Financing Your Dream: Manufactured Home Loans in Texas

Explore manufactured home loans Texas options. Learn about chattel vs. real property, requirements, rates, and find your dream home.

Your Guide to Getting Started

Manufactured home loans texas provide several financing paths for affordable homeownership. Whether you need a chattel loan, real property financing, or a specialized program, Texas has options for various credit profiles and budgets.

Quick Comparison: Your Main Financing Options

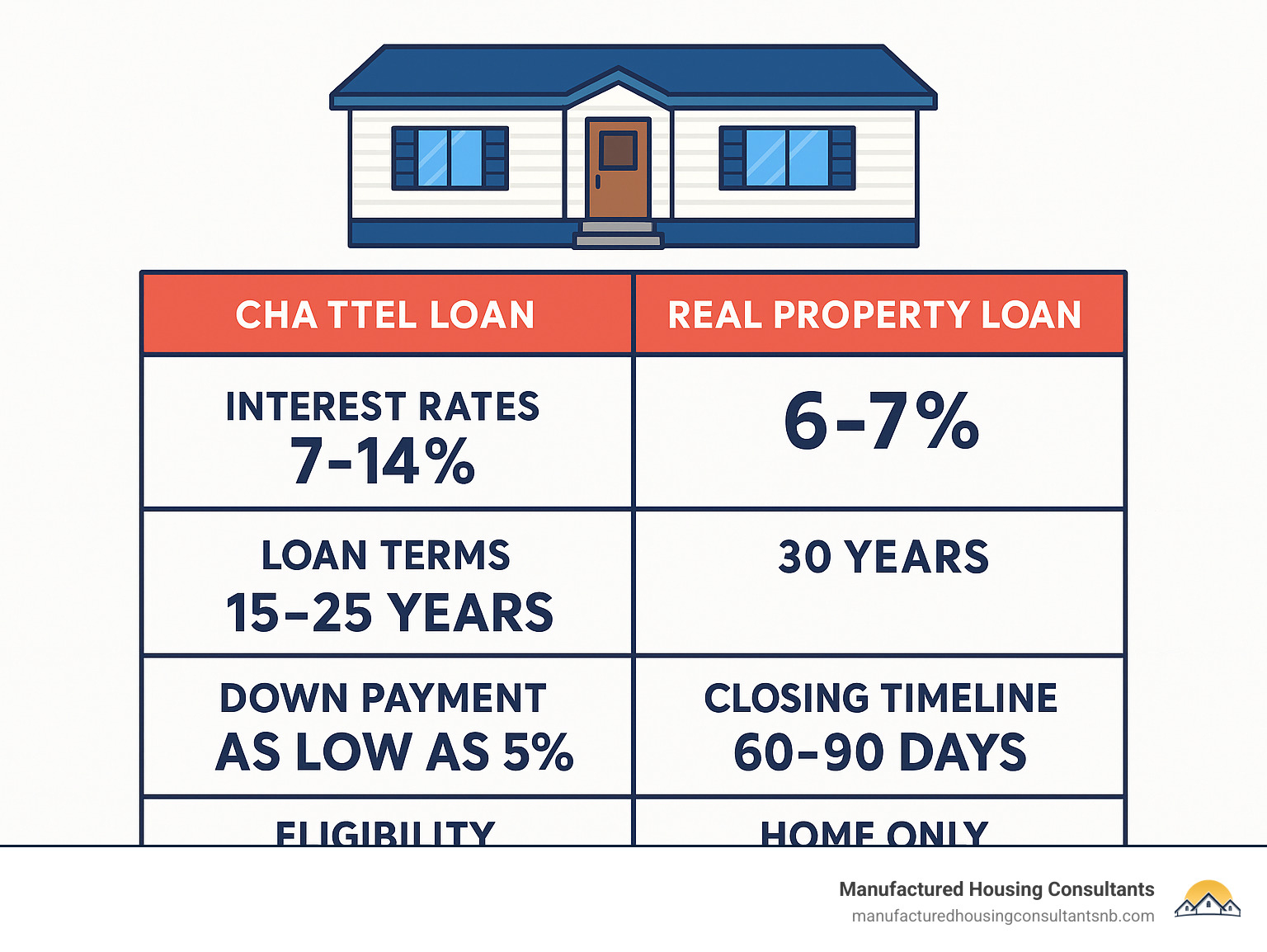

- Chattel Loans: 7-14% rates, 15-25 year terms, faster approval (30 days), home-only financing

- Real Property Loans: Lower rates (6-7%), 30-year terms, slower approval (60-90 days), includes land

- FHA/VA Programs: 3.5% down payment, government backing, permanent foundation required

- In-House Financing: Flexible credit requirements, dealer-arranged, varies by manufacturer

Manufactured homes are a popular path to homeownership in Texas, with strong demand for affordable housing. Modern homes built after 1976 meet strict HUD standards, allowing them to qualify for traditional mortgages when titled as real estate. However, about 42% of loans used for manufactured homes are chattel loans, which treat the home as personal property.

Your choice depends on land ownership, credit, and desired closing speed. Chattel loans close faster (around 30 days) but often have higher interest rates than traditional mortgages, which can take up to 90 days. Understanding these differences is key to making an informed decision.

Manufactured home loans texas terms you need:

Comparing Your Manufactured Home Loans Texas Options

Navigating manufactured home loans texas means choosing between financing your home as “real property” or as “chattel.” This fundamental choice significantly impacts your loan terms, interest rates, and the long-term value of your investment.

