Can FHA Loans Help You Buy a Manufactured Home? Find Out Now

Will fha finance a manufactured home? Discover FHA rules, eligibility, loan types, and tips to buy your manufactured or mobile home.

FHA Loans and Manufactured Homes: The Affordable Path to Homeownership

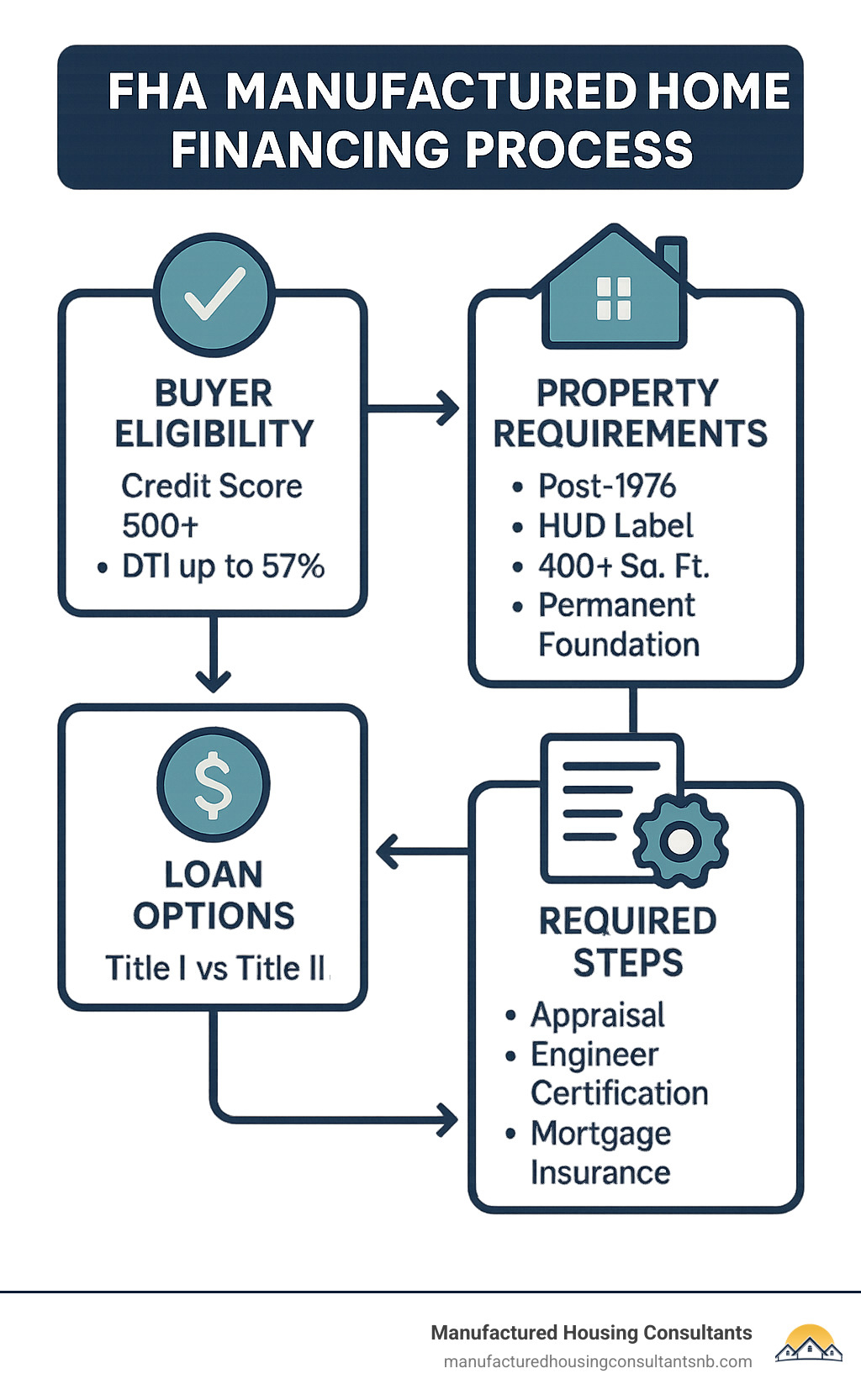

Yes, FHA will finance a manufactured home under specific conditions. The Federal Housing Administration offers two main loan programs for manufactured homes: Title I for home-only or leased land situations, and Title II for homes permanently attached to owned land.

