Unlocking the Door: Mobile Home Financing Tips for Bad Credit

Unlock mobile home financing with bad credit. Learn options, improve your profile, and get approved for your affordable dream home today!

Why Bad Credit Doesn’t Have to Block Your Dream Home

Mobile home financing with bad credit is absolutely possible, and thousands of families prove it every year. While traditional lenders might turn you away, specialized programs and lenders understand that your credit score doesn’t tell your whole story.

Quick Answer: Mobile Home Financing Options for Bad Credit

- FHA loans: Credit scores as low as 500 (10% down) or 580 (3.5% down)

- Chattel loans: Available with scores around 575, though rates are higher

- VA loans: No official minimum score, but lenders prefer 620+

- Personal loans: Typically need 600+ score but offer flexibility

- Specialized lenders: Work with scores below 500 with proper down payment

The path to homeownership doesn’t end because of past financial struggles. More than 17.5 million Americans currently live in manufactured homes, and many started their journey with less-than-perfect credit.

Bad credit typically means a FICO score below 580, but even with scores in the 500s, you can find acceptable financing options. The key is understanding which programs work for your situation and how to strengthen your application.

As one Texas mobile home dealer puts it: “If you have a minimum credit score over 500 and a modest down payment, it’s usually possible to find acceptable mobile home financing with bad credit at a reasonable interest rate.”

The difference between getting approved and getting rejected often comes down to preparation, choosing the right loan type, and working with lenders who specialize in manufactured home financing.

Related content about mobile home financing with bad credit:

How to Get Mobile Home Financing with Bad Credit

Getting mobile home financing with bad credit might feel overwhelming at first, but it’s absolutely achievable when you know where to look and how to prepare. Think of it like putting together a puzzle – once you understand the pieces, the whole picture becomes clear.

The key is approaching this strategically. You’ll want to explore your financing options first, then strengthen your financial profile, and finally prepare a solid application that tells your story in the best possible light.

Understanding Your Options for Mobile Home Financing with Bad Credit

The good news? You have more financing options than you might think. Different loan programs have different requirements, and some are specifically designed to help people with credit challenges achieve homeownership.

FHA loans are often your best starting point for mobile home financing with bad credit. These government-backed loans accept credit scores as low as 500 with a 10% down payment, or 580 with just 3.5% down. The beauty of FHA loans lies in their flexibility – they understand that life happens, and past financial struggles don’t define your future ability to make payments.

However, there are some trade-offs. Your manufactured home must meet HUD standards (which means homes built before 1976 typically won’t qualify), and you’ll pay mortgage insurance. But for many families, these requirements are worth it for the chance to get approved with lower credit scores.

Chattel loans treat your mobile home like personal property rather than real estate. You can often qualify with a credit score around 575, making them accessible when traditional mortgages aren’t an option. The approval process is typically faster, and closing costs are lower.

The downside? Interest rates usually run between 8% and 11%, and loan terms are shorter (often 10-20 years instead of 30). This means higher monthly payments, but it also means you’ll own your home outright much sooner.

VA loans offer incredible benefits if you’re an eligible veteran, service member, or surviving spouse. While most lenders prefer credit scores of 620 or higher, the VA itself doesn’t set a minimum score. Even better, you won’t need a down payment, and there’s no mortgage insurance requirement.

For those in rural areas, USDA loans can be a fantastic option. They prefer credit scores of 640, but the program focuses more on your willingness and ability to manage debt than just your score. The biggest advantage? 100% financing with no down payment required for eligible applicants.

Conventional loans through Fannie Mae or Freddie Mac typically require credit scores of 620 or higher, making them less accessible for bad credit borrowers. However, if you’re close to that threshold, they often offer competitive rates and terms.

Sometimes personal loans make sense, especially for older or used mobile homes. You’ll need a credit score of 600 or better, but these loans offer flexibility and quick approval. Just be prepared for higher interest rates and shorter terms.

Strengthening Your Profile for a Mobile Home Loan

Here’s where you can really make a difference in your approval odds and loan terms. Even small improvements to your financial profile can lead to significantly better offers.

Improving your credit score is the most powerful step you can take. Start by getting your free credit report from all three bureaus. You might be surprised by what you find – errors are more common than you’d think, and disputing them can provide quick wins.

Focus on paying all bills on time moving forward. Your payment history accounts for 35% of your credit score, so consistency here makes a huge impact. If you have credit cards, work on reducing balances below 30% of your credit limits. This shows lenders you can manage credit responsibly.

Saving for a larger down payment can be a game-changer when you’re seeking mobile home financing with bad credit. While you might qualify with minimal down payment, putting down 10% to 20% demonstrates commitment and reduces the lender’s risk. This often translates to better interest rates and loan terms.

Your debt-to-income ratio matters tremendously. Lenders prefer to see this below 43%, meaning your monthly debt payments shouldn’t exceed 43% of your gross monthly income. If yours is higher, focus on paying down existing debts before applying.

Sometimes bringing in a co-signer with good credit can open doors that would otherwise remain closed. Just make sure both you and your co-signer understand the commitment – they’re equally responsible for the loan.

Preparing Your Application for Mobile Home Financing with Bad Credit

Once you’ve strengthened your profile, it’s time to put together a compelling application. Organization and transparency will work in your favor here.

Gather your documentation before you start applying. You’ll need recent pay stubs (2-3 months), W2 forms from the past two years, and bank statements showing your down payment funds. If you’re self-employed, tax returns become even more important.

Don’t underestimate the power of a letter of explanation. This is your chance to tell your story in your own words. If medical bills, job loss, or divorce caused your credit problems, explain what happened and what you’ve done to get back on track. Lenders are human too – they understand that life throws curveballs.

