Step-by-Step Guide to Manufactured Home Mortgages

Discover financing options and requirements for a manufactured home mortgage. Learn about FHA loans, credit scores, and lender challenges.

Manufactured home mortgage options can provide a more affordable pathway to homeownership, especially when traditional housing markets seem out of reach. Manufactured homes are gaining popularity due to their cost-effectiveness, especially given the rising median sales price of traditional homes, which reached $406,100 in November 2024 according to the National Association of REALTORS®. In contrast, the average price for a manufactured home stood at $124,300 in 2023.

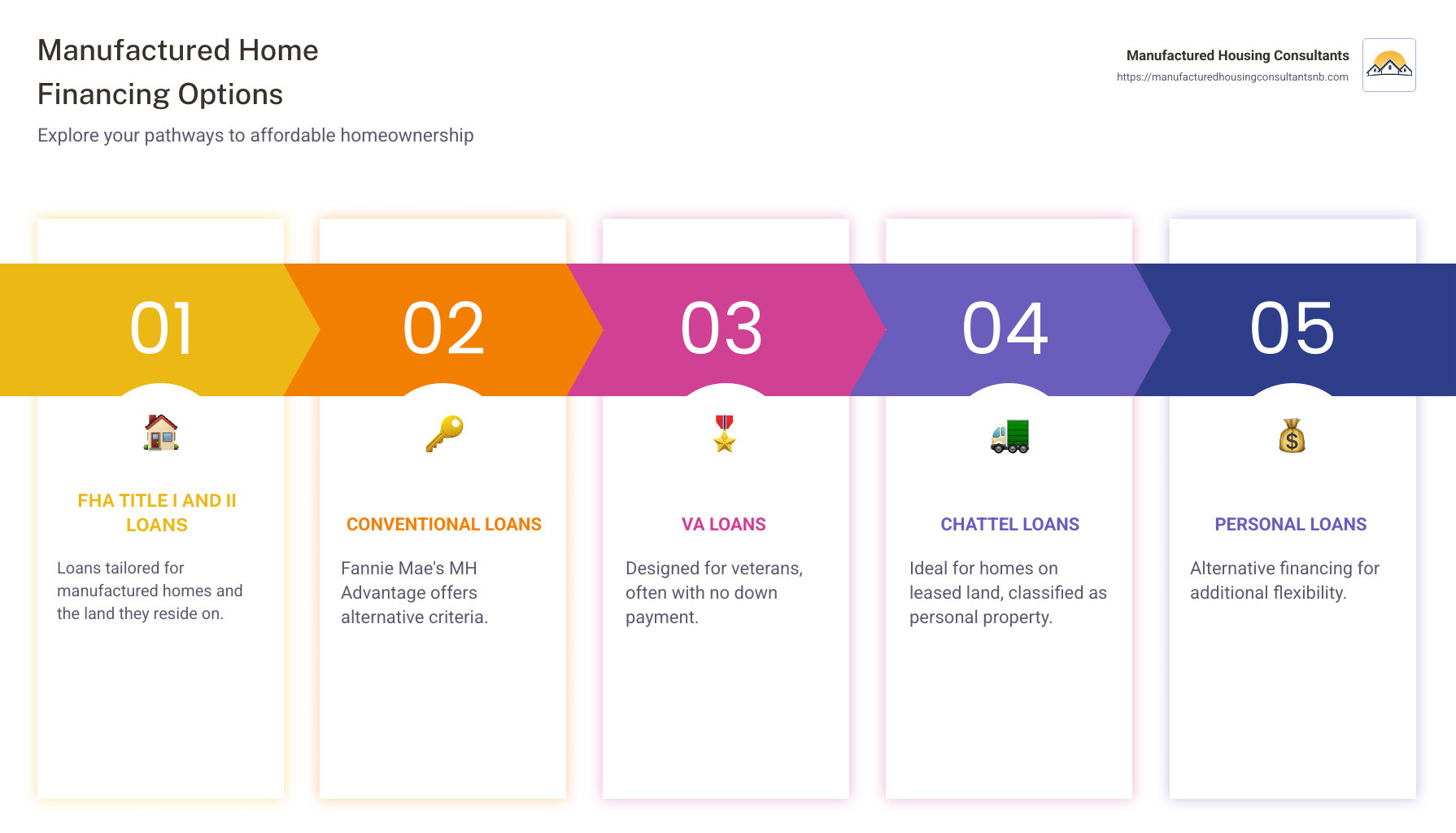

Here’s a quick snapshot of what you need to know about financing options for manufactured homes:

- FHA Title I and II Loans: Designed specifically for buyers of manufactured homes and/or the land upon which they sit.

- Conventional Loans: Such as Fannie Mae’s MH Advantage, offering pathways with different criteria.

- VA Loans: Available for veterans and their families, often with no down payment required.

- Chattel Loans: Ideal for homes classified as personal property, often used when the land is leased.

