Unlock Your Home’s Potential: Mastering the Manufactured Home Financing Calculator

Master the manufactured home financing calculator. Get accurate estimates, compare loans, and budget for affordable homeownership.

Your First Step to Affordable Homeownership

A manufactured home financing calculator is an online tool that estimates your monthly mortgage payment, providing a clear roadmap to affordable homeownership. By understanding what you can afford before you shop, you gain budget confidence and negotiating power.

To get an estimate, you’ll input these key details:

- Home Price: The total cost of the manufactured home.

- Down Payment: Your upfront payment, typically 3.5% to 20%.

- Interest Rate: Current rates for manufactured homes are often 0.5% to 1% higher than for site-built homes.

- Loan Term: Usually 15, 20, or 30 years.

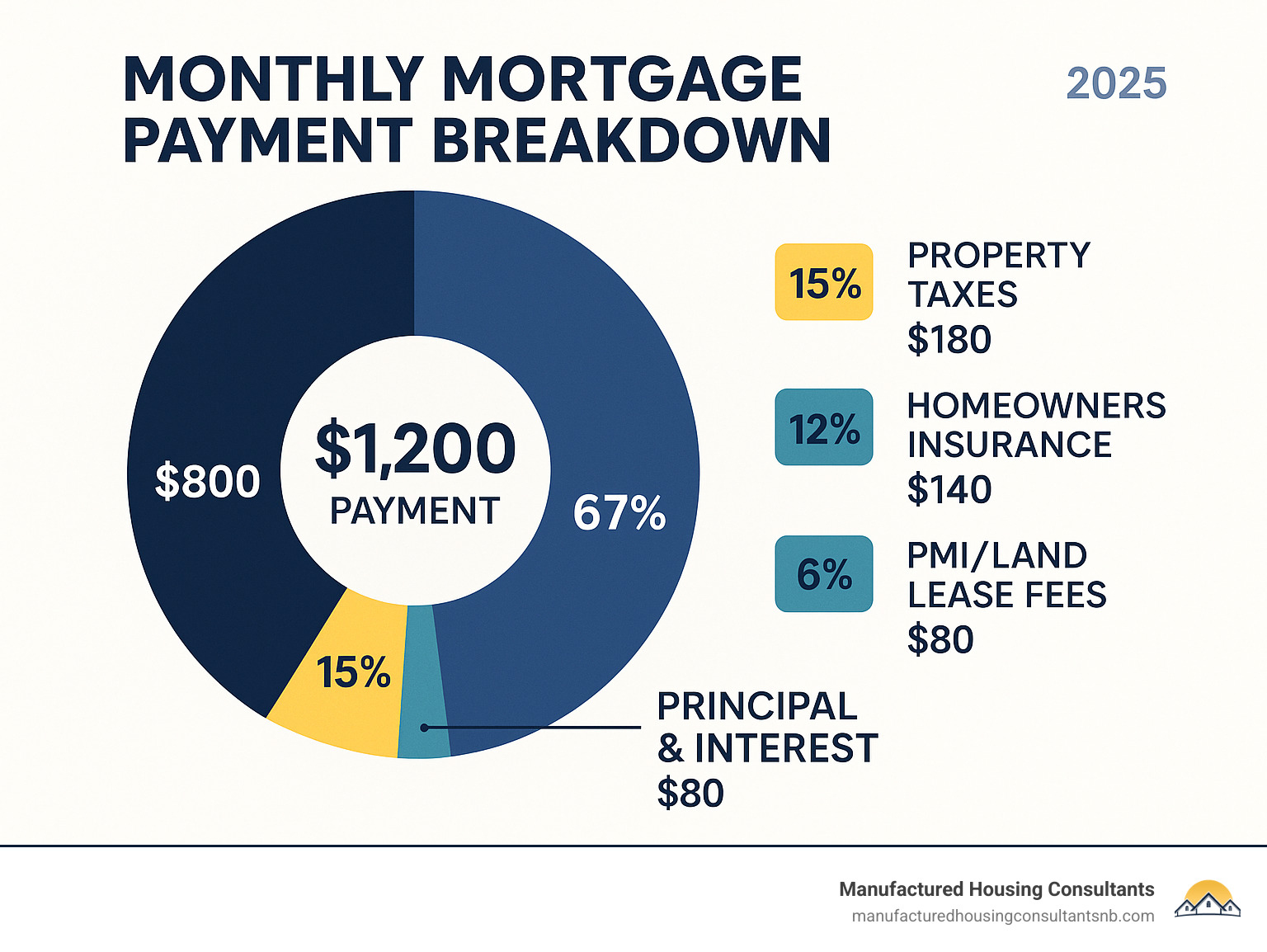

- Additional Costs: Property taxes, homeowners insurance, and any land lease fees.

The calculator breaks down your total estimated monthly payment, including principal, interest, taxes, and insurance (PITI). This first step helps you avoid the disappointment of falling for a home outside your price range and puts you in control of your home-buying journey.

Explore more about manufactured home financing calculator:

- Financing Mobile Home with Land

- How to Buy a Mobile Home with No Money Down

- Will FHA Finance a Manufactured Home

How to Use a Manufactured Home Financing Calculator for Accurate Estimates

