7 Practical Ways to Finance a Mobile Home with Bad Credit

Finance a mobile home with bad credit in Texas! Explore 7 practical ways, including government loans & alternative options. Get approved today.

Why Bad Credit Doesn’t Have to Stop Your Texas Homeownership Dreams

Finding a mobile home with bad credit might feel impossible, but thousands of Texans successfully secure financing every year despite credit challenges. The key is knowing your options.

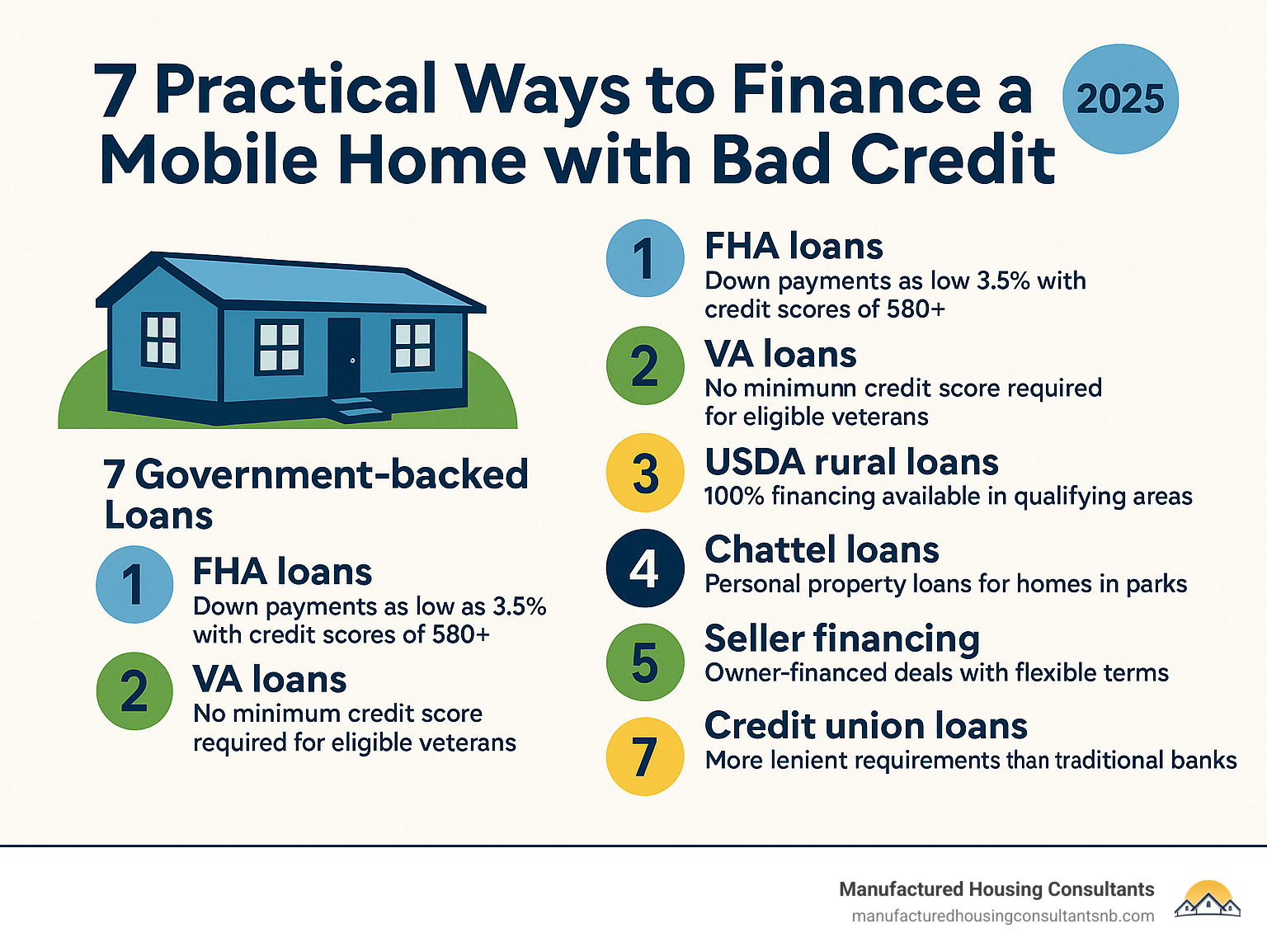

Quick Answer: 7 Main Financing Options for Mobile Homes with Bad Credit:

- FHA loans – Down payments as low as 3.5% with credit scores of 580+

- VA loans – No minimum credit score required for eligible veterans

- USDA rural loans – 100% financing available in qualifying Texas areas

- Chattel loans – Personal property loans for homes in parks

- Seller financing – Owner-financed deals with flexible terms

- Credit union loans – More lenient requirements than traditional banks

- Rent-to-own agreements – Path to ownership without traditional lending

Bad credit is a temporary phase, not a permanent barrier. While you might face higher interest rates, multiple financing paths exist for credit-challenged buyers.

