Cheat Sheet to VA Loan Rules for Manufactured Homes

Discover va loan rules for manufactured homes. Learn eligibility, property standards, tips, and how to finance your affordable dream home.

VA Loan Rules for Manufactured Homes: The Complete Guide

Looking for quick answers about VA loan rules for manufactured homes? Here’s what you need to know:

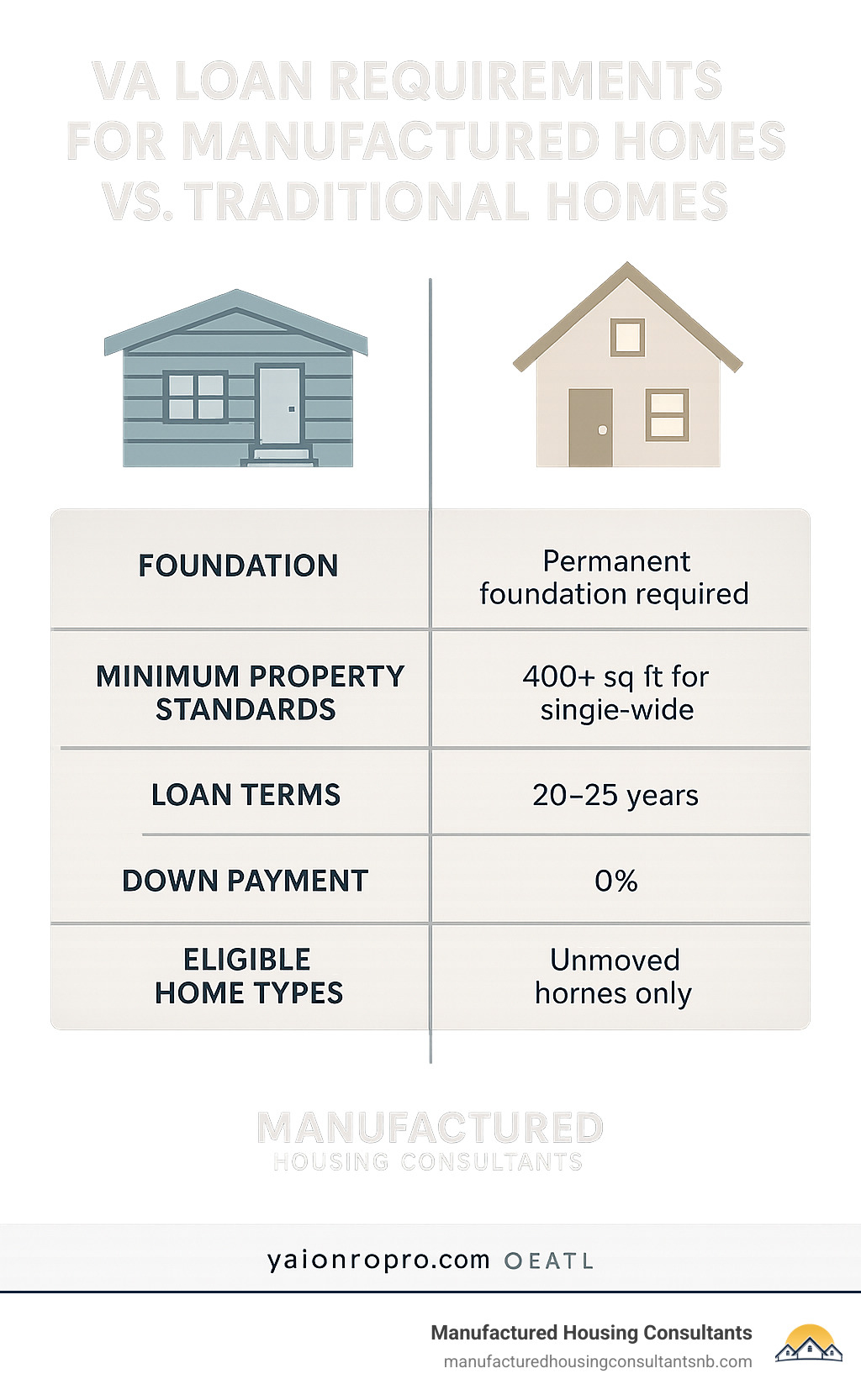

| VA Loan Requirement | Details for Manufactured Homes |

|---|---|

| Minimum Home Age | Built after June 15, 1976 (meets HUD code) |

| Foundation | Permanent foundation required, must be classified as real property |

