From Dream to Reality: Navigating Manufactured Home Financing Requirements

Navigate manufactured home financing requirements. Explore loan options, government programs, and secure your affordable dream home.

Your Path to an Affordable Home

Manufactured home financing requirements depend on your property, land, and loan program. Understanding these core criteria helps you secure affordable homeownership, even with imperfect credit.

Key Manufactured Home Financing Requirements:

- Property Classification: Home must meet HUD code standards and may need permanent foundation for traditional mortgages

- Land Ownership: Owned land typically qualifies for better rates than leased community lots

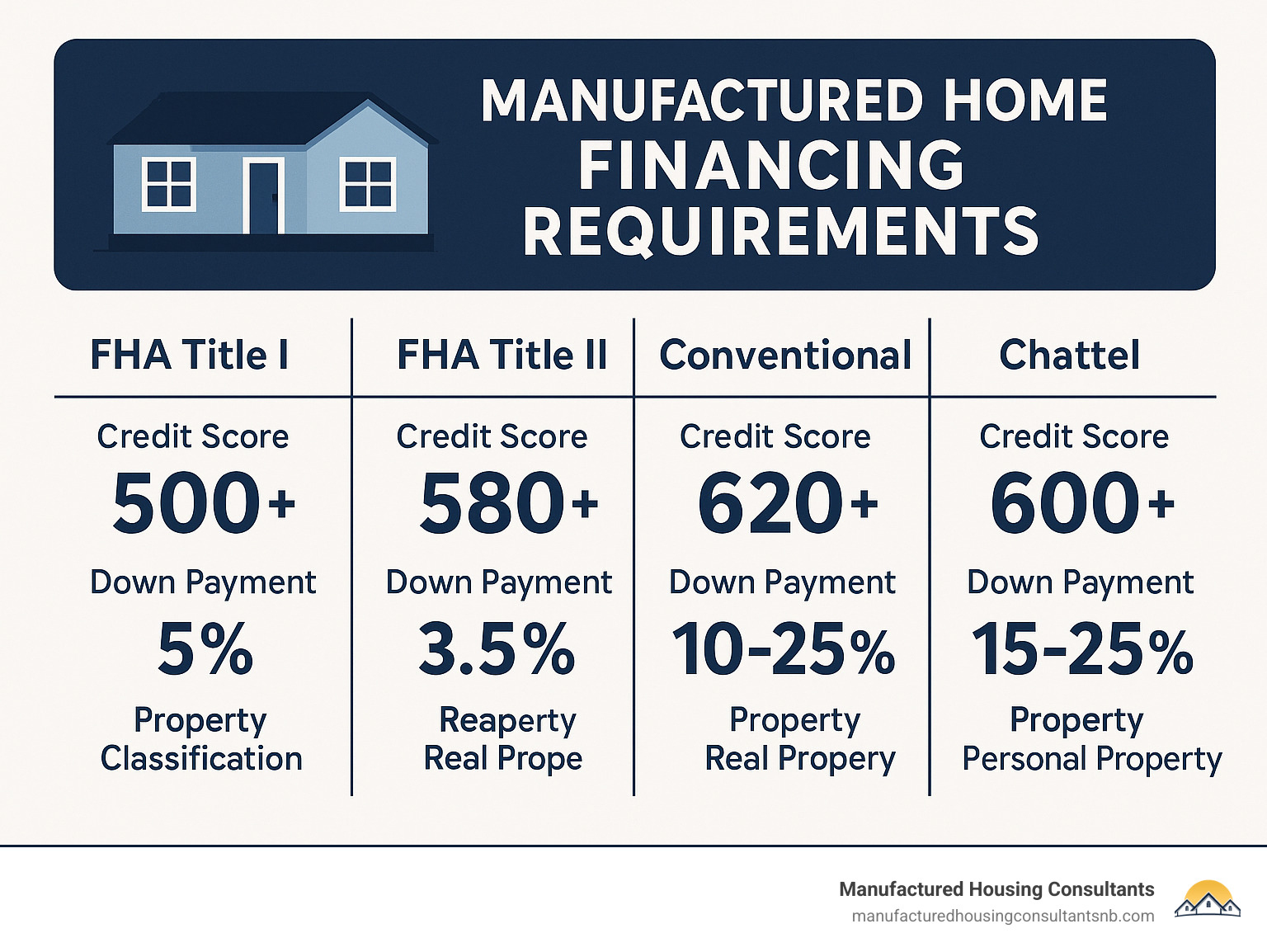

- Credit Score: Ranges from 500+ for FHA Title I loans to 620+ for conventional mortgages

