Repo Mobile Homes with Land: The Perfect Match

Discover repo mobile homes with land for sale, compare deals, learn risks, and find tips to buy and finance your perfect investment.

Finding Affordable Home Ownership Through Repos

Looking for repo mobile homes with land for sale? Here’s a quick overview of what you need to know:

- Price Range: Typically 20-40% below market value

- Financing Options: Up to 100% LTV financing available on primary residences

- Closing Timeline: 6-8 weeks for homes with land

- Where to Find Them: Bank listings, specialized dealers, online marketplaces

- Key Benefits: Lower entry costs, immediate equity, negotiation flexibility

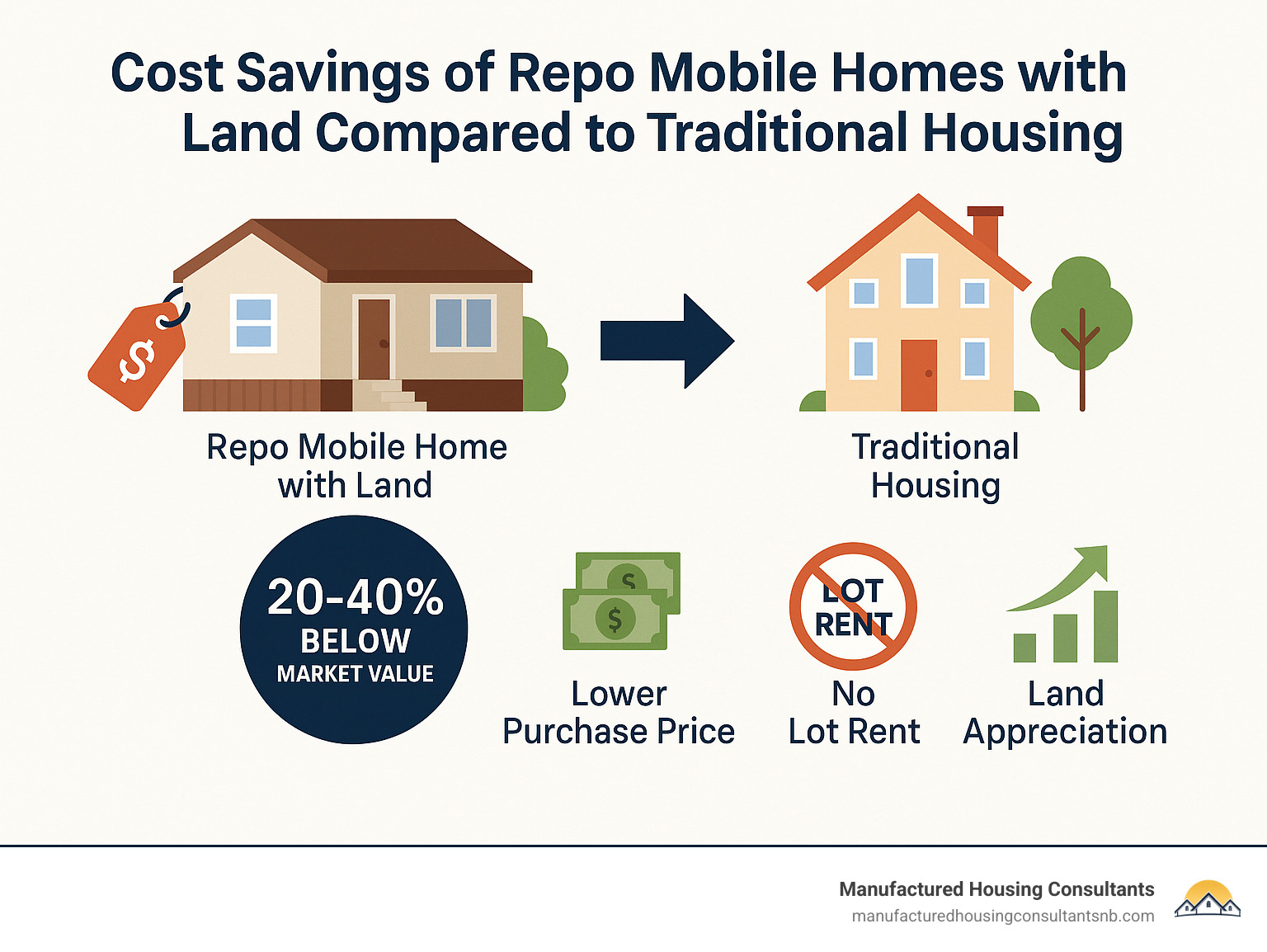

Repo mobile homes with land for sale represent one of the most affordable pathways to homeownership in today’s challenging housing market. These properties—manufactured homes that have been repossessed by lenders due to loan default—offer budget-conscious buyers a chance to own both a home and land at significantly reduced prices.

For Sarah and many other Texans facing similar challenges, repos provide a practical solution to the affordable housing crisis. With average discounts of 20-40% below market value, these properties create immediate equity opportunities that simply aren’t available with traditional housing options.

The combination of a repo mobile home with land delivers a powerful financial advantage. Unlike mobile homes in parks or on rented lots, owning the land eliminates monthly lot fees and provides long-term stability. It also opens up more financing options, with some lenders offering up to 100% LTV (loan-to-value) financing for qualified buyers.

In states like Arizona and Texas, the market for these properties is active and diverse. Arizona currently has over 500 mobile homes with land listings at an average price of $328,215, while Texas offers numerous opportunities at various price points with flexible seller financing options.

While repos do come with considerations—they’re typically sold “as-is” and may require inspections and repairs—the potential savings make them worth exploring for anyone seeking affordable homeownership.

Learn more about repo mobile homes with land for sale:

Repo Mobile Homes with Land for Sale: Benefits, Risks & Listings

When you compare repossessed mobile homes with land to traditional housing options, the differences jump right out at you. It’s a bit like comparing a hidden gem to something in a fancy display case – both have their place, but one offers a lot more value for your dollar.

