Crunch the Numbers: Estimating Your Manufactured Home Loan Payments

Explore our Manufactured home loan calculator to estimate payments, compare loans, and maximize savings for your affordable housing needs.

Why a Manufactured Home Loan Calculator is Essential for Your Budget

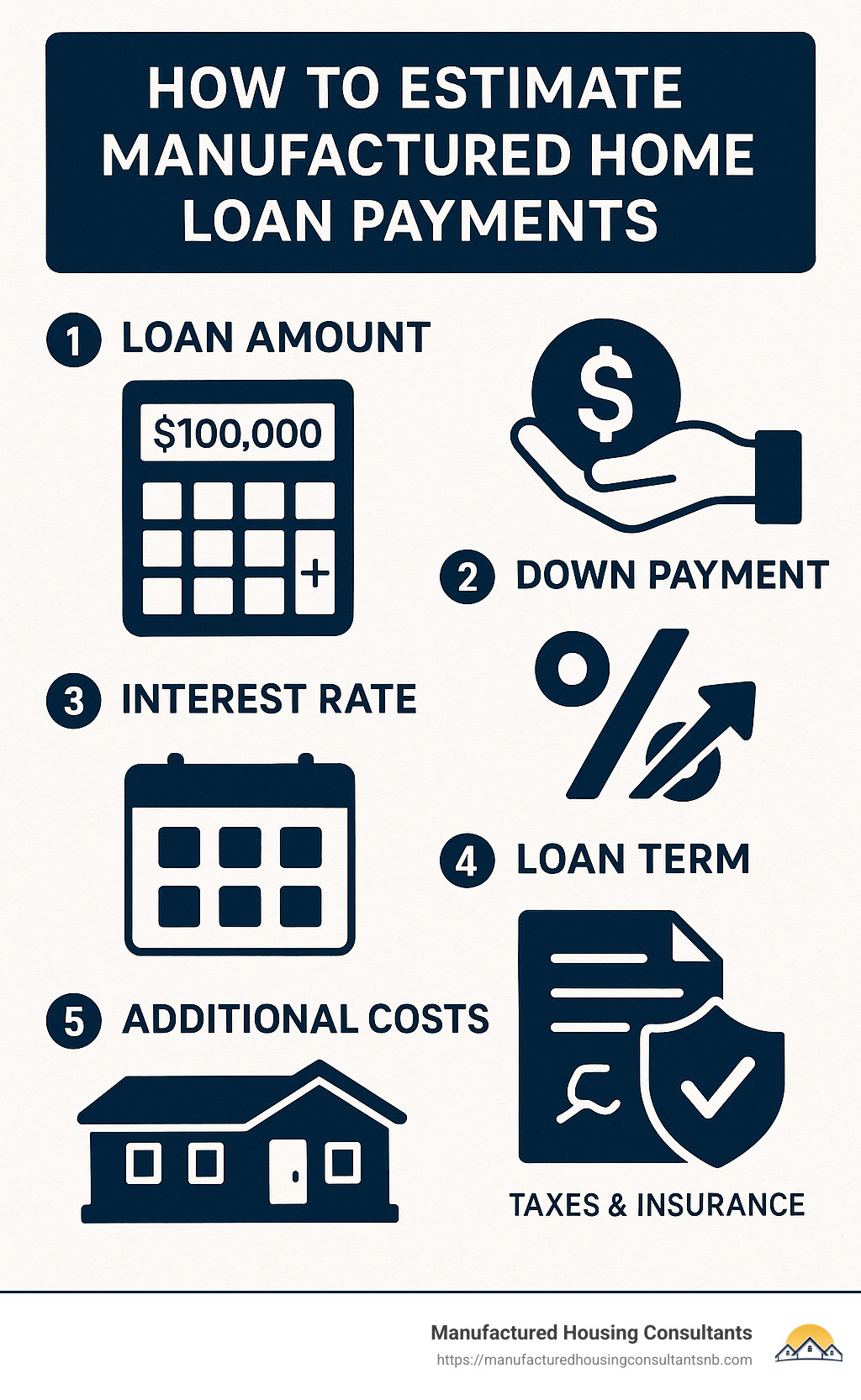

A Manufactured home loan calculator helps you instantly estimate your monthly payments when buying a manufactured home. If you need a quick answer without reading further, here’s how it works:

- Enter Loan Amount: The total price of the manufactured home you’re looking to buy.

