How to Buy a Mobile Home With No Money Down: 5 Methods That Guarantee Results

Discover how to buy a mobile home with no money down using 5 proven methods. Compare zero-down options and start your path to ownership today!

Why Zero-Down Mobile Home Financing Is More Achievable Than You Think

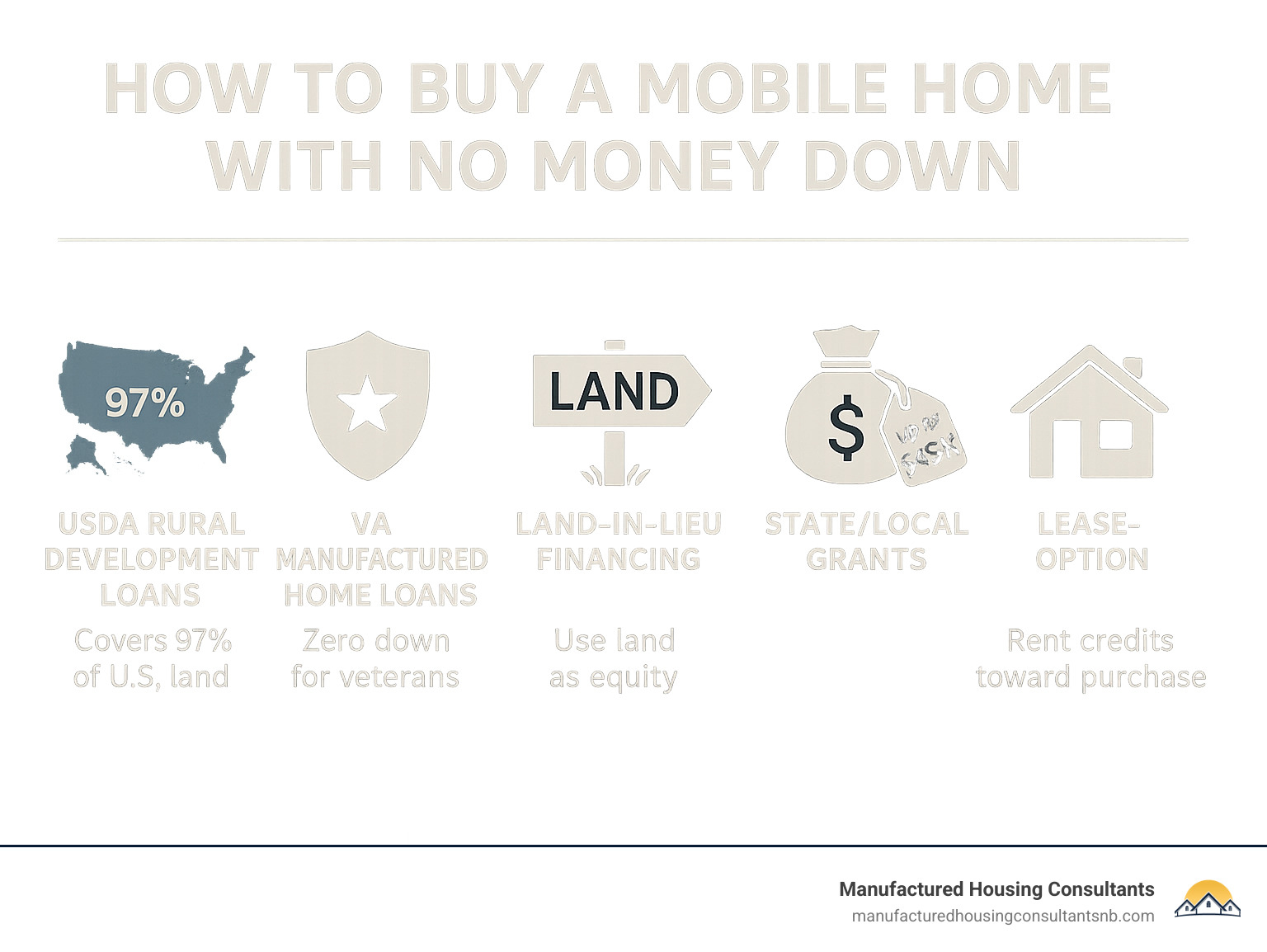

How to buy a mobile home with no money down is a reality for thousands of Americans who use government-backed loans, down payment assistance programs, and creative financing strategies. Here are the five proven methods:

Quick Answer – 5 Zero-Down Methods:

- USDA Rural Development Loans – 100% financing in eligible rural areas (covers 97% of U.S. land)

- VA Manufactured Home Loans – Zero down for veterans and active military

- Land-in-Lieu Financing – Use owned land as collateral for $0 cash down

- State/Local Down Payment Assistance – Grants up to $45,000 in some cities

- Lease-Option & Alternative Financing – Rent-to-own and personal loan strategies

The dream of homeownership feels impossible when traditional homes average $513,400 while manufactured homes cost just $88,000. About 97% of U.S. land mass qualifies for USDA loans that require zero down payment. Veterans can access VA loans with no down payment and no mortgage insurance.

