The Repossession Rundown: Your Guide to Manufactured Home Foreclosures

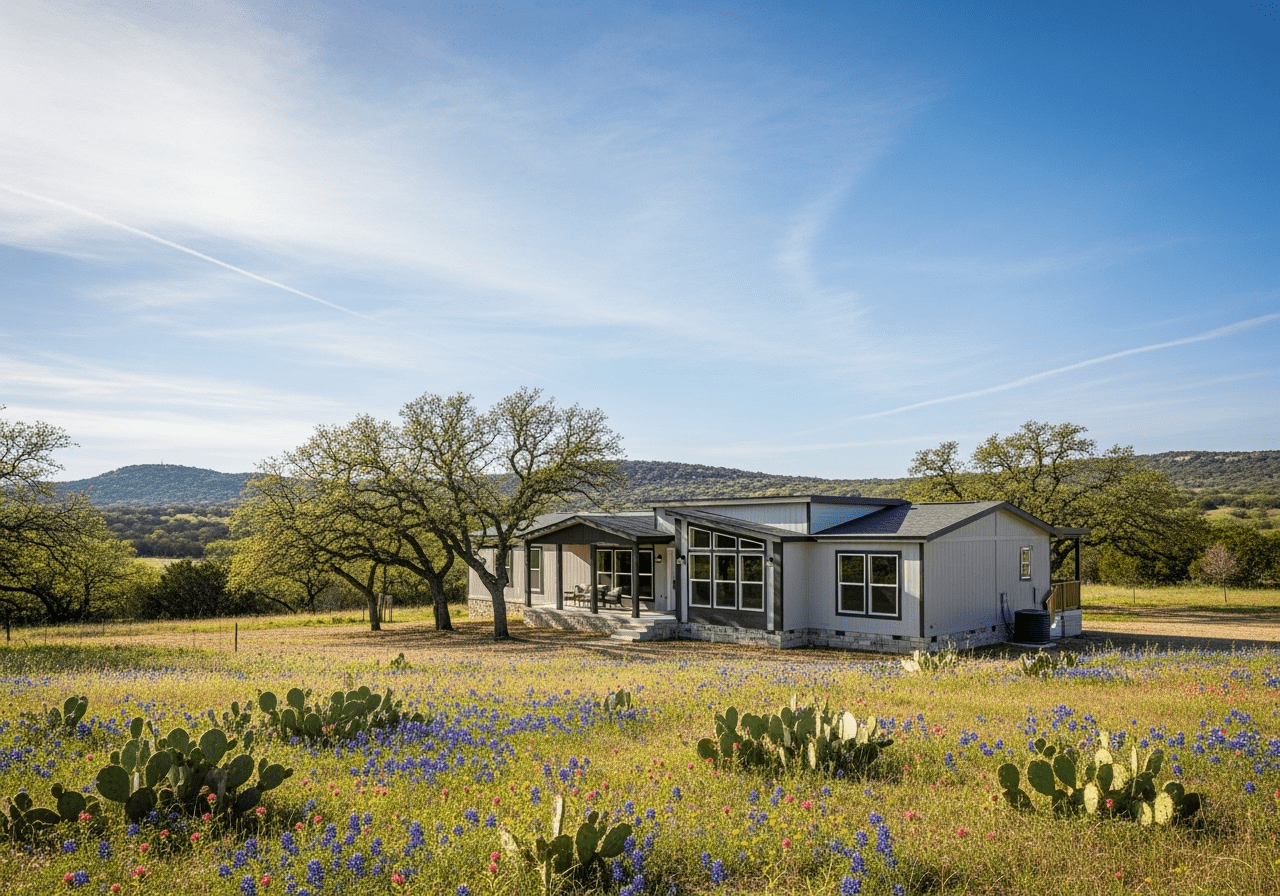

Find affordable manufactured homes repossessed in Texas. Learn to buy, finance, or avoid foreclosure with our expert guide.

Understanding Repossessed Manufactured Homes: Your Fast Facts

Manufactured homes repossessed are properties that lenders have taken back after homeowners defaulted on their loan payments. For those seeking affordable housing in Texas, they offer a significant opportunity, but it’s crucial to understand the unique risks and rewards before buying.

Here’s what you need to know right now:

- What they are: Homes reclaimed by banks or lenders after payment default.

- Pricing: Typically sold 20-40% below market value, often in the $10,000-$50,000 range.

- Condition: Usually sold “as-is,” with potential for hidden damage or deferred maintenance.

- Availability: Found through specialized dealers like Manufactured Housing Consultants, bank REO departments, and foreclosure auctions.