Navigating home financing can feel complex, but a manufactured home financing calculator makes the process much clearer. This tool is designed to estimate your potential monthly payments and help you budget with precision. Let’s break down how to use it effectively.

What are the key inputs for a manufactured home financing calculator?

To get an accurate estimate from a manufactured home financing calculator, you need a few key pieces of information. The more precise your inputs, the more reliable your results will be.

- Home Price: The total cost of the manufactured home. Find More info about the cost of a new home on our site.

- Down Payment: The cash you’re paying upfront. This can range from 0% for VA/USDA loans to 3.5% for FHA loans or 5%+ for conventional loans.

- Interest Rate: The cost of borrowing. Rates for manufactured homes are typically 0.5% to 1% higher than for site-built homes and depend heavily on your credit score.

- Loan Term: The repayment period, usually 15, 20, or 30 years.

- Property Taxes & Insurance: Annual property taxes (often 0.5% to 2% of the home’s value) and homeowners insurance costs are factored into your monthly payment.

- Additional Fees: Be sure to include Private Mortgage Insurance (PMI) if your down payment is under 20%, plus any land lease or HOA fees if applicable.

When you’re ready to apply for a loan, our lenders will require essential documents to verify your financial standing. Having these ready will streamline the process:

- Pay stubs

- Tax returns

- Bank statements

- Identification

How do loan terms and interest rates impact your payment?

