 10%.

- VA Loans: May offer options with no down payment for eligible veterans.

A larger down payment can reduce the overall loan amount and may also lower your interest rate. It’s wise to save as much as possible to strengthen your financial position.

In summary, understanding the intricacies of loan requirements, credit scores, and down payment options is crucial when planning to finance a mobile home. This knowledge will empower you to make informed decisions and pave the way for a smoother financing process.

Financing a Mobile Home: Options and Requirements

When it comes to financing a mobile home, you have several options to consider. Each type of loan comes with its own set of requirements and benefits. Here’s a closer look at some of the most common financing options:

FHA Loans

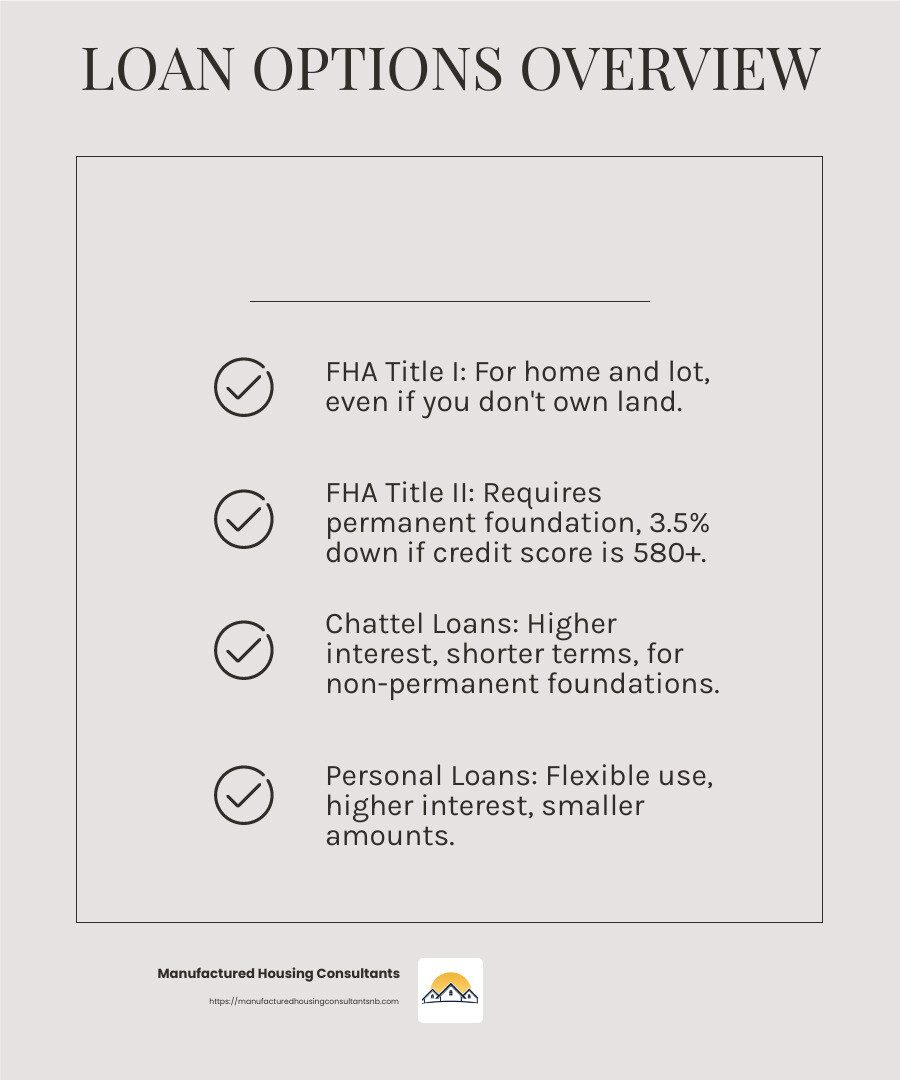

The Federal Housing Administration (FHA) offers two types of loans for mobile homes: Title I and Title II.

-

Title I Loans: These loans can be used for purchasing a mobile home, the land, or both. They are available even if you don’t own the land where the home will be placed. The maximum loan amount varies, with limits up to $148,909 for a single-section home and lot combination. These loans can be a good option if your credit score is on the lower side, as they have more lenient credit requirements.

-

Title II Loans: These are for those who plan to live in the mobile home as their primary residence. The home must be on a permanent foundation, and the loan must cover both the home and the land. Title II loans offer longer terms, up to 30 years, and require a down payment as low as 3.5% for those with a credit score of 580 or higher.

Chattel Loans

Chattel loans are designed specifically for mobile homes that are not permanently affixed to land. They differ from traditional mortgages in that they finance the home itself, not the land.

-

Key Features: Chattel loans typically have shorter terms, around 25 years or less, and often come with higher interest rates. They are a good option if you plan to place your mobile home in a leased lot or a mobile home park.

