A Practical Guide to Mobile Home Loans with Bad Credit

Discover practical tips for securing a mobile home loan bad credit. Improve credit, explore options, and get financing today!

Mobile home loan bad credit situations can feel like a daunting barrier, but they don’t have to stand in the way of your dream of homeownership. For those like Sarah, a budget-conscious Texan, exploring mobile homes presents a practical and affordable path to owning a home, even with a less-than-stellar credit score.

If you’re searching for quick answers, here’s what you need to know to get started:

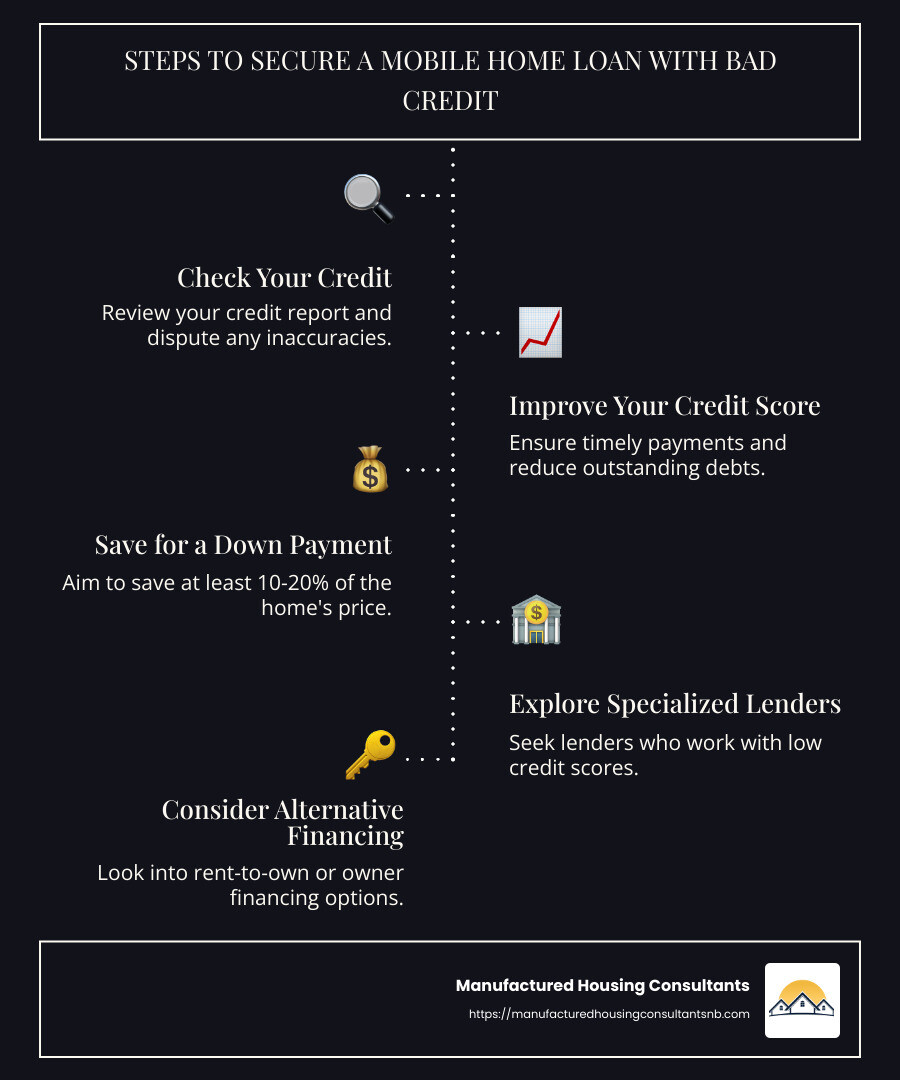

- Know Your Credit: Check your credit report and dispute any inaccuracies.

- Improve Your Credit: Make timely payments and reduce outstanding debts.