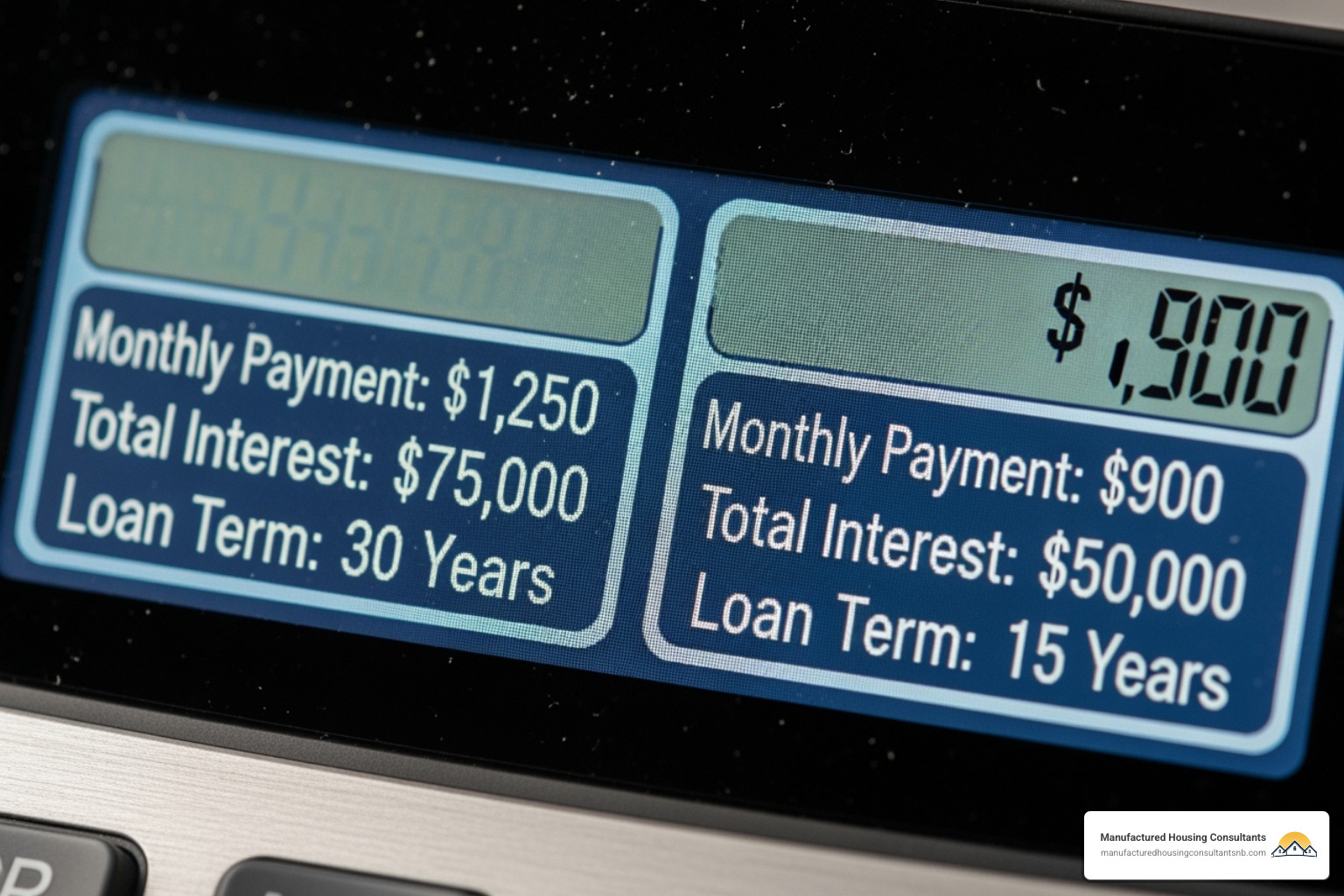

The loan term and interest rate are the two biggest factors determining your monthly payment. Understanding their interplay is key to choosing the right loan.

- Interest Rate: This is the cost of borrowing. Even a small difference can save you thousands over the life of the loan. Your rate is influenced by your credit score, the market, and whether the home is financed as real property (with land) or personal property (a chattel loan). Chattel loans typically have higher rates. You can check current trends on sites like Bankrate Mortgage Rates.

- Loan Term: This is how long you have to repay the loan. A shorter term (e.g., 15 years) means higher monthly payments but less total interest paid. A longer term (e.g., 30 years) results in lower, more manageable monthly payments but more total interest paid over time.

A manufactured home financing calculator can show you an amortization schedule, which details how much of each payment goes toward principal versus interest. This helps you visualize the long-term financial impact of your choices.

For more insights, see our Introduction to Mobile Home Financing.

What are the different types of loans for manufactured homes?