| Feature | Repo Mobile Home with Land | Traditional Home Purchase |

|---|---|---|

| Cost | 20-40% below market value | Full market price |

| Condition | Sold “as-is” | May include repairs or warranties |

| Purchase Process | Faster, often less competitive | More competitive, longer process |

| Financing | Specialized options, up to 100% LTV | Traditional mortgages |

| Negotiation | More flexibility with motivated lenders | Less flexibility with individual sellers |

| Closing Timeline | 6-8 weeks with land | 30-45 days typical |

Right now in Arizona, there are 512 mobile homes with land waiting for new owners. The average listing price sits at $328,215, with land costing around $29,906 per acre. Most properties are listed around $309,950, and the average size is a generous 11.7 acres – plenty of room to breathe!

Texas offers similar opportunities, from cozy lots perfect for single-wides to sprawling properties for those who want space to roam and privacy from neighbors.

“What makes these properties particularly attractive,” says John Martinez from our team at Manufactured Housing Consultants, “is the immediate equity position buyers can achieve. Walking into a property with 20-40% built-in equity is practically unheard of in today’s housing market. It’s like getting a head start in a race everyone else is running from behind.”

If you’re looking for affordable land to pair with your repo mobile home, check out Cheap Land deals for options that might complement your search.

What Are Repo Mobile Homes with Land for Sale?

Repo mobile homes with land for sale are essentially package deals where both a manufactured home and the land beneath it have been reclaimed by a lender after the previous owner couldn’t keep up with payments. Think of it as a two-for-one special that often comes with a substantial discount tag.

When someone falls behind on payments for their manufactured home with land, the lender starts a process to get their investment back. This varies by state but usually involves some legal notices, a period where the owner can catch up on payments, and eventually, the lender taking the property back.

Unlike regular mobile home repos that might leave you hunting for somewhere to place your new home, these packages include the land parcel—giving you both shelter and the ground beneath it in one transaction. The land could be anything from a small residential lot to several acres of countryside.

