Manufactured Home Insurance Texas 101

Compare coverage, costs, and tips for Manufactured home insurance Texas. Learn risks, discounts, and how to protect your investment now.

Why Manufactured Home Insurance Texas Protection is Essential

Manufactured home insurance Texas coverage protects your factory-built home investment from the Lone Star State’s unique weather risks and provides required financial protection. Unlike traditional homeowners insurance, manufactured home policies are specifically designed for homes built to HUD standards and often situated in mobile home communities.

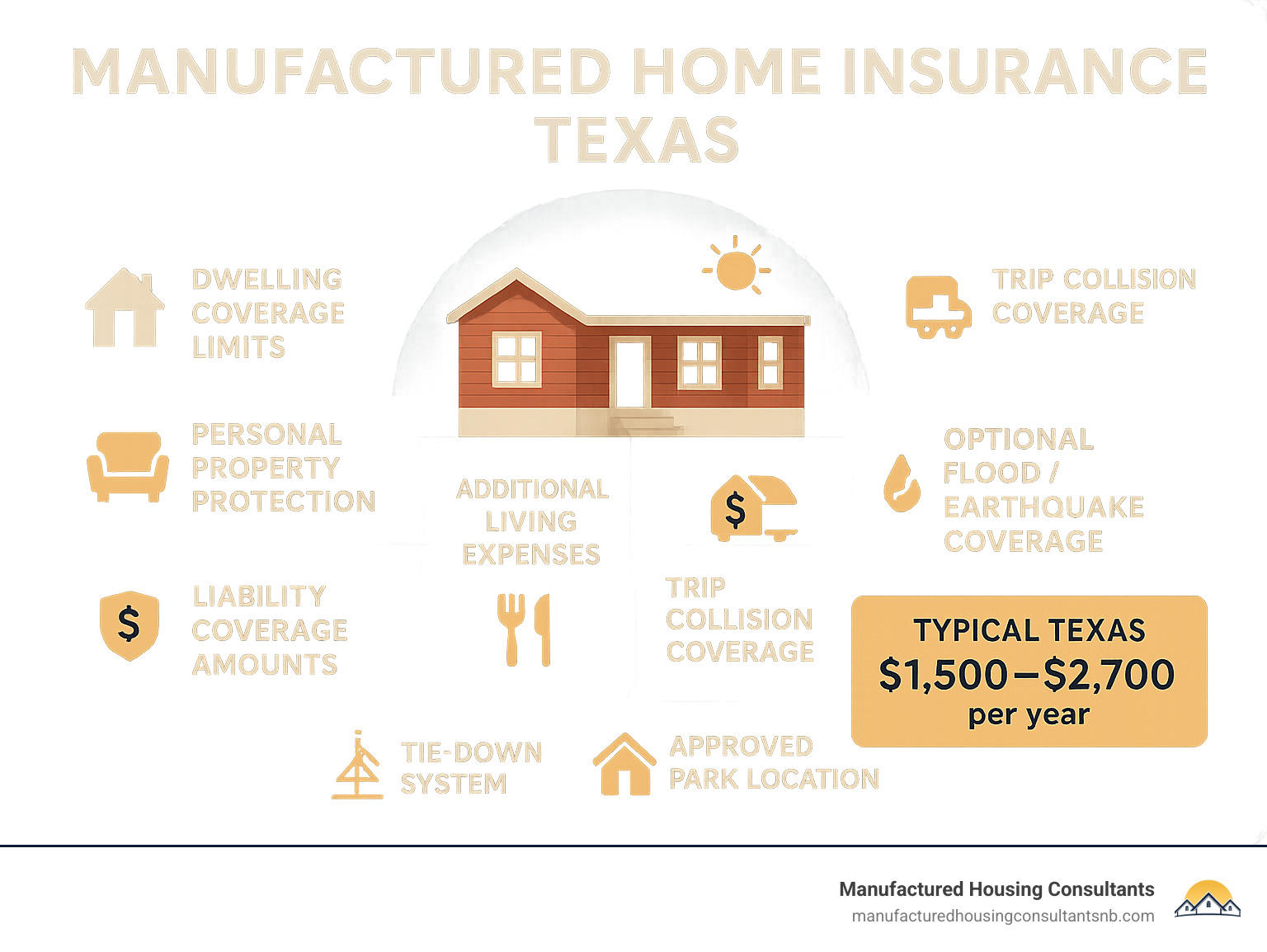

Quick Answer: Manufactured Home Insurance Texas Basics

- Cost Range: $1,500 to $2,700 annually in Texas

- Required By: Mortgage lenders and most mobile home communities (not state law)

- Coverage Types: Dwelling, personal property, liability, additional living expenses

- Excluded Risks: Flood and earthquake (require separate policies)

- Special Features: Trip collision coverage during moves, tie-down discounts

- If Denied: Texas FAIR Plan available after two insurer denials

Texas manufactured homeowners face specific challenges that make proper insurance coverage critical. The state’s severe weather patterns – from Gulf Coast hurricanes to Panhandle tornadoes and destructive hailstorms – pose constant threats to factory-built homes.