Here’s a quick answer to your question about FHA manufactured home financing:

| Question | Answer |

|---|---|

| Will FHA finance a manufactured home? | Yes, if the home was built after June 15, 1976, is at least 400 square feet, has a HUD certification label, and meets foundation requirements. |

| Minimum down payment | 3.5% with credit score ≥580; 10% with score 500-579 |

| Maximum loan amount (2024) | $92,904 for home and lot combined (Title I); up to standard FHA loan limits for Title II |

| Maximum loan term | 20-25 years (Title I); up to 30 years (Title II) |

| Credit score minimum | 500 (though many lenders require 580+) |

Manufactured homes offer an affordable alternative to traditional housing, costing up to 20% less than site-built homes. According to research, approximately 8% of U.S. homes are manufactured or mobile homes, making them a significant housing option for budget-conscious buyers.

The FHA has been helping Americans achieve homeownership since 1934. Their manufactured home programs are designed to make factory-built housing more accessible through lower down payments and more flexible credit requirements.

It’s important to understand that what many people call “mobile homes” are actually manufactured homes if built after June 15, 1976. This date marks when HUD established federal construction and safety standards, which is a key requirement for FHA financing eligibility.

Will FHA Finance a Manufactured Home? Program Basics & Eligibility

The short answer is yes, FHA will finance a manufactured home, but there’s more to the story. Both you and your dream home need to meet certain requirements before the FHA will approve your loan. Understanding these details upfront can save you time and headaches down the road.

According to the FHA, a manufactured home is “a structure that is transportable in one or more sections. In traveling mode, the home is eight feet or more in width and forty feet or more in length.” This official definition helps separate manufactured homes from other factory-built housing options and plays a key role in determining if you can get that loan.

The FHA gives you two main paths to finance your manufactured home:

| Feature | FHA Title I | FHA Title II |

|---|---|---|

| Property Type | Can be classified as personal property | Must be classified as real estate |

| Land Requirement | Can finance home on leased land | Home must be on owned land |

| Maximum Loan Amount (2024) | $69,678 (home only) $23,226 (lot only) $92,904 (home and lot) |

Standard FHA loan limits (up to $498,257 in most areas) |

| Maximum Loan Term | 20 years (home only or single-section home with lot) 15 years (lot only) 25 years (multi-section home with lot) |

Up to 30 years |

| Foundation | Must meet HUD requirements | Must be permanent and meet HUD guidelines |

| Down Payment | Typically 5% or more | As low as 3.5% with 580+ credit score |

As mortgage expert Dana Hendrix puts it: “The short answer is yes, you can get a 30-year FHA loan on a manufactured home, but there are specific requirements and considerations to keep in mind.”

FHA Definition, Age & Size Rules

When asking “will FHA finance a manufactured home,” you need to understand what makes a manufactured home eligible in the FHA’s eyes.

First and most importantly, your home must be built after June 15, 1976. This date isn’t random – it’s when the HUD Code went into effect, establishing federal standards for these homes. If your home was built before this date (often called a “mobile home”), unfortunately, the FHA won’t finance it.

Your home also needs that red HUD certification label (sometimes called a “tag”) attached to the exterior of each section. Think of this as your home’s passport – it proves your home was built to federal standards and is eligible for FHA financing.

Size matters too – your home must have at least 400 square feet of floor area and measure at least 8 feet wide and 40 feet long when being transported. And it must be designed as a single-family home – multi-family units, tiny homes, or shipping container homes won’t qualify.

HUD is crystal clear on this point: “Mobile homes manufactured before June 15, 1976 cannot be approved for an FHA mortgage.” This date is non-negotiable – it’s when manufactured homes began being built under the Federal Manufactured Construction and Safety Standards.

Key FHA Loan Programs: Title I vs Title II

The FHA gives you two different loan programs for manufactured homes, each with its own set of rules and benefits.

Title I Loans are more flexible about where your home sits. You can finance the home as personal property (chattel loan) and place it on leased land. The loan limits are lower – $69,678 for just the home, $23,226 for just a lot, or $92,904 for both together. Your loan term maxes out at 20 years for a home only or a single-section home with lot, 15 years for just buying a lot, or 25 years for a multi-section home with lot.