Lenders aren’t in the business of property management—they’re in the money business. They want these properties off their books quickly, which is great news for buyers. Their motivation to sell creates room for negotiation that you rarely find elsewhere.

“We’re seeing more and more lenders streamlining their repo inventory processes,” shares Carlos Rodriguez from our office. “They’re increasingly willing to work with qualified buyers to move these properties quickly. Just last month, we helped a family secure a 15% discount beyond the already reduced listing price because the bank was eager to close by quarter-end.”

Want to learn more about what’s available? Visit our Repossessed Mobile Homes page for current listings and details.

Biggest Perks of Repo Mobile Homes with Land for Sale

The advantages of buying repo mobile homes with land for sale go way beyond just getting a good deal. These properties offer some unique benefits that make them particularly attractive for both homeowners and investors.

Immediate Equity Position is like starting a race halfway to the finish line. With discounts ranging from 20-40% below market value, you’re building wealth from day one instead of slowly over time. This built-in equity gives you financial security and potential borrowing power right from the start.

Improved Negotiation Leverage comes from dealing with lenders who view these properties as financial assets, not homes filled with memories. Unlike private sellers who might dig in their heels over sentimental value, banks focus on clearing inventory and recovering investments. This business-minded approach gives you more room to negotiate favorable terms.

Favorable Financing Options can make these properties even more accessible. Many lenders offer specialized financing with up to 100% loan-to-value (LTV) ratios for qualified primary residence buyers. This means you might need little or no down payment—a game-changer for many first-time buyers.

Rental Income Potential exists in today’s tight housing market where affordable rentals are scarce. A repo mobile home with land can become a steady income stream with relatively low initial investment. Several of our clients have turned their purchases into profitable rental properties, generating returns of 8-12% annually.

Land Appreciation adds another dimension to your investment. While manufactured homes may depreciate over time (though less than commonly believed), land typically grows in value. In Arizona, where land averages $29,906 per acre, values have been climbing steadily, with some areas seeing 5-7% annual appreciation.

No Lot Rent means one less monthly bill compared to mobile homes in parks. This can save you $300-$800 monthly in many areas—money that can go toward building equity in your own property instead of someone else’s.

Freedom and Flexibility come with owning both home and land. Want to add a workshop? Plant a garden? Park your RV? With your own land, you don’t need permission from a park manager or HOA (though local zoning regulations still apply).

The Rodriguez family from New Braunfels shared their success story with us: “We purchased a repo double-wide on 3 acres for 30% below comparable properties in the area. Three years later, our property has appreciated by 15%, and we’ve been able to add a workshop and garden that wouldn’t have been possible in a mobile home park. Our monthly payment is less than what we were paying in rent, and now we’re building equity instead of just paying someone else’s mortgage.”

Hidden Risks & How to Mitigate Them

While repo mobile homes with land for sale offer amazing opportunities, they do come with some challenges. It’s a bit like finding a great deal on a used car – wonderful if you know what to look for, but potentially costly if you dive in without checking under the hood.

“As-Is” Condition Concerns top the list of potential issues. Repos are typically sold without warranties or guarantees about the property’s condition. That beautiful bargain might hide some not-so-beautiful repair needs. To protect yourself, hire a professional inspector who specializes in manufactured homes. Their trained eye will catch issues you might miss, and their report gives you a roadmap for budgeting repairs. Factor these costs into your offer price – a $10,000 discount isn’t much of a deal if you need $15,000 in immediate repairs.

Title and Lien Issues can create headaches down the road. Repos sometimes come with complicated title histories or outstanding claims against the property. Your best defense is a comprehensive title search and title insurance. For manufactured homes, you need to verify both the home title (through your state’s department of motor vehicles or manufactured housing division) and the land title (through county records). This double-check ensures you don’t inherit someone else’s financial obligations.