- Legal status: Can be personal property (repossession) or real property (foreclosure).

- Financing: May require specialized lenders, chattel loans, or FHA Title I loans.

When a homeowner in Texas falls behind on payments, the lender has the right to take the home back. Banks aren’t in the housing business—they want to recover their losses quickly. That’s why these homes hit the market at steep discounts.

However, while you can save thousands, you inherit the home’s condition. Financially struggling owners often defer maintenance, leading to potential issues like foundation work (needed in ~30% of homes) or costly water damage repairs that can exceed $15,000.

At Manufactured Housing Consultants in New Braunfels, we help Texas families steer the repo home market. We understand the local regulations, financing, and inspection requirements unique to these properties.

All modern manufactured homes are built to federal HUD Code standards (post-1976), ensuring a baseline of construction and safety. However, a repossessed home will likely need work to return to its original condition.

A Buyer’s Guide to Manufactured Homes Repossessed

Buying a repossessed manufactured home can be a smart move, opening doors to homeownership that might otherwise be locked. At Manufactured Housing Consultants, we’ve walked hundreds of Texas families through this process, and we know both the opportunities and the obstacles.

The Pros and Cons of Buying Manufactured Homes Repossessed

Before you fall in love with a low price tag, it’s important to understand what buying manufactured homes repossessed really means.

| Advantages of Buying Repossessed Manufactured Homes | Disadvantages of Buying Repossessed Manufactured Homes |

|---|---|

| Significant Cost Savings: Typically sold 20-40% below market value, often in the $10,000 to $50,000 range, making homeownership more accessible. | “As-Is” Condition: The buyer assumes all responsibility for repairs. Previous owners may have neglected maintenance. |

| Investment Potential: Renovating a discounted home for resale or rental can yield substantial returns, with some investors seeing 8-12% annually. | Potential for Hidden Damage: Lack of maintenance can lead to serious issues like water damage (repairs can exceed $15,000) or faulty wiring. |

| Immediate Equity: The deep discount means you could have equity from day one. | Limited Financing Options: Traditional lenders may be hesitant. You might face higher interest rates or need a larger down payment. |

| Negotiation Flexibility: Lenders are motivated to sell quickly and are less emotionally attached than private sellers, creating room for negotiation. | Legal and Title Issues: There’s a risk of lingering liens or title discrepancies, making thorough legal checks essential. |

The savings are substantial, but “as-is” is a serious warning. Deferred maintenance can lead to costly surprises. Be aware of common issues like water damage, faulty electrical systems (a fire hazard), and foundation problems, which affect about 30% of manufactured homes in Texas. With a smart purchase and repairs, you can still come out far ahead financially.

Ready to see what’s available? Check out our current inventory of bank repossessed manufactured homes.

The Hunt: How to Find and Inspect Manufactured Homes Repossessed in Texas

Finding a quality repossessed home requires knowing where to look and how to inspect it properly.

Where to Find Deals: Most manufactured homes repossessed aren’t on major real estate sites. Banks work with specialized dealers like us at Manufactured Housing Consultants. Our direct relationships with lenders give our clients access to exclusive inventory. While auctions are an option, they are risky and often require cash and little inspection time. Our team provides professional guidance to help you avoid money pits.

The Can’t-Skip Inspection: A professional inspection is your best defense against costly surprises. For around $400, an inspector specializing in manufactured homes will check these critical areas:

- Foundation and Anchoring: Check for levelness, solid piers, and proper anchoring to Texas standards.

- Roof and Water Damage: Inspect the roof for leaks and floors for soft spots. Water is the biggest threat to a manufactured home.

- Electrical Systems: Test outlets and the breaker box. Faulty wiring is a major fire risk.

- Plumbing: Look for leaks, corrosion, and check water pressure.

- HVAC Systems: Verify heating and cooling work. Replacement can cost $3,000-$7,000.

- HUD Data Plate and Certification Label: These are non-negotiable for financing and prove the home meets federal safety standards.

Home-Only vs. Land Packages: You can buy just the structure or a package with land. Home-only purchases require you to have your own land or a space in a community. Budget for transport ($3,000-$10,000) and a complete setup ($7,000-$47,000), which includes foundation, utilities, and skirting. Homes with land are often a better long-term investment as you build equity in the land and avoid lot rent. Our repo mobile homes land complete guide has more details.

Texas Regulations: The Texas Department of Housing and Community Affairs (TDHCA) has specific rules for titling and installation. You can review the Texas manufactured housing regulations online, but working with our experienced team ensures your purchase complies with all state laws.