Manufactured homes can be a lifesaver for budget-conscious buyers like Sarah, who is navigating the high costs and credit challenges of traditional housing. These homes offer flexible styles and financing solutions to meet her needs. More people are considering these options as an attainable solution for affordable living.

Understanding Manufactured Home Mortgages

When it comes to financing a manufactured home, there are several loan options available, each with its own set of requirements and benefits. Let’s explore these options to help you understand which might be the best fit for you.

Types of Loans for Manufactured Homes

FHA Title I and Title II Loans

These loans are backed by the Federal Housing Administration (FHA) and cater to different needs. Title I loans are for purchasing a manufactured home and/or the land it sits on, while Title II loans are more like traditional mortgages and require the home to be on a permanent foundation. Both options can provide more accessible financing for those who meet FHA eligibility standards.

VA Loans

For veterans and their families, VA loans offer a fantastic opportunity. These loans often require no down payment and come with favorable terms. They can be used to purchase manufactured homes, making homeownership more attainable for those who have served in the military.

Chattel Loans

Chattel loans are specifically designed for movable personal property. If you plan to place your manufactured home on leased land, this might be the right choice for you. While they often come with higher interest rates, chattel loans are easier to qualify for than traditional mortgages.

Personal Loans

Depending on the cost of the home, a personal loan might cover the purchase. However, these loans typically have higher interest rates and lower borrowing limits, which might not be sufficient for more expensive manufactured homes.

Challenges in Securing a Manufactured Home Mortgage

While there are multiple financing options, securing a manufactured home mortgage can still present challenges.

Depreciation

Manufactured homes often depreciate in value over time, unlike traditional homes that typically appreciate. This can make lenders hesitant to offer loans, as they may see it as a higher risk.

Land Ownership

One significant factor is whether you own the land where the home will be placed. Owning the land can make the home qualify as real property, which might make it easier to obtain financing. Conversely, if the home is on leased land, options like chattel loans become necessary.

Lender Security and Credit Requirements

Lenders often have stricter credit requirements for manufactured home loans compared to traditional mortgages. A good credit score can improve your chances of securing a loan with favorable terms. However, many potential buyers face problems due to credit history issues, leading to a higher loan denial rate for manufactured homes compared to site-built homes.

Loan Terms

Manufactured home loans may come with shorter terms and higher interest rates, especially for chattel loans. This can lead to higher monthly payments, which might not be ideal for everyone.

Understanding these challenges and options can help you better steer the path to owning a manufactured home. In the next section, we’ll explore the specific financing options and requirements in more detail.

Financing Options and Requirements

When financing a manufactured home, understanding the various loan options and their requirements is crucial. Let’s break down the key components and choices available to you.