- Down Payment: 3.5% to 25% depending on loan type and lender requirements

- Debt-to-Income Ratio: Generally 43% or lower for most loan programs

- Home Age/Condition: Newer homes (built after 1976) with HUD certification preferred

For many Texans, manufactured homes are a realistic path to homeownership amid rising housing costs. These homes cost 10-35% less per square foot than traditional site-built homes, making them attractive for budget-conscious buyers.

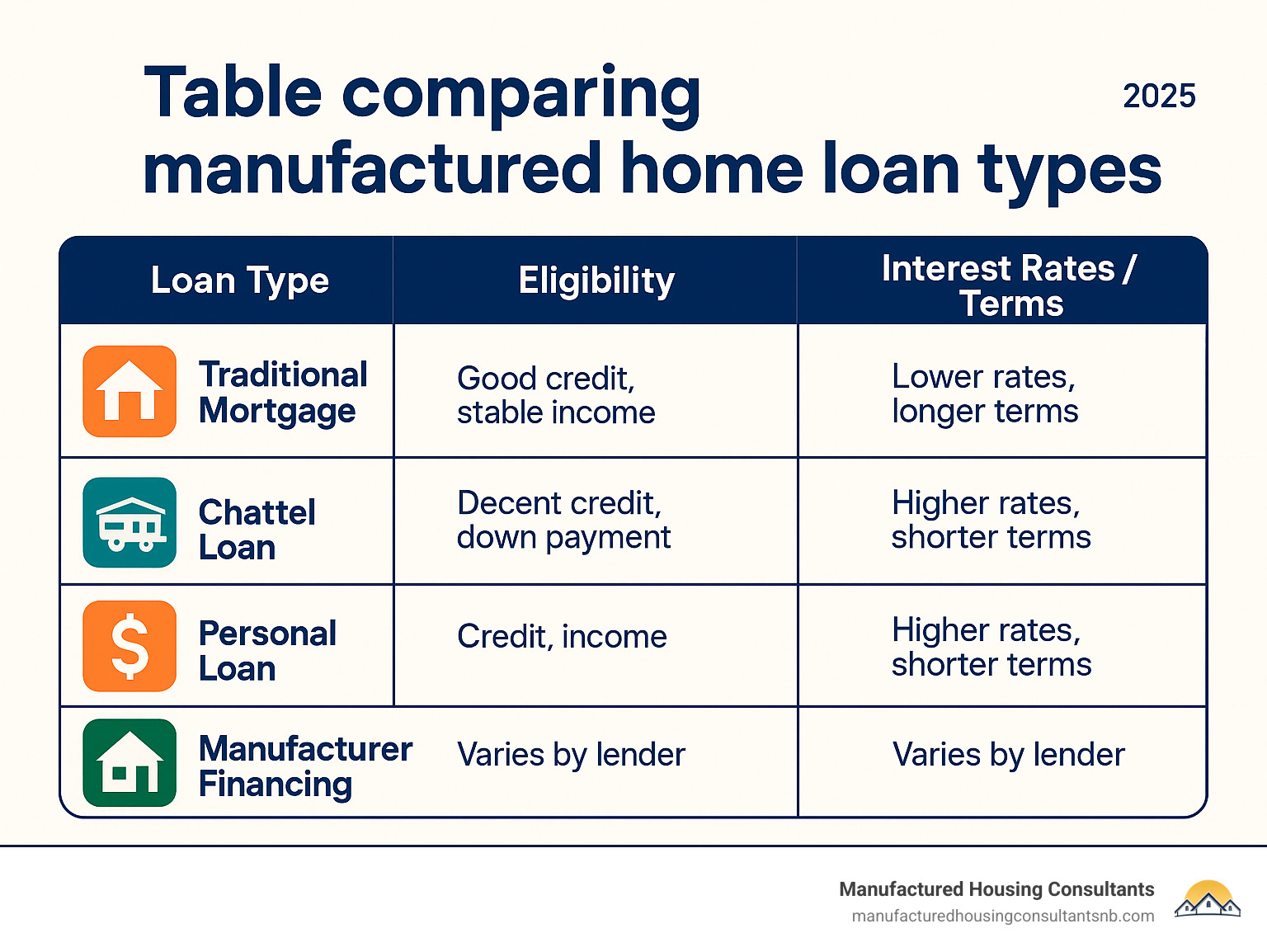

Financing options include traditional mortgages, chattel loans, FHA programs, and VA loans, each with distinct requirements. Your financing success hinges on whether your home is classified as real or personal property, which affects interest rates and loan options.

Relevant articles related to manufactured home financing requirements:

- financing mobile home with land

- how to buy a mobile home with no money down

- will fha finance a manufactured home

Understanding Key Manufactured Home Financing Requirements

Understanding manufactured home financing requirements is like following a roadmap. We’ll guide you through each step to help you make confident decisions.

Property & Land: The First Step in Your Financing Journey

The most critical factor in manufactured home financing is its legal classification, which determines your financing options and costs.

Is your manufactured home considered “real property” or “personal property”? This classification determines if you qualify for a traditional mortgage or a chattel loan.

A home becomes real property when it’s on a permanent foundation on land you own, with the title converted to real estate. This treats it like a traditional house. The benefits are significant: real property qualifies for conventional, FHA Title II, and VA loans, which offer lower interest rates and longer repayment terms.

Personal property classification applies to homes not permanently attached to land you own, such as in leased-land communities. This typically requires a chattel loan, a common and effective financing option.

Owning your land provides the best financing options. Lenders prefer these secure “land-home packages.” Manufactured Housing Consultants also offers land improvement services to prepare your property.

Leasing land in a community is also common. Your home is considered personal property, financed with a chattel loan. Many customers enjoy this lifestyle.

To learn more about your options when you own land, check out our guide on financing mobile home with land.