The Purchase: Financing and Legal Steps for a Repo Home

Financing a repossessed manufactured home is different from a regular mortgage, but options are available.

Your Financing Toolkit: At Manufactured Housing Consultants, we connect our clients with lenders who understand manufactured housing.

- Chattel Loans: These treat the home as personal property. They are often easier to qualify for, with 15-20 year terms and down payments of 5-20%.

- FHA Title I Loans: Government-backed loans that may offer better terms and can cover the home and site improvements.

- Specialized Lenders: Our partners are more flexible about a home’s “as-is” condition and understand the value of a discounted property.

- Cash Purchases: Offer maximum negotiating power and a faster closing.

Lenders we work with can consider credit scores as low as 550, though 600+ is preferred. Our repo mobile homes for sale first time buyer guide has more info.

The Paperwork: Getting the legal documentation right is critical. We guide our clients through:

- Certificate of Title: Proof of ownership for homes as personal property. It must be clear of all liens.

- Lien Releases: Official documents proving all previous debts are settled.

- Bill of Sale: Formalizes the transfer and details what’s included in the sale.

- Affidavit of Affixation: A legal document filed to convert the home to real property when it’s permanently attached to land.

When you’re ready, check our repo manufactured homes Texas listings to see current opportunities.

An Owner’s Guide: Navigating Repossession and Foreclosure in Texas

If you’re a manufactured home owner in Texas who’s fallen behind on payments, you’re not alone. Understanding the process and your options can help you steer this difficult time.

Repossession vs. Foreclosure: Understanding the Legal Differences

The legal process your lender follows depends on how your home is classified.

When Your Home is Personal Property:

If your home is titled as personal property (like a vehicle), defaulting on the loan leads to repossession. In Texas, this is a judicial process called “replevin,” where the lender must get a court order to take an occupied home. This process is governed by the Uniform Commercial Code.

When Your Home Becomes Real Property:

If your home is on a permanent foundation on land you own and has been legally converted to real property (with a deed), defaulting leads to foreclosure. This is the same legal process used for a traditional site-built house. To convert a home to real property, you must permanently affix it to a foundation, remove the wheels and axles, and file an Affidavit of Affixation with the county after surrendering the title to the TDHCA.

This distinction is critical, as the timeline and your rights differ significantly. For more details, you can review resources from Nolo and Justia.

How to Avoid Losing Your Home: Options for Texas Homeowners

The earlier you act, the more options you’ll have. Lenders prefer to find a solution rather than repossess a home.

Your Rights and Options:

As a homeowner, you have the right to be notified of the default and a period (typically 10-30 days in Texas) to cure the default by catching up on payments. You can also contest the action in court. Most lenders offer loss mitigation programs to help you avoid losing your home:

- Forbearance Agreement: Temporarily pause or reduce your payments to get through a short-term crisis.

- Repayment Plan: Spread the past-due amount over several months on top of your regular payment.

- Loan Modification: Permanently change your loan terms (e.g., lower interest rate, longer term) to make your monthly payment more affordable.

- Short Sale: Sell the home for less than you owe, with the lender’s approval, to avoid foreclosure.

- Deed in Lieu of Foreclosure: Voluntarily give the home back to the lender to satisfy the debt and avoid a public foreclosure record.

The Critical Step: Communication

We can’t stress this enough: do not ignore letters or calls from your lender. Explain your situation and ask about their hardship programs. If you need help, a HUD-approved housing counselor can offer free, confidential advice and even negotiate on your behalf.

Conclusion: Your Path to an Affordable Texas Home

Whether you’re a buyer or a current owner, understanding manufactured homes repossessed creates solutions.

For buyers, these homes are a path to affordable homeownership, with prices often 20-40% below market. Due diligence, including professional inspections, is key. For owners facing hardship, options like forbearance and loan modification exist, but you must communicate with your lender early.

A repossession can impact credit for seven years, but it is possible to rebuild and buy again. Many of our clients have successfully recovered and purchased homes within a few years.

At Manufactured Housing Consultants, our New Braunfels team offers honest guidance and local Texas expertise. We help buyers steer financing and find opportunities in our exclusive inventory, including those in our Repo Mobile Homes Land Complete Guide. We work with all credit levels and have access to specialized lenders who can help you secure financing.

Our selection of Bank Repossessed Manufactured Homes and Repo Manufactured Homes Texas listings gives you access to opportunities you won’t find anywhere else.

Ready to explore your options? Browse our available repossessed mobile homes today, or reach out to our team for a conversation about your specific situation.