How Does Mobile Home Interest Rates Work?

Learn how mobile home interest rates work in 2024-2025 and discover tips to secure the best loan for your manufactured home.

Why Mobile Home Interest Rates Matter More Than You Think

Mobile home interest rates can make or break your path to affordable homeownership. If you’re considering a manufactured home, understanding these rates is crucial because they work differently than traditional mortgages.

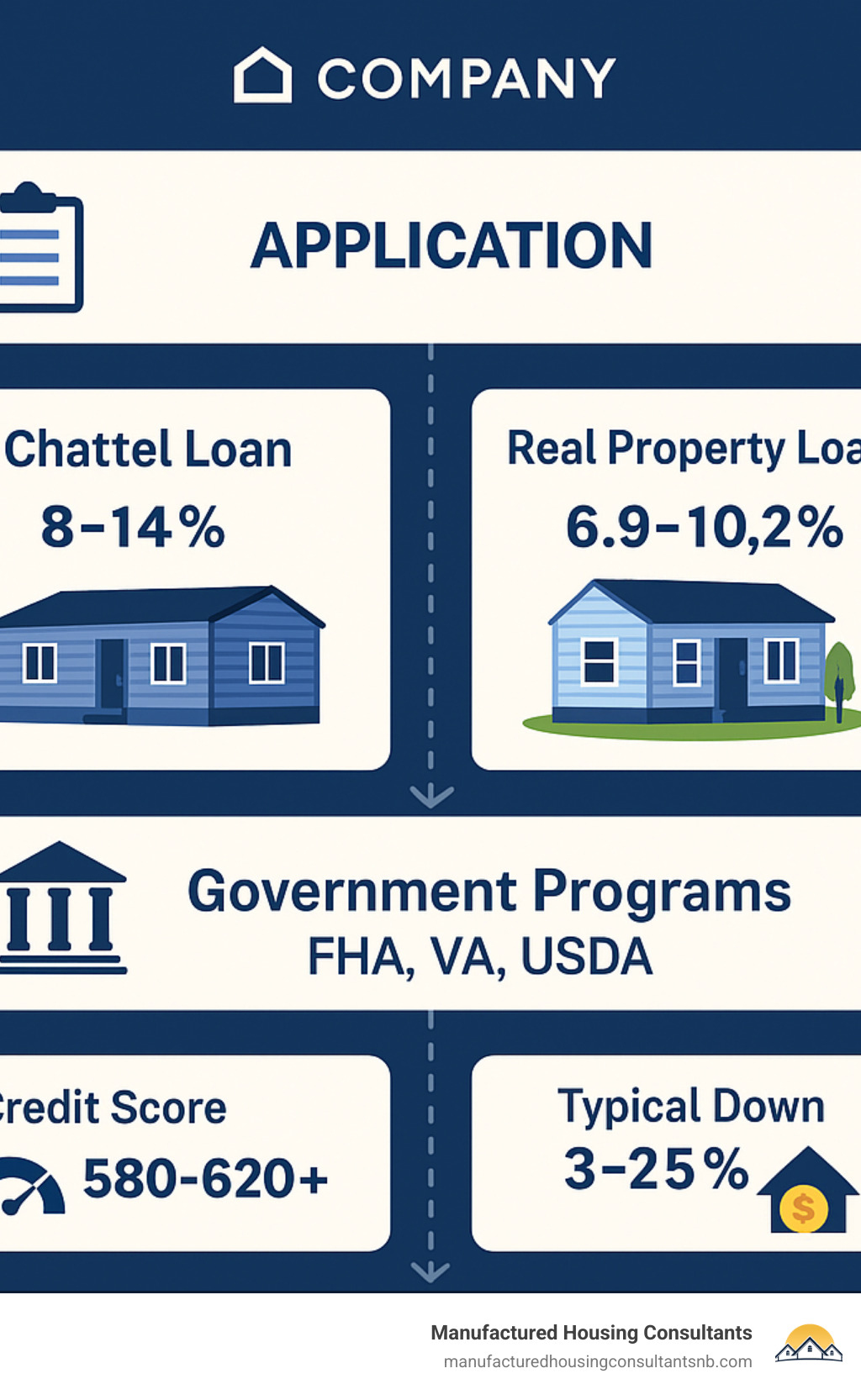

Quick Answer for Mobile Home Interest Rates:

- Chattel loans: 8% to 14% APR (home only, no land)

- Real property loans: 6.9% to 10.2% APR (home + land owned)

- Personal loans: Up to 36% APR (unsecured financing)

- Credit score impact: 580 minimum, 620+ for best rates

- Down payment: 3% to 25% depending on loan type

As one frustrated homebuyer shared on Reddit: “I’m looking at purchasing a mobile home that is in great condition” but was shocked to find a 10% interest rate over 25 years – far higher than traditional mortgage rates.

The reality is stark. While site-built homes enjoy mortgage rates around 6-7%, manufactured homes often face significantly higher costs. This happens because many mobile home loans are chattel mortgages – meaning the home is treated as personal property, not real estate.

Why the rate difference? Three main factors drive higher mobile home interest rates:

- Limited securitization – Banks can’t easily sell these loans to investors

- Higher risk perception – Homes may depreciate rather than appreciate

- Smaller loan market – Fewer lenders mean less competition

But here’s the good news: with the right knowledge, you can secure competitive rates. Government programs like FHA, VA, and USDA loans offer better terms when you own land. Even chattel loans become more affordable when you understand the system.

The manufactured housing market is booming as Americans seek affordable alternatives to expensive site-built homes. Average mobile home costs hit $88,000 in 2022 – a fraction of traditional housing prices. This surge in demand is creating new financing options and competitive pressure on lenders.

Understanding Mobile Home Interest Rates in 2024-2025

Let’s be honest – mobile home interest rates in 2024-2025 can feel like a puzzle with too many pieces. But once you understand how lenders think, the picture becomes much clearer.

The biggest factor affecting your rate? Whether lenders see your home as real property (like a traditional house) or personal property (like a fancy car). This single distinction can mean the difference between a reasonable 7% rate and a wallet-draining 12% rate.

Chattel loans treat your home as personal property, which explains why rates typically run from 8% to 14%. Lenders see these as riskier because the home can be moved, and frankly, mobile homes don’t always appreciate like traditional houses. As one lending expert put it, “Over 40% of manufactured home loans are chattel loans” – which explains why so many buyers face higher rates.

Real property loans are the golden ticket, offering rates between 6.9% and 10.2%. These work just like regular mortgages when your home sits on a permanent foundation and you own the land. Suddenly, lenders have both home and land as security, making them much more comfortable with lower rates.

Here’s something most people don’t know: banks struggle to sell mobile home loans to investors the way they do with regular mortgages. This securitization risk means lenders often keep these loans on their books, which costs them more money. Guess where that extra cost goes? Straight to your interest rate.

The depreciation factor also plays a role. While your dream home might hold its value beautifully, lenders worry about mobile homes losing value over time. Combined with the fact that there are fewer lenders in this space (less competition equals higher rates), and you start to see why rates run higher.

But here’s the encouraging part – the macro-economy is creating opportunities. As housing costs soar everywhere, more lenders are entering the manufactured housing market. This increased competition is slowly pushing rates down, especially for well-qualified buyers.

| Loan Type | Interest Rate Range | APR Range | Typical Term | Land Required |

|---|---|---|---|---|

| Chattel | 8.0% – 14.0% | 8.3% – 14.5% | 10-20 years | No |

| Real Property | 6.9% – 10.2% | 7.0% – 10.4% | 15-30 years | Yes |

| FHA Title I | 7.5% – 12.0% | 7.8% – 12.3% | Up to 20 years | No |

| FHA Title II | 6.5% – 9.5% | 6.7% – 9.8% | 15-30 years | Yes |

| VA Loans | 6.0% – 8.5% | 6.2% – 8.7% | Up to 25 years | Usually |

Current Mobile Home Interest Rates Snapshot

Right now in 2024-2025, mobile home interest rates are all over the map – but there’s method to the madness.