Real Property vs. Chattel Loans: The Fundamental Choice

Real property financing treats your manufactured home like a traditional site-built home. It requires the home to be permanently affixed to land you own and titled as real estate. This process involves placing the home on a permanent foundation and merging the home’s title with the land’s deed. As real property, your home can qualify for traditional mortgages, which typically offer lower interest rates and longer terms (up to 30 years), allowing you to build equity in both the home and land.

Chattel financing treats the home as personal property, similar to a vehicle. This loan is ideal if you plan to place your home on leased land, as it finances the home separately. While chattel loans offer flexibility, they usually have higher interest rates and shorter terms than real property mortgages.

A Deep Dive into Chattel Loans

A chattel loan is a personal property loan that finances the home itself as a movable asset. It’s a popular option, making up about 42% of loans used for manufactured homes. This type of loan is ideal if you don’t own the land where the home will be placed.

Pros of Chattel Loans:

- Faster Closing: Typically close in about 30 days, much faster than the 90 days common for real property mortgages.

- Lower Fees: Processing fees can be significantly lower than traditional mortgage fees.

- Flexibility: The best option for homes on leased land or in manufactured home communities.

Cons of Chattel Loans:

- Higher Interest Rates: Rates are often 0.5% to 5% higher than traditional mortgages.

- Shorter Loan Terms: Terms are usually 15 to 25 years, leading to higher monthly payments.

- Faster Repossession: The repossession process is quicker than a traditional mortgage foreclosure if payments are missed.

Exploring Manufactured Home Loan Programs

A variety of manufactured home loan programs are available in Texas to meet diverse buyer needs. Many dealers offer in-house financing or work with specialized lenders, providing flexible options for those with imperfect credit. Low down payment options are available, with requirements typically ranging from 5% to 35%. Your down payment depends on credit, home type, and whether it’s a primary residence or an investment property (which usually requires at least 20% down).

Lenders often finance both new and used homes. All manufactured homes built after June 15, 1976, must meet federal HUD Code safety standards. In Texas, the Texas Department of Housing and Community Affairs (TDHCA) oversees the industry to ensure compliance and protect consumers.

Understanding Loan Requirements for Manufactured Home Loans in Texas

To qualify for manufactured home loans texas, lenders generally review the following criteria:

- Credit Score: Requirements vary. Chattel loans may start at a 575 score, while traditional mortgages often require 620 or higher. A higher score typically leads to better rates.

- Debt-to-Income (DTI) Ratio: Lenders check your DTI to ensure you can afford the loan. For chattel loans, a DTI of 50% or less is often required.

- Down Payment: This can range from 0% for some government-backed loans to 35% or more, depending on your credit. Down payments can come from cash, trade-ins, or land equity.

To streamline your application, gather these documents:

- Recent pay stubs (last 30 days)

- W-2s (past two years)

- Tax returns (past two years)

- Bank statements (past 2-3 months)

- A valid, government-issued photo ID

- Proof of residency (e.g., utility bill)

Financing Both the Home and Land

Yes, you can finance both a manufactured home and the land together in a single transaction. This is typically done with a real property loan, where the home and land are treated as a single piece of real estate.

Land and home packages are financed with traditional mortgage products, often resulting in better rates and terms. For new homes, construction-to-permanent loans can cover the cost of the land, home, transport, and setup in one loan. This simplifies the process into a single closing.

Key requirements for financing both the home and land include:

- Land Ownership: You must own the land with a clear title.

- Zoning: The land must be zoned for manufactured homes.

- Utilities: The site needs access to essential utilities.

- Foundation: The home must be installed on an approved, permanent foundation.

Typical Rates, Terms, and Timelines for Manufactured Home Loans in Texas

Understanding the typical rates, terms, and timelines for manufactured home loans texas is key. Here’s a comparison between the two main loan types:

Chattel Loans (Home as Personal Property):

- Interest Rates: Higher, typically 7% to 14%.

- Loan Terms: Shorter, usually 15 to 25 years.

- Closing Timeline: Faster, often closing in about 30 days.

Real Property Loans (Home + Land as Real Estate):

- Interest Rates: Lower, often comparable to traditional mortgages.

- Loan Terms: Longer, typically 30 years.

- Closing Timeline: Slower, taking around 90 days due to appraisals and title work.

Choosing the right loan depends on your financial situation, whether you own land, and your desired timeline. Weighing these factors will help you select the best option for your budget.

Ready to Find Your Texas Dream Home?

Now that you understand the landscape of manufactured home loans texas, you have a roadmap to make smart decisions. Whether you choose the speed of a chattel loan or the long-term stability of real property financing, the right option depends on your credit, land ownership status, and timeline.

Your home buying journey doesn’t have to be overwhelming. With the right guidance, you can steer the process of choosing a loan type, down payment, and timeline with confidence.

At Manufactured Housing Consultants, we provide expert guidance every step of the way. We help you understand your financing options and find the perfect home to fit your lifestyle and budget. With our guaranteed lowest prices, a wide selection from 11 top manufacturers, and available land improvement services, we make homeownership affordable and achievable.

Today’s manufactured homes are energy-efficient, customizable, and built to last, offering an excellent alternative to site-built homes. Combined with the diverse financing options in Texas, your dream of homeownership is closer than ever.

Ready to take the next step? Explore our available homes in New Braunfels and let us help turn your dream into a new address!