| Minimum Size | 400+ sq ft for single-wide, 700+ sq ft for double-wide |

| Down Payment | Typically 5% (vs. 0% for traditional homes) |

| Maximum Loan Term | Single-wide: 20 years, 32 days Double-wide: 23 years, 32 days With land: 25 years, 32 days |

| Credit Score | Most lenders require 620+ |

| Previously Moved Homes | Generally not eligible |

| HUD Tags | Both exterior HUD tag and interior data plate required |

For many veterans and active-duty service members, traditional homes have become increasingly unaffordable. Manufactured homes offer a practical solution at roughly half the cost per square foot compared to site-built homes. If you’re eligible for VA benefits, understanding the VA loan rules for manufactured homes can open the door to affordable homeownership.

Unlike conventional loans that might require 20% down, VA loans for manufactured homes can finance up to 95% of the home’s value. This means you’ll typically need just 5% down – still a significant advantage over non-VA options.

What makes manufactured homes different? These factory-built homes are constructed entirely in a controlled environment, then transported to their permanent location. This building process creates affordable housing but also requires special financing considerations.

VA loans for manufactured homes come with specific requirements that differ from traditional VA mortgages. The home must be built after June 15, 1976 (when HUD established construction standards), permanently affixed to a foundation, and classified as real property under state law.

Did you know? Only about 3 in 10 veterans realize they can purchase a home with a VA loan – and even fewer understand the rules for manufactured housing.

Finding a lender experienced with both VA loans and manufactured homes is crucial, as many lenders impose stricter requirements (called “overlays”) due to perceived higher risk with manufactured homes.

Simple guide to va loan rules for manufactured homes terms:

Why This Cheat Sheet Matters

With housing costs continuing to rise across Texas and nationwide, manufactured homes represent one of the most affordable paths to homeownership. The average cost of a new manufactured home in 2022 was around $125,200 – significantly less than the median price of traditional site-built homes.

Interest rates have also been volatile, making it more important than ever to understand all your financing options. This cheat sheet gives you a quick reference to steer the sometimes confusing world of VA loan rules for manufactured homes, helping you make informed decisions without spending hours researching.

As one veteran from New Braunfels told us: “I thought my VA benefit wouldn’t work for a manufactured home. This guide saved me thousands in unnecessary down payments and helped me understand exactly what to look for.”

VA Loan Basics for Factory-Built Housing

When you’ve served our country, you deserve a place to call home that won’t break the bank. That’s where VA loans come in – they’re not actually loans from the VA itself, but rather mortgages from private lenders that come with a government guarantee. This backing gives lenders the confidence to offer you some pretty sweet perks:

- No down payment (for traditional homes)

- No private mortgage insurance (PMI)

- Competitive interest rates

- More flexible credit requirements

The good news? These benefits still apply when buying a manufactured home, though with some tweaks we’ll explore throughout this guide.

What Is a VA Loan & How It Works for Manufactured Homes

Think of a VA loan as the government giving your lender a promise: “If this veteran can’t pay, we’ve got your back.” This promise is what open ups those favorable terms you’ve earned through your service.

For manufactured homes, the process follows the same general path as traditional home loans, but with a few extra hoops to jump through. The home must be your primary residence – the place you actually live. As one VA loan specialist told us with a smile, “The VA isn’t in the business of helping veterans become real estate tycoons. They want to put roofs over the heads of those who served.”