Understanding interest rate implications is crucial, especially in today’s market. When you’re seeking mobile home financing with bad credit, you’re already likely to face higher rates than someone with excellent credit. Current market conditions can make this even more challenging.

Consider your options carefully. A larger down payment can help offset higher rates by reducing your loan amount. Shorter loan terms mean higher monthly payments but less interest paid over time. Some borrowers choose to secure financing now with plans to refinance later when their credit improves, though this strategy involves additional costs and risks.

Getting pre-approved before you start shopping gives you a clear budget and shows sellers you’re serious. It also helps you avoid falling in love with a home that’s outside your price range.

When reviewing loan offers, pay attention to more than just the monthly payment. Look at the total cost over the loan’s life, including all fees and interest. Sometimes a slightly higher monthly payment with a shorter term saves you thousands in the long run.

Securing mobile home financing with bad credit is often just the beginning of your homeownership journey. As you make on-time payments and build equity, your financial picture will continue to improve, opening up even more opportunities down the road.

Your Path to Homeownership Starts Here

Getting mobile home financing with bad credit might feel overwhelming at first, but you’ve just learned that it’s absolutely achievable. The secret isn’t having perfect credit – it’s knowing your options, preparing thoroughly, and taking the right steps to strengthen your application.

Think of this journey like building a house. You start with a solid foundation (understanding your loan options), add strong walls (improving your credit and saving for a down payment), and finish with a sturdy roof (preparing a complete application). Each step builds on the last, creating a path that leads straight to your front door.

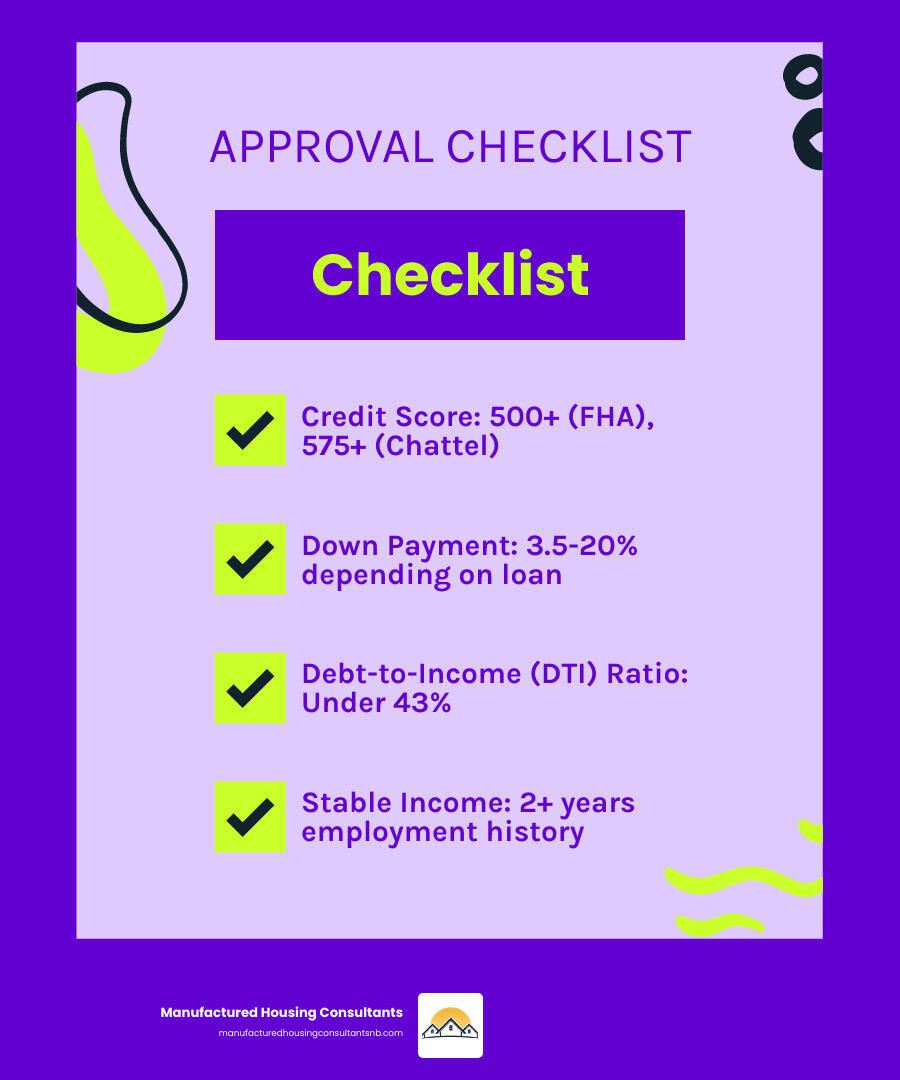

Your homeownership checklist includes checking your credit report, exploring FHA and chattel loan options, saving for a larger down payment to offset credit challenges, and gathering all your financial documents. When you make timely payments on your new mobile home loan, you’re not just building equity – you’re actively rebuilding your credit score for future financial opportunities.

Here in New Braunfels, Texas, we’ve seen families transform their lives through homeownership, even when they started with credit scores in the 500s. At Manufactured Housing Consultants, we work with 11 top manufacturers to offer you the widest selection at guaranteed lowest prices. But more importantly, we understand the financing landscape and can guide you toward the loan program that fits your unique situation.

Whether you qualify for an FHA loan with just 3.5% down, need a chattel loan for a home in a mobile home park, or have VA benefits to leverage, we’ll help you steer every detail. Our team doesn’t just sell homes – we provide comprehensive financing guidance and even land improvement services to make your transition to homeownership seamless.

Your credit history tells the story of where you’ve been, not where you’re going. Every family deserves a place to call home, and we’re here to help you write the next chapter of your story.

Ready to take the first step? Explore your financing options today and let’s start building your path to homeownership together.