30-year fixed rates for manufactured homes with land are running 6.9% to 10.2% APR. That’s a pretty wide range, but it makes sense when you consider that someone with excellent credit and 25% down gets treated very differently than someone with fair credit putting down 5%. We’ve seen Texas lenders offering rates as low as 6.939% APR for their best customers.

15-year fixed rates typically land between 6.4% and 9.9% APR. Yes, your monthly payment will be higher, but you’ll save thousands in interest over the loan’s life. If you can swing the higher payment, it’s often worth it.

Chattel loans are still commanding 8% to 14% rates, with most qualified borrowers landing somewhere around 9-10%. We’ve seen credit unions offering rates of 9.29% to 9.79% APR, with a nice little 0.25% discount if you set up automatic payments.

Personal loans for mobile homes can hit up to 36% APR – ouch! These make sense only for smaller purchases or when you absolutely can’t qualify for secured financing. Think of them as a last resort, not a first choice.

For perspective, 30-year site-built home mortgages are averaging 6-7% right now. That 1-4 percentage point gap reflects the extra risk lenders see in manufactured housing, but it’s not impossible.

The prime rate drives many of these rates, especially if you’re considering an adjustable-rate mortgage. When the Federal Reserve moves rates up or down, mobile home borrowers feel it through rate adjustments on ARM products.

Factors That Move Mobile Home Interest Rates

Your mobile home interest rate isn’t pulled out of thin air – lenders use specific factors to calculate your risk level, and understanding these can help you get better terms.

Credit score is the big kahuna. Most lenders want to see at least 580-620, but the sweet spot for great rates starts around 720. The difference between excellent and fair credit can cost you 2-3 percentage points – that’s real money over the life of your loan.

Down payment size directly impacts your rate because it shows lenders you have skin in the game. The loan-to-value ratio matters too. Put down 25% instead of 10%, and you might save 0.5-1.0% on your rate. Some lenders reserve their best pricing for borrowers who keep their LTV at 75-80%.

Home age can make or break your financing options. Homes built after June 15, 1976, carry HUD tags that certify they meet federal construction standards. If your home is older, you’ll face limited options and higher rates due to safety and condition concerns.

Foundation type is crucial. Homes on permanent foundations with eliminated titles qualify as real property, opening the door to traditional mortgage rates. If your home sits on blocks or piers in a rental community, you’re looking at chattel financing with higher rates.

Loan purpose affects pricing too. Purchase loans often get better treatment than refinances, and cash-out refinances typically cost an extra 0.25-0.50% compared to simple rate-and-term refinances.

Points and fees can buy down your rate if you have cash upfront. Each point (1% of your loan amount) typically reduces your rate by 0.25%. Whether this makes sense depends on how long you plan to keep the loan.

Loan Level Pricing Adjustments add another layer of complexity. These risk-based add-ons from Fannie Mae can bump up rates based on credit score, LTV, and loan purpose. A borrower with 640 credit and 90% LTV might face significant LLPA adjustments.

Scientific research on manufactured-housing finance reveals that only 27% of manufactured home mortgage applications were approved in 2019, often because borrowers applied to lenders who don’t even offer these specialized loans.

Loan Types & Their Typical Rates

Different loan programs offer very different mobile home interest rates and terms. Picking the right one can save you thousands.

Conventional MH Advantage programs from Fannie Mae offer some of the best rates available – typically 6.9-8.5% for qualified borrowers. Your home needs to meet specific criteria: permanent foundation, HUD compliance, and at least 400-600 square feet. When you qualify, you get rates that mirror conventional mortgage pricing.