Exploring Loan Options and Borrower Eligibility

With property classification covered, let’s explore your loan choices. Each has different requirements and benefits.

Traditional mortgages (conventional, FHA Title II, VA loans) are the gold standard, but your home must be classified as real property to qualify. Requirements include good credit (620+ conventional, 580+ FHA), stable income, and a debt-to-income ratio under 43%. Down payments range from 3.5% (FHA) to 20% (conventional), while VA loans often require no down payment. Meeting these requirements yields lower interest rates, longer terms (15-30 years), and the ability to build equity.

Chattel loans are designed for manufactured homes classified as personal property. These loans have more forgiving credit requirements (scores around 600), with down payments from 5-20%. The trade-off is higher interest rates and shorter terms (10-20 years), but they close faster with less paperwork.

Manufacturer financing is a specialty at Manufactured Housing Consultants. Our relationships with specialized lenders mean we can find financing options custom to your situation, even if you’ve been denied elsewhere.

We encourage you to explore our detailed guide on Loan Options for Mobile Homes to dig deeper into what might work best for you.

Understanding Government-Backed Programs and Manufactured Home Financing Requirements

Government-backed loans can be game-changers for buyers with imperfect credit or limited savings. They offer more flexible manufactured home financing requirements than private loans.

FHA loans, backed by the Federal Housing Administration, come in two types. FHA Title I loans are for personal property homes (like those on leased land). You can qualify with a credit score of 500 (10% down) or 580 (3.5% down). Loan amounts are limited and terms are shorter (up to 20 years), but they are very accessible.

FHA Title II loans are for real property homes (permanently attached to owned land). They offer longer terms (up to 30 years) and higher loan amounts. The home must be built after June 15, 1976, meet HUD standards, and have a permanent foundation.

VA loans are a key benefit for eligible veterans, active-duty members, and surviving spouses. They often feature no down payment, competitive rates, and no private mortgage insurance. The home must be permanently attached to owned land, titled as real estate, and meet HUD standards. A Certificate of Eligibility from the VA is required. Learn more in our guide on VA Loan Rules for Manufactured Homes.