- Save for a Down Payment: Aim for at least 10-20% of the home’s price.

- Explore Specialized Lenders: Look for lenders who work with low credit scores.

- Consider Alternative Financing: Options like rent-to-own or owner financing can be viable.

The journey might challenge you, but with informed steps and the right guidance, affordable homeownership through a mobile home loan is within grasp. This guide will dig deeper into how you can secure financing even with bad credit, turning the key to your dream home.

The Basics of Mobile Home Loans

When it comes to mobile home loans, understanding the different types and their requirements is essential. Whether you’re dealing with bad credit or simply exploring your options, knowing the ins and outs can make the process smoother. Let’s break down the types of loans available and what lenders typically look for.

Types of Loans Available

-

Chattel Loans

Chattel loans are specifically designed for movable personal property, like mobile homes. Unlike traditional mortgages, chattel loans use the mobile home itself as collateral. While these loans often come with higher interest rates and shorter terms, they are a viable option for those who might not qualify for traditional financing.

-

FHA Loans

FHA loans are popular for those with lower credit scores. These loans, backed by the Federal Housing Administration, allow for lower down payments and more flexible credit requirements. For mobile homes, FHA loans can cover both the home and the land it sits on, or just the home itself.

-

VA Loans

VA loans are available to veterans, active-duty service members, and eligible spouses. These loans often come with favorable terms, such as no down payment and competitive interest rates. They can be used for mobile homes, making them an excellent option for those who qualify.

-

USDA Loans

USDA loans are designed for rural homebuyers with low to moderate incomes. These loans can cover mobile homes if they meet certain criteria, such as being in a USDA-approved area. Like VA loans, they often require no down payment.

-

Conventional Loans

Conventional loans are not backed by the government and typically require higher credit scores and down payments. However, they can offer competitive rates and terms for those who qualify. For mobile homes, conventional loans might be more challenging to secure, especially for those with bad credit.

Loan Requirements

Securing a mobile home loan involves meeting specific requirements, which can vary depending on the type of loan:

-

Credit Score

While some loans, like FHA, are more forgiving of lower credit scores, others, like conventional loans, require higher scores. Generally, a score of 620 is a common minimum for many loans, but options exist for those with lower scores.

-

Down Payment

The down payment can vary significantly based on the loan type. FHA loans might require as little as 3.5%, whereas conventional loans often expect 5-20%. Saving for a larger down payment can improve your loan terms, especially if you have bad credit.

-

Income Verification

Lenders will need proof of income to ensure you can make monthly payments. This typically involves providing recent pay stubs, tax returns, and bank statements.

-

Debt-to-Income Ratio (DTI)

Your DTI ratio is crucial in determining loan eligibility. It compares your monthly debt payments to your gross monthly income. A lower DTI ratio indicates better financial health, making you a more attractive candidate to lenders.

Understanding these loans and their requirements can help you steer the path to securing a mobile home loan, even if your credit isn’t perfect. Next, we’ll explore how to overcome challenges related to bad credit in your journey to homeownership.

Mobile Home Loan Bad Credit: Overcoming Challenges

Securing a mobile home loan with bad credit might seem daunting, but it’s not impossible. Let’s explore some practical steps to improve your chances.

Improving Your Credit Score

Check Your Credit Report

Start by obtaining your credit report from the three major bureaus: Equifax, Experian, and TransUnion. Look for errors or inaccuracies. Correcting these can boost your score.

Payment History Matters

Make on-time payments a priority. Consistently paying bills on time is one of the most effective ways to improve your credit. Even a few months of timely payments can make a difference.

Credit Counseling

If you’re struggling, consider working with a credit counselor. They can offer personalized advice and help you develop a plan to improve your credit score.

Saving for a Down Payment

Down Payment Assistance

Some programs offer down payment assistance to those with low income or bad credit. Research local and state programs that might provide grants or low-interest loans to help with your down payment.