FHA Title I loans let you finance a manufactured home without owning land. These chattel loans typically run 7.5-12.0% – higher than conventional mortgages but accessible to more borrowers. Loan limits cap at $148,909 for single-wide homes and $237,096 for multi-section homes.

FHA Title II loans work like traditional mortgages when you’re buying both home and land. With rates typically 6.5-9.5% and just 3.5% down, these real property loans offer excellent value for qualified borrowers.

VA loans are fantastic if you’re eligible – 6.0-8.5% rates with no down payment required. The catch? Your home must be on a permanent foundation and classified as real property. For veterans and service members, this is often the best deal available.

USDA loans serve rural buyers with no down payment and competitive rates. They work well for manufactured homes in eligible areas, though guarantee fees add to the overall cost.

Chattel loans remain the workhorse of mobile home financing, representing over 40% of the market. With 8-14% rates and 10-20 year terms, they’re more expensive but available to more buyers.

Personal loans can hit 36% APR – expensive but sometimes necessary for quick funding or when you can’t qualify for secured financing.

Adjustable vs fixed rates present a classic trade-off. Fixed rates give you payment certainty, while ARMs offer lower initial rates that adjust with market conditions. Common 5/1 ARMs have annual adjustment caps of 2% and lifetime caps of 5%.

More info about Loan Options for Mobile Homes

Owning Land vs Leasing a Lot

This decision dramatically impacts your mobile home interest rates and your entire financial picture. It’s not just about monthly payments – it’s about building wealth versus renting forever.