Title II Loans offer higher loan amounts and longer terms, but with stricter requirements. Your home must be classified as real property and permanently attached to land that you own. The loan limits follow standard FHA single-family limits (much higher than Title I), and you can get a full 30-year loan term. Your home needs a permanent foundation that meets HUD’s Permanent Foundations Guide for Manufactured Housing.

As one housing expert explains it, “Title I covers personal property loans and Title II covers homes permanently attached to land with different maximum terms.” This distinction is crucial for figuring out which program fits your situation best.

Want to explore more options? Check out our loan options page for detailed information about financing mobile and manufactured homes.

Property & Foundation Requirements

One of the most important factors in answering “will FHA finance a manufactured home” involves the foundation. The FHA takes foundations very seriously, and for good reason – they ensure your home is safe and secure.

For Title II loans, your home must be permanently affixed to a foundation according to HUD’s Permanent Foundations Guide for Manufactured Housing. This isn’t just paperwork – you’ll need an engineer to certify that the foundation meets these requirements. As one industry expert who prepares “800 to 900 such engineer reports annually” shares, “We know what lenders require so that there is no learning curve to delay closing dates.”

Your home must be installed according to the manufacturer’s instructions and local building codes. All those transportation parts – hitches, wheels, axles – need to be removed, though the home will still sit on a permanent chassis.

You’ll also need proper foundation skirting that’s permanently attached, properly ventilated, braced, and includes a tool-free access point. If your home sits in a flood zone, the lowest finished grade must be at or above the 100-year flood elevation in Zones A or V.

Industry experts emphasize that “Tie-downs must be corrosion-resistant and secure the home against front-to-rear and side-to-side movement.” These technical requirements might seem picky, but they ensure your home is safe, durable, and meets the standards for FHA financing.

For those who want to dive deeper into the science behind manufactured home foundations, check out the HUD Permanent Foundations Guide.

Will FHA Finance a Manufactured Home on Leased Land?

Yes, FHA will finance a manufactured home on leased land, but only through the Title I program. This is great news if you don’t own land or prefer to place your home in a manufactured home community.

If you’re going the leased land route, the FHA has some requirements to protect you. Your initial lease must run for at least 3 years, and it must include a clause requiring at least 180 days’ advance notice before termination. This gives you plenty of time to make other arrangements if needed.

Your site needs to have adequate water, sewer, and all-weather access. Your home and its installation must comply with all community regulations. And even on leased land, your home must meet HUD’s foundation requirements, though these may differ somewhat from those for homes on owned land.

As one expert notes, “Leased-lot financing requires a minimum three-year lease and 180 days’ advance notice of termination to protect homeowners.” This provision is designed with your security in mind, ensuring you won’t be caught off guard if your lease situation changes.

Want to learn more about combining home and land financing? Visit our financing with land page.

Can You Get a 30-Year FHA Loan?

We often hear from folks at Manufactured Housing Consultants asking if they can get the same 30-year terms for manufactured homes that are common with traditional site-built homes.

The good news is yes, you can get a 30-year FHA loan on a manufactured home, but there are some specific boxes you’ll need to check.

First, this option is only available through the FHA Title II program. Your home must be classified as real property, not personal property, and it must be permanently attached to a foundation on land that you own.

There’s also an advantage to going bigger – while single-section homes with land typically max out at 20-year terms, multi-section homes with land can qualify for the full 30 years.

The benefit of stretching to 30 years is pretty clear – lower monthly payments make your home more affordable month-to-month. The trade-off, of course, is that you’ll pay more interest over the life of the loan compared to shorter terms.

As Dana Hendrix confirms, “The maximum loan term is 30 years for a home and lot combined, 15 years for a lot only, and 30 years for a home classified as real property.”

How to Qualify and Apply for an FHA Manufactured Home Loan

Now that we know that FHA will finance a manufactured home, let’s walk through the qualification process and application steps. At Manufactured Housing Consultants in New Braunfels, we’ve helped many Texas families steer this journey to affordable homeownership.

Borrower Requirements: Credit, Down Payment, DTI

Getting approved for an FHA manufactured home loan depends on meeting several key requirements. Your credit score plays a crucial role – while the FHA allows scores as low as 500, you’ll need a more substantial down payment with lower scores. With a score of 580 or higher, you can qualify with just a 3.5% down payment. If your score falls between 500-579, expect to put down 10%.