USDA loans are for new manufactured homes in eligible rural areas. They offer zero down payment and competitive rates, but income and location restrictions apply. The home must be permanently attached to owned land.

For more information, visit Financing Manufactured (Mobile) Homes (Title I) – HUD. These programs make homeownership more achievable, and we are experienced in helping clients steer them.

Navigating Interest Rates, Terms, and Additional Costs

Understanding manufactured home financing requirements includes knowing the full cost. Let’s break down interest rates, loan terms, and additional costs.

Interest rates are the cost of borrowing and significantly impact your payments. Key factors influencing your rate include:

- Loan Type: Chattel loans usually have higher rates than traditional mortgages.

- Credit Score: Higher scores earn lower rates.

- Down Payment: A larger down payment can secure a better rate.

- Loan Term: Shorter terms may have lower rates but higher payments.

- Market Conditions: Rates fluctuate with the overall economy.

Loan terms determine your repayment period. Chattel loans typically run 10-20 years, while traditional mortgages offer 15-30 year terms.

Beyond the loan, other costs are part of the financing picture:

- Setup and installation fees cover transport, foundation setting, and utility connections.

- Closing costs (2-5% of the loan) include appraisal, title insurance, and origination fees.

- Property taxes apply to real property; personal property has different tax rules.

- Insurance is mandatory to protect your investment.

- Land preparation costs for raw land can include grading, septic systems, and utility connections.

- Mortgage insurance is required for FHA loans and conventional loans with less than 20% down.

Understanding all costs upfront prevents surprises. For more details, see our guide on Mobile Home Interest Rates.

Securing Your Loan and Finding Your Dream Home

You’ve done the homework on manufactured home financing requirements. Now comes the exciting part: securing the loan and finding your perfect home.

Tips for Comparing Lenders and Meeting Manufactured Home Financing Requirements

Finding the right lender is crucial. Not all lenders understand manufactured homes, which can cost you money or derail your purchase.

Shopping around is essential. Contact at least three to five lenders, including banks, credit unions, and specialists. Each will have different manufactured home financing requirements and rates. One denial doesn’t mean you won’t find an approval elsewhere.

When comparing offers, focus on the Annual Percentage Rate (APR), not just the interest rate. The APR includes interest plus fees, giving you the true cost of the loan.

Read the loan terms carefully. Look for hidden prepayment penalties or excessive late fees. A good lender will be transparent about all terms.

Understand each lender’s requirements before applying. Different loan programs have vastly different manufactured home financing requirements, so confirm you qualify before proceeding.

Consider professional help. A specialized financial advisor or mortgage broker knows which lenders are manufactured home-friendly and can often negotiate better terms for you.

For a head start on finding reputable lenders, check out our guide to Manufactured Home Financing Companies.

Partnering with Experts to Finalize Your Purchase

Manufactured homes are often the most realistic path to homeownership. You get significantly more home for your money compared to site-built houses, including modern, energy-efficient features.

Today’s manufactured homes are quality-built to strict HUD standards in climate-controlled factories. This ensures consistency, customization, and quality craftsmanship. Plus, you can move in months sooner than with a site-built home.

At Manufactured Housing Consultants, we make homeownership accessible and affordable for Texas families. We work with 11 top manufacturers, offering choices to fit any lifestyle and budget with guaranteed lowest prices.

What truly sets us apart is that we understand manufactured home financing inside and out. We’ve helped thousands of families steer the complex manufactured home financing requirements, from first-time buyers to veterans using VA loans. We know which lenders to work with.

Our financing expertise goes beyond connecting you with lenders. We help you prepare your documentation, present your application effectively, and understand the approval process, helping you avoid common pitfalls.

Need land preparation or improvements? We can coordinate site prep, utility connections, and foundation work to ensure your home meets all financing requirements.

Your dream of homeownership doesn’t have to remain just a dream. We’re here to make it happen, walking alongside you from financing to handing you the keys.

Ready to turn that dream into reality? Let’s get started on your financing journey today.