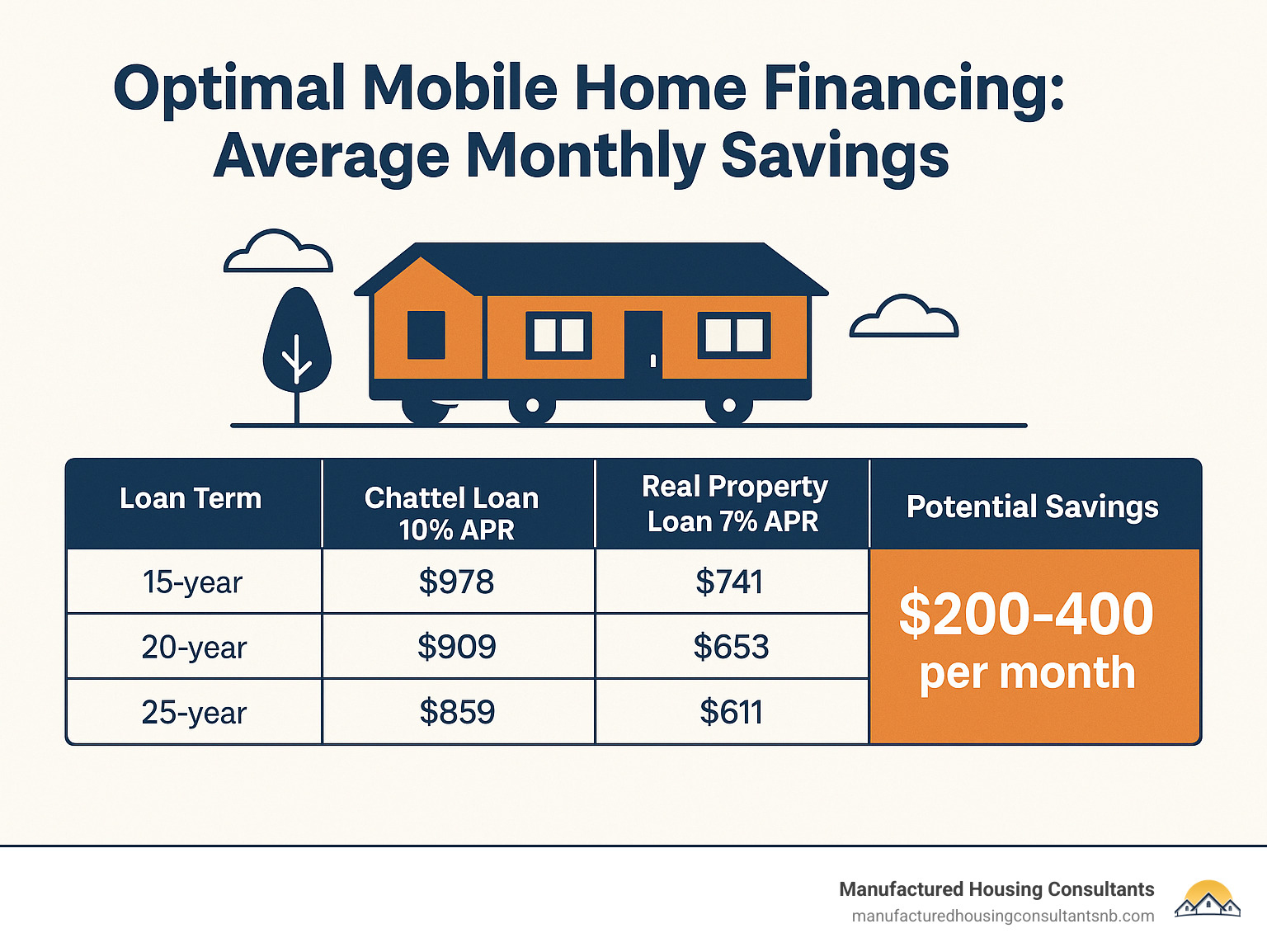

Land ownership transforms your financing options completely. When you own land and put your home on a permanent foundation, lenders can offer real property financing with rates 2-4 percentage points lower than chattel loans. That’s the difference between a 7% mortgage and an 11% chattel loan.

Equity building becomes possible when you own both home and land. While the home might depreciate, land typically appreciates over time. This equity can support future refinancing, home equity loans, or provide proceeds when you sell.

Tax treatment heavily favors land ownership. You’ll likely qualify for homestead exemptions and can deduct mortgage interest on your taxes. Lot rent payments? Not deductible, making ownership more attractive financially.

Park rent risk is real and growing. Private equity firms are buying mobile home parks and raising lot rents dramatically. When you lease, you’re vulnerable to rent increases that can price you out even though you own the home.

Lender options multiply with land ownership. Instead of being limited to specialized chattel lenders, you can shop conventional mortgages from banks, credit unions, and government programs. More competition equals better rates.

Title conversion can sometimes transform a chattel loan into a real property mortgage. This involves permanently affixing your home to land, eliminating the title, and getting the property reclassified as real estate. It’s complex but can significantly reduce your rate.

Permanent foundation rules vary by location but typically require engineered foundations, proper tie-downs, and removal of mobility features like wheels and hitches. Meeting these requirements qualifies your home for real property classification and much better financing.

The math often favors ownership despite higher upfront costs. A $78,000 home with a 10% chattel loan costs about $900 monthly over 25 years. Add $500 lot rent, and you’re paying $1,400 monthly while building zero equity. The same home on owned land might qualify for a 7% mortgage with similar total costs but substantial equity accumulation over time.

How to Secure the Best Mobile Home Loan & Avoid Pitfalls

Securing favorable mobile home interest rates requires strategy, preparation, and knowledge of potential pitfalls. We’ve helped countless families steer this process at Manufactured Housing Consultants, and we know what works.

The key to success lies in understanding that mobile home financing operates differently than traditional mortgages. Lenders use different criteria, offer different products, and assess risk differently. By positioning yourself correctly and avoiding common mistakes, you can secure competitive rates and favorable terms.

