Bargain Hunt: Where to Find Repossessed House Trailers for Sale Near You

Bargain hunt for repossessed house trailers for sale! Get expert tips on finding, inspecting, and financing your affordable dream home.

Why Repossessed House Trailers Offer Unbeatable Value for Texas Homebuyers

Repossessed house trailers for sale are one of the smartest paths to affordable homeownership in Texas. For budget-conscious buyers frustrated by high housing costs, these homes offer a real solution. Here’s a quick overview:

Quick Answer: Where to Find Repossessed House Trailers

- Specialized dealers like Manufactured Housing Consultants with exclusive repo inventory

- Direct bank partnerships and lender REO departments

- Online auction sites and public vehicle auctions

- Local credit unions in Texas

- Government auctions for surplus properties

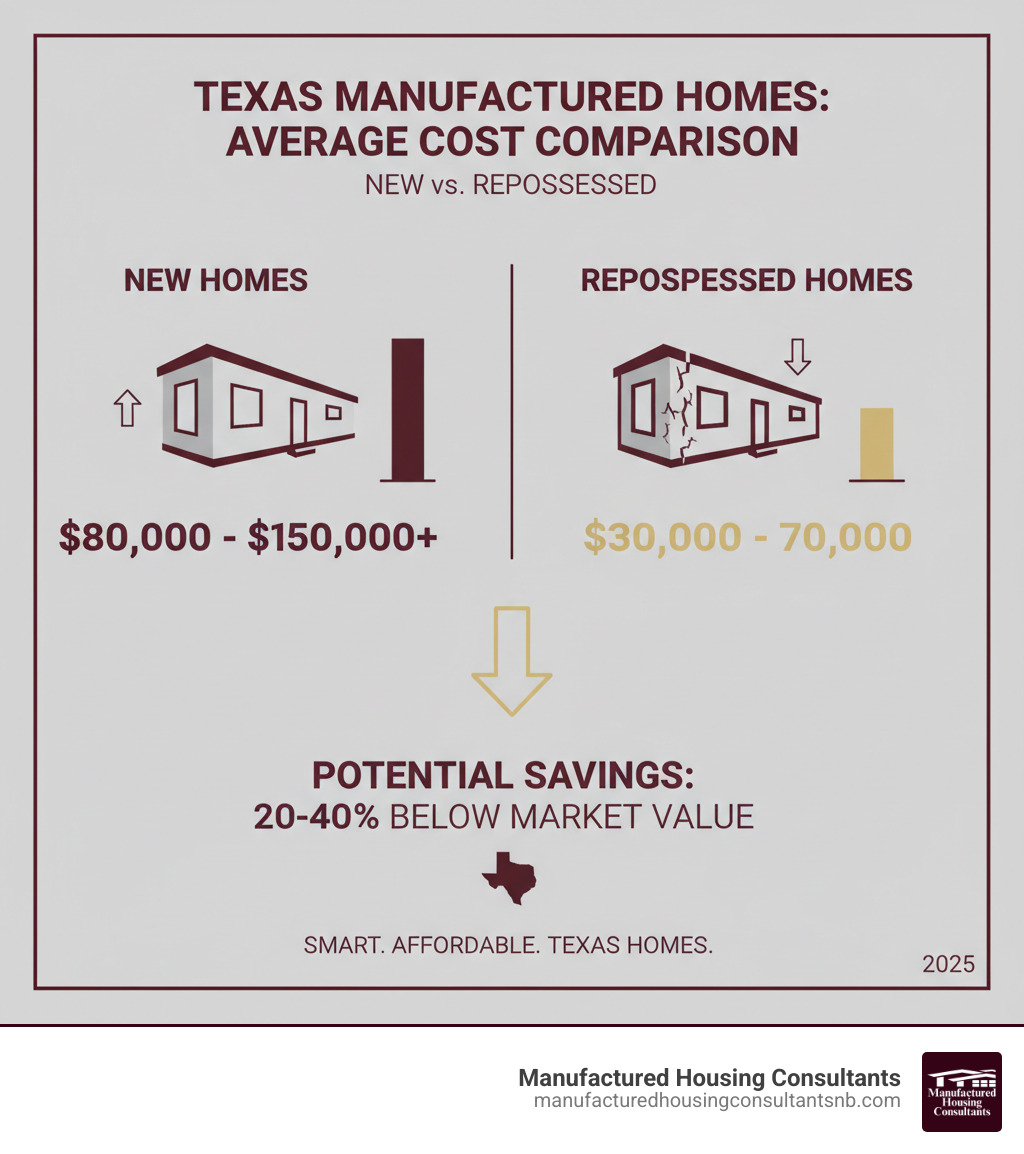

Expected Savings: 20-40% below market value

Typical Price Range: $25,000-$60,000 for quality homes

Timeline to Ownership: 4-8 weeks from offer to closing

When lenders repossess homes due to non-payment, they’re motivated to sell quickly. This urgency creates opportunities for savvy buyers, with savings that can translate into immediate equity. A home that might sell for $50,000 on the used market could be priced at $30,000-$35,000 as a repo.

