Repo Mobile Homes: Your Guide to Local Deals

Find affordable repo mobile homes near you! Learn how to finance, inspect, and get the best local deals on manufactured housing.

Why Repo Mobile Homes Are Your Path to Affordable Homeownership

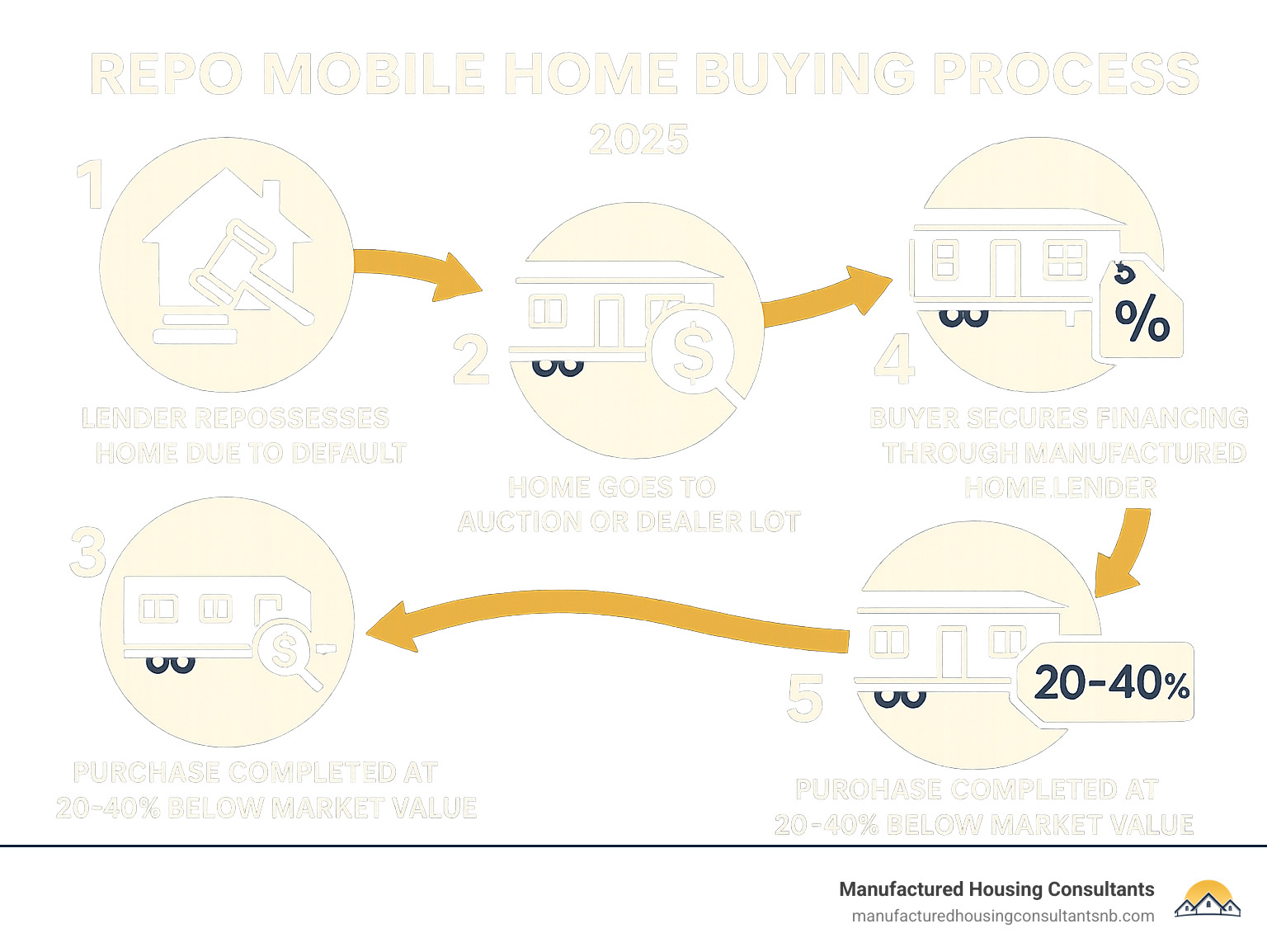

Repo mobile homes are manufactured homes that lenders have taken back when buyers couldn’t make their payments. These properties often sell for 20-40% below market value, making homeownership possible for people who thought it was out of reach.

Quick Facts About Repo Mobile Homes:

- What they are: Repossessed manufactured homes sold by lenders

- Typical savings: 20-40% below market price

- Where to find them: Banks, credit unions, and specialized dealers

- Financing: Available through manufactured home lenders like 21st Mortgage

- Best for: First-time buyers and those with limited budgets

The manufactured housing market has grown steadily, with millions of Americans choosing mobile homes as their primary residence. When economic challenges hit families, some can’t keep up with payments. That’s when these homes become available as repos.