Foundation and Installation Problems are particularly important with manufactured homes. Improper installation can lead to structural issues that compromise both safety and comfort. Have a qualified professional inspect the foundation, anchoring system, leveling, and tie-downs. One client saved thousands by identifying inadequate pier supports during inspection – an issue that would have caused serious structural damage if left unaddressed.

Zoning and Land Use Restrictions might limit your plans for the property. That perfect spot for your home business might not be zoned for commercial use, or that dream of raising chickens might be prohibited by local ordinances. Contact the local planning department to verify zoning regulations, building codes, and restrictions before you buy. This simple step prevents disappointing surprises after closing.

Utility and Access Challenges are common with rural properties. Will you have reliable water access? Is the septic system functioning properly? Do you have legal, year-round access to the property? Verify all utilities are working correctly and that you have guaranteed access via public or private roads. Get estimates for any needed utility upgrades before making your offer.

Financing Problems can arise because not all lenders understand manufactured housing. Traditional mortgage lenders might offer limited options or higher rates for these properties. Work with lenders experienced in manufactured housing, like those we partner with at Manufactured Housing Consultants. Be prepared for potentially higher down payment requirements or interest rates, though specialized programs can often mitigate these concerns.

Insurance Considerations differ for manufactured homes. Coverage might be more limited or expensive than for traditional homes. Shop around for insurance quotes before committing to purchase, and ensure you understand what your policy covers – and what it doesn’t.

“The most common mistake we see,” explains Maria Hernandez from our New Braunfels office, “is buyers skipping the professional inspection to save a few hundred dollars, only to find thousands in needed repairs after closing. I remember one family who waived inspection on what looked like a perfect home, only to find the HVAC system needed complete replacement within a month of moving in. That $400 inspection would have saved them over $6,000. The professional inspection is non-negotiable in our view.”

By anticipating these challenges and taking proactive steps to address them, you can minimize risks and maximize the value of your repo mobile home with land purchase. The key is going in with your eyes open and your research complete – something we’re here to help with every step of the way.

How to Find & Finance Repo Mobile Homes with Land

Looking for repo mobile homes with land for sale is a bit like treasure hunting – you need to know where to look and have the right map to guide you. Unlike traditional home buying, these unique properties don’t always show up on the usual real estate radar.

The search might take you through bank websites, government listings, or to specialists like us at Manufactured Housing Consultants, where we maintain close relationships with lenders and often have access to properties before they hit the public market. This insider access can be invaluable in today’s competitive housing landscape.

That purchasing a repo with land typically takes longer than buying just a mobile home – usually 6-8 weeks compared to 4-6 weeks for home-only deals. This extended timeline accounts for additional steps like land surveys, more complex title work, and appraisals that must consider both the home and the property it sits on.

“Most of our clients are surprised by how much paperwork is involved when land enters the equation,” says Maria from our New Braunfels office. “But the end result – owning both your home and the ground beneath it – is absolutely worth the extra few weeks.”

For more detailed guidance on finding these properties in your area, check out our Find Repo Mobile Homes for Sale Near Me resource. And when you’re ready to explore financing options, our Financing Mobile Home with Land page breaks down all available programs in detail.

Where to Look Online & Offline

Finding your perfect repo mobile homes with land for sale means casting a wide net both online and in the real world. These properties don’t always make it to mainstream listing sites, so knowing the hidden corners to search can give you a significant advantage.

Online, your first stop should be bank and lender websites where REO (Real Estate Owned) or bank-owned sections often list their repossessed inventory. Government agency websites like HUD, VA, and Fannie Mae/Freddie Mac also maintain listings of foreclosed properties, including manufactured homes with land.

Specialized manufactured housing marketplaces often have dedicated repo sections, and traditional MLS platforms can be useful if you filter specifically for “manufactured,” “mobile,” “repo,” or “foreclosure” properties. Online auction sites are another goldmine, frequently offering competitive starting bids on repo properties.

In the offline world, connecting with specialists like us at Manufactured Housing Consultants can open doors to inventory that never makes it to public listings. Our New Braunfels team has built relationships with lenders across Texas who alert us when new repos become available.