Lender shopping becomes crucial because rate spreads between lenders can exceed 2-3 percentage points for identical borrowers. Unlike conventional mortgages where rates cluster tightly, mobile home financing shows wide variation based on lender specialization and risk appetite.

Pre-approval strengthens your negotiating position and speeds the buying process. Many sellers prefer pre-approved buyers, and you’ll know your exact budget before falling in love with a home you can’t afford. Pre-approval also locks in your rate for 30-60 days, protecting you from rate increases during your home search.

Rate locks protect you from rising rates during the application and closing process. Given the volatility in today’s market, a 30-60 day rate lock provides valuable protection. Some lenders offer extended locks for longer closing periods, though these may carry fees.

Fee negotiation can save hundreds or thousands of dollars. While interest rates may be non-negotiable, many fees are. Origination fees, processing fees, and third-party charges often have wiggle room, especially if you’re comparing multiple offers.

Avoiding predatory terms requires vigilance. The mobile home finance market unfortunately attracts some predatory lenders who target vulnerable borrowers with excessive rates, fees, and unfavorable terms. Understanding market rates helps you identify and avoid these traps.

Refinance pathways should be considered from day one. Even if you start with a higher-rate loan due to credit or down payment constraints, improving your situation over time may qualify you for better terms through refinancing.

Long-term cost planning extends beyond the monthly payment. Consider total interest costs, potential lot rent increases, maintenance expenses, and resale value when evaluating different financing options.

At Manufactured Housing Consultants, we work with multiple lenders to find the best financing for each customer’s situation. Our experience with 11 top manufacturers and various financing programs helps us match buyers with optimal loan products.

Strategies to Lower Your Mobile Home Interest Rate

Reducing your mobile home interest rate by even one percentage point can save thousands of dollars over your loan’s life. Here are proven strategies we’ve seen work for our customers:

Raise your credit score before applying. Even modest improvements can open up better rates. Pay down credit card balances, make all payments on time, and consider paying off small debts to boost your score. The difference between a 620 and 720 credit score might save you 1-2% in interest rate.

Larger down payments reduce lender risk and often qualify you for better pricing tiers. While some programs accept 3-5% down, putting down 20-25% frequently open ups the best available rates. Use savings, land equity, or even trade-in value from an existing home to increase your down payment.

Shorter loan terms typically offer lower rates than longer terms. A 15-year loan might carry a rate 0.5-1.0% lower than a 30-year loan, though monthly payments will be higher. Run the numbers to see if the payment increase fits your budget.

Buying points allows you to prepay interest to reduce your rate. Each point (1% of loan amount) typically reduces your rate by 0.25%. This makes sense if you plan to keep the loan long enough to recoup the upfront cost through monthly payment savings.

Fixed vs ARM decisions depend on your risk tolerance and rate outlook. ARMs offer lower initial rates but carry adjustment risk. If you plan to refinance or sell within the fixed period, an ARM might save money. For long-term ownership, fixed rates provide payment certainty.

First-time buyer assistance programs offer rate reductions, down payment help, or closing cost assistance. Many states and localities provide these programs, and some lenders offer their own first-time buyer incentives.

Veteran benefits through VA loans provide some of the best terms available. Eligible veterans and service members can access no-down-payment loans with competitive rates and no private mortgage insurance requirements.

Down payment assistance programs help qualified buyers who lack cash for substantial down payments. These programs, offered by states, localities, and nonprofits, can provide grants or low-interest loans for down payments and closing costs.

More info about Financing for Mobile Homes with Bad Credit

The key is combining multiple strategies. A borrower who improves their credit score, saves for a larger down payment, and shops multiple lenders might reduce their rate by 2-3 percentage points compared to rushing into the first available loan.

Fee Watch: Points, Origination & Hidden Costs

Understanding fees helps you calculate the true cost of your mobile home interest rate and compare offers accurately. The APR includes many fees, but some costs remain outside this calculation.