FHA and Government-Backed Loans

Loan-to-Value (LTV) and Down Payment

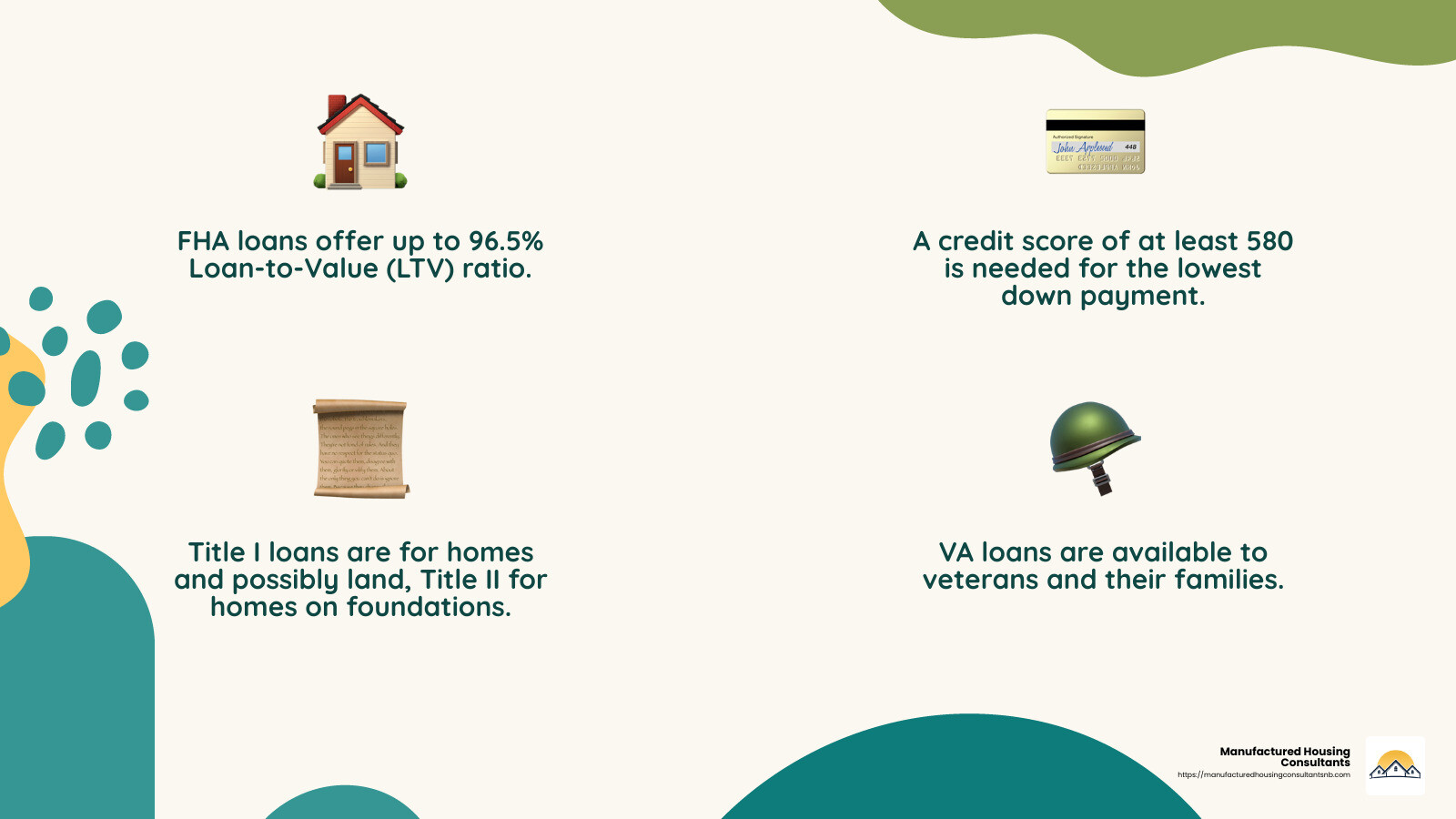

The Loan-to-Value ratio is a critical factor in determining how much you can borrow compared to the home’s value. For FHA loans, the maximum LTV can be up to 96.5%, meaning you’ll need a minimum down payment of 3.5%. This makes FHA loans an attractive option for those with limited upfront cash.

Credit Score and Loan Limits

To qualify for an FHA loan, a credit score of at least 580 is needed for the lowest down payment. If your score is between 500 and 579, a 10% down payment is required. FHA loans have specific loan limits that vary by location, so check the limits in your area.

FHA Title I and Title II Loans

Title I loans are designed for purchasing a manufactured home and possibly the land, while Title II loans are for homes on permanent foundations. Both types offer accessible financing options for eligible borrowers.

VA and USDA Loans

VA loans, available to veterans and their families, offer no down payment and favorable terms, making them an excellent option for eligible borrowers. USDA loans, designed for rural areas, can also finance manufactured homes with attractive terms, provided the home meets specific requirements.

Conventional and Alternative Financing

Fannie Mae MH Advantage and Freddie Mac CHOICEHome

These programs offer conventional loan options for manufactured homes that meet specific criteria, such as features similar to site-built homes. They require a minimum down payment of 3% to 5% and offer competitive interest rates. These loans are ideal for borrowers with higher credit scores and those looking for terms similar to traditional mortgages.

Chattel Loans

For homes placed on leased land, chattel loans are an option. These loans treat the home as personal property, which can lead to higher interest rates but are typically easier to qualify for. They are a practical solution for those not purchasing the land with the home.

Alternative Financing Options

In some cases, personal loans or other alternative financing methods may be suitable, especially if the manufactured home’s cost is lower. However, these options often come with higher interest rates and stricter borrowing limits.

Navigating manufactured home mortgages can seem daunting, but understanding your options and their requirements can help you make an informed decision. In the next section, we’ll dig deeper into the specific loan programs and their benefits.

Conclusion

At Manufactured Housing Consultants, we understand that the journey to homeownership can be daunting, especially when navigating the complexities of financing a manufactured home. Our mission is to make this process as seamless as possible while providing affordable housing solutions custom to your needs.

Affordable Housing and Financing Solutions

Manufactured homes offer a cost-effective entry into homeownership, especially when traditional housing prices continue to rise. According to the U.S. Census Bureau, the average price of a manufactured home was $124,300 in 2023, significantly lower than the median sales price of a site-built home. This affordability makes manufactured homes an attractive option for many.

Expert Guidance and Personalized Service

Our team at Manufactured Housing Consultants is here to guide you every step of the way. We offer a wide range of financing options, including FHA loans, VA loans, and conventional loans like Fannie Mae’s MH Advantage. These options can be customized to fit your financial situation, whether you’re a first-time buyer or looking for a cost-effective housing alternative.

Comprehensive Support

We don’t just help you find your dream manufactured home; we also assist with financing and land improvement services. Our commitment to providing the lowest prices and a diverse selection ensures that you get the best value for your investment.

Your Path to Homeownership

By choosing Manufactured Housing Consultants, you’re not just buying a home; you’re investing in a future of stability and comfort. Our focus on affordability, expert advice, and comprehensive services makes us the ideal partner in your homeownership journey.

Ready to explore your options? Find how we can help make your dream of owning a manufactured home a reality. Learn more about our financing solutions and take the first step towards affordable homeownership with us today.