Most mortgage lenders and mobile home communities require manufactured home insurance even though Texas law doesn’t mandate it. This specialized coverage differs significantly from standard homeowners policies because it accounts for your home’s HUD construction standards, mobility features, and unique foundation requirements.

The average cost ranges from $1,500 to $2,700 per year, depending on your home’s age, location, and coverage choices. While standard policies exclude flood and earthquake damage, you can add optional coverages like replacement cost protection and trip collision coverage for relocating your home.

Manufactured home insurance Texas helpful reading:

Manufactured Home Insurance Texas Essentials

Getting the right manufactured home insurance Texas coverage starts with understanding what makes your home unique. If your home was built after June 15, 1976, it’s officially a manufactured home under federal law. That HUD label on your home proves your house meets strict federal building standards.

Your manufactured home might share a neighborhood with modular homes, park model RVs, or tiny homes. While they might look similar, each type requires different insurance approaches. Manufactured homes follow HUD codes and keep their steel chassis. Modular homes are built in sections but follow local building codes once assembled.

Manufactured Home Insurance Texas vs Traditional Homeowners Policies

Think of manufactured home insurance Texas as homeowners insurance’s specialized cousin. They’re related, but one is definitely more suited for your specific situation.

The biggest difference comes down to how your home was built. Traditional homeowners insurance assumes your house was constructed on-site following local building codes. Your manufactured home was built in a climate-controlled factory following HUD standards.

Your home’s steel chassis is another game-changer. Even if your home sits on a permanent foundation, that chassis remains part of the structure. Traditional homeowners policies don’t account for this unique feature, but manufactured home insurance does.

Foundation types also matter more than you might expect. Whether your home sits on tie-downs and piers, a crawl space, or a full basement affects both your premium and coverage options. Insurance companies view permanent foundations more favorably, often offering better rates and coverage terms.

Most lenders require manufactured home insurance even though Texas doesn’t legally mandate it. Many mobile home communities also require coverage as part of their lease agreements.

Here’s the key difference between coverage types:

| Coverage Type | Payout Method | Example Scenario | Best For |

|---|---|---|---|

| Actual Cash Value | Original cost minus depreciation | $50,000 home, 5 years old = ~$35,000 payout | Budget-conscious buyers |

| Replacement Cost | Full replacement without depreciation | $50,000 home = up to $60,000 for equivalent new home | Complete protection |

Replacement cost coverage costs more upfront but provides much better protection when disaster strikes.

Manufactured Home Insurance Texas Coverage & Exclusions

Your manufactured home insurance Texas policy typically includes four main protection areas, each designed to cover different aspects of your life and property.

Dwelling coverage protects your home’s structure, including any attached decks, porches, and built-in appliances. This should cover the full cost to replace your home with a similar model.

Personal property coverage handles your belongings inside the home. Most policies automatically provide coverage equal to 50-70% of your dwelling amount. High-value items like jewelry or collectibles usually need separate scheduling for full protection.

Liability coverage protects you when life gets complicated. If someone gets hurt on your property or you accidentally damage someone else’s property, this coverage handles medical bills, legal fees, and potential settlements.

Additional living expenses become crucial when your home is uninhabitable due to covered damage. This pays for hotel stays, restaurant meals, and other extra costs while your home is being repaired or replaced.

But here’s what your standard policy won’t cover: flood damage, earthquake damage, normal wear and tear, maintenance issues, and problems from pests or mold.

You can add protection through optional endorsements like replacement cost coverage for personal property, scheduled coverage for valuable items, and water backup protection for sewer issues.

Trip collision coverage is one unique feature you won’t find in traditional homeowners insurance. If you ever need to relocate your manufactured home, this coverage protects against damage during transport.

Unique Texas Risks & Required Extra Policies

Living in Texas means dealing with weather that can be absolutely spectacular – and spectacularly destructive. Your manufactured home insurance Texas policy covers many weather-related damages, but Texas’s unique climate creates some gaps you need to address separately.

Hail damage tops the list of Texas weather concerns. The state sees more hail damage than anywhere else in the country, with storms regularly dropping ice chunks the size of golf balls or larger.

Tornado activity peaks from April through June, with Texas averaging 132 tornadoes annually. Manufactured homes face higher tornado risks due to their construction and typical locations in rural or suburban areas.

Hurricane threats along the Gulf Coast require special attention. If you live in designated coastal areas, you’ll need separate windstorm coverage through the Texas Windstorm Insurance Association (TWIA).

Wildfire risk continues growing across Central and West Texas. If your home sits in a rural or wooded area, make sure your policy includes adequate coverage for fire damage.

Two coverage types require separate policies in Texas. Flood insurance through the National Flood Insurance Program (NFIP) is mandatory in high-risk flood zones and strongly recommended elsewhere. Earthquake coverage is available as an endorsement, though seismic activity remains relatively low in most of Texas.

If standard insurance companies decline your application, don’t panic. The Texas FAIR Plan Association provides basic coverage after two insurers have turned you down.

For help understanding insurance terminology, check out the Glossary of Common Insurance Terms from the Texas Department of Insurance.