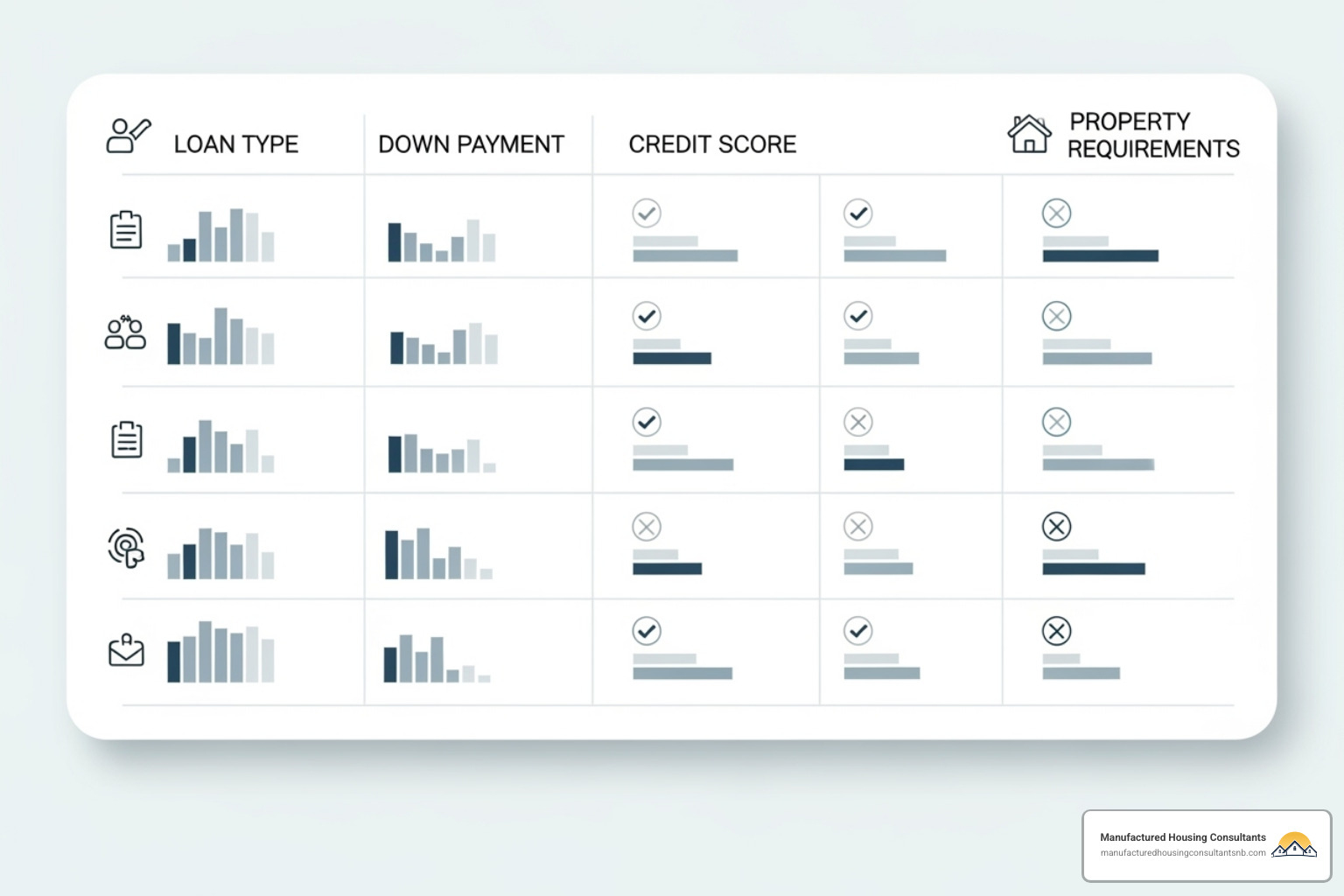

Several loan options are available for manufactured homes, and we work to connect you with the best solution for your needs. Here are the primary types:

- FHA Loans: Backed by the Federal Housing Administration, these are great for first-time buyers. They feature low down payments (as low as 3.5%) and flexible credit requirements. The home must be on a permanent foundation on land you own. Learn more about FHA Mobile Home Financing.

- VA Loans: A benefit for eligible veterans and service members, often requiring no down payment and no PMI. The home must be on a permanent foundation on owned land.

- USDA Loans: For eligible rural areas, these government-backed loans can offer zero down payment options for low-to-moderate-income buyers. The home must be new and on a permanent foundation.

- Conventional Loans: Offered by private lenders, these loans typically require a 3-5% down payment and higher credit scores (620+). PMI is usually required for down payments under 20%.