- Input Interest Rate: The yearly interest rate you expect to pay.

- Set Your Down Payment: The amount of money you plan to pay upfront.

- Select Loan Term: How long (usually in years) you’ll be repaying your loan.

- Include Extra Costs: Property taxes, insurance, and optional fees (like PMI or HOA dues).

The calculator then shows you a quick estimate of your monthly payment, including principal, interest, taxes, and insurance.

Crunching these numbers upfront can save you big surprises down the road, helping you find the perfect manufactured home within your budget.

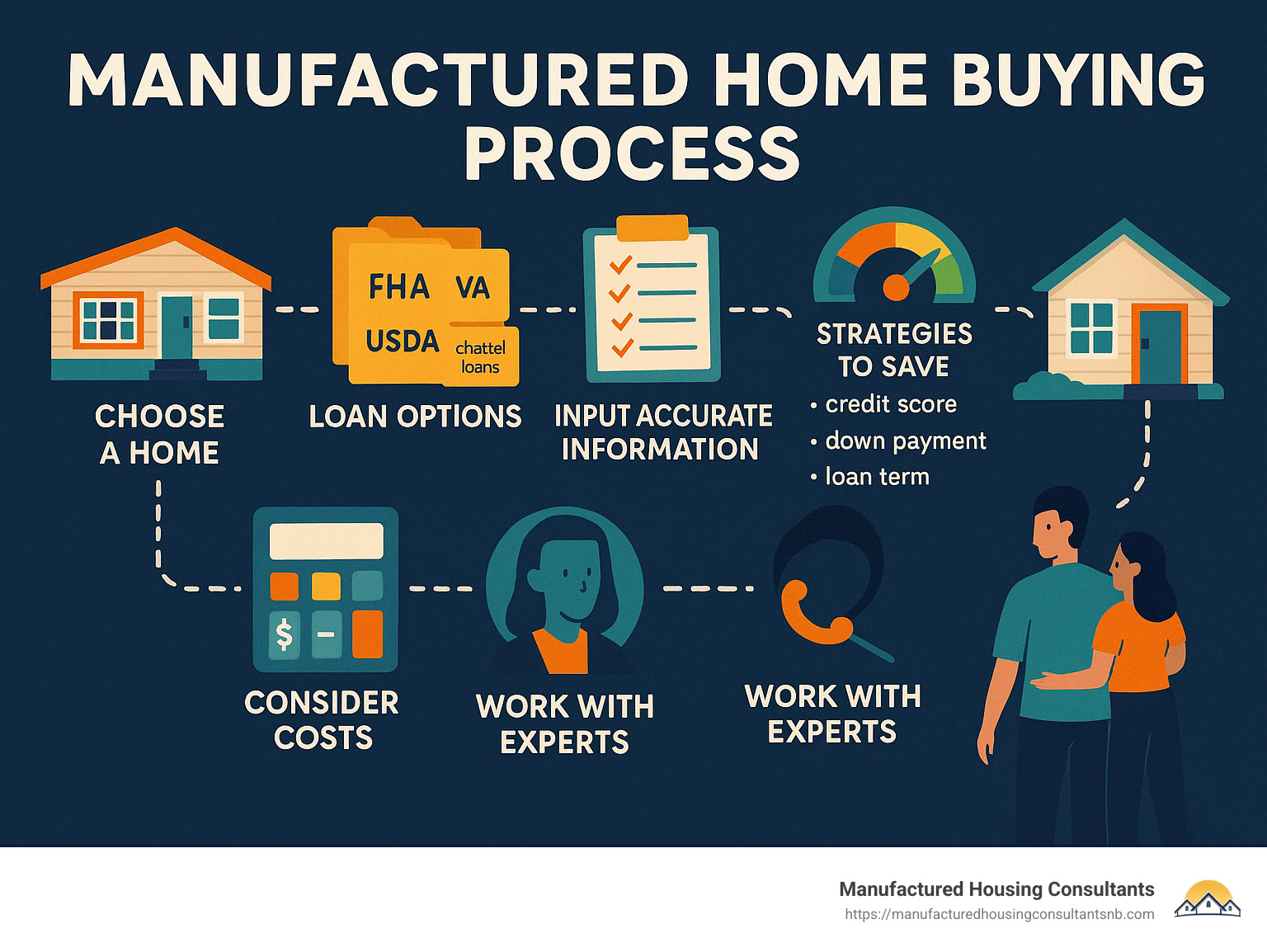

Understanding Manufactured Home Loans and Financing Options

When you’re thinking about buying a manufactured home, knowing your financing options makes all the difference. Unlike purchasing a traditional site-built home, financing a manufactured home has some unique considerations. But don’t worry—at Manufactured Housing Consultants, we’ve guided countless families in New Braunfels and across Texas through this exact process. Let’s take a friendly walk through the main types of loans available for your dream manufactured home.