Homes built after June 15, 1976 are classified as “manufactured homes” under HUD Code and qualify for these programs. With the right strategy, you can move from renter to homeowner without depleting your savings.

Simple guide to how to buy a mobile home with no money down terms:

How to Buy a Mobile Home With No Money Down – 5 Proven Methods

Manufactured homes built after 1976 under the HUD Code qualify for many of the same government-backed programs as traditional homes. Your credit score matters – most zero-down programs look for a minimum credit score of 640, though VA loans can be more flexible.

The closing cost reality: Even without a down payment, you’ll encounter closing costs ranging from 2-6% of your loan amount. Many zero-down programs allow sellers to cover these costs or let you roll them into your loan.

Foundation requirements are crucial. Your manufactured home needs to be permanently attached to a foundation and titled as real property rather than personal property.

| Program Type | Down Payment | Credit Score | Key Benefit |

|---|---|---|---|

| USDA Rural Development | 0% | 640+ | Covers 97% of U.S. land |

| VA Manufactured Home | 0% | Flexible | No mortgage insurance |

| Land-in-Lieu Financing | 0% cash | 640+ | Use owned land as collateral |

| Down Payment Assistance | 0% (grants available) | Varies | Up to $45,000 in grants |

| Lease-Option Agreements | 0% initially | Varies | Rent credits toward purchase |

1. USDA Rural Development Loan

The USDA Rural Development loan program covers an astonishing 97% of all U.S. land. What the USDA considers “rural” includes many suburban neighborhoods just outside major cities.

You get 100% financing with no down payment required, plus below-market interest rates. Your household income can’t exceed 115% of your area’s median income, and the manufactured home must be your primary residence.

Your credit score needs to be at least 640 for most lenders. The manufactured home must meet HUD construction standards and be permanently installed on a foundation. You’ll pay a 1% USDA guarantee fee upfront and an annual fee of 0.35%, typically rolled into your loan.

Scientific research on USDA mobile home financing confirms thousands of families have successfully used this program.

2. VA Manufactured Home Loan

Veterans and active-duty service members can access zero down payment and no monthly mortgage insurance premiums through VA manufactured home loans.

Getting started requires your Certificate of Eligibility (COE), which proves your military service qualifies you for this benefit. Credit requirements are reasonable – VA lenders typically work with credit scores as low as 580-620.

There is a VA funding fee ranging from 0.5% to 3.3% of the loan amount, but you can roll this fee into your loan. First-time VA loan users typically pay a 2.3% funding fee.

Manufactured homes must be permanently affixed to a foundation and classified as real property. You can use your VA benefit multiple times throughout your homeownership journey.

More info about VA Loan Rules for Manufactured Homes walks you through the specific requirements.

3. Land-In-Lieu & Equity Strategies

If you already own land, you can use your land equity as your down payment. Instead of cash upfront, lenders accept your land’s value as collateral.

When your manufactured home gets permanently attached to a foundation, you’ll qualify for real property mortgages with great rates. If not permanently attached, you’ll get a chattel loan with higher rates but faster processing.

Your land needs clear title and must be properly zoned for manufactured homes. Most lenders want land value equal to at least 25-30% of your total project cost. The appraisal process determines your land’s current market value and your loan terms.

4. State & Local Down-Payment Assistance Grants

State and local down payment assistance programs exist in nearly every state and city, often providing grants that never need to be repaid – essentially free money toward your home purchase. In cities like Orlando, these grants can reach up to $45,000.

Forgivable loans require you to stay in the home for 5-10 years, after which the loan disappears completely. Income requirements typically target families earning 80-120% of their area’s median income.

Start with your state housing finance authority and county housing departments. Texas offers excellent programs through the Texas State Affordable Housing Corporation (TSAHC).

More info about Mobile Home Financing: What You Need to Know and Scientific research on zero-down home loans provide additional details.

5. Lease-Option, Seller & Personal Loan Alternatives

Lease-option agreements (rent-to-own) offer accessible paths when conventional methods aren’t available. You’ll pay an option fee of $2,000-$5,000 upfront, with $100-$300 monthly rent credits toward the purchase price.

Seller financing allows dealers and private sellers to act as the bank, offering flexible terms and competitive rates. Personal loans work for smaller manufactured homes under $50,000, with 8-15% interest rates but fast approval.

Combining strategies often works best – use a small personal loan for the option fee on a lease-purchase, then improve your credit to qualify for traditional financing later.