Costs, Discounts & How to Get Covered

When you’re shopping for manufactured home insurance Texas coverage, you’ll likely pay between $1,500 and $2,700 each year. Understanding what drives these costs and how you can save money helps you protect your biggest investment affordably.

Price Factors, ACV vs Replacement Cost, Discounts

Your premium depends on several key factors. Your home’s age plays a huge role – newer homes under 10 years old get the best rates, while homes over 20 years might need inspections or face coverage limits.

Where you live matters tremendously in Texas. Gulf Coast areas pay more because of hurricane risks, while inland areas face hail storms and tornadoes. Your ZIP code can make a difference of hundreds of dollars annually.

The value of your home directly affects your premium since higher-value homes need more coverage. Your claims history follows you for 3-5 years, so recent claims might still be affecting your rates.

Here’s where many homeowners make a costly mistake: choosing actual cash value over replacement cost coverage. ACV pays you what your home is worth today (minus depreciation), while replacement cost coverage pays to rebuild without deducting for age. Yes, replacement cost coverage costs 10-20% more, but it can provide up to 20% additional funds above your policy limits when you need to rebuild.

Your deductible choice creates an immediate trade-off. Higher deductibles lower your premium but mean more out-of-pocket costs when you file a claim.

Now for the savings opportunities. Bundling your home and auto insurance typically saves 10-25%. Claims-free history for 3-5 years can earn 5-15% discounts.

Newer homes often qualify for 5-10% discounts automatically. Adding safety features like smoke detectors, security systems, and fire extinguishers can reduce your rates. Proper tie-down systems can qualify for wind-resistance discounts, and living in approved mobile home parks may offer rate reductions.

Getting Quotes, FAIR Plan, Claims & Best Practices

Getting accurate quotes for manufactured home insurance Texas coverage requires having the right information ready. You’ll need your home’s HUD label number or VIN, the year it was manufactured and who made it, plus the square footage and whether it’s single, double, or triple-wide.

The current location matters, especially whether the installation is permanent or temporary. Your foundation type affects both coverage options and pricing. Don’t forget to mention safety features like smoke detectors and security systems.

Independent agents can be your best friend in this process. They shop multiple insurers at once and understand the quirks of manufactured home insurance that online calculators might miss. Expect quotes within 24-48 hours for most applications.

If two insurers turn you down, don’t panic. The Texas FAIR Plan provides basic coverage for hard-to-insure properties. The rates are higher, but it’s better than no coverage. You can reach them at 800-979-6440.

When damage happens, knowing how to file a claim properly can save you thousands. Contact your insurance company immediately, then start documenting everything with photos and videos. Make temporary repairs to prevent further damage, but keep those receipts.

Cooperate with adjusters and provide whatever documentation they request. The smartest homeowners maintain detailed inventories with photos and receipts. Keep improvement receipts too – they document your home’s increased value and help ensure adequate coverage.

Consider umbrella liability coverage for additional protection beyond your standard policy limits.

For comprehensive pricing information that helps you understand your home’s value and insurance needs, check out our More info about Mobile Home Pricing Guide.

Final Checklist & Next Steps

Before you sign on the dotted line, make sure you understand exactly what you’re buying. Ask about dwelling coverage limits and what’s actually included. Find out if personal property coverage includes replacement cost. Liability limits recommendations vary by situation, but don’t skimp here.

Ask about flood and earthquake coverage availability since standard policies exclude these. Understand your additional living expense limits.

Compare costs carefully. What discounts are you eligible for? How do deductible choices affect your premium? What’s the real difference between ACV and replacement cost coverage for your specific situation? Are there multi-policy bundling opportunities?

Understand the practical side too. How do you file a claim? What’s the typical claims process timeline? Can you make policy changes mid-term without penalties? What happens if you relocate your home?

Schedule yearly policy reviews to keep your coverage current. Adjust coverage limits when you make home improvements. Update personal property values as you acquire new belongings. Review discount eligibility periodically. Compare rates with other insurers. Assess whether you need additional coverage as your situation changes.

At Manufactured Housing Consultants, we understand insurance from the ground up because we’ve helped Texas families with manufactured homes for years. Our experience with 11 top manufacturers and guaranteed lowest prices means we know how home age, construction quality, and location affect your insurance options.

We’re not just about selling homes – we’re about supporting you through the entire ownership experience. Our comprehensive services include financing assistance and land improvement services, making us your complete manufactured housing resource in New Braunfels and throughout Texas.

For more information about how we support manufactured homeowners beyond the initial purchase, visit More info about Our Services.

Manufactured home insurance Texas protection gives you the peace of mind every homeowner deserves. By understanding your coverage options, cost factors, and Texas-specific risks, you can make decisions that protect your home and family while keeping insurance costs reasonable.

Your insurance needs will change over time as you improve your home, as weather patterns shift, and as your personal situation evolves. Regular policy reviews ensure your coverage grows with your needs while taking advantage of new discounts and better coverage options.

Start by gathering your home information, comparing quotes from multiple insurers, and working with agents who truly understand manufactured home insurance. With the right coverage in place, you can enjoy your manufactured home with confidence, knowing you’re protected against whatever Texas weather throws your way.