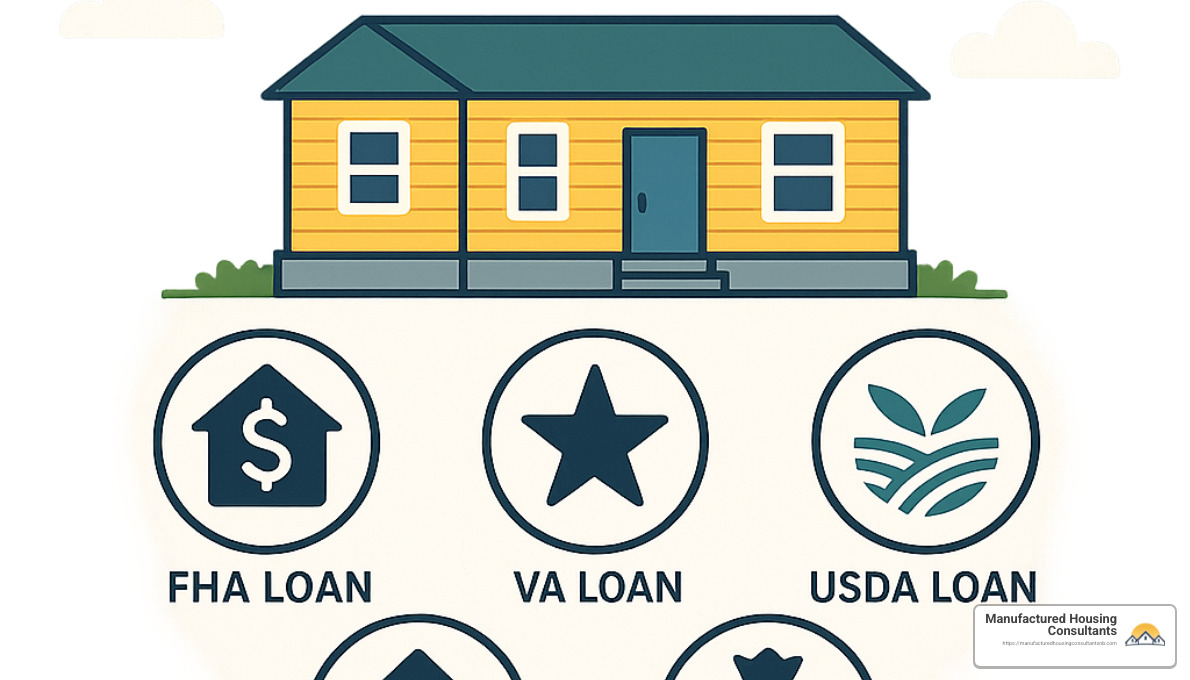

Government-Backed Loans

Government-backed loans are a great option, especially if you’re a first-time homebuyer, have limited savings, or even if some bumps in your credit history are holding you back.

FHA Loans: The Federal Housing Administration (FHA) provides two key loan programs specifically custom to manufactured homes: Title I and Title II loans. These are especially popular because you can qualify with a credit score as low as 580 and put as little as 3.5% down. According to one of our financing specialists, “FHA loans can really open up homeownership to people who might otherwise think it’s out of reach. They’re perfect if you’re getting started or rebuilding your credit.”

VA Loans: Are you a veteran, active-duty service member, or surviving spouse? If so, VA loans can offer some incredible benefits, including up to 100% financing and no private mortgage insurance (PMI). For eligible buyers, this is one of the most affordable ways to own a manufactured home.