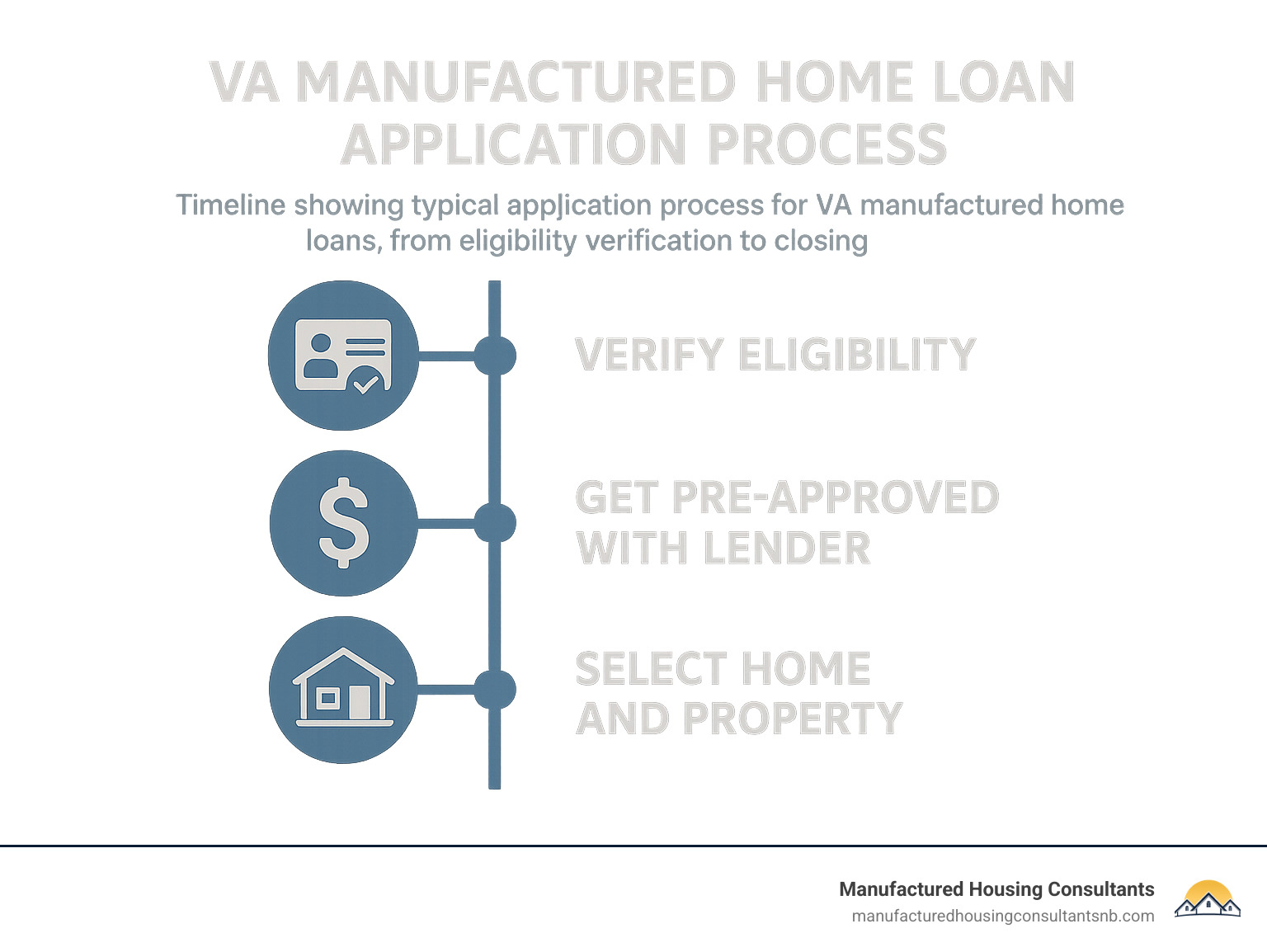

Getting your manufactured home financed typically follows this journey: you’ll obtain your Certificate of Eligibility, find a lender who knows both VA loans AND manufactured homes (this part is crucial!), get pre-approved, find your dream factory-built home, complete the VA appraisal, and finally close on your loan.

Manufactured vs. Modular vs. Mobile: Key Differences

When talking about VA loan rules for manufactured homes, the terminology matters – a lot. These aren’t just different names for the same thing:

| Type | Construction | Codes | Foundation | VA Loan Eligibility |

|---|---|---|---|---|

| Mobile Home | Factory-built before June 15, 1976 | Pre-HUD standards | Often non-permanent | Generally not eligible |

| Manufactured Home | Factory-built after June 15, 1976 | HUD federal code | Can be permanent | Eligible with permanent foundation |

| Modular Home | Factory-built in sections | State/local building codes | Always permanent | Eligible (treated like site-built) |

Manufactured homes are built on a permanent chassis and transported to their forever home in one or more sections. The dead giveaway? That red HUD certification label on the exterior of each section – it’s like the home’s birth certificate.