Origination fees typically range from 1-5% of the loan amount for mobile home financing. These fees compensate lenders for processing your loan and can often be negotiated or financed into the loan balance. A $100,000 loan with a 2% origination fee adds $2,000 to your costs.

Documentation preparation fees cover paperwork processing and can range from $200-800. While these fees seem small, they add up quickly when combined with other charges.

Title and insurance costs vary by state and loan type. Title insurance, required for real property loans, typically costs 0.5-1.0% of the loan amount. Homeowner’s insurance, flood insurance (if required), and private mortgage insurance (for high-LTV loans) add ongoing monthly costs.

Escrow requirements for taxes and insurance increase your monthly payment beyond principal and interest. Lenders typically require escrow accounts for loans exceeding 80% LTV, adding these costs to your monthly payment.

How fees affect APR varies by loan type and lender. The APR calculation includes interest, origination fees, discount points, and certain other charges spread over the loan’s life. However, third-party fees like appraisals, title insurance, and inspections typically aren’t included.

Comparison shopping requires looking beyond the interest rate to the total cost of borrowing. A loan with a slightly higher rate but lower fees might cost less overall than a low-rate loan with excessive charges.

Required disclosures help you understand loan costs. The Loan Estimate, provided within three days of application, details all costs and allows meaningful comparison between lenders. The Closing Disclosure, provided before closing, shows final terms and costs.

CFPB protections give you rights in the lending process. You can shop for certain services, question fees that seem excessive, and file complaints if you encounter problems. The Consumer Financial Protection Bureau provides resources and handles complaints about unfair lending practices.

Scientific research on loan fees shows that manufactured home borrowers often pay higher fees than traditional mortgage borrowers, making fee comparison even more important.

Smart borrowers focus on the total cost of borrowing, not just the interest rate. A loan with a 7.5% rate and $3,000 in fees might cost more than an 8.0% loan with $1,000 in fees, depending on how long you keep the loan.

Refinance & Rate-Drop Opportunities

Refinancing can help you secure better mobile home interest rates if your situation has improved or market conditions have changed. Understanding your options helps you time refinancing decisions effectively.

Rate-and-term refinancing replaces your existing loan with new terms, potentially lowering your rate, changing your payment, or shortening your loan term. This makes sense when rates have dropped or your credit has improved enough to qualify for better terms.

Cash-out refinancing allows you to borrow against your home’s equity for other purposes. However, cash-out refis typically carry slightly higher rates than rate-and-term refinances and may require more equity or better credit.

Seasoning requirements mandate waiting periods before refinancing. Most lenders require 6-12 months of on-time payments before considering a refinance application. This seasoning period demonstrates your ability to handle the current loan responsibly.

Equity requirements for refinancing typically demand 20-25% equity in your home. This can be challenging with manufactured homes that may depreciate, especially in the early years. Land appreciation can offset home depreciation in owned-land situations.

Chattel-to-mortgage conversion represents a powerful refinancing strategy. If you initially financed with a chattel loan but later acquire land and install a permanent foundation, you might qualify for real property financing with significantly better terms.

No-refi rate-drop clauses offered by some lenders automatically reduce your rate when market rates fall, without requiring a full refinance. These programs typically require excellent payment history and may have limitations on frequency or amount of reductions.

Break-even analysis helps determine if refinancing makes financial sense. Calculate the monthly savings from a lower rate, then divide the refinancing costs by this savings to determine how many months you need to keep the new loan to break even.

More info about Manufactured Home Loan Calculator

Consider refinancing when:

- Market rates have dropped 1% or more below your current rate

- Your credit score has improved by 50+ points

- You’ve acquired land and can convert to real property financing

- You want to eliminate private mortgage insurance

- You need to change loan terms or access equity

The refinancing process for manufactured homes can be more complex than traditional mortgages, especially for chattel loans. Working with experienced lenders who understand manufactured housing helps ensure smooth transactions.