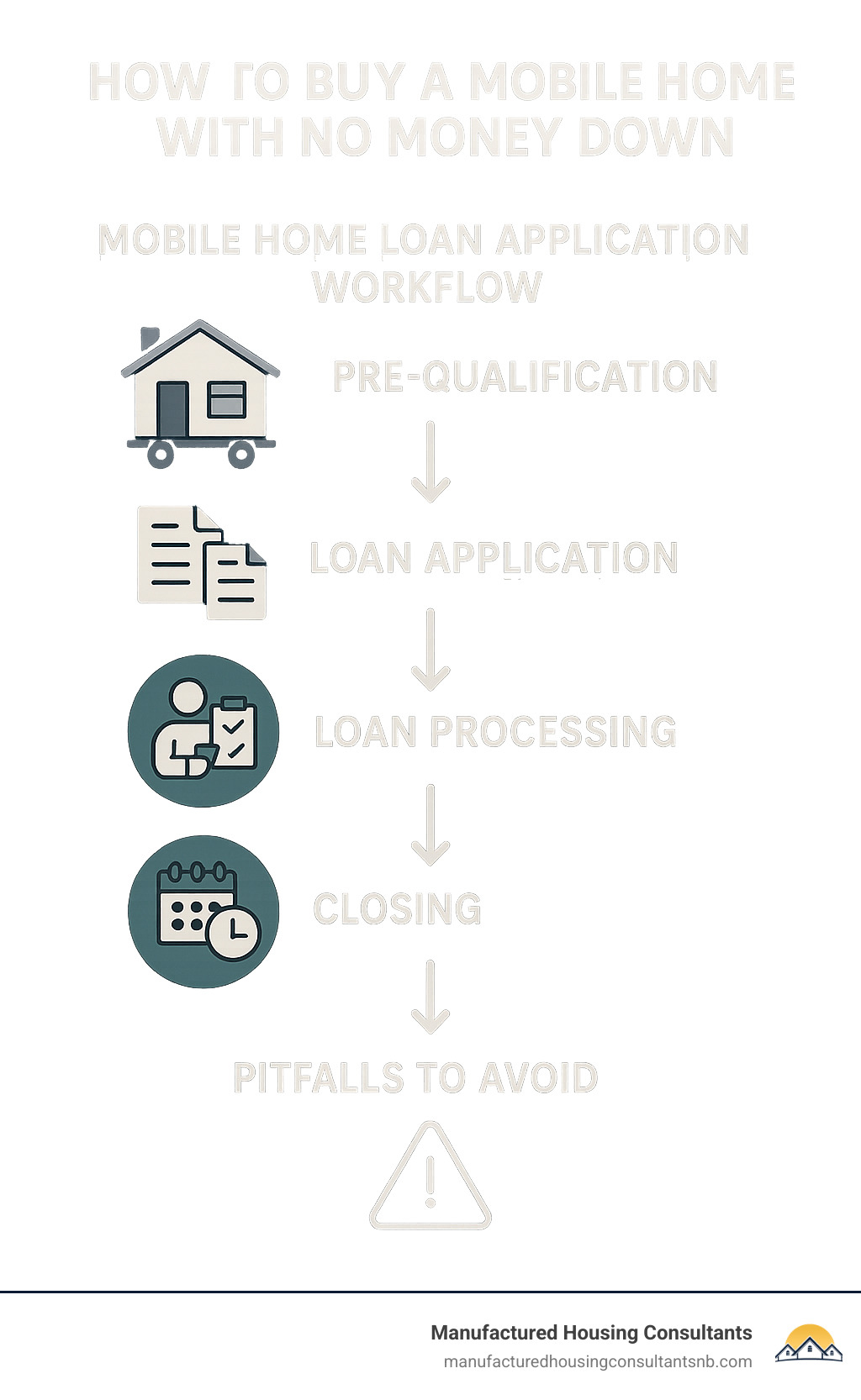

Final Checklist, Risks & Next Steps Before You Close

Required Documents: Last two years of tax returns, recent pay stubs, bank statements, photo ID, Social Security card, and HUD data plate information. Veterans need their Certificate of Eligibility.

Credit and Income Requirements: Pull your free credit reports at AnnualCreditReport.com. Your debt-to-income ratio shouldn’t exceed 43% of gross monthly income. Budget $300-$800 annually for specialized manufactured home insurance.

Understanding Risks: Appraisal gaps can surprise buyers when homes appraise for less than purchase price. Depreciation may occur, especially if not permanently attached to owned land. Higher interest rates often come with zero-down loans.

Timeline: Zero-down loans typically take 30-60 days to close. Shop around with at least 2-3 lenders within a 30-day window.

More info about Manufactured Home Loan Calculator helps you run different scenarios.

Your Action Plan – Secure Financing & Avoid Pitfalls

Choose Your Best Path: Military service favors VA loans. Rural locations suit USDA financing. Own land? Try land-in-lieu financing. Need credit improvement time? Consider lease-options.

Get pre-approval from multiple lenders to compare terms and show sellers you’re serious. Zero-down financing eliminates upfront cash requirements but comes with higher monthly payments and potentially higher interest rates.

At Manufactured Housing Consultants in New Braunfels, we coordinate financing, land improvement services, home delivery and installation. How to buy a mobile home with no money down isn’t just possible – it’s happening every day across Texas.

Ready to explore your zero-down options? Contact us at Manufactured Housing Consultants to discuss which strategy works best for your situation and start your homeownership journey today.

More info about Mobile-Home Financing Options provides current program information and additional resources.