USDA Loans: Another excellent choice—especially if you’ve got your heart set on country living—is a USDA loan. Designed for rural and suburban homebuyers, USDA loans offer up to 100% financing with attractive interest rates to households that meet certain income limits.

Conventional Loans

If your manufactured home will be permanently affixed to owned land, a conventional loan could be a great fit. Conventional financing typically has slightly stricter requirements compared to government programs, usually asking for credit scores of 620 or higher and down payments ranging from 5% to 20%. The trade-off? Well-qualified borrowers often enjoy competitive interest rates and flexible loan terms (usually 15 to 30 years).

Chattel Loans

If your new home will sit on leased land or in a manufactured home community, a chattel loan (also known as a personal property loan) is typically the way to go. These loans usually come with slightly higher interest rates—often 1% to 5% more than conventional loans—but they do come with some clear advantages. You’ll typically see lower closing costs, quicker closings, fewer property restrictions, and shorter loan terms (around 15 to 20 years).

Greg & Sylvia Q., recent customers of ours, shared their experience: “Honestly, we weren’t sure what we could qualify for after past credit issues. But the team at Manufactured Housing Consultants helped us find an FHA loan with a down payment way lower than we ever imagined. Now, we’re proud homeowners!”

Key Differences Between Manufactured, Modular, and Mobile Home Loans

When exploring your financing options, understanding the differences between manufactured, modular, and mobile homes can be crucial. Each classification affects the type of loan you can qualify for and the terms you’ll be offered.

Manufactured homes are built entirely in a factory according to HUD Code standards (in place since June 15, 1976). They have a permanent chassis, come with a HUD certification label, and can either be permanently installed on land you own or placed in manufactured home communities. Due to their flexibility, they can be financed either as real property or personal property.

Modular homes are also factory-built, but they’re assembled on-site and must comply with local building codes (just like traditional site-built homes). Because they’re always installed on a permanent foundation, modular homes are typically financed as real property, often resulting in stronger appreciation in value.

Mobile homes specifically refer to those built before the HUD Code (before June 15, 1976). Financing options are usually more limited for older mobile homes, with higher interest rates and stricter property requirements. Mobile homes are typically financed through chattel loans and often depreciate faster than newer manufactured homes.

One of our satisfied customers, Rosie D., summed it up perfectly: “They really took the time to clearly explain the differences between chattel loans and regular home loans, all while meeting my tight schedule. I was thoroughly impressed.”

How your home is classified can significantly impact your available loan programs, terms, and monthly payments:

- Real Property Classification: If your manufactured home is permanently attached to land you own, it’s typically considered real property. This classification opens up traditional mortgage financing with better rates and terms.

- Personal Property Classification: Manufactured homes placed in communities or on leased land are usually considered personal property. This classification typically requires chattel financing, which has higher interest rates but fewer property restrictions.

For more details on choosing the right home and financing options, check out our guide to “buying a manufactured home”.

Eligibility Requirements for Manufactured Home Financing

Before jumping straight into your Manufactured home loan calculator, it’s smart to understand lender eligibility requirements. Knowing this ahead of time helps avoid surprises and smooths your financing journey.

Credit scores play a big role. FHA loans, for instance, start at 580 for the lowest down payments (though you can still qualify with scores from 500-579 by putting 10% down). VA loans have no official minimum, but lenders usually look for a score of at least 620. Conventional loans commonly require scores of 620 or higher, and chattel loan lenders typically want to see scores around 575-600 or more (but some can go lower).

Income and employment stability matter, too. Lenders prefer stable income and employment history (usually two years or more) and typically want your debt-to-income (DTI) ratio below 43%, although some government programs might allow up to 50%.

Property details are also very important for loan eligibility. Your manufactured home must have HUD certification (for homes built after June 15, 1976) and meet minimum square footage and installation standards. For traditional mortgage financing, your home usually needs to be permanently affixed to either owned land or land with a qualifying long-term lease.

Another happy customer, Tomas A., recalls, “I had approval in 24 hours, and my loan officer personally guided me at every step. Seriously, it took just 12 days from finding our dream manufactured home to closing!”