The key advantage? You get a quality manufactured home at a fraction of the original cost. Many repo homes are nearly new, having been repossessed within the first few years of ownership.

But finding and buying repo mobile homes isn’t always straightforward. You need to know where to look, how to evaluate the deals, and what financing options work best for your situation.

Quick repo mobile homes definitions:

- used manufactured home for sale near me

- repo mobile homes with land for sale

- repo mobile homes for sale first time buyer

Understanding Repo Mobile Homes

Let’s clear up what repo mobile homes actually are – and why they might be your ticket to affordable homeownership.

When someone buys a manufactured home but can’t keep up with their monthly payments, the lender steps in to repossess the property. It’s the same process that happens with cars or traditional homes when loans go into default. The bank or financing company takes back the home to protect their investment.

Here’s the thing that surprises most people: these aren’t beat-up homes that nobody wants. Many repo mobile homes are practically brand new. We’re talking about homes that are only a few years old, sometimes even less than a year. The previous owners often took great care of them before financial hardship hit.

The lender’s main goal is simple: get their money back as quickly as possible. They’re not in the business of holding onto homes, so they price them to move fast. That’s where the savings come in – and why these homes offer such incredible value for affordable housing seekers.

Now, let’s talk about what you’re actually buying. While people say “mobile homes,” what you’re getting is technically a “manufactured home.” These homes are built in climate-controlled factories following strict federal HUD standards. They’re designed to be your permanent residence, not something you’ll be moving around.

The financing options work differently than traditional home mortgages, though. You’ll typically work with specialized manufactured home lenders who understand this market inside and out. Companies like 21st Mortgage focus specifically on manufactured home financing, making the process smoother for buyers.

Understanding these basics puts you ahead of the game when you start shopping for your repo home. You’ll know what you’re looking at and why the prices are so attractive.

How to Find Repo Mobile Homes Near You

Finding repo mobile homes doesn’t have to be overwhelming. Think of it as a treasure hunt where you know exactly which maps to use. The secret is understanding where lenders and dealers actually list these gems.

Your best starting point? Specialized dealers like us. As Manufactured Housing Consultants in New Braunfels, Texas, we’ve built relationships with lenders across the region. When banks need to move repo mobile homes quickly, they often turn to experienced dealers who can handle the entire process smoothly. We maintain an inventory of these discounted homes and can often find exactly what you’re looking for at our guaranteed lowest prices.

Local banks and credit unions are goldmines for repo listings. When they repossess a manufactured home, they need to sell it fast to recover their investment. Call their asset recovery or real estate departments directly. Many times, they’ll have homes that aren’t even advertised yet. The key is building relationships with these lenders – something we’ve already done for our clients.

Don’t overlook online marketplaces either. While not always labeled as repos, you’ll spot them by their below-market pricing. Look for manufactured homes that seem too good to be true – they often are repos in disguise. You might find a used manufactured home for sale near me that’s actually a fantastic repo deal.

Manufactured home communities can be surprising sources of information. Park managers often know when residents are facing financial difficulties or when lenders are preparing to repossess homes. They’re connected to the local manufactured housing network in ways that can benefit your search.

When searching online, use terms like “repossessed manufactured homes,” “bank-owned mobile homes,” or “foreclosed manufactured homes.” These specific phrases will help you find the hidden deals that others might miss.

The real advantage of working with local experts like us? We’re already connected to all these sources. Instead of spending weeks calling banks and scrolling through listings, you can tap into our network and focus on choosing the perfect home for your family.

Financing Options for Repo Mobile Homes

Securing financing for repo mobile homes is one of the most crucial steps, and it’s a bit different from getting a traditional mortgage for a site-built home. Since many manufactured homes are considered personal property (especially if not permanently affixed to land you own), they often require different types of loans.

Here are the primary loan options and mortgage alternatives available:

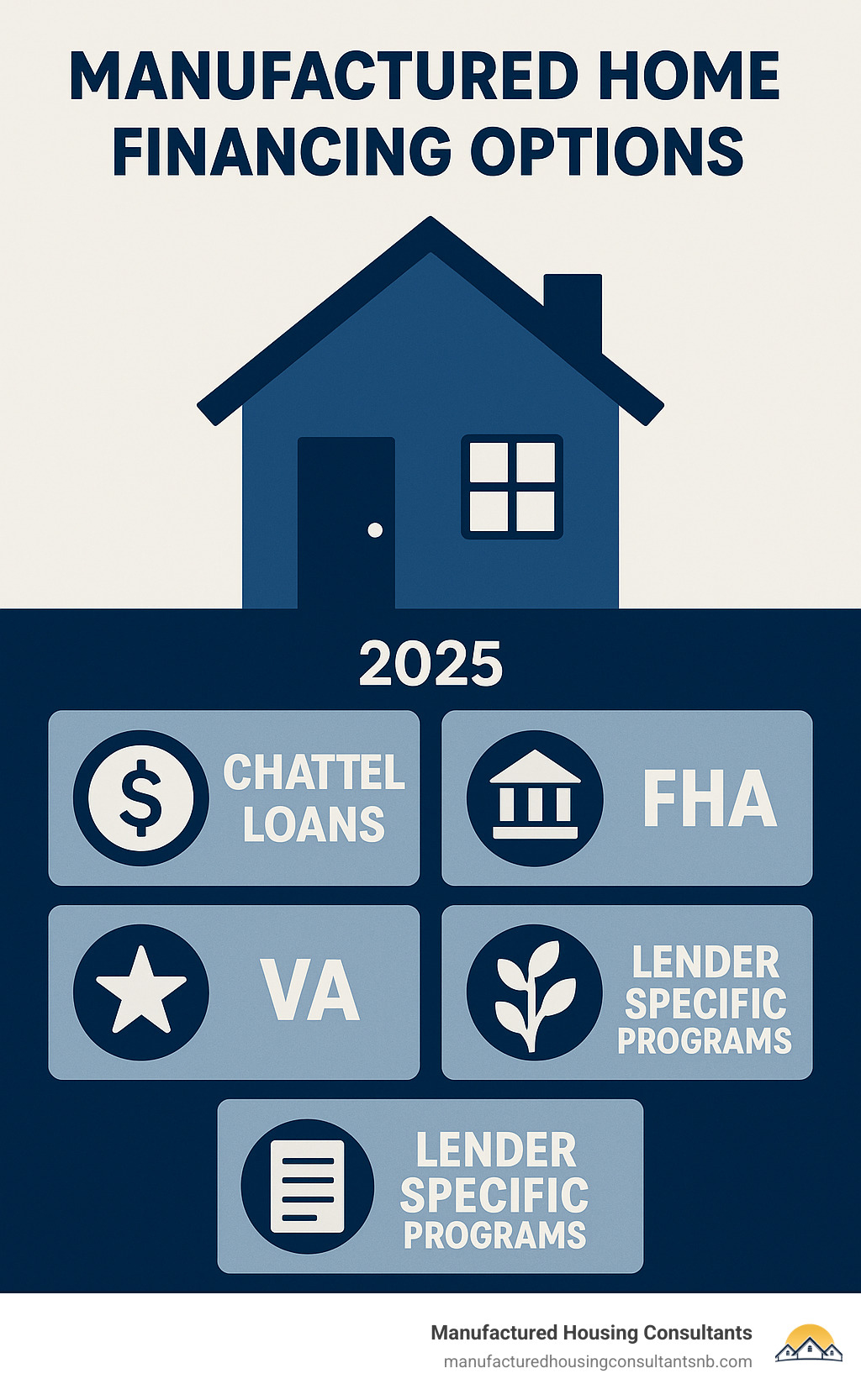

- Chattel Loans: This is the most common type of financing for manufactured homes that are not attached to real estate. A chattel loan is essentially a personal property loan, similar to an auto loan. They typically have shorter terms and slightly higher interest rates than traditional mortgages, but they are specifically designed for manufactured homes and offer flexibility.

- FHA, VA, and USDA Loans: If the repo mobile home is on a permanent foundation and affixed to land you own (or are purchasing simultaneously), you might qualify for government-backed loans.

- FHA (Federal Housing Administration) loans offer low down payments and are great for first-time buyers.

- VA (Department of Veterans Affairs) loans are a fantastic benefit for eligible veterans and active-duty service members, often requiring no down payment.

- USDA (United States Department of Agriculture) loans are for rural areas and can offer 100% financing.

These options can make affordable housing even more accessible.

- 21st Mortgage Corporation: As mentioned in our intro, 21st Mortgage is a major player in manufactured home financing. They specialize in loans for manufactured homes, including chattel loans, and are often a go-to resource for buyers of both new and pre-owned homes. Their expertise makes them a valuable partner in your homeownership journey.

- In-House Financing and Partnerships: At Manufactured Housing Consultants, we understand that financing can be complex. That’s why we offer various financing options and work with a network of lenders to help you find the best loan for your specific situation. Our goal is to make the path to owning your repo mobile home as smooth as possible. We’re here to help you steer through the loan options, ensuring you get a deal that fits your budget.