Modular homes are the close cousins of traditional homes. They’re built in sections at a factory but follow the same building codes as site-built homes. Once they arrive at your property, they’re assembled on a permanent foundation. The VA essentially treats these the same as traditional stick-built homes.

“I can’t tell you how many veterans come to us confused about mobile versus manufactured homes,” says one of our housing consultants. “If it rolled off the assembly line before 1976, it’s a mobile home and won’t qualify for VA financing. Post-1976 manufactured homes built to HUD standards can qualify when properly set up.”

Eligibility of Manufactured & Modular Homes Under VA

To use your VA benefit for a manufactured home, your dream home needs to check these boxes:

Built after June 15, 1976 – this isn’t arbitrary; it’s when national construction standards kicked in. The home must be permanently attached to a foundation that meets VA requirements and legally classified as real property (not personal property like a car). Size matters too – single-wides need at least 400 square feet, while double-wides need 700+.

Both the exterior HUD tag and interior data plate must be present – these are like the home’s ID and medical records. And with rare exceptions, the home shouldn’t have been moved from its original installation site.

Modular homes have it easier since they’re built to local codes and permanently installed from day one. The VA treats them like traditional homes, meaning standard 30-year financing and zero down payment options.

Want to dig deeper into financing options? Check out our detailed guide about financing a mobile home.

Minimum Property Requirements & HUD Code

The VA doesn’t just want you to have a home – they want you to have a safe, solid home. Their Minimum Property Requirements ensure exactly that. For manufactured homes, your property needs functioning heating and cooling, safe electrical systems, proper water and waste disposal, sound structure, no termite damage, good drainage, a ventilated crawl space, and adequate weatherproofing.

Beyond the VA requirements, manufactured homes must meet the HUD Code – federal standards covering everything from structural design to energy efficiency. Every post-1976 manufactured home should have a HUD tag – that metal plate on the home’s exterior. Inside, you’ll find a data plate (usually in a kitchen cabinet, electrical panel, or bedroom closet) with crucial details about the manufacturer, serial number, manufacture date, and various ratings for wind, roof load, and thermal zones.

During the appraisal, the VA appraiser will check for both these items – they’re non-negotiable parts of the process.

A Texas veteran who recently purchased through us summed it up perfectly: “There were more boxes to check than with a traditional home, but having an expert guide me through the VA loan rules for manufactured homes made all the difference. Now I’ve got a beautiful home that cost half what my buddy paid for his stick-built house!”

VA Loan Rules for Manufactured Homes: Eligibility, Property, Money & More

Now that we’ve covered the basics, let’s roll up our sleeves and explore the nitty-gritty details of VA loan rules for manufactured homes. Understanding these specifics will save you time, prevent headaches, and potentially help you secure the financing you need for your dream home.

Age, Size & Construction Standards

When it comes to age, the VA doesn’t mess around: your manufactured home must have been built after June 15, 1976. This isn’t just an arbitrary date – it marks when the HUD Code went into effect, ensuring basic safety standards. Many lenders take this a step further, preferring homes that are 20 years old or newer.

Size matters too, especially for comfortable living:

- Single-wide homes need at least 400 square feet of living space

- Double-wide or larger homes require a minimum of 700 square feet

“These size requirements aren’t just about checking boxes,” explains a housing specialist at Manufactured Housing Consultants. “They ensure you’re getting a true home that meets your family’s needs, not something designed for weekend getaways.”

Energy efficiency is becoming increasingly important in today’s market. Many newer manufactured homes come with excellent insulation, energy-efficient windows, and modern HVAC systems. The VA even offers Energy Efficient Mortgages (EEMs) that can add up to $6,000 to your loan amount specifically for green upgrades – a smart way to lower your monthly utility bills while helping the environment.

Foundation & Real Property Classification

The foundation is perhaps the most critical element of the VA loan rules for manufactured homes. Without the right foundation, your loan simply won’t happen.