For more information and tips about financing your home, have a look at our articles:

Knowing your financing options and eligibility requirements upfront makes the whole process easier and faster. So, get comfortable, grab a cup of coffee, and start crunching some numbers with our handy Manufactured home loan calculator. You’re on your way to affordable homeownership!

How to Use a Manufactured Home Loan Calculator

A manufactured home loan calculator can feel like having your very own financial crystal ball. Instead of guessing or scratching your head over confusing numbers, you’ll quickly see your potential monthly payments clearly laid out. Let’s walk through exactly how you can use one effectively to make your home-buying journey smooth and stress-free.

Essential Inputs for Your Manufactured Home Loan Calculator

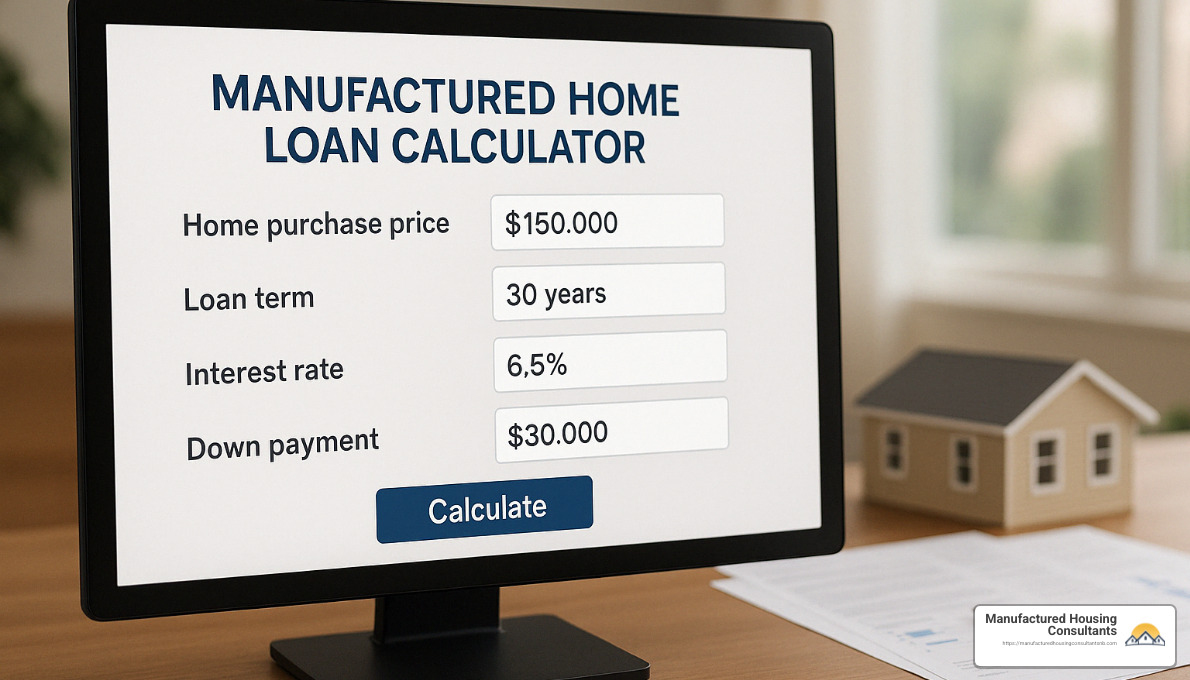

Using your manufactured home loan calculator requires just a few simple pieces of information. Don’t worry—you probably already have most of these handy!

Start by entering the home purchase price. At Manufactured Housing Consultants, we offer a wide variety of homes—from cozy single-wide models starting around $50,000 to spacious double-wides with all the bells and whistles priced at $100,000 or more. Knowing your price range upfront helps set realistic expectations.

Next up, your down payment amount or percentage. Depending on your loan type, this could be as little as 3.5% with an FHA loan, or zero down if you’re eligible for a VA loan. Conventional and chattel loans usually require a down payment between 5-20%. The more you can comfortably pay upfront, the lower your monthly payment will be (your wallet will thank you later!).