“I always tell people not to overlook county courthouse records,” shares David Thompson, our regional manager. “Those foreclosure notices can tip you off to properties before they’re officially listed anywhere else.”

Good old-fashioned drive-by scouting still works too, especially in rural areas where you might spot “bank owned” signs before they appear online. Building connections with real estate agents who specialize in manufactured housing and chatting with community managers can also yield valuable leads.

When you find a promising online source, set up alerts to be notified immediately when new properties match your criteria. In today’s market, repo mobile homes with land for sale – especially those in good condition or desirable locations – don’t stay available for long.

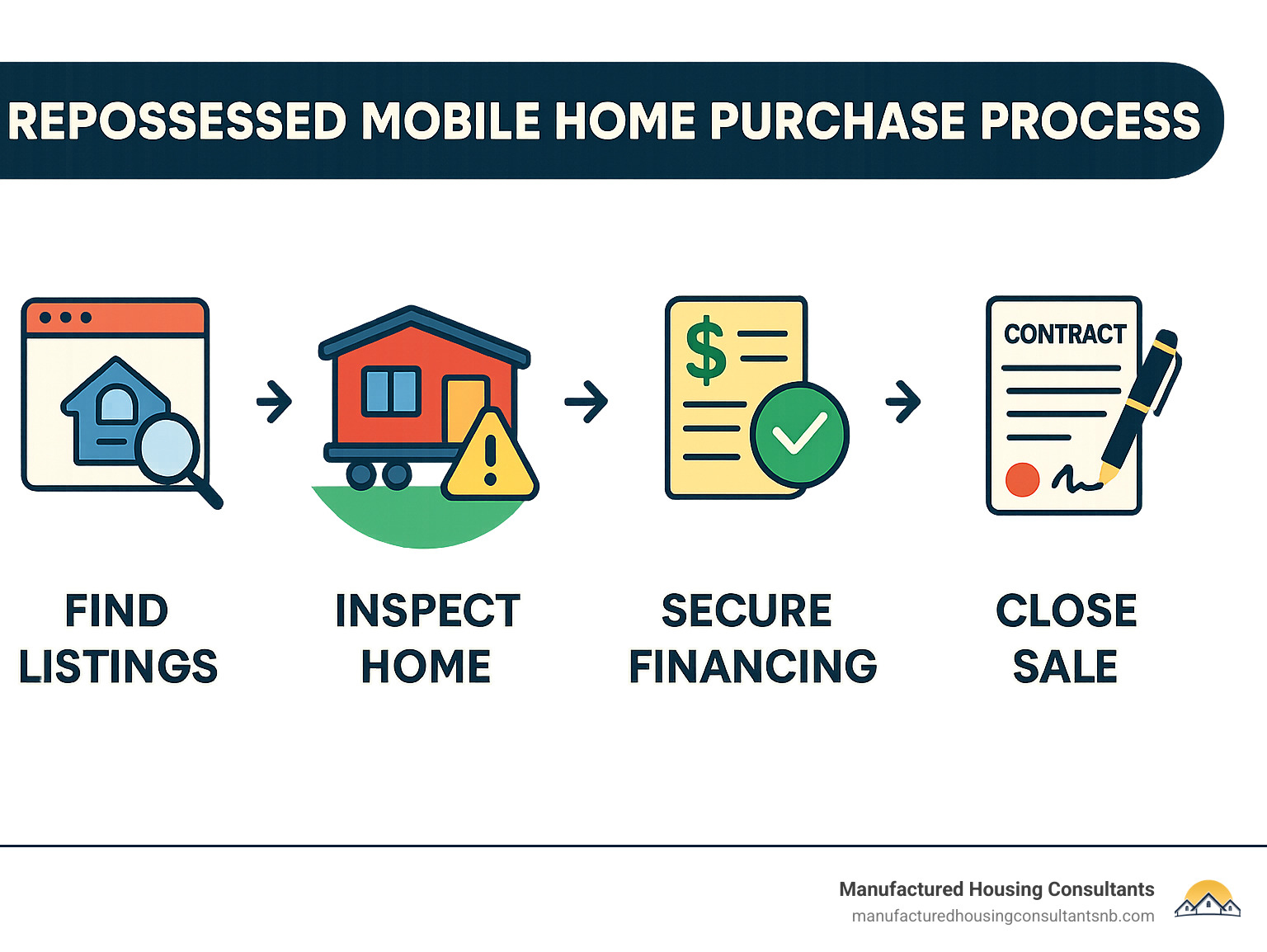

Step-by-Step Purchase, Inspection & Closing

Buying a repo mobile home with land for sale follows a unique pathway that combines elements of both traditional real estate and manufactured home purchases. Let me walk you through what to expect, step by step.

Start by identifying potential properties through your search efforts and doing some homework. Research the property’s history, including previous sale prices and how long it’s been on the market. When possible, drive by to check out the neighborhood and get a feel for the property’s exterior. Photos can be deceiving, so seeing it in person (even just from the road) can be eye-opening.

Before making any offers, secure financing pre-approval. This step is crucial as it defines your budget and strengthens your position when making offers. Have your pre-approval letter or proof of funds ready to submit alongside any offers you make.

When you’re ready to make a move, submit a written offer through your agent or directly to the lender. Include contingencies for inspection, appraisal, and financing to protect yourself. Be prepared for counter-offers, especially on desirable properties that may attract multiple bidders.

Once your offer is accepted, hire a specialized manufactured home inspector – this is not the place to cut corners! A thorough inspection should cover both the home (structure, roof, systems) and land components (drainage, access, potential environmental issues). If the property has a well or septic system, make sure these are carefully evaluated too.

“A $500 inspection can save you $5,000 in surprise repairs down the road,” explains Jennifer Martinez, our closing specialist. “I’ve seen too many buyers skip this step only to regret it later.”