Your home must be permanently attached to a foundation that meets both VA and HUD requirements. This typically means:

- A professionally engineered foundation system

- Complete removal of all wheels, axles, and towing hitches

- Permanent connection to utilities (water, sewer, electric)

- Proper structural support under all sections

- Compliance with local building codes

“The foundation isn’t just about stability,” notes our foundation specialist. “It’s about changing your manufactured home from a vehicle into real estate.”

Once properly installed, you’ll need to legally classify the home as “real property” rather than personal property. This process varies by state, but in Texas, you’ll file a Statement of Ownership and Location with the Texas Department of Housing and Community Affairs. This paperwork officially declares your home is permanently affixed to your land.

For a deeper dive into this process, check out our guide on financing mobile home with land.

Can You Finance a Manufactured Home That’s Been Moved?

I wish I had better news on this front, but the truth is that most VA lenders simply won’t touch a manufactured home that’s been relocated from its original installation site.

Why the strict stance? There are legitimate concerns:

First, moving these homes can compromise their structural integrity – even when done carefully. Second, ensuring proper reinstallation becomes much more complicated once a home has been moved. Finally, relocated homes have historically shown higher default rates, making lenders understandably nervous.

“It’s like buying a car that’s been in an accident,” one VA loan specialist told me. “Even if the repairs look perfect, there’s always the worry about hidden damage that might cause problems down the road.”

There are rare exceptions, typically for homes moved directly from the manufacturer to the first permanent site, or homes relocated under carefully documented circumstances with proper engineering oversight. But these exceptions are uncommon, and you’ll need to hunt for a specialty lender willing to work with you.

Credit, Debt & Income: VA Loan Rules for Manufactured Homes

While the VA itself doesn’t set minimum credit scores, the lenders who actually provide the loans certainly do – and they tend to be stricter for manufactured homes.

Most lenders require a minimum credit score of 620 for manufactured home VA loans. Some may go as low as 580, but you’ll likely face additional requirements if your score is on the lower end. On the flip side, a score of 660 or higher might qualify you for better interest rates – so it pays to work on your credit before applying.

Debt-to-income (DTI) ratios generally follow standard VA guidelines, with most lenders preferring a maximum DTI of 41%. However, the VA’s residual income guidelines often play a more significant role than DTI. These guidelines ensure you have enough money left after paying major expenses to cover everyday living costs.

For example, a family of four in Texas needs at least $1,003 in residual income for loans of $80,000 and above. This practical approach helps ensure you won’t be house-rich but cash-poor.

Before you start the application process, get your free credit score today to see where you stand. Knowledge is power when it comes to financing.

Down Payment, Funding Fee & Closing Costs

One of the biggest differences between traditional VA loans and those for manufactured homes is the down payment requirement. While traditional VA loans famously offer 0% down, manufactured home loans typically require some skin in the game:

Most lenders ask for around 5% down for manufactured homes. While this is a departure from the zero-down benefit many veterans expect, it’s still significantly better than conventional loans, which often require 10-20% down.

The VA funding fee still applies, ranging from 1.4% to 3.6% of the loan amount depending on your service type, down payment amount, and whether it’s your first VA loan. There’s good news for veterans with service-connected disabilities, though – you may qualify for a complete funding fee waiver.

Closing costs remain similar to traditional loans, covering expenses like origination fees, appraisal fees, title insurance, and recording fees. Many of these costs can be rolled into the loan or covered by the seller, depending on your negotiation and lender policies.

Loan Terms, Rates & How They Differ from Site-Built Homes

One significant difference between manufactured and site-built home loans is the maximum term:

- Single-wide homes: Up to 20 years and 32 days

- Double-wide homes: Up to 23 years and 32 days

- Double-wide with land: Up to 25 years and 32 days

Compare these to the standard 30-year terms for site-built homes, and you can see why your monthly payments might be higher despite a lower purchase price. The shorter amortization schedule means you’re paying off your loan faster – building equity more quickly but with higher monthly payments.

Interest rates typically run about 0.25% to 1% higher than rates for site-built homes. The good news is this gap has been narrowing in recent years as manufactured homes improve in quality and performance data becomes more favorable.