However, these deals move fast and are sold “as-is,” meaning you must do your homework. This guide will walk you through finding, inspecting, financing, and closing on repossessed house trailers in Texas, with a focus on the New Braunfels area.

What Are Repo House Trailers and Why Are They a Smart Buy?

A repossessed house trailer, or repo mobile home, is a home a lender has taken back after the original owner defaulted on payments. Because banks want these properties off their books quickly, they offer them at significant discounts.

This urgency creates a prime opportunity for buyers. Repossessed house trailers for sale typically sell for 20-40% below market value, which can mean tens of thousands of dollars in savings. For example, buying a home for $30,000 that would normally sell for $45,000 gives you $15,000 in instant equity. This makes repos one of the fastest paths to affordable homeownership in Texas.

These properties are also excellent investment opportunities for flipping or renting. Many repos are newer models that are in good condition, requiring only minor repairs.

At Manufactured Housing Consultants, we specialize in the New Braunfels repo market. Our direct partnerships with Texas lenders give our clients access to exclusive inventory. To learn more, see Why Should You Get a Repo Mobile Home?

The savings are clear when you compare a new manufactured home to a repossessed one. A home that costs $50,000 new might be available as a repo for $30,000 to $40,000. With a thorough inspection, you can move into a beautiful home for a fraction of the typical cost. Our team provides the local Texas expertise to help you find, inspect, and close on a quality repo with confidence.

Your Guide to Finding and Buying Repossessed House Trailers for Sale

You’ve decided that repossessed house trailers for sale could be your ticket to affordable homeownership. This guide will walk you through finding these homes and navigating the buying process with the help of our team at Manufactured Housing Consultants.

Where to Find Listings for Repossessed House Trailers for Sale in Texas

Finding repossessed house trailers for sale requires knowing where to look, as these deals move fast. Here are the best sources:

- Specialized Dealers: Companies like Manufactured Housing Consultants have exclusive relationships with lenders, giving us early access to repo inventory. Our dealership locations in New Braunfels and throughout Texas are hubs for the best deals.

- Direct Bank and Lender Listings: Check the REO (real estate owned) sections on the websites of banks and credit unions. These institutions are motivated sellers.

- Online Auction Sites: Platforms like GSA Auctions (for federal surplus) and other general auction sites can be a source of deals, but be aware of buyer’s premiums and competition.

- Online Marketplaces: Use filters on sites like MHVillage or Zillow to search specifically for “foreclosure” or “bank-owned” manufactured homes.

Juggling these sources can be overwhelming. At Manufactured Housing Consultants, we simplify your search with our streamlined online inventory and expert guidance. Get started by exploring our dedicated pages: Find Repo Mobile Homes for Sale Near Me and Repo Manufactured Homes Texas.

The Smart Buyer’s Pre-Purchase Inspection Checklist

Repossessed house trailers for sale are sold “as-is,” meaning the seller is not responsible for repairs. A thorough inspection is non-negotiable to ensure your bargain doesn’t become a money pit.

While we recommend hiring a professional inspector ($300-$500), you should also know what to look for. Here’s a quick checklist:

- Structural Integrity: Check the steel frame for rust or damage. Ensure the home is level and look for sagging floors or ceilings.

- Roof: Look for missing shingles, poor seals, and any interior water stains.

- Plumbing & Electrical: Test all faucets and toilets. Check for signs of water damage. Test every outlet and inspect the breaker panel.

- HVAC and Appliances: Run the heat and A/C. Test all included appliances.

- Windows, Doors, and Exterior: Ensure they open, close, and seal properly. Inspect siding for damage.

- HUD Tag and Data Plate: Verify the exterior metal HUD tag and interior data plate are present. These are crucial for financing and legality on homes built after 1976.

Our team at Manufactured Housing Consultants can connect you with qualified inspectors in the New Braunfels area to ensure you buy with confidence.

Understanding “As-Is” and Budgeting for Extra Costs

“Sold as-is” means you are buying the home in its current condition. The seller (usually a bank) offers no warranties and will not perform repairs. This is why the homes are discounted, but it requires careful budgeting.