-

Requirements: Lenders usually require a minimum credit score of 575 and will assess your income history and debt-to-income ratio.

Personal Loans

If you don’t meet the criteria for FHA or chattel loans, a personal loan might be an alternative.

-

Flexibility: Personal loans can be used for any type of mobile home, even older ones that don’t meet current HUD standards. This makes them a flexible option if you have specific needs or a unique situation.

-

Considerations: Interest rates on personal loans tend to be higher, and loan amounts are usually smaller, ranging from $1,000 to $50,000. Some lenders might offer up to $200,000, but these come with high origination fees.

In conclusion, choosing the right financing option for your mobile home depends on various factors, including your credit score, the type of home, and whether you own the land. By understanding these options, you can make an informed decision and find the best loan to suit your needs.

Next, we’ll explore how to prepare your mobile home for financing, including site preparation and zoning requirements.

Preparing Your Mobile Home for Financing

Preparing your mobile home for financing involves more than just picking a loan. It’s also about ensuring your home meets specific requirements. Let’s explore some key areas you’ll need to focus on.

Permanent Foundation

To qualify for certain types of loans, like FHA Title II, your mobile home must be placed on a permanent foundation. This means the home is securely attached to a foundation that meets local building codes and HUD standards.

Why is this important? Lenders want to ensure that the home is stable and won’t be moved easily. A permanent foundation also helps protect the home from weather damage and can increase its value.

Site Preparation

Before moving your home to a new site, you’ll need to handle site preparation. This includes:

-

Leveling the Land: Make sure the land is flat and stable to support the home.

-

Utility Connections: Arrange for water, electricity, and sewage hookups.

-

Foundation Installation: Install the foundation according to local codes.

-

Driveways and Sidewalks: Depending on your loan and zoning requirements, you might need to add these.

Tip: Site preparation can be a lengthy process, so plan ahead and coordinate with your manufacturer to align timelines.

Zoning Requirements

Zoning requirements vary by location. They dictate what types of homes can be placed on specific plots of land.

Why does this matter? If your mobile home doesn’t meet local zoning laws, you might face fines or be forced to move it. Check with your local zoning department to ensure your plans comply with all regulations.

Key Takeaways

- Permanent Foundations are often required for financing and add stability and value to your home.

- Site Preparation involves leveling land, setting up utilities, and installing a foundation.

- Zoning Requirements must be checked to ensure compliance with local laws.

By taking these steps, you can position your mobile home for successful financing. Next, we’ll tackle some frequently asked questions about financing a mobile home.

Frequently Asked Questions about Financing a Mobile Home

Is it harder to get a mortgage for a mobile home?

Yes, it can be more challenging to secure a mortgage for a mobile home compared to a traditional house. One reason is depreciation. Unlike traditional homes, mobile homes often lose value over time, which makes lenders cautious. They see a higher risk in lending money for something that might not retain its value.

Moreover, many traditional lenders don’t offer loans for mobile homes. You might need to look for specialized lenders who understand the unique aspects of mobile home financing.

What credit score is needed to finance a mobile home?

Your credit score plays a big role in getting approved for a mobile home loan. Generally, a higher credit score will give you better loan options and lower interest rates.

- For FHA loans, you can qualify with a score as low as 500, but you’ll need a larger down payment.

- For more favorable terms, aim for a score of at least 700.

- Chattel loans, which are common for mobile homes, typically require a minimum score of 575.

Each lender will have its own requirements, so check with them directly.

What is the lowest down payment for a mobile home?

The down payment required can vary based on the type of loan you choose:

- FHA Loans: If your credit score is 580 or higher, you might qualify for a 3.5% down payment. If your score is between 500 and 579, expect to pay at least 10%.

- Chattel Loans: These often require a down payment, but the amount varies by lender.

- VA Loans: If eligible, you might not need a down payment at all.

The type of loan you choose will affect your down payment, so it’s crucial to explore your options and see which fits your situation best.

By understanding these aspects, you’ll be better prepared to steer mobile home financing.

Conclusion

At Manufactured Housing Consultants, we believe everyone deserves a place to call home. Our mission is to make affordable housing a reality for more people by providing a wide range of financing options. Whether you’re looking to buy a new mobile home or refinance an existing one, we’ve got you covered.

Financing a mobile home doesn’t have to be complicated. With the right guidance and support, you can secure the funding you need to move into your dream home. We work with a variety of lenders to offer options like FHA loans, Title I and Title II loans, and even chattel loans for those who require them.

Our team is committed to helping you understand your options and find the best fit for your financial situation. We offer personalized advice and resources to make the process as smooth as possible. Plus, with our guaranteed lowest prices and a vast selection from 11 top manufacturers, you’re sure to find a home that suits your needs and budget.

If you’re ready to explore your options, contact us today to learn more about how we can help you achieve your homeownership dreams in New Braunfels and beyond. Let’s make your dream of owning a home come true!