Red Flags & Predatory Lending Traps

The mobile home financing market unfortunately attracts predatory lenders who target vulnerable borrowers with excessive mobile home interest rates and unfavorable terms. Recognizing these red flags protects you from financial harm.

Triple-digit APR personal loans represent the worst predatory practice. Some lenders offer unsecured personal loans for mobile homes with APRs exceeding 100%. These loans create debt traps that can lead to financial ruin. Legitimate mobile home financing should never exceed 36% APR, even for poor credit borrowers.

Balloon payment notes require large final payments that most borrowers can’t afford. These loans offer low initial payments but require refinancing or sale when the balloon comes due. If you can’t refinance due to credit problems or falling home values, you risk losing your home.

Excessive prepayment penalties trap borrowers in high-rate loans. While some penalties are normal, excessive penalties (more than 2% of the loan balance or lasting longer than 3 years) may indicate predatory lending. Legitimate lenders want borrowers to succeed, not trap them in expensive loans.

Forced arbitration clauses eliminate your right to sue or join class-action lawsuits against the lender. While arbitration clauses are common, be wary of lenders who refuse to explain these terms or pressure you to sign without reading.

High dealer markups occur when dealers add percentage points to the lender’s rate and keep the difference. While some markup is normal, excessive markups (more than 2-3 percentage points) inflate your costs unnecessarily. Ask dealers to disclose their markup and shop directly with lenders when possible.

CFPB complaint filing provides recourse when you encounter unfair practices. The Consumer Financial Protection Bureau investigates complaints and can help resolve disputes with lenders. Document all interactions and keep copies of all loan documents.

Community rent escalations in manufactured home parks can make your housing unaffordable even with reasonable loan terms. Research park ownership, rent history, and local rent control laws before buying in a leased-land community.

Borrower protections include the right to:

- Receive accurate loan disclosures

- Shop for certain services like title insurance

- Cancel the loan within three days of closing (for refinances)

- Receive fair treatment regardless of race, gender, or other protected characteristics

- File complaints against unfair lenders

Warning signs of predatory lending include:

- Pressure to sign immediately without reading documents

- Promises that seem too good to be true

- Refusal to provide written loan estimates

- Encouragement to lie on applications

- Loans you clearly can’t afford based on your income

Trust your instincts. If something feels wrong or too good to be true, it probably is. Legitimate lenders want informed borrowers who can successfully repay their loans.

Ready to Get Started?

At Manufactured Housing Consultants, we’re committed to helping you secure the best possible mobile home interest rates and find the perfect home for your family. Our lowest-price guarantee ensures you get the best value, while our financing expertise helps you steer the complex world of manufactured home loans.

Our lowest-price guarantee means you can shop with confidence, knowing you’re getting the best deal available. We work with 11 top manufacturers to offer the widest selection of quality homes at guaranteed lowest prices.

Home selection becomes easier when you understand your financing options. Whether you’re looking for a cozy single-wide or a spacious multi-section home, we’ll help you find options that fit your budget and financing parameters.

In-house financing guidance connects you with lenders who specialize in manufactured housing. Our relationships with multiple lenders mean we can shop your loan to find the best rates and terms for your situation.

Land improvement services help you prepare your site for your new home. From site preparation to utility connections, we coordinate the entire process to ensure your home is properly installed and ready for occupancy.

The path to homeownership through manufactured housing offers tremendous value when you understand the financing landscape. With the right knowledge, preparation, and professional guidance, you can secure competitive rates and achieve your homeownership dreams.

Don’t let complex financing options discourage you from pursuing affordable homeownership. Contact Manufactured Housing Consultants today to explore your options and take the first step toward owning your dream home. Our experienced team will guide you through every step of the process, from home selection to financing to final installation.

Your perfect home and favorable financing are waiting. Let’s make your homeownership dreams a reality with the right manufactured home and the best possible interest rate for your situation.