Many of our customers are pleasantly surprised to learn that down payment funds can come from various sources. Your personal savings are the most straightforward option, but gift funds from family members are perfectly acceptable too. Some buyers even qualify for down payment assistance programs. If you already own land, you might be able to use that equity toward your down payment requirements.

Your debt-to-income ratio (DTI) matters too. The FHA typically looks for a DTI of 43% or lower, though they can be flexible up to 57% if you have compensating factors like excellent credit or substantial savings. As one customer told us, “I was worried my car payment would disqualify me, but my steady employment history helped me get approved despite my higher DTI.”

When you apply, be prepared to share documents that verify your income. This typically includes recent pay stubs, W-2 forms from the past two years, and bank statements. Self-employed? You’ll need two years of tax returns instead. Recipients of Social Security, pension income, child support, or alimony can use those income sources too – just bring the appropriate documentation.

For more details about these options, check out our FHA mobile home financing page.

Step-by-Step Application Process

The path to financing your manufactured home with an FHA loan follows several clear steps. First, you’ll need to find an FHA-approved lender that specializes in manufactured housing loans. Not all lenders offer these programs, so start your search using the official HUD lender list to find options in the New Braunfels and San Antonio areas.

Before you start shopping for your dream home, get pre-approved so you know exactly what you can afford. The lender will review your financial documents, check your credit, verify your income, and analyze your existing debts. This gives you a clear budget and strengthens your position when making an offer.

At Manufactured Housing Consultants, we’ll help you select a manufactured home that meets all FHA requirements. The home must be built after June 15, 1976, have HUD certification labels, measure at least 400 square feet, and be designed as a single-family dwelling. With options from 11 top manufacturers, we’ll find something perfect for your needs and budget.

Once you’ve chosen your home, an FHA-approved appraiser will determine its value. For manufactured homes, this includes checking the HUD labels and inspecting the foundation and installation. This is followed by an engineer’s certification confirming the foundation meets HUD requirements – a step that’s absolutely essential for approval.

The lender will also run a CAIVRS check (Credit Alert Verification Reporting System) to verify you don’t have any delinquent federal debt. Then comes underwriting, where the lender reviews all documentation to make a final decision. If approved, you’ll move to closing, sign the final paperwork, and receive the keys to your new home.

As one of our happy homeowners shared, “Shopping around for lenders made a huge difference – I found rates that varied by almost a full percentage point!” We always recommend getting loan estimates from multiple lenders to ensure you’re getting the best possible terms.

Mortgage Insurance, Loan Limits & Terms

All FHA loans require mortgage insurance, which protects the lender if you default. This insurance comes in two parts: an upfront premium of 1.75% of your loan amount (which most borrowers roll into the loan) and an annual premium between 0.15% and 0.75% of your loan balance (divided into monthly payments). For most borrowers, this insurance continues for the life of the loan.

The loan limits for 2024 vary depending on which FHA program you use. For Title I loans, you can borrow up to $69,678 for the home alone, $23,226 for a lot only, or $92,904 for a home and lot combined. Title II loans follow standard FHA loan limits, which can go up to $498,257 in most counties and even higher in expensive markets.

Your loan term options depend on the program too. Title I loans offer terms up to 20 years for a manufactured home or a single-section home with lot, 15 years for a lot-only loan, or 25 years for a multi-section home with lot. Title II loans can stretch up to 30 years, giving you smaller monthly payments.

“The FHA adjusts their loan limits periodically,” explains our financing specialist. “This helps ensure the program keeps pace with housing costs while staying focused on affordable options.”

Pros, Cons & Common Misconceptions

FHA manufactured home loans offer several advantages. The lower down payment requirements make homeownership accessible to more families. The flexible credit guidelines help buyers who might not qualify for conventional financing. You’ll also enjoy competitive interest rates and, depending on the program, the ability to finance a home on leased land or stretch payments over 30 years.

Of course, there are some downsides too. The mortgage insurance requirement typically lasts for the life of the loan, adding to your monthly costs. The property requirements are stricter than some other loan types. The approval process might take longer due to the additional inspections and certifications. And if you’re looking at a Title I loan, the lower loan limits might restrict your options in higher-priced markets.