“The math is interesting,” explains a financial advisor at Manufactured Housing Consultants. “With a shorter loan term and slightly higher rate, your monthly payment might be higher than expected. But you’ll build equity faster and pay less total interest over the life of the loan. For many veterans, that’s a worthwhile trade-off.”

Buying the Home and Land Together

VA loans can finance both the manufactured home and the land it sits on in a single transaction – often the smartest approach if you don’t already own suitable land.

These “land-home packages” offer several advantages: longer maximum loan terms (up to 25 years and 32 days), often better interest rates than home-only loans, and typically more lenders willing to consider your application. Perhaps most importantly, the land component often appreciates over time, potentially offsetting any depreciation in the home itself.

Your loan can cover a surprising number of costs beyond just the home and land: site preparation (clearing and grading), foundation construction, utility connections, delivery and installation of the home, and even basic landscaping, driveways, and walkways.

If you’re lucky enough to already own suitable land, you might be able to use its equity toward your down payment – potentially reducing or even eliminating your out-of-pocket expenses.

For more options, visit our page on loan options for mobile homes.

Eligible Types: Single-Wide vs. Double-Wide

While VA guidelines technically allow for both single-wide and double-wide manufactured homes, the reality is that many lenders impose their own restrictions, often limiting financing to double-wide or larger units only.

There are practical reasons for this preference. Double-wide homes typically have better resale value, are perceived as more permanent structures, offer more living space (easily meeting the 700+ sq ft requirement), and generally appreciate better than single-wide units.

“Double-wide and larger manufactured homes simply make more financial sense for most buyers,” our financing specialist often tells clients. “They look and function more like traditional homes, which makes them more attractive to both lenders and future buyers.”

If your heart is set on a single-wide home, be prepared for a potentially more challenging financing journey. You’ll likely face higher down payment requirements, higher interest rates, shorter loan terms, and more stringent credit requirements. It’s not impossible, but you’ll need to shop around for lenders willing to work with you.

Lender Availability & State Nuances (e.g., California)

Here’s a reality check: not all VA-approved lenders offer loans for manufactured homes. In fact, many national lenders avoid this market entirely, which means you may need to work with regional lenders or specialists in manufactured housing finance.

In Texas, we’re fortunate to have several lenders who understand the VA loan rules for manufactured homes and regularly work with veterans. But availability varies significantly by region, and you may need to do some digging to find the right lender for your situation.

State-specific requirements can also impact your loan. California has specific earthquake safety requirements, often requiring specialized straps or bracing. Florida has hurricane wind-load requirements that exceed standard HUD Code. Even in Texas, homes in coastal wind zones face additional requirements.

Regional VA loan centers may interpret guidelines differently as well. The VA Regional Loan Center serving Texas is located in Houston and may have specific procedures for manufactured home loans in our state that differ from other regions.

Working with a dealer like Manufactured Housing Consultants who understands both local requirements and VA guidelines can help you steer these regional variations without unnecessary stress.

Refinance & Streamline Options

Already have a manufactured home loan? You have several refinancing options through the VA:

The Interest Rate Reduction Refinance Loan (IRRRL), also called a “streamline refinance,” allows you to refinance an existing VA loan to a lower interest rate with minimal paperwork and no appraisal requirement. This is the fastest, easiest way to lower your payment on an existing VA manufactured home loan.

A Cash-Out Refinance lets you refinance an existing loan (VA or non-VA) and take cash out based on your home’s equity. For manufactured homes, lenders typically limit the loan-to-value ratio to 90-95%, meaning you’ll need to maintain some equity in the home.

If you initially financed your manufactured home with a construction loan or dealer financing, a Construction-to-Permanent Refinance lets you transition into a permanent VA loan once the home is installed and classified as real property.

For more refinancing details, check out our page on manufactured home mortgage.

Documentation Checklist: VA Loan Rules for Manufactured Homes

When applying for a VA loan for a manufactured home, you’ll need the standard VA loan documentation plus additional items specific to manufactured housing.