The manufactured housing market in Texas offers unique advantages. Homes can cost significantly less than traditional houses, making homeownership achievable. Many lenders specialize in manufactured home loans and understand that credit scores don’t tell the whole story.

At Manufactured Housing Consultants in New Braunfels, we’ve helped countless Texas families steer these financing options. Our local expertise in the Texas Hill Country market means we know which lenders work best for different credit situations.

Find more about mobile home with bad credit:

How to Finance a Mobile Home with Bad Credit in Texas

Even with a few credit dings, owning a home in Texas is within reach. Securing financing for a mobile home with bad credit is possible if you know where to look and how to present yourself as a responsible borrower. Let’s walk through the most effective strategies to turn your homeownership dreams into reality.

Understanding Your Starting Point: Credit & Down Payments

Before exploring loan options, it’s crucial to understand your financial starting point. We know talking about credit challenges isn’t fun, but knowing where you stand is the key to choosing the right path.

Your FICO score (ranging from 300-850) shows lenders your financial history. A score below 620 is often considered “sub-prime,” but a low score today doesn’t define your financial future.

When seeking a mobile home with bad credit, lenders often require a larger down payment to offset their risk. Aiming for 20% down can significantly improve your approval odds, but even a smaller amount shows commitment.

Your debt-to-income ratio is also critical. It compares your monthly debt to your gross income. Lenders prefer total debts below 40-50% of your income. Paying down debts before applying can help.

Simple saving strategies, like automating transfers to a dedicated account, can help you build your down payment faster. Every dollar saved brings you closer to holding those house keys.

Bad credit is a temporary roadblock. For more guidance on the pre-approval process, we’re here to help you take those first important steps.

Government-Backed Loan Programs

Government-backed programs offer promising opportunities for financing a mobile home with bad credit. They are designed to make homeownership accessible for those who might not qualify for conventional loans.

FHA loans offer a realistic path with down payments as low as 3.5% for credit scores of 580 or higher. You might still qualify with a score between 500-579 if you can provide a 10% down payment. For manufactured homes, FHA requires the home to be on a permanent foundation on land you own. The home must also meet FHA safety standards, which most modern homes do. For details, visit the official FHA Home Loan information page and see our guide on Will FHA Finance a Manufactured Home.

VA loans are a great benefit for veterans and active military. The VA sets no minimum credit score, though lenders often look for 620+. Best of all, VA loans require no down payment and have no private mortgage insurance. Like FHA loans, the home must be permanently affixed to land you own. These benefits make homeownership very affordable for veterans.

USDA rural loans offer 100% financing (no down payment) for homes in eligible rural areas, including many communities around New Braunfels. Income limits are reasonable, often up to 115% of the area’s median income. USDA prefers scores above 640 but may consider lower scores with proof of a responsible payment history. This program removes the down payment barrier for many Texas families.

Our team at Manufactured Housing Consultants in New Braunfels understands these programs and has helped many Texas families use them to achieve homeownership.

Exploring Chattel Loans and Specialized Lenders

For a mobile home with bad credit, especially one in a mobile home park, chattel loans and specialized lenders are practical alternatives to traditional mortgages.

Chattel mortgages treat your home as personal property. This is key because it allows you to finance a home on a leased lot in a mobile home park, a flexible option many Texans prefer. The trade-offs include higher interest rates and shorter loan terms (typically 15-20 years) compared to traditional mortgages. This results in a higher monthly payment but a faster payoff.

Specialized lenders focus on manufactured housing. They often prioritize income stability over past credit mistakes and have high approval rates for buyers with credit challenges. While Manufactured Housing Consultants doesn’t lend directly, our relationships with these lenders streamline approvals. They trust the quality of our homes and are motivated to help you.

Whether your home is in a park or on owned land significantly affects financing. Park homes usually require chattel loans, while homes on owned land can qualify for traditional mortgages. Both are viable paths. For more information, explore our guide to Mobile Home Financing Options.

Alternative Financing for a mobile home with bad credit

Alternative financing bypasses traditional lenders, opening doors for those buying a mobile home with bad credit.