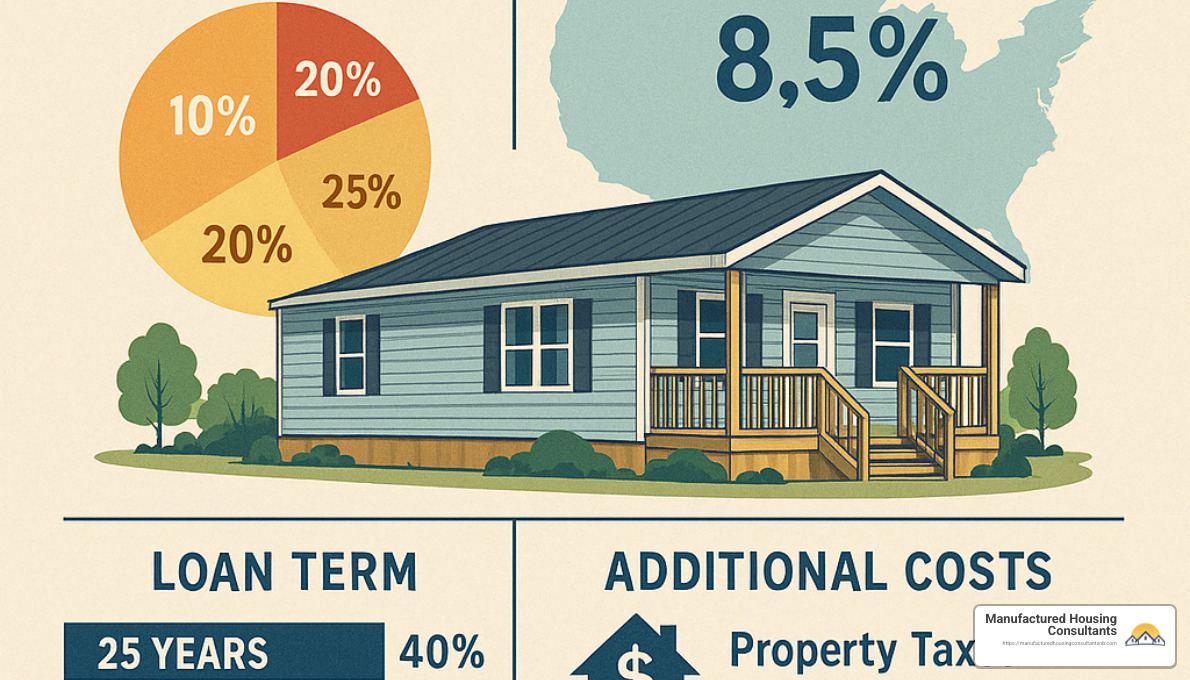

You’ll also need to input your expected interest rate. As of 2025, typical rates for manufactured home loans range from about 5-7% for conventional loans (real property) to around 6-12% for chattel loans (homes on leased land). Your exact rate depends on your credit score, loan term, and down payment, so accurate numbers are key here.

Don’t forget about the loan term. This is simply how long you’ll take to repay your loan—usually 15, 20, or 30 years for conventional or government-backed loans, and typically around 15-20 years for chattel loans. Generally, longer terms mean lower monthly payments, but you’ll pay more in total interest over time.

You’ll also add in annual property taxes. These vary by county in Texas and depend on how your manufactured home is classified (real or personal property). Your calculator will conveniently divide these annual taxes into your monthly payment.

Include your annual homeowner’s insurance cost as well. Manufactured homes usually carry slightly higher premiums compared to site-built homes, due to different risk factors.

Lastly, be sure to factor in any additional costs like Private Mortgage Insurance (PMI) if your down payment is less than 20%, Mortgage Insurance Premium (MIP) for FHA loans, HOA fees if you’re moving into a community, or monthly space rent for leased-land properties.

Plugging in these details accurately ensures the manufactured home loan calculator gives you a realistic snapshot of your financial future.

Interpreting Calculator Results: Beyond the Monthly Payment

Once you’ve entered your info, you’ll get more than just a monthly payment number—the manufactured home loan calculator will reveal a wealth of information to help you make smarter financial decisions.

Your results will first show your monthly principal and interest payment. Principal is the amount you borrowed, and interest is what you pay the lender for borrowing money (think of it as the lender’s thank-you gift!). This figure is your baseline monthly payment.