Next comes title work and due diligence. Order a title search to identify any liens or encumbrances, verify both the home title and land title, and check for unpaid taxes or HOA fees. Confirm property boundaries with a survey if one isn’t provided, and verify that zoning allows your intended use of the property.

The appraisal process follows, with your lender ordering an appraisal to verify the property’s value. Be aware that manufactured homes with land require specialized appraisers who understand the unique aspects of these properties.

Before closing, conduct a final walk-through to verify utilities are functioning properly and the property condition hasn’t changed since the initial inspection. Confirm any agreed-upon repairs have been completed to your satisfaction.

Finally, the closing process brings everything together. Review all documents carefully, bring certified funds for closing costs and down payment, sign the required paperwork, and receive your keys and title (or confirmation of title transfer).

After closing, don’t forget important post-purchase steps like transferring utilities to your name, setting up insurance, filing for homestead exemption if applicable, and updating your address with relevant parties.

Financing Routes & Budget Checklist

Financing a repo mobile home with land for sale requires navigating specialized loan programs designed for these unique properties. Let’s break down your options and create a budget roadmap to ensure you’re fully prepared for this investment.

FHA Title I loans are specifically designed for manufactured homes and can cover both the home and land with down payments as low as 3.5%. These government-backed loans offer competitive interest rates but require the home to meet HUD standards. For many buyers, this is the most affordable entry point to manufactured home ownership.

Chattel loans focus on the home itself rather than the land. They typically come with higher interest rates and shorter terms (15-20 years) than mortgage loans, but they can be combined with separate land loans and often have less stringent credit requirements. The approval and closing process is usually faster too.

Land-home combo loans wrap everything into one package, similar to traditional mortgages. These loans typically offer lower interest rates than chattel loans and longer terms (up to 30 years), but they may require the home to be permanently affixed to a foundation.

VA and Rural Development loans provide excellent options for eligible veterans or those purchasing in qualifying rural areas. Both can offer up to 100% financing with favorable terms, though specific property requirements apply.