Beyond the usual suspects (Certificate of Eligibility, ID, pay stubs, W-2s, tax returns, bank statements), you’ll need to gather:

- HUD data plate information or photos

- HUD certification label numbers or photos of the tags

- Engineer’s foundation certification

- Manufacturer’s installation manual

- Title elimination documentation

- Land deed or purchase agreement

- Site preparation plans

- Dealer invoice or purchase agreement for the home

“Being organized is half the battle,” says one of our loan specialists. “Veterans who come in with these documents ready typically close weeks faster than those who scramble to find paperwork at the last minute.”

Common Challenges & How to Avoid Them

After helping hundreds of veterans secure financing for manufactured homes, we’ve seen several recurring challenges – and developed strategies to overcome them.

Appraisal issues are perhaps the most common stumbling block. Finding comparable sales can be difficult, potentially leading to low appraisals. The solution? Work with real estate agents and appraisers who specialize in manufactured housing in your specific area.

Land lease communities present another challenge, as most VA lenders won’t finance homes in these parks. Your best bet is to focus on land-home packages or homes already installed on owned land.

Insurance requirements can be surprising, with some companies charging significantly higher premiums for manufactured homes. Shop around with insurers who specialize in manufactured housing – they often offer much more competitive rates.

Timing complications arise when coordinating land purchase, home delivery, and loan closing. Working with experienced dealers who understand the VA loan rules for manufactured homes can help synchronize these moving parts.

Foundation documentation problems can delay or even derail the loan process. Ensure you have proper engineer’s certification for your foundation system from the very beginning.

As one veteran from San Antonio told me: “We almost lost our loan because the seller couldn’t locate the HUD tags. Thankfully, our dealer helped us work with HUD to verify the home’s compliance through alternative documentation. Having experts on your side makes all the difference.”

Conclusion & Next Steps

You’ve made it through our comprehensive guide to VA loan rules for manufactured homes! By now, you understand that while these loans have more specific requirements than traditional VA loans, they offer an incredibly practical path to affordable homeownership – especially in today’s challenging housing market.

For many veterans like James, a retired Army sergeant we worked with last month, manufactured housing provided a solution when traditional homes seemed out of reach. “I never thought I’d be able to afford a home in Texas with prices the way they are,” he told us. “My manufactured home has all the space and features I wanted, at literally half the price.”

Here at Manufactured Housing Consultants in New Braunfels, we’ve guided hundreds of veterans through this process. Our team works with 11 top manufacturers, ensuring you have plenty of quality options at guaranteed lowest prices. We don’t just sell homes – we’re your partners throughout the journey, offering:

- Personalized financing guidance custom to your VA benefits

- Comprehensive land improvement services to prepare your site

- Expert coordination with contractors for site preparation

- Foundation installation that strictly adheres to VA requirements

- Professional delivery and setup of your beautiful new home

Your homeownership journey doesn’t end with understanding the rules – it’s just beginning! Here’s what your path forward looks like:

First, verify your VA eligibility and get your Certificate of Eligibility through the VA eBenefits portal. Next, take a good look at your credit report and address any issues that might affect your application. Getting pre-approved with a lender experienced in VA manufactured home loans will give you a clear budget before you start shopping.

When you’re ready, visit our dealership to explore floor plans and design options that match your family’s needs. We’ll help you select a suitable property or lot if you don’t already have land. Our team will then coordinate all the technical details – from site preparation to final installation – ensuring everything meets VA specifications.

Today’s manufactured homes are a far cry from the “mobile homes” of decades past. Modern manufactured housing offers contemporary designs, impressive energy efficiency, and durability that rivals site-built construction – all at a fraction of the cost. Many of our customers are surprised by the spacious layouts, high ceilings, and premium finishes available in these homes.

“The biggest compliment we get,” says our sales manager, “is when visitors can’t tell they’re in a manufactured home. That’s how far the quality has come.”

Ready to explore your options? We’d love to welcome you to our dealership in New Braunfels. You can also browse our selection online, including popular models from Jessup Homes known for their craftsmanship and attention to detail.

Your service to our country has earned you valuable VA home loan benefits. Let us help you make the most of them with a beautiful, affordable manufactured home that meets all the VA loan rules for manufactured homes while providing your family with the comfortable, stable housing you deserve.

After all, the home where you’ll create memories shouldn’t just fit your budget – it should fit your life.