Seller financing means you negotiate terms directly with the seller, offering flexibility on credit requirements, down payments, and closing times. Rates may be higher and terms shorter, but it can be a great bridge to ownership.

Rent-to-own agreements let you live in your future home while building toward ownership. A portion of your rent goes toward the down payment, giving you time to improve your credit and save. Downsides include higher monthly costs and the risk of losing your equity if you don’t complete the purchase. Ensure the contract clearly defines the terms.

Personal loans are fast and don’t require the home as collateral, but they have much higher interest rates and shorter terms (5-7 years). They work best for less expensive homes due to high monthly payments.

Family loans offer maximum flexibility. Always put the agreement in writing to protect your finances and the relationship.

Here’s how these options compare:

| Option | Seller Financing | Personal Loans | Rent-to-Own |

|---|---|---|---|

| Credit Requirements | Very flexible | Moderate requirements | Focus on rental history |

| Down Payment | Negotiable | Usually none required | Option fee plus rent equity |

| Interest Rates | Negotiable, often higher | Much higher than mortgages | Built into higher rent |

| Best For | Buyers with bad credit | Quick financing needs | Building credit while living in home |

Improving Your Approval Odds

To improve your chances of financing a mobile home with bad credit, take these steps to strengthen your application. Small improvements can make a big difference.

A co-signer with strong credit dramatically reduces the lender’s risk, often leading to approval with better rates. A co-signer is legally responsible for the loan if you default, and their credit will be affected by your payment history. It’s a serious commitment for both parties.

Prepare your required documentation: proof of income (pay stubs, W-2s, tax returns) and recent bank statements. A stable employment history is also crucial, so be prepared to provide details and explain any job gaps.

Follow these credit improvement tips:

- Pay bills on time. This is the most important factor in your credit score. Use automatic payments to avoid missing due dates.

- Reduce debt, especially on credit cards. Keep balances below 30% of your credit limit to improve your credit utilization ratio.

- Avoid applying for new credit while home shopping, as each “hard inquiry” can temporarily lower your score.

For more guidance, see these Tips to improve your credit score and our guide on How to Get a Mobile Home with Bad Credit.

Key Considerations for Your Texas Mobile Home

Beyond financing, buying new vs. used and your home’s location will impact your loan options, especially when financing a mobile home with bad credit.

New manufactured homes are easier to finance as they are lower risk, meet current standards, and have warranties. Our inventory of new homes at Manufactured Housing Consultants provides access to the best financing opportunities.

Used homes can be harder to finance, especially older models, and may have higher interest rates. However, they cost less upfront. Our Repo Mobile Homes for Sale First Time Buyer program offers great value on quality used homes.

Location impact is significant. In mobile home parks, you lease the land, so your home is personal property, typically requiring a chattel loan. Placing a home on owned land and a permanent foundation allows it to be titled as real property. This opens up traditional financing like FHA, VA, and USDA loans, which usually have better rates and terms.

If you’re using your own property, remember to budget for land improvement services like site prep and utility connections. Some loans can bundle these costs. Our New Braunfels team understands Texas regulations for manufactured housing and can guide you through local zoning, permits, and inspections.

Understanding these considerations helps you choose the right financing path for your mobile home with bad credit purchase in Texas.

Your Path to Texas Homeownership Starts Here

Buying a mobile home with bad credit is achievable. As we’ve shown, there are many financing paths available, from government loans to creative alternatives. Bad credit is a temporary setback, not a final verdict.

In New Braunfels, we regularly help families who thought homeownership was impossible due to credit issues. We know that with the right guidance, these obstacles can be overcome.

At Manufactured Housing Consultants, we’re your local experts for the Texas Hill Country market. We have strong relationships with specialized lenders who look beyond credit scores. They trust the quality of manufactured homes and work with buyers who show stability and commitment.

Our approach is simple: we offer homes from 11 top manufacturers at guaranteed lowest prices. This frees up more of your budget for financing. Whether you want a new home or a quality used one from our repo mobile homes for sale first time buyer program, we’ll find the right financing for you.

Manufactured housing in Texas offers great flexibility. You might qualify for an FHA loan with land, a chattel loan for a home in a park, or even a rent-to-own agreement to build equity while improving your credit.

Beyond financing, our land improvement services ensure your property is ready. Our local expertise helps match you with the best lenders in the Texas Hill Country.

Credit challenges are temporary. Homeownership provides lasting stability and pride. We’re committed to helping you find your home.

Ready to take the next step? Explore your mobile home financing options today and find how we can turn your homeownership dreams into reality. Our New Braunfels team is standing by to answer your questions and guide you through every step of the process.