Savings Strategies

Set a savings goal and stick to it. Consider setting up automatic transfers to a dedicated savings account. Even small, regular contributions can add up over time.

Exploring Co-Signer Options

Benefits of a Co-Signer

Having a co-signer with good credit can significantly improve your loan application. A co-signer agrees to take responsibility for the loan if you default, which reduces the lender’s risk.

Eligibility Criteria

Not everyone can be a co-signer. They need to have a good credit score and sufficient income. Make sure they understand their obligations before signing on.

By focusing on these areas, you can improve your chances of securing a mobile home loan with bad credit. Next, we’ll dive into the practical steps of securing a loan, from researching lenders to preparing your documentation.

Steps to Secure a Mobile Home Loan with Bad Credit

Navigating mobile home loan bad credit can be tricky, but with a clear plan, you can improve your chances of success. Let’s break down the steps you need to take.

Researching Lenders

Start with Lender Research

Not all lenders are the same, especially when it comes to dealing with bad credit. Begin by looking into credit unions, online lenders, and mobile home dealerships. These options often have more flexible terms for those with less-than-perfect credit.

- Credit Unions: These member-owned institutions often offer personalized service and may have more lenient lending criteria.

- Online Lenders: They can provide quick responses and a range of options, sometimes catering specifically to bad credit borrowers.

- Mobile Home Dealerships: Some dealerships offer in-house financing or can connect you with lenders who specialize in mobile home loans.

Preparing Documentation

Gather Your Financial Documents

Before applying, make sure you have all necessary documents ready. This will streamline the process and show lenders that you’re serious.

- Proof of Income: This could include recent pay stubs, tax returns, or other income sources.

- Bank Statements: Lenders want to see your savings and checking account balances to assess your financial health.

- Employment History: Provide details about your job history, including any recent changes.

Applying for the Loan

Get Pre-Approved

Before you start shopping for a mobile home, aim to get pre-approved for a loan. Pre-approval gives you a clearer picture of your budget and shows sellers you’re a serious buyer.

Understand Loan Terms

When you’re ready to apply, pay attention to the loan terms. These include interest rates, repayment schedules, and any fees. It’s crucial to understand what you’re agreeing to.

- Interest Rates: With bad credit, expect higher rates. However, shopping around can help you find the best available rate.

- Loan Terms: Carefully review the repayment schedule and any penalties for late payments or early payoff.

By following these steps, you can steer the process of securing a mobile home loan with bad credit more effectively. Next, we’ll explore how to make the most of your loan and manage your finances for successful homeownership.

Conclusion

Securing a mobile home loan with bad credit is challenging, but not impossible. At Manufactured Housing Consultants, we’re committed to helping you achieve your dream of homeownership. Let’s recap how you can make this a reality.

Manufactured Housing Consultants: Your Partner in Homeownership

Based in New Braunfels, Texas, we offer a wide selection of affordable mobile and manufactured homes. Our unique selling point is our guaranteed lowest prices, backed by financing options custom to your needs. We understand the problems of bad credit and are here to guide you through every step.

Planning for Your Financial Future

Owning a mobile home isn’t just about finding the right loan; it’s about planning for your future. Here are some key points to consider:

- Budget Wisely: Knowing your budget helps you avoid overextending financially. Stick to what you can afford, even if it means starting with a smaller home.

- Build an Emergency Fund: Life is unpredictable. Having savings set aside for unexpected expenses can prevent financial stress.

- Improve Your Credit Over Time: While your credit score may not be ideal now, making consistent, on-time payments can help improve it over time, potentially leading to better refinancing options.

Your Path to Homeownership

With the right planning and support, you can overcome the challenges of bad credit. Manufactured Housing Consultants is here to help you find the perfect home and financing solution. Start your journey to mobile home ownership today by visiting our mobile home financing page. Let’s work together to make your dream of owning a home a reality.