Seller financing is sometimes available directly from banks or lending institutions holding repos. These arrangements often feature flexible terms and qualification requirements, making them ideal for buyers with credit challenges.

When budgeting for your purchase, look beyond just the down payment. Your closing costs will typically run 3-6% of the loan amount, covering origination fees, title work, and other administrative expenses. Specialized inspections for manufactured homes range from $300-$500, and you may need a land survey ($400-$1,000) depending on lender requirements.

Title insurance protecting both home and land titles will cost $500-$1,500, while home insurance for manufactured properties typically runs higher than for traditional homes ($600-$1,200 annually). Don’t forget to budget for moving costs if relocating from another area, and set aside 5-15% of the purchase price for initial repairs based on inspection findings.

“The biggest financial surprise for most buyers is the need for reserves beyond closing,” explains Michael Rodriguez from our New Braunfels office. “Having a cushion for unexpected repairs or utility deposits can make the difference between a stressful move and a smooth transition to your new home.”

For qualified buyers with excellent credit and stable income, some lenders offer up to 100% LTV financing on primary residences. Additionally, seller concessions can sometimes cover part or all of closing costs, reducing your out-of-pocket expenses.

At Manufactured Housing Consultants, we’ve built relationships with multiple lenders specializing in manufactured home financing. We can help match you with the best option for your specific situation, whether you’re a first-time buyer, a retiree looking to downsize, or an investor seeking rental property opportunities.

Conclusion

Finding the perfect repo mobile home with land for sale isn’t just about scoring a good deal—it’s about finding a pathway to affordable homeownership in a market that feels increasingly out of reach for many Americans. Throughout this guide, we’ve seen how these unique properties offer that rare combination of immediate affordability, built-in equity, and the security that comes with owning both your home and the land beneath it.

With typical discounts of 20-40% below market value, these properties give you a financial head start that’s practically unheard of in traditional real estate. For the Martinez family in San Antonio, their repo purchase meant the difference between continuing to rent and finally having a place to call their own. “We never thought we’d be homeowners in this market,” Maria Martinez told us, “but our repo mobile home with two acres gave us an affordable entry point and room for our kids to play.”

At Manufactured Housing Consultants, our New Braunfels team has guided hundreds of Texans through the repo purchase process. We’ve seen how these properties can transform financial futures when approached with the right knowledge and expectations.

Your Next Steps

Ready to explore repo mobile homes with land for sale? Here’s your action plan:

First, get your finances in order. Secure pre-approval so you know exactly what you can afford and which loan programs you qualify for. This financial clarity gives you confidence when making offers and helps you avoid falling in love with properties outside your budget.

Next, connect with manufactured housing specialists. The repo market has unique considerations that general real estate agents might miss. Working with experts who understand manufactured housing codes, financing quirks, and common structural issues can save you thousands in the long run.

Begin your property search using multiple channels. Don’t rely solely on traditional listings. Check lender websites, auction platforms, and specialized dealers like us who maintain relationships with banks and loan servicers.

Budget for thorough inspections and title searches. The $300-500 you might spend on a specialized manufactured home inspector is perhaps the best investment you’ll make in the entire process. Similarly, comprehensive title searches protect you from unexpected liens or ownership issues.

Use lender motivation to your advantage. Banks and lending institutions aren’t in the business of property management—they want these assets off their books. This motivation gives you negotiating power that simply doesn’t exist with traditional sellers.

For those ready to take action, we invite you to explore our current bank-repo inventory or stop by our New Braunfels office. Our team specializes in helping buyers throughout Texas find and secure these valuable opportunities, often before they hit public listings.

While repos offer tremendous advantages, they do require careful evaluation and sometimes specialized knowledge. The right professional guidance can transform a potentially risky purchase into a sound investment that serves your family for years to come.

As housing costs continue climbing nationwide, repo mobile homes with land for sale represent more than just affordable housing—they’re a practical strategy for building equity, establishing stability, and creating a place that truly belongs to you. We’re here to help you steer that journey successfully, with honest advice and support at every step.