Many misconceptions surround manufactured home financing. The biggest myth is that FHA won’t finance manufactured homes at all – absolutely untrue! Another common belief is that you can’t get a 30-year loan term – also false, as Title II loans offer exactly that. Some people think they can move their home after financing it, but FHA-financed homes must be permanently installed. Not all manufactured homes qualify either – only those built after June 15, 1976, with HUD certification labels. And contrary to popular belief, FHA loans aren’t just for first-time homebuyers – they’re available to any qualified borrower.

“I was shocked to learn that FHA loans were an option for my manufactured home purchase,” one customer told us. “The information out there is so confusing, but working with experts made all the difference.”

FHA vs Conventional, VA, USDA for Manufactured Homes

While FHA loans are wonderful options, they’re not the only path to manufactured home financing. Conventional loans typically require higher credit scores (usually 620+) and larger down payments (5-20%). Their mortgage insurance (PMI) can be removed once you reach 20% equity, unlike FHA’s lifetime MIP for most loans. However, conventional loans often have more flexible property standards for manufactured homes.

VA loans serve our veterans and active service members with incredible benefits including 0% down payment options. Instead of monthly mortgage insurance, VA loans have a one-time funding fee. The property requirements are similar to FHA standards. If you’re eligible for a VA loan, it’s definitely worth exploring.

USDA loans offer 0% down payment options for homes in rural areas, but they come with income limits (typically 115% of the area median income). They charge upfront and annual guarantee fees similar to FHA’s mortgage insurance. The property requirements for manufactured homes are comparable to FHA standards.

“The difference in interest rates between FHA manufactured home loans and standard FHA loans is minimal,” notes our financing specialist. “This makes FHA an attractive option for many buyers, especially those with limited down payment funds or credit challenges.”

For research on rural housing loans and options, the HUD Housing Counseling page offers valuable insights.

At Manufactured Housing Consultants, we’re committed to helping you steer all these options to find the perfect financing solution for your new manufactured home. Our experience with FHA manufactured home financing has helped countless families in New Braunfels and beyond achieve affordable homeownership.

Conclusion & Next Steps

So, we’ve unpacked a lot about manufactured home financing, and the verdict is clear: Yes, FHA will finance a manufactured home! It’s not just possible—it’s a pathway many families have successfully traveled to affordable homeownership.

Let’s recap what we’ve learned. FHA offers two distinct financing paths: Title I for homes that might be on leased land, and Title II for homes permanently attached to land you own. Both programs can work wonderfully, but they come with specific requirements.

Your manufactured home needs to be a youngster—built after June 15, 1976—and proudly displaying those HUD certification labels (those little metal plates that prove it meets federal standards). Size matters too, with a minimum of 400 square feet required. And let’s not forget about that foundation—it needs to be properly installed according to HUD guidelines.

On the borrower side, you’ll need a credit score of at least 500, though 580+ will get you that sweet 3.5% down payment option. Your debt-to-income ratio should ideally stay under 43%, though there’s wiggle room up to 57% if you have other financial strengths. And yes, you’ll need to budget for those mortgage insurance premiums—they’re part of the FHA package.

Here at Manufactured Housing Consultants in New Braunfels, we see families achieve their homeownership dreams every day. Our team has deep experience with FHA financing, and we’re proud to offer homes from 11 top manufacturers that meet all those important FHA standards.

What makes us different? Well, beyond our guaranteed lowest prices (which we’re pretty proud of!), we genuinely care about helping you steer this process. When you walk through our door, you’re not just another customer—you’re a future homeowner with unique needs and dreams.

Our team can help with every step—from finding the perfect home model to connecting you with lenders who specialize in manufactured home financing. Got land that needs some work to meet FHA requirements? Our land improvement services can help with that too.

Whether you’re eyeing a cozy single-section starter home or dreaming of a spacious multi-section family home with all the bells and whistles, we have options that can work with FHA financing. Our goal is making homeownership accessible to more families throughout the Texas Hill Country.

Ready to take the next step? We’d love to sit down with you, understand your needs, and help you explore your options. There’s no pressure—just friendly guidance from folks who understand both manufactured homes and FHA financing inside and out.

For even more details about your financing options, check out our mobile home financing page. Or better yet, come see us in person. Your affordable homeownership journey might be shorter than you think!