Don’t let financing be a barrier. We’ve helped countless families in New Braunfels and across Texas find suitable loan solutions for their new homes.

Frequently Asked Questions about Repo Mobile Homes

We hear these questions all the time, and honestly, we love talking about repo mobile homes! They’re one of the best-kept secrets in affordable housing, but we understand why folks have questions. Let’s explore the most common ones we get here at our New Braunfels office.

What are repo mobile homes?

Here’s the straightforward answer: repo mobile homes are manufactured homes that banks or lenders took back when the original owners couldn’t keep up with their payments. It’s not really different from what happens with cars or other financed items – when payments stop coming in, the lender has to protect their investment by taking the property back.

Now, before you start imagining rundown homes with problems, let me set the record straight. Most of these homes are in surprisingly good condition. We’ve seen plenty that are only a few years old, sometimes barely lived in! The previous owners often took good care of them right up until financial hardship hit.

The real beauty of this situation? Lenders aren’t in the business of being landlords or home dealers – they want these properties off their books fast. That urgency translates into serious savings for you, often 20-40% below market value. It’s honestly one of the most reliable ways to get quality affordable housing without compromising on what you want in a home.

How can I finance a repo mobile home?

Financing repo mobile homes is absolutely doable, though it works a bit differently than getting a regular house mortgage. Don’t worry though – we’ve walked hundreds of families through this process, and it’s not as complicated as it might seem.

Your main loan options start with chattel loans, which are perfect if your home won’t be permanently attached to land you own. Think of these like car loans, but for your home. They’re specifically designed for manufactured homes and work really well for most buyers.

If you’re planning to put your home on a permanent foundation on your own land, then you might qualify for traditional mortgage alternatives like FHA, VA, or USDA loans. These government-backed programs often have better terms and lower down payments – especially helpful for first-time buyers.

Here at Manufactured Housing Consultants, we’ve built relationships with multiple lenders who understand manufactured homes inside and out. Companies like 21st Mortgage Corporation specialize in exactly what you need. We’ll sit down with you, look at your situation, and find the financing that makes the most sense for your budget. Whether you’re a repo mobile homes for sale first time buyer or you’ve done this before, we’ll make sure you get the best deal possible.

What should I consider when buying a repo mobile home?

Smart question! While repo mobile homes are fantastic opportunities, you want to go in with your eyes wide open. Let me share what we always tell our customers.

Inspection should be your first priority. Even though many repo homes are in excellent shape, you never know what might have been overlooked. We always recommend getting a professional to look things over – plumbing, electrical, structural elements, the works. It might cost a few hundred dollars upfront, but it can save you thousands down the road. Plus, if issues do pop up, you can often negotiate repairs or adjust the price.

Pricing is where our expertise really shines. Our guaranteed lowest prices mean you’re getting true value, but it’s still smart to understand what you’re buying. We’ll show you how your potential home compares to similar manufactured homes in the area, so you know you’re getting the deal you deserve.

Location matters more than you might think. Are you looking at repo mobile homes with land for sale, or just the home itself? If it’s with land, we’ll help you evaluate everything from zoning to utility access. If you’re buying just the home, we need to factor in transport costs and setup – these aren’t huge expenses, but they’re worth planning for.

The age and condition of the home will also affect your financing options and future maintenance costs. We’ll walk through all of this with you, making sure there are no surprises. And don’t worry about title issues or liens – we handle all that paperwork so you don’t have to stress about the legal details.

Conclusion

Finding your dream home doesn’t have to break the bank. Repo mobile homes offer an incredible opportunity to step into homeownership at prices that actually make sense for real families. When you can save 20-40% off market value and still get a quality manufactured home, it’s hard to argue with the math.

The journey to finding and financing these affordable housing gems might feel different from traditional home buying, but that’s exactly what makes it so rewarding. You’re not just getting a house – you’re getting a smart financial move that puts homeownership within reach.

Here in New Braunfels, Texas, we’ve seen countless families transform their lives through repo mobile homes. There’s something special about watching a family get the keys to their first home, knowing they found an amazing local deal that fits their budget perfectly.

At Manufactured Housing Consultants, we’re not just selling homes – we’re opening doors to possibilities. Our wide selection from 11 top manufacturers means you’ll find the right fit, and our guaranteed lowest prices ensure you’re getting the best value possible. Whether you need financing help or land improvement services, we’ve got your back every step of the way.

The affordable housing market is always changing, and the best repo mobile homes don’t stay available long. Families who act quickly often find themselves in homes they never thought they could afford, building equity instead of paying rent month after month.

Ready to see what’s available? Contact Manufactured Housing Consultants today and let’s find your perfect home. Your future self will thank you for taking this step toward homeownership – and your wallet will too!