Plan to budget 5-15% of the purchase price for repairs. On a $30,000 repo, that’s $1,500-$4,500 for potential fixes.

Beyond repairs, factor in these additional costs:

- Delivery and Setup: Transporting and professionally installing the home on your site.

- Land Costs or Lot Rent: The expense of buying land or paying monthly rent in a community.

- Taxes and Insurance: Property taxes and mandatory homeowners insurance ($600-$1,200 annually).

- Utility Connections: Fees for hooking up water, sewer/septic, and electricity.

- Permits: Local permits for transport, installation, and utilities.

Even with these costs, the savings are significant. We help you create a comprehensive budget so you can Buy Used Mobile Homes Cheap without financial surprises.

Financing Your Repossessed Mobile Home in Texas

Securing a loan for an “as-is” repo home is achievable with the right lender. At Manufactured Housing Consultants, we work with a network of specialists who understand this market.

Common financing options include:

- Chattel Loans: The most common type for manufactured homes, similar to an auto loan with 15-20 year terms.

- Land-Home Combo Loans: For financing the home and land together, functioning like a traditional mortgage.

- Government-Backed Loans:

- FHA Title I Loans: Low down payments (as low as 3.5%) and flexible credit requirements.

- VA Loans: For veterans, offering up to 100% financing with no down payment.

- USDA Loans: For eligible rural areas, also offering up to 100% financing.

“Can I get a loan with bad credit?” Yes. Our lending partners look at your full financial picture, not just a credit score. We specialize in financing for all credit types and consider factors like income and work history.

The first step is getting pre-qualified with our experts to understand your budget. Learn more on our Repossessed Mobile Homes page.

Navigating Legal Problems: Titles, Liens, and Permits

Legal due diligence is as crucial as a physical inspection when buying repossessed house trailers for sale.

Key legal steps include:

- Title Search: This verifies legal ownership and ensures there are no outstanding liens (claims for unpaid debts) against the home. A clear title is essential. A deed in lieu of foreclosure is one way lenders clear up title issues before a sale.

- Property Title Type: In Texas, a home on leased land is titled as personal property. A home permanently affixed to owned land can be converted to real property. This affects financing, taxes, and resale value.

- Permits and Zoning: Before buying, confirm local zoning laws permit manufactured homes on your property. You will also need transport and installation permits from state (TxDOT) and local authorities.

The Texas Department of Housing and Community Affairs (TDHCA) sets state regulations. Our team at Manufactured Housing Consultants handles this paperwork, ensuring a smooth, legal transfer of ownership. For more on land options, see our Repo Mobile Homes Land Complete Guide.

Making an Offer and Closing on Repossessed House Trailers for Sale

Once you’ve found a home, completed inspections, and arranged financing, it’s time to make an offer and close the deal.

The process involves these key steps:

- Submit a Written Offer: We help you prepare an offer with your price and contingencies for inspection and financing. These protect you if issues arise or your loan falls through.

- Negotiate the Price: Banks are motivated sellers. Based on the inspection and market data, there is often room to negotiate, especially for buyers who can close quickly.

- Closing Timeline: The process is fast, typically 4-6 weeks for home-only loans and 6-8 weeks for land-home packages.

- Budget for Closing Costs: Expect to pay 3-6% of the loan amount for fees like loan origination, title services, and prepaid insurance/taxes.

- Final Walk-Through and Closing: Before signing, you’ll do a final walk-through to ensure the home is in the agreed-upon condition. The closing involves signing legal documents to transfer ownership.

Our team provides full support through closing. We’ve helped hundreds of Texas families buy repossessed house trailers for sale. For more details, see our Repo Mobile Homes Guide 2025.

Start Your Affordable Homeownership Journey Today

You now have the roadmap to find, inspect, and purchase repossessed house trailers for sale. It’s time to take action and make your dream of affordable homeownership a reality.

Purchasing a repo home is a smart financial move that offers 20-40% savings and builds immediate equity. Success depends on due diligence: thorough inspections, clear title searches, and realistic budgeting.

This is where our local Texas expertise is invaluable. At Manufactured Housing Consultants, we are your New Braunfels-based partners, dedicated to helping Texans steer the repo market. We stand out by offering:

- Guaranteed lowest prices and a wide selection from 11 top manufacturers.

- Financing for all credit types, thanks to our network of specialized lenders.

- Complete services, including land improvement and setup.

The repo market moves quickly, so don’t wait. The best deals are snapped up fast. Whether you’re ready to buy or just starting your research, our team is here to guide you.

Ready to find your home? Explore our current inventory of bank repos today. Contact us to start your journey to affordable homeownership in Texas.