But that’s just the start—your calculator also adds up property taxes, homeowner’s insurance, and any applicable PMI, MIP, HOA fees, or space rent. This gives you your total monthly payment, the number that you’ll actually pay each month. This helps you avoid surprises later on.

One of the best features is the amortization schedule. It sounds like a scary finance term, but it’s actually pretty friendly. This schedule clearly shows exactly how each monthly payment is split between principal and interest, how much you’ve paid off each month, and how much you still owe. Early on, you’ll notice most of your payment goes toward interest—knowing this upfront lets you plan strategies to pay down your loan faster.

You’ll also see your loan payoff date, the magical day when your loan is completely paid off (cue the celebration!). Plus, you’ll find the total interest paid over the life of your loan. This amount can be eye-opening—did you know a $100,000 loan at 7% interest over 30 years results in around $139,500 just in interest? Ouch! Understanding this can inspire you to consider shorter terms or extra payments.

Finally, many calculators let you explore the impact of extra payments. Even tossing an extra $100 a month toward your loan can save thousands in interest and shave years off your repayment time. Brian R., one of our recent clients, shared how eye-opening this was: “Dealing with them has been the most pleasant experience of any prior loan closings. This refinance offered the best rates, ease of closing, and excellent customer support throughout the entire process.”

Taking a few minutes to use a manufactured home loan calculator helps ensure you’re fully informed and confident about your financing choices. No stress, no surprises—just a clear path toward your new manufactured home!

Maximizing the Value of Your Manufactured Home Loan

You’ve used our handy manufactured home loan calculator to estimate your monthly payments (great job!). Now, let’s talk about ways you can get even more value from your loan and keep more money in your pocket. After all, buying a manufactured home should feel empowering—not overwhelming!

Strategies to Lower Your Monthly Payments

One of the easiest ways to lower your monthly payments is to make a bigger down payment. While it might feel tough to part with more cash upfront, paying more initially reduces your loan amount and can significantly trim your monthly payment. Plus, if you put down at least 20% on a conventional loan, you’ll avoid paying PMI (private mortgage insurance)—a nice bonus!

Another powerful strategy is to improve your credit score before applying for your loan. Even small moves—like paying down high-interest credit cards, making every payment on time, and correcting errors on your credit report—can boost your credit score. Raising your score just a bit (say, from 660 to 700) can lower your interest rate by half a percent or more, saving you thousands over the life of your loan. Not too shabby, right?

Speaking of interest rates, here’s a pro tip: shop around for the best rates! At Manufactured Housing Consultants, we work closely with multiple lenders to help you find the most competitive options. Rates can vary widely, so exploring your options can really pay off.

You might also want to consider shortening your loan term. Choosing a 15-year loan instead of a 30-year loan means higher payments each month, but you’ll save a ton of money in interest and own your home outright twice as fast. If your budget allows, it’s a win-win!

Another little-known secret is to buy down your interest rate. By paying “discount points” at closing, you lower your interest rate for the duration of your loan. This strategy makes sense if you plan to keep your manufactured home for a long time.

Once you’ve settled comfortably into your home, stay alert for opportunities to refinance. If interest rates drop significantly after you purchase, refinancing could lower your monthly payments and save you money long-term. Our client Brian R. recently refinanced his manufactured home, and he shared, “This refinance offered the best rates, ease of closing, and excellent customer support throughout the entire process.”

Lastly, consider making bi-weekly payments (half your monthly payment every two weeks). This simple trick adds up to one extra payment per year, helping you pay off your loan faster and trimming down total interest payments significantly.

Additional Costs to Consider When Financing a Manufactured Home

Your monthly payments aren’t the whole story, though. There are some additional costs you’ll want to factor into your home-buying budget—especially if you’re buying your first manufactured home.

Let’s start with upfront expenses. Apart from your down payment, you’ll have closing costs (usually 2-5% of your loan amount) covering things like loan origination fees, appraisal, title insurance, and recording fees.

If you’re placing your home on your own land, you’ll also face land preparation expenses. This typically includes site clearing, constructing a home foundation, installing driveways, and setting up septic, water, or utility connections. And in Texas, remember—homes wider than 16 feet require a “home pad” to ensure proper drainage (trust us, you don’t want to skip this step!).