- Chattel Loans: This is a personal property loan used when the home is on leased land or not permanently affixed to land you own. These loans typically have higher interest rates and shorter terms than traditional mortgages.

We are proud to offer a wide selection of financing options through our network of trusted partners. You have the right to choose any lender, and we’re here to guide you.

For a personalized assessment, we encourage you to discuss your options with our specialists. Find more details on Financing Options for Mobile Homes.

How does a manufactured home financing calculator help compare scenarios?

A manufactured home financing calculator is a powerful comparison tool. It allows you to experiment with different financial scenarios to see what works best for your budget. You can instantly see how adjusting your down payment, loan term, or interest rate affects your monthly payment and the total interest you’ll pay. This is invaluable for comparing different loan offers or understanding the financial impact of a larger down payment. Some calculators can even work backward to estimate how much home you can afford based on a desired monthly payment. This helps you set a realistic budget and focus your search, preventing the disappointment of choosing a home that’s out of reach. It’s also a great tool for homeowners considering refinancing.

By playing with these variables, you gain clarity and confidence. While options like How to Buy a Mobile Home With No Money Down exist, the calculator can show the powerful savings of even a small down payment.

What are the limitations of a mortgage calculator?

While a manufactured home financing calculator is an excellent planning tool, it’s important to remember its limitations. The figures it provides are estimates, not a guaranteed loan offer.

Here’s what a calculator doesn’t always account for:

- Final Loan Terms: Your actual interest rate and terms are determined by the lender after a full credit review and application.

- Closing Costs: These fees (typically 2-5% of the purchase price) for things like loan origination, appraisal, and title insurance are often not included in the monthly payment estimate.

- Fluctuating Rates: Mortgage rates change daily. The rate you use in the calculator may not be the rate you lock in with a lender.

- Lender-Specific Fees: Some lenders have unique administrative fees not captured by generic calculators.

- Property Nuances: Factors like the home’s age, foundation type, and whether it’s new or used can influence financing options and rates.

Because of these variables, the calculator is your first step. The crucial next step is getting pre-approved by a lender for an accurate, official loan offer. For more on costs, see our Mobile Home Pricing Guide.

How does financing differ for manufactured vs. modular homes?

Though often confused, “manufactured” and “modular” homes have a key distinction that impacts financing.

-

Manufactured Homes: Built to a national HUD code, these homes can be financed in two ways. If placed on a permanent foundation on land you own, they are treated as real property and can qualify for traditional mortgages (FHA, VA, Conventional) with better rates and terms. If placed on leased land or not on a permanent foundation, they are considered personal property and financed with chattel loans, which typically have higher interest rates and shorter terms. We offer financing for both new and Used Manufactured Housing For Sale.

-

Modular Homes: Built in sections to meet all state and local building codes (the same as site-built homes), they are assembled on a permanent foundation on owned land. Because of this, they are almost always treated as real property and financed with traditional mortgages, just like a site-built home.

The main takeaway for financing is whether the home is classified as real or personal property. A manufactured home financing calculator generally assumes real property financing, so if you’re considering a home on leased land, you must manually add the land lease fee to the estimated mortgage payment for an accurate total housing cost. Learn more about Financing for Modular Homes.

Next Steps: From Calculation to Homeownership

You’ve used the manufactured home financing calculator, and now you have something powerful: financial clarity. This knowledge gives you budget confidence and empowers you to make informed decisions on your path to homeownership.

At Manufactured Housing Consultants, we see Texas families turn this clarity into reality every day. With our guaranteed lowest prices and a huge selection from 11 top manufacturers, your affordable dream home is within reach.

Your next step is to get pre-approved. This turns your calculator estimates into a solid loan offer, so you know exactly what you can borrow. Once pre-approved, you can shop with confidence, knowing which homes fit your budget.

We’re here to guide you through every step, from financing to finding the perfect home. Your dream of homeownership doesn’t have to stay a dream—it can become your new address.

Ready to take the leap from calculator to keys? Explore your mobile home financing options and let’s turn those numbers into your new home.