Transportation costs for home delivery, crane services (if needed), home setup, and utility connections are other one-time expenses you’ll want to keep in mind.

Once you’re moved in, ongoing costs become part of your monthly budget too. Property taxes vary based on your home’s value and county location, so be sure to budget accordingly. It’s also wise to set aside money for your homeowner’s insurance, which tends to be a bit pricier for manufactured homes compared to site-built houses due to different risk factors.

Are you planning to live in a manufactured home community? In that case, monthly lot rent or homeowner’s association (HOA) fees will also apply. Texas lot rent usually ranges between $300 and $700 monthly, potentially bundled with some utilities.

Routine maintenance and repairs are a reality for every homeowner—manufactured homes included. It’s smart to build a small emergency fund to cover things like roof maintenance, HVAC servicing, plumbing work, and skirting repairs.

Don’t overlook your monthly utility bills for electricity, water, sewer, gas, internet, and cable, either.

Finally, it’s worth mentioning that manufactured homes may depreciate if they’re classified as personal property (rather than real property) or located in certain communities. Keeping your home well-maintained can help retain its value over time.

By thinking about all these additional costs upfront, you’ll feel confident in your budget and ready to enjoy your beautiful new manufactured home without financial stress.

At Manufactured Housing Consultants, our team cares deeply about helping you make informed financial choices. We want you to love your home—and feel great about your loan! A bit of wise planning now can lead to big savings and peace of mind down the road.

Conclusion

A manufactured home loan calculator is more than a quick way to estimate your monthly housing payments. It’s your personal guide to making smart, confident decisions about your manufactured home investment. By clearly showing you how different factors—like loan terms, interest rates, and down payments—impact your monthly budget, this tool helps you strike the perfect balance between affordability and getting the home you’ve always dreamed about.

At Manufactured Housing Consultants, we believe everyone deserves affordable, quality housing. That’s why we’ve dedicated ourselves to helping families in New Braunfels and throughout Texas steer the home buying and financing process from start to finish.

We’re more than just a dealership—we’re a friendly team that’s here to support you every step of the way. From selecting the perfect manufactured home out of our wide selection from 11 top manufacturers, to securing the best possible financing options available, we ensure your journey to homeownership is smooth, simple, and enjoyable.

As we’ve covered, your loan options might include FHA, VA, USDA, conventional, or chattel loans, each designed to serve different buyer needs and circumstances. Using a manufactured home loan calculator with accurate, reliable figures helps you clearly understand your monthly costs so you can confidently choose the best financing option for your budget.

Beyond your monthly payments, it’s crucial to remember to factor in all the associated costs—like taxes, insurance, land preparation, and ongoing maintenance—to paint a complete financial picture. Our experienced team can help you anticipate these extra expenses, ensuring you avoid any surprises down the road.

To get the most out of your manufactured home loan, consider strategies that can significantly lower your monthly payments. Simple steps like improving your credit score, increasing your down payment, shopping around for lower interest rates, or even opting for a shorter loan term can all help save you thousands over the life of your loan. And don’t forget, refinancing when rates drop or making extra payments can bring even more savings to your wallet.

When it comes to manufactured home financing, expert guidance can make a world of difference. Our knowledgeable team at Manufactured Housing Consultants understands all the nuances—from eligibility requirements to property classifications—and we specialize in helping you secure the right financing at the lowest rates possible.

Just ask Tomas A., one of our happy customers: “From taking a Sunday drive in the Texas country and finding a brand-new manufactured home to closing took just 12 DAYS! That is entirely thanks to the expertise, transparency, and personal attention we received throughout the process.”

Ready to make your own dream home a reality? At Manufactured Housing Consultants in New Braunfels, Texas, we guarantee the lowest prices on quality manufactured homes from the best manufacturers around. Our welcoming team is eager to help you crunch the numbers, find a home that fits your lifestyle, and get you financed quickly and comfortably.

Whether you’re buying your first home, upgrading your family’s living space, or downsizing for retirement, choosing a manufactured home can be an affordable and rewarding experience. With the right financing and thoughtful planning, affordable homeownership is closer than ever.

Use our manufactured home loan calculator today to start planning your path forward. And when you’re ready to turn your calculations into reality, contact